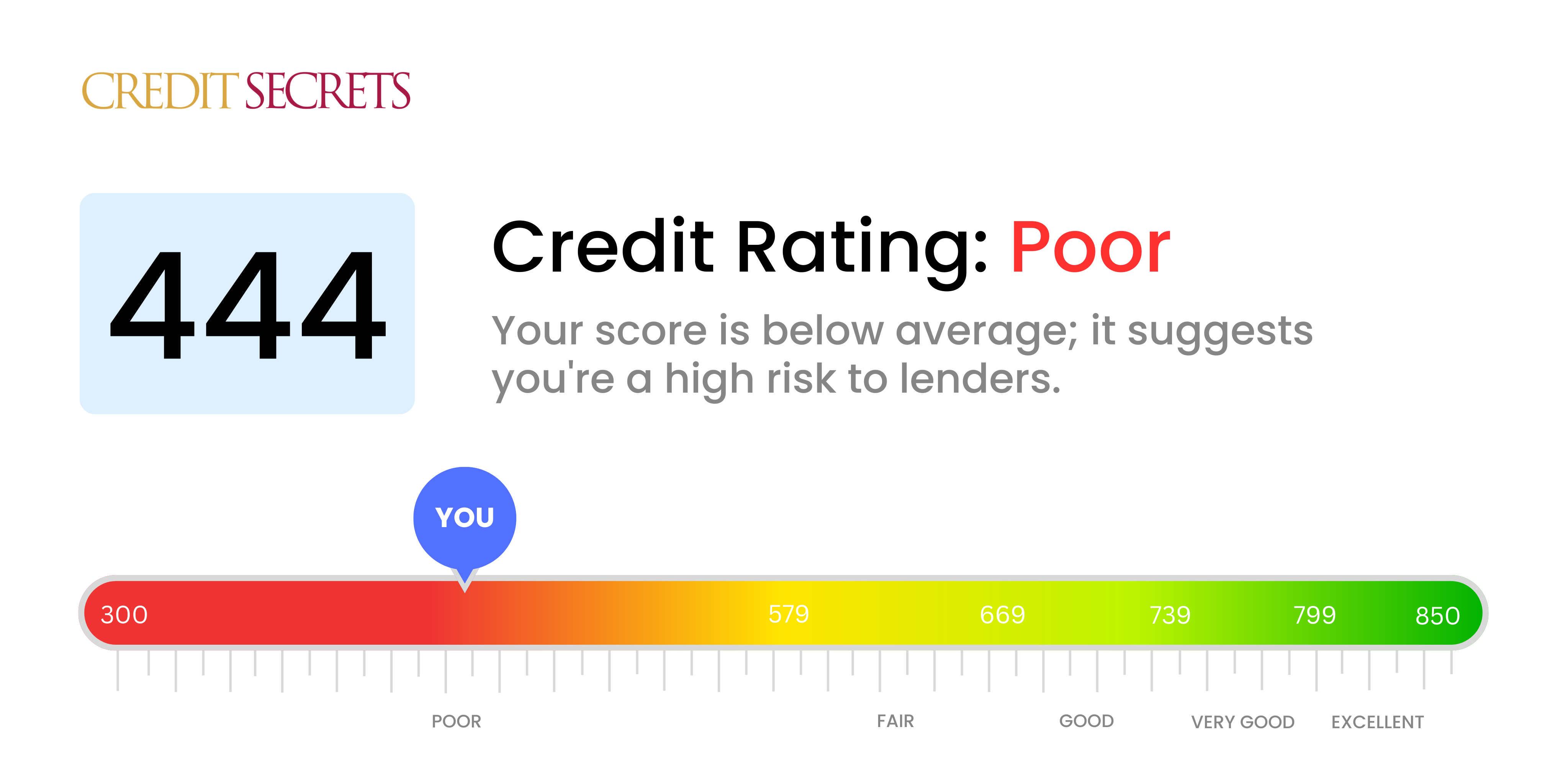

Is 444 a good credit score?

Unfortunately, a credit score of 444 is not considered a good credit score, but it falls into the range of 'poor'. However, this doesn't mean you're stuck with this situation forever. There are ways to improve.

Having a credit score of 444 may make it difficult for you to gain approval for loans or credit cards and if you do get approved, you might have to confront high interest rates. Nevertheless, with consistent efforts, you can take steps to increase your score over time. You just have to be persistent and disciplined in your efforts.

Can I Get a Mortgage with a 444 Credit Score?

Carrying a credit score of 444, unfortunately, regularly results in difficulties getting approval for a mortgage. This score is significantly below what most mortgage lenders require. A score within this range reflects a background of financial hardships, such as late payments or defaults.

In light of these financial challenges, it's essential to actively work on elevating your credit score. Begin by addressing any existing debts or late payments that might be bringing your score down. From there, focus on establishing a consistent record of timely payments and responsible credit management. Even though increasing your credit score can take time and patience, it's certainly possible with continual effort and commitment. Embrace the journey towards a financially secure future.

Additionally, you should be aware that a lower credit score often results in higher interest rates when it comes to loans. This is because lenders perceive you to be at a higher risk of defaulting on the loan. Therefore, elevating your credit score can not only increase your chances of being approved for a loan, but can also help you to secure better terms.

Can I Get a Credit Card with a 444 Credit Score?

If you have a credit score of 444, it may be tough to secure approval for a traditional credit card. This score is often seen as high-risk by lenders an indication of past financial difficulties. It's not an easy pill to swallow, but facing the truth with maturity and realism is the first step towards improving your financial situation.

With such a low score, you might want to consider alternatives like secured credit cards. These cards require an upfront deposit, meaning your credit limit equals the amount you deposit. It might be easier for you to get approval for these types of cards, and they can help you build your credit bit by bit. Other viable options could range from persuading a co-signer to help shore up your credit application to considering options like pre-paid debit cards. While none of these choices provide an instant turnaround, they can put you on the right path towards better financial stability. Remember, interest rates for available credit can be high with such a score, as lenders view the risk as greater. The journey towards a higher credit score is long, but it absolutely can be accomplished with patience and discipline.

Having a credit score of 444 might present quite a challenge when seeking approval for a personal loan. Unfortunately, this score is below the minimum threshold that most lenders find acceptable, which may result in your application being declined. This score from your credit report indicates a high risk to potential lenders. It's a tough reality to confront, but understanding your credit score and what it means for your borrowing capabilities is a critical first step.

Despite the odds, there are still options you could explore when traditional personal loans aren't available. Secured loans, which require collateral, or co-signed loans, where you have someone with a stronger score standing behind you as a guarantor, could be alternatives. Peer-to-peer lenders might also be an option - these online platforms often have more flexible credit requirements. Be aware though, these options generally come with higher interest rates and less favorable repayment terms to offset the risk involved for the lender.

Can I Get a Car Loan with a 444 Credit Score?

A credit score of 444 is unfortunately considered quite low. For something like a car loan, lenders often seek out individuals who have scores that are above 660. When scores fall below that - specifically beneath 600 - they're often labeled as subprime. That's where your score of 444 falls. Lenders may hesitate to approve a loan given this score because it represents a greater risk that the loan might not be paid back reliably.

There is, however, room for hope. The road to getting a car loan may be a bit winding, but it doesn't end here. Some lenders focus on working with people whose scores are somewhat lower. Just bear in mind, these types of loans often come with a higher interest rate – this is the lender's way of balancing out the risk they're taking. As long as you're cautious and fully understand the terms of the loan, it's still possible to secure a car loan.

What Factors Most Impact a 444 Credit Score?

A score of 444 signals significant room for financial growth and improvement. Unearthing the factors that contribute to such a score is vital in strategizing your financial betterment path.

Payment Track Record

Your payment history has a significant bearing on your credit score. Any history of delayed or defaulted payments might primarily explain your score.

Action Step: Dip into your credit reports to unearth any late or missed payments. Equip yourself with knowledge on how different situations have affected your score.

Credit Usage

An inflated credit card utilization ratio might negatively impact your score. If you consistently max out your credit cards, this might be a pivotal factor.

Action Step: Investigate your credit card activity. Are you frequently reaching or breaching your credit limits? Maintaining a lower balance can work in your favor.

Credit Tenure

A shorter than average credit history can result in a low credit score.

Action Step: Scrutinize your credit report to assess the lifespan of your oldest, newest, and all combined accounts. Newer accounts might lead to a lower score.

Type and Quantity of Credit

A healthy mix of credit types and fewer new credit applications can lead to a better score.

Action Step: Evaluate the diversity of your credit accounts. Excessive recent applications might lower your score.

Public Filings

Public records such as bankruptcies and tax liens can seriously degrade your score.

Action Step: Scrutinize your credit report for any public filings. Act to resolve pending items that might affect your score.

How Do I Improve my 444 Credit Score?

Experiencing a credit score of 444 might be daunting, but don’t worry! With conscious efforts, you can definitely elevate your score. These are the most immediate and effective strategies tailored specifically for your credit score:

1. Evaluate Your Credit Report

Investigate your credit report to understand what’s bringing your score down. Look for any inaccuracies, late payments, charge-offs, or collection accounts. If you spot errors, dispute them immediately with the credit bureau and the reporting company.

2. Tackle Outstanding Debts

Outstanding debts can severely hurt your credit score. Prioritize paying them off, especially those with the highest interest rate. Contact your creditors to negotiate terms, including possibly lower interest rates or extended payment plans.

3. Opt for a Secured Loan or Secured Credit Card

With a low credit score, obtaining a standard loan or credit card can be challenging. Consider a secured loan or credit card, where you provide collateral. This can offer a way to expand your credit profile while demonstrating responsible credit use.

4. Utilize Credit-Builder Loans

A credit-builder loan can be a powerful tool. These loans are designed specifically for those wanting to improve their credit. The lending institution holds onto the money until the loan is paid back. A successful repayment plan can substantially improve your credit score.

5. Monitor Credit Card Balances

Keep your credit card balances low. Keeping your balance below 30% of your credit limit will positively impact your credit utilisation rate, a key factor in credit scoring.

Rest assured, rebuilding your credit is achievable, and the targeted steps above can set you on the right path towards a healthier financial life.