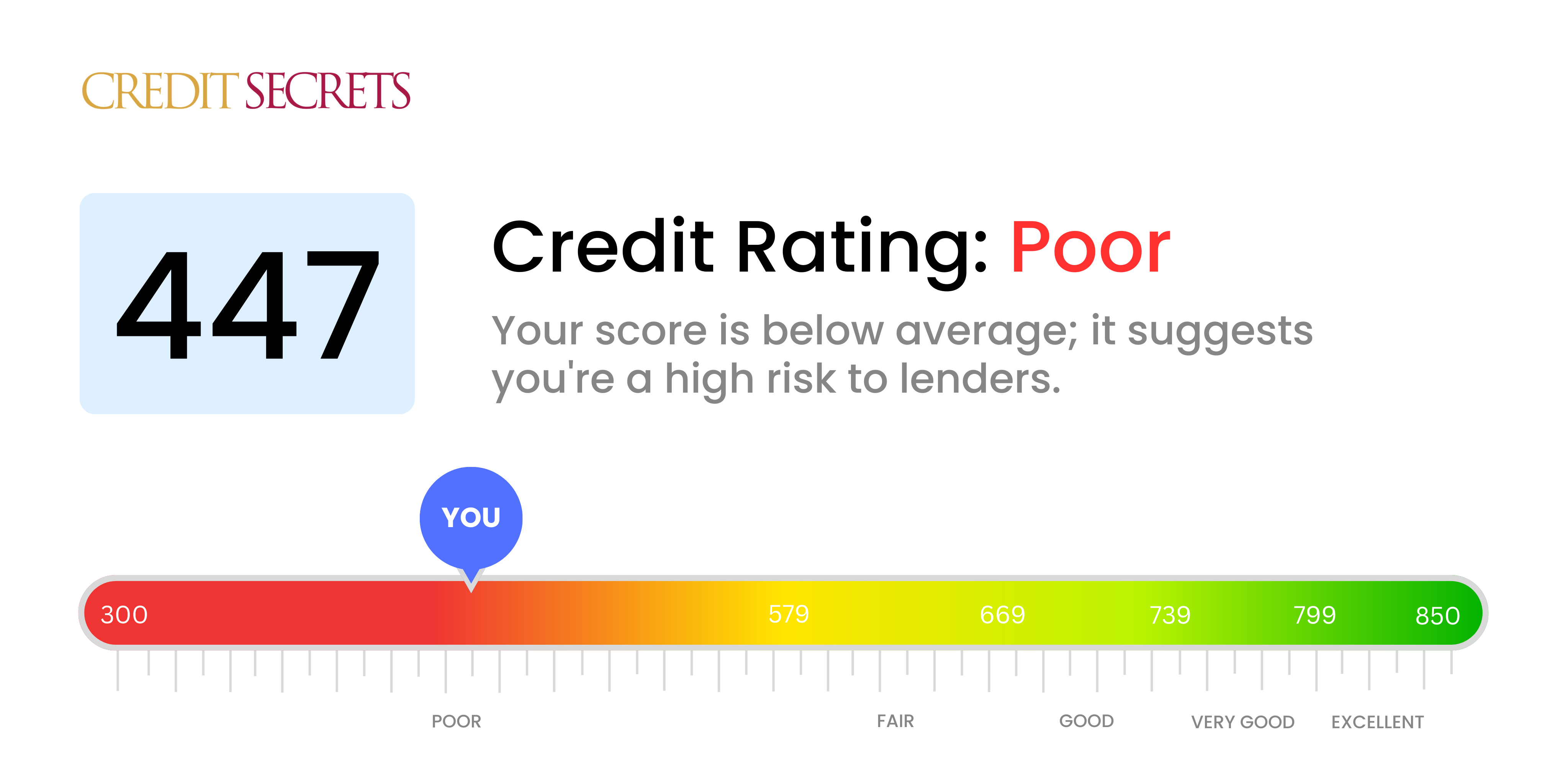

Is 447 a good credit score?

With a score of 447, your credit rating unfortunately falls into the 'Poor' category. This isn't where you want to be, but the good news is there are ways to start improving your score right away.

At this level, you may find it challenging to secure loans, mortgages, or credit cards, and if approved, you're likely to face high-interest rates. Despite these hurdles, don't lose hope. By consistently making payments on time, maintaining a low balance, and exhibiting responsible financial behavior, you can begin to lift this score. Remember, improving your credit score is a journey, and it's the small, consistent steps that lead to big changes.

Can I Get a Mortgage with a 447 Credit Score?

A credit score of 447 suggests that you may have faced financial difficulties, such as late payments or defaults. Unfortunately, it raises concerns for lenders and it's unlikely that a mortgage application with this score will be approved. This is considerably lower than the minimum score requirement by most mortgage lenders, which is typically at least 600.

However, it's not the end of the road as there are several alternatives available. For instance, you could explore government-insured loans like FHA loans. These loans are specifically designed for individuals with lower credit scores and require a smaller down payment. You could also consider working to improve your credit score before applying for a mortgage. This involves making timely payments on all your debts and minimizing your credit utilization. Though this can be a time-consuming process, it can significantly enhance your chances of securing a home mortgage in the future.

Keep in mind that even though you may get approved for a mortgage with a lower score through some of these alternative routes, you may face higher interest rates due to the perceived risk associated with low credit scores. Therefore, it's in your best interest to bolster your credit score before applying.

Can I Get a Credit Card with a 447 Credit Score?

Holding a credit score of 447 is, unfortunately, seen as a red flag to potential lenders. A score like this is considered high-risk, indicating past financial difficulties. However, facing this reality is crucial. Turn it into a positive; let it be the starting point to your financial recovery journey. Dealing with a credit score like this is tough, no doubt, but understanding it is an important step.

Getting conventional credit might be hard with such a score. Don't lose hope, though; alternatives like secured credit cards could be a good starting point. These require a deposit that serves as your credit limit, potentially simplify the approval process and can help rebuild credit over time. You might also want to consider using a co-signer or a prepaid debit card as an alternative credit option. Keep in mind that interest rates tend to be significantly higher with these alternatives, reflecting the increased risk to lenders. Remember, these aren't instantaneous solutions, but they're moves in the right direction towards regaining financial stability.

With a credit score of 447, it's rather unlikely that you'd be approved for a personal loan through traditional lenders. Credit scores in this range are seen as high risk, creating hesitations for lenders. This can be a tough reality to face, but it's an important part of understanding your financial situation.

While traditional personal loans might not be in reach, there are other options available. Secured loans, co-signed loans, or peer-to-peer lending platforms may be more accessible. Each of these alternatives requires a different kind of assurance to the lender, such as collateral or another person to co-sign. It's important, however, to keep in mind that because these options are perceived as riskier, they typically come with higher interest rates and less favorable terms. So while they may provide the loan you need, it will likely come at a greater cost.

Can I Get a Car Loan with a 447 Credit Score?

A credit score of 447 is considered quite low, especially in the context of seeking a car loan. Lenders generally look for scores that are above the 660 mark to offer favorable conditions. Regrettably, your score falls into what is often regarded as the subprime category. This simply means that from a lender's perspective, the lower credit score signifies a higher risk. With the history of this score, it suggests that you might struggle with repaying the loan.

Nevertheless, don't let this discourage you. Even with a low score, there are possibilities of achieving your goal of owning a car. Some lenders specifically cater to those with lower credit scores. Do keep in mind, however, that these types of loans often have higher interest rates as this is the lender's way of mitigating their risk. It’s crucial that you carefully assess the terms, and while it may be a slightly tougher journey, the possibility of securing a car loan still exists. Always remember, the situation isn't hopeless despite the low score.

What Factors Most Impact a 447 Credit Score?

Recognizing the constituents of a 447 credit score is instrumental in building a robust plan for financial betterment. The factors that brought your score to this level can be identified and addressed to work towards a healthier economic status. Each financial journey is distinct and comes with opportunities for personal growth and learning.

Payment History

Preserving a good payment history can greatly improve your credit score. The presence of late payments, unpaid loans or defaults may be a significant contributor to your current score.

How to Check: Scan your credit report for any late payments or loan defaults. Check to ensure if you have made payments on time as these might have reflected negatively on your credit score.

Credit Utilization Ratio

A high credit utilization ratio might have caused your score to drop. If your credit card balances are near their limits, it might be contributing to your present score.

How to Check: Go through your credit card statements. Are your balances close to your limits? Try to keep your balances comparatively lower than your credit limits.

Length of Credit History

A limited credit history could have impacted your score negatively.

How to Check: Inspect your credit report to know the age of your oldest and youngest accounts and the overall average age. Reflect if you have opened any new accounts recently.

Credit Variety and Fresh Credit

Having a diversified set of credit accounts and responsibly managing new credit can help in improving your score.

How to Check: Ponder over your mix of credit accounts encompassing credit cards, retail accounts, installment loans, mortgage loans. Be considerate about sparingly applying for new credit.

Public Records

Public records encompassing bankruptcies or tax liens can significantly bring down your credit score.

How to Check: Browse your credit report for any public records. Take necessary action to resolve items listed, if any.

How Do I Improve my 447 Credit Score?

With a credit score of 447, you’re undoubtedly facing some challenges when it comes to financial matters. But don’t lose hope, better credit is within reach through commitment and smart actions. Here are some practical suggestions tailored to your situation:

1. Prioritize Missed Payments

Begin by focusing on any missed payments you have. Contact your creditors to design a possible plan for repayment. Your willingness to pay off overdue debt displays active responsibility and can positively impact your credit score.

2. Controlling Credit Card Utilization

Minimize the amount of your available credit you’re using. Start lowering your credit card balance to under 30% of your limit. Ideally, keep it under 10% for even better results. Tackle the cards with the highest balance first.

3. Secured Credit Cards can be Beneficial

Obtaining a regular credit card can be difficult with your current score. A secured credit card, backed by a cash deposit, can be a good alternative. Use it wisely to gradually build a hopeful credit history.

4. Consider Becoming an Authorized User

Family or friends with an impressive credit history can be a great asset. If they let you be an authorized user on their credit card, your credit report could benefit from their good financial habits.

5. Exploring Different Credit Options

Once you’ve proved yourself with a secured card, diversify your credit portfolio. Try a credit-builder loan or a retail credit card to show you can manage different types of credit. This diversity can lead to an improved credit score.

Remember, patience is key. Rebuilding credit doesn’t happen overnight, but with consistent effort, you can significantly enhance your financial situation.