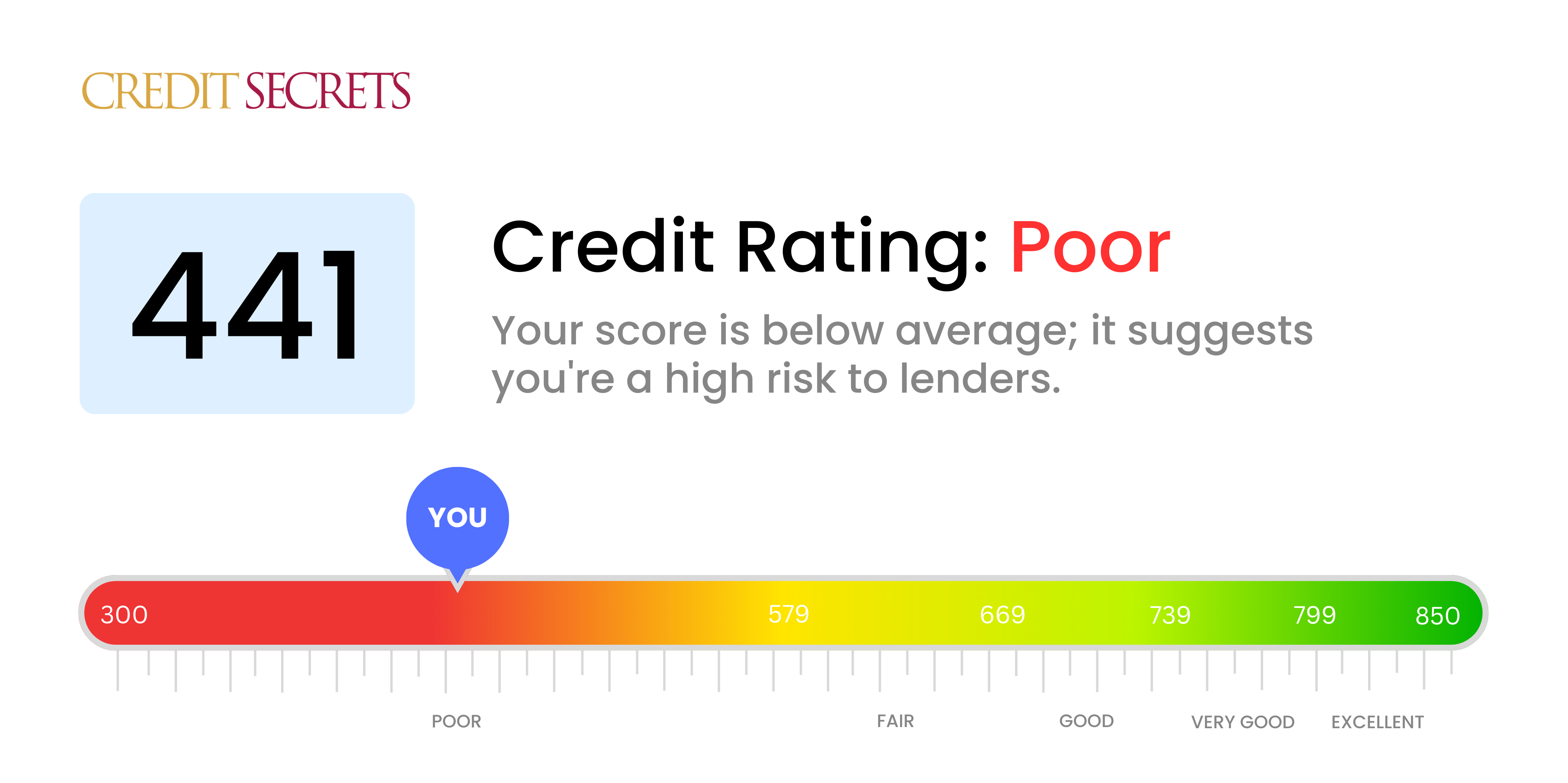

Is 441 a good credit score?

Having a credit score of 441 indicates that your score falls within the 'poor' credit range. This may make it challenging for you to secure loans or credit cards, as well as potentially impacting insurance rates, job opportunities, and your ability to rent a home or apartment.

However, don't be disheartened—improving your credit score is possible with time, patience, and the right approach. You can begin making a positive impact on your credit score by paying bills on time, keeping credit card balances low, and dealing with any delinquent accounts or collection items without delay. Remember, the journey towards excellent credit is all about making consistent, responsible financial decisions.

Can I Get a Mortgage with a 441 Credit Score?

With a credit score of 441, obtaining approval for a mortgage can be an uphill battle. This score is quite below the minimum most lenders seek, indicating past financial challenges such as consistent late payments or debt defaults. Being in such a situation is tough, but not indefeasible. It's worth noting that this score could lead to higher interest rates, further complicating the process.

Focus now should be centered on elevating your score. Begin by sorting any outstanding debts that are causing significant harm to your credit. Strive to establish punctual payment records and responsible credit etiquette. There are no shortcuts in this endeavor. An enhanced credit score won't happen overnight, but steady dedication can place you in a favorable situation for future financial undertakings. It's a difficult process, but remember, hard work and perseverance can alter the landscape of your financial future significantly.

Can I Get a Credit Card with a 441 Credit Score?

Unfortunately, with a credit score of 441, the likelihood of being approved for a standard credit card is quite low. This could be difficult news to hear, but it's crucial to approach these realities with clarity and determination. The credit score might suggest past financial hardships or struggles, but remember, being conscious of your financial situation is the first yet most vital step towards your goal of financial stability.

While traditional credit card approval may be challenging with this score, there are other options to consider. One alternative could be a secured credit card, where the credit limit is equivalent to a deposit you initially make. These cards might be easier to get approved for and can assist in rebuilding your credit gradually. Additionally, having a co-signer or using pre-paid debit cards might also be feasible alternatives. These options might not instantly improve your financial conditions, but they are effective tools in your journey to improve your credit. Bear in mind that anything regarding credit accessible to someone with your score may come with higher interest rates, due to the higher perceived risk to lenders.

Having a credit score of 441 can make obtaining a personal loan a significant challenge. Traditional lenders generally find such a score to represent too much risk. It's a harsh reality to accept, but it's a critical step towards understanding your financial situation and exploring alternative solutions.

While traditional loans might be exceedingly difficult to secure with your current credit score, there are other avenues to consider. Secured loans, where property or assets serve as collateral, could be a potential solution. Likewise, co-signer loans allow individuals with a higher credit score to act as your sponsor. Alternatively, you may explore peer-to-peer lending platforms known for a more lenient credit scoring policy. However, it's essential to recognize that these alternatives often entail higher interest rates and less favorable rights due to the increased risk to the lender. Remember, every financial decision has consequences, so it is crucial to thoroughly understand the terms before proceeding.

Can I Get a Car Loan with a 441 Credit Score?

Navigating the world of car loans with a credit score of 441 could pose a significant hurdle. Typically, lenders are more inclined to offer loans and better interest rates to individuals with scores above 660. A score of 441 is significantly below that benchmark and is considered high risk by lenders. High risk is often associated with higher loan denial rates and more expensive interest rates because this score suggests possible difficulties with repaying loans in the past.

Despite the challenging outlook, don't lose hope. There are lenders out there who tailor their services to those with lower credit scores. However, it's crucial to understand that these loans may come with steeper interest rates as lenders try to counterbalance the risk they're taking on. Just remember, getting a car loan could still be possible, but it may require extra diligence to ensure the terms won't put you under additional financial strain.

What Factors Most Impact a 441 Credit Score?

For those seeking to enhance their financial standing, working to understand a score of 441 is vital. There are a number of factors that could be causing this score, and knowing how to address them can guide the course of your financial growth. Remember, all financial journeys are unique, each offering its own lessons and opportunities for improvement.

Consistent Payment History

Possessing a consistent record of on-time payments is significant in improving your credit score. Missed payments or defaults can decrease your score sharply.

How to Check: Check your credit report for any inconsistency or missed payments. Reflect on any instances of delayed payments, as they may have resulted in a lower score.

High Credit Utilization Ratio

Utilizing a high percentage of your available credit can negatively impact your score. If your credit cards are nearly maxed out, this can be a significant issue.

How to Check: Go through your credit card statements. Are you using high percentages of your credit limits? Keeping your balance lower than your credit limit can help.

Short Credit History

Having a short credit history can negatively impact your score, with newer accounts being particularly damaging.

How to Check: Check your credit report to see the length of your oldest and newest accounts, as well as the average age of all your accounts. Have you opened multiple new accounts recently?

Diversity of Credit and Responsible New Credit Management

Maintaining a range of credit types and responsibly handling new credit is crucial for a healthier score.

How to Check: Review your different types of credit accounts, like credit cards, retail accounts, installment loans, and mortgage loans. Have you been applying sparingly for new credit?

Derogatory Public Records

Public records marked as derogatory, such as bankruptcies or tax liens, can drastically affect your score.

How to Check: Look into your credit report for any derogatory public records. Make sure to address any listed items that require resolution.

How Do I Improve my 441 Credit Score?

A credit score of 441 is regarded as severely challenged, but that does not mean it’s impossible to rebuild. Specific, targeted efforts can definitely result in a drastic change. Here are effective strategies you can implement at this score level:

1. Prioritize Outstanding Debts

Repaying any outstanding debt is a crucial initial step. Focus on settling the oldest debts first as they have a profound impact on your score. Negotiate with your creditors to establish a feasible repayment schedule if necessary.

2. Lower Your Credit Card Usage

Highly utilized credit cards can substantially decrease your credit score. Aim to limit your credit card usage to less than 30% of your available credit, ideally keeping it below 10%. Prioritize the credit cards having the highest balance relative to their limit.

3. Apply for a Secured Credit Card

Given your credit score, getting approved for a conventional credit card might be difficult. A secured credit card could be a good alternative. Use this card wisely, making minor purchases, and pay off the entire balance every month to establish a positive payment record.

4. Take Advantage of Credit Builder Loans

Consider a credit builder loan, which is specifically designed to help individuals build or rebuild their credit. Payments made towards this loan are reported to the credit bureaus, positively impacting your credit score.

5. Maintain Diversified Credit

Once you’re able to manage a secured credit card responsibly, consider diversifying your credit sources. This might include small installment loans or retail store cards. Ensure you make timely payments to all your credit sources to enhance your credit profile.