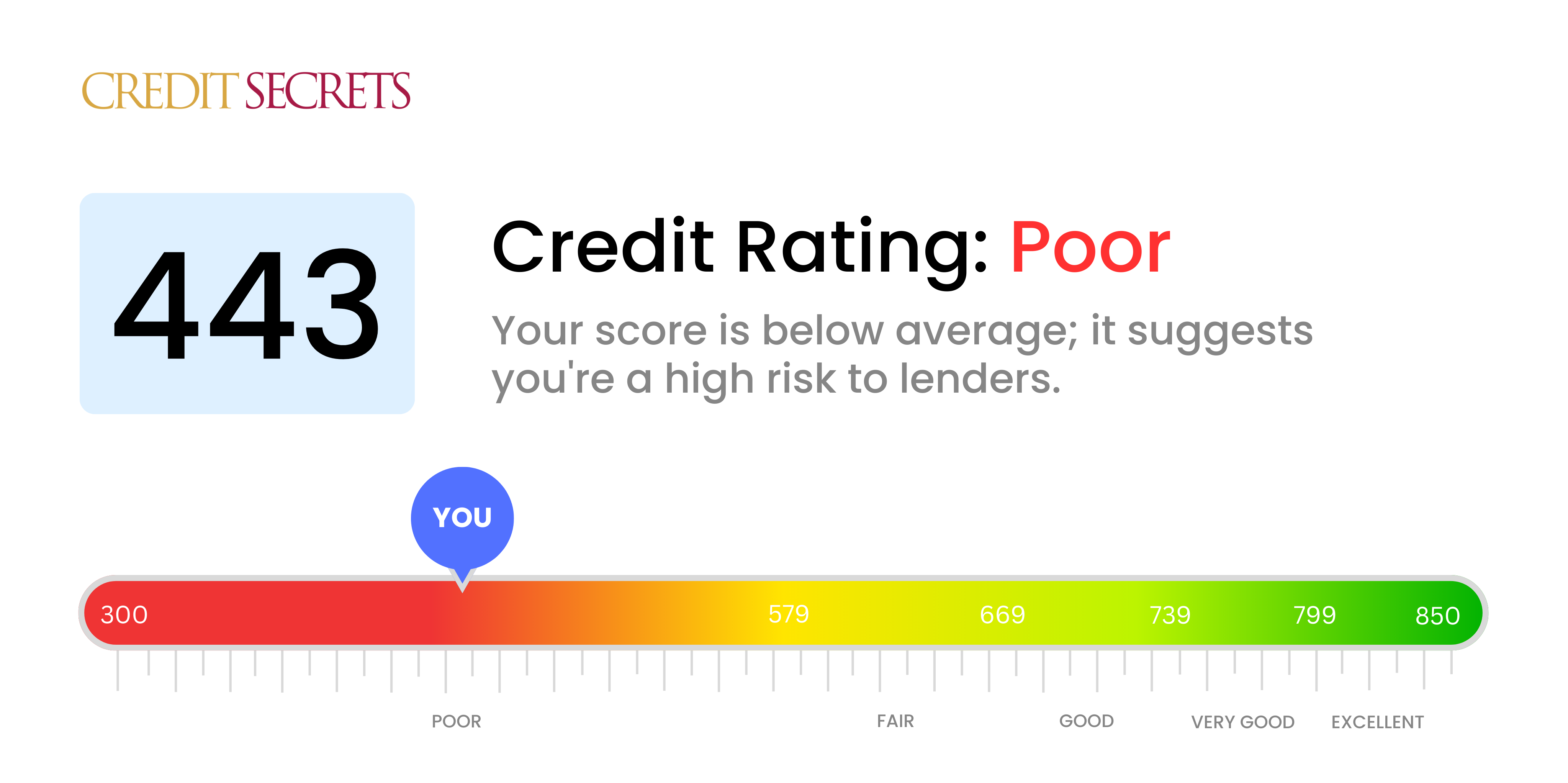

Is 443 a good credit score?

With a credit score of 443, it's quite evident that your standing falls within the 'Poor' range. This certainly may seem disheartening, but it's not the end of the road by any means. There are ways to mend such financial situations.

At this level, gaining approval for new credit or loans could be substantially difficult, and when granted, they often come with high interest rates. Unfortunately, landlords and utility providers might demand higher security deposits, and auto or home insurers may present elevated premiums. However, remember, it's always possible to improve your score and Credit Secrets is here to guide you on that journey.

Can I Get a Mortgage with a 443 Credit Score?

Having a credit score of 443 would, unfortunately, make it extremely difficult for you to be approved for a mortgage. Such a score is significantly below the minimum requirement that most lenders look for. The implication of a score within this range is that there have been considerable financial issues in the past, such as defaulted payments or severe debt.

Though finding yourself in this situation is undeniably tough, it's important to remember that it's not the end of the road. Stabilizing your credit situation should be your first step. Seek to manage and settle any outstanding debts causing harm to your score. Simultaneously, aim to demonstrate strong financial responsibility through timely repayments and prudent credit use. While the journey to a higher credit score is progressive, persistent effort can greatly enhance your chances for future credit opportunities.

Sometimes, a less traditional route such as using a co-signer or opting for a smaller scale loan might be alternative routes to consider. A co-signer, someone with a higher credit score, could potentially help you secure a loan. Smaller scale loans could require a lower credit score for approval. Remember, your current score isn't a life sentence, and with diligent effort, you can improve your credit status for better opportunities in the future.

Can I Get a Credit Card with a 443 Credit Score?

If the credit score is 443, chances are slim for approval of a traditional credit card. This score does reflect high risk in the eyes of lenders, which may signal past financial struggles or mishandling of credit. It's not an easy fact to accept, however, understanding your standing is an essential stride towards financial stability.

Your current situation doesn’t mean that there's no solution. Exploring other options like secured credit cards could be beneficial. These cards require a deposit and can assist in rebuilding good credit over time. Moreover, the concept of a co-signer or using prepaid debit cards could also be sensible solutions. It's crucial to note that these alternatives won't give instant improvements, but can be reliable stepping stones on your path to better financial health. Keep in mind, the interest rates for the available credit options are typically higher for those with lower scores due to the increased risk for the lender.

Having a credit score of 443 puts you in a tough spot when seeking a personal loan. Traditional lenders often see a score this low as an indication of high risk. Therefore, it's less likely that you'll be approved for a loan under typical circumstances. This may seem discouraging, but it's crucial to understand what this credit score means for your borrowing options.

When conventional loans aren't an option, you might explore alternatives like secured loans, where you put up collateral, or co-signed loans, where another individual with a higher credit score stands as your guarantor. There's also the possibility of peer-to-peer lending platforms, known sometimes for their more forgiving credit requirements. But remember, these alternatives can come with higher interest rates and less flexible conditions, as they too reflect the elevated risk for the lender. Moving forward, it's important for you to learn about each option, understand the costs, and choose wisely.

Can I Get a Car Loan with a 443 Credit Score?

For a credit score of 443, securing a car loan may pose a significant hurdle. Most lending institutions prefer to see credit scores of at least 660 before providing favorable terms. Since your score is below this benchmark, it is viewed as subprime. This term means that lenders might consider you to be higher risk, potentially leading to steeper interest rates or even the possibility of your loan application being declined. This is because a low credit score may indicate past difficulties in servicing debt.

Yet, this score doesn't completely close all avenues to car ownership. There are lenders who cater to borrowers with lower credit scores. But proceed with caution because loans from these lenders usually come with notably increased interest rates. This high cost is a mechanism to protect themselves from the risk identified by your credit score. Despite the challenges, obtaining a car loan isn't an impossible task. It just requires careful thought and a critical review of the terms attached to the loan.

What Factors Most Impact a 443 Credit Score?

Recognizing the value of your 443 credit score is a significant step towards achieving healthier finances. By addressing your specific financial situation and improving the contributing factors, you can build towards greater financial stability. Always remember, financial growth takes time.

Delinquent Payments

Your credit score can take a hit if you have a pattern of late or missed payments. These carry a significant weight and can be a major contributor to your score.

What to Do: Review your credit history for any delinquencies. Prioritize consistent and timely payments to help improve your credit score.

Heavy Debt Burden

If your score is on the lower side, it might be due to high outstanding debt compared to your income.

What to Do: Look into your credit statements, if the amounts are consistently high, try to maintain a lower usage and start reducing your existing debt.

Short Credit Age

A younger credit history can potentially bring down your score, particularly if not managed well.

What to Do: Go over your credit report to check the average age of your accounts. Be cautious with opening new ones too quickly.

Lack of Credit Variety

A lack of variety in your credit portfolio could be negatively affecting your score.

What to Do: Assess your credit report for diversity of credit types. Strive to manage a mix of credit, like credit cards, installment loans and mortgage, effectively.

Public Record Issues

If you have public records like judgments, bankruptcies or tax liens, these can heavily impact your score.

What to Do: Regularly scan your credit report for public records. Plan to resolve any issues that may impact your credit.

How Do I Improve my 443 Credit Score?

A credit score of 443 is significantly low, however, you’re not bound by this less than stellar number. You have within you the power to pull this number up and regain control of your financial life. Here are some efficient and attainable steps for boosting your current score:

1. Make Current Delinquent Accounts

Failing to stay up-to-date on your payments heavily weighs on your credit score. Contact your creditors and devise a payment plan that satisfies your past-due balance. Always prioritize the most delinquent accounts for the fastest improvement.

2. Seek a Secured Credit Card

Secured credit cards are a viable option for your current score range. These require a refundable deposit, which determines your credit limit. Regular, responsible use, will display your ability to make timely payments, reflecting positively on your credit report.

3. Decrease Your Credit Utilization Ratio

Your credit utilization ratio – the percentage of your total credit that you’re using – should ideally be below 30%. Focus on paying down your balances, especially on cards where the balance is close to the credit limit. This action will have a positive effect on your credit score.

4. Request to be an Authorized User

If a loved one has a credit card with a good history, ask to be added as an authorized user. Their good credit behavior could help to improve your score. However, ensure their card issuer reports the activity of authorized users to credit bureaus.

5. Nurture Diverse Credit

Diversifying your credit can positively contribute to your score improvement. Once a secured card has helped you establish a good payment history, consider applying for other types of credit like retail credit cards or credit builder loans, and judiciously manage them.