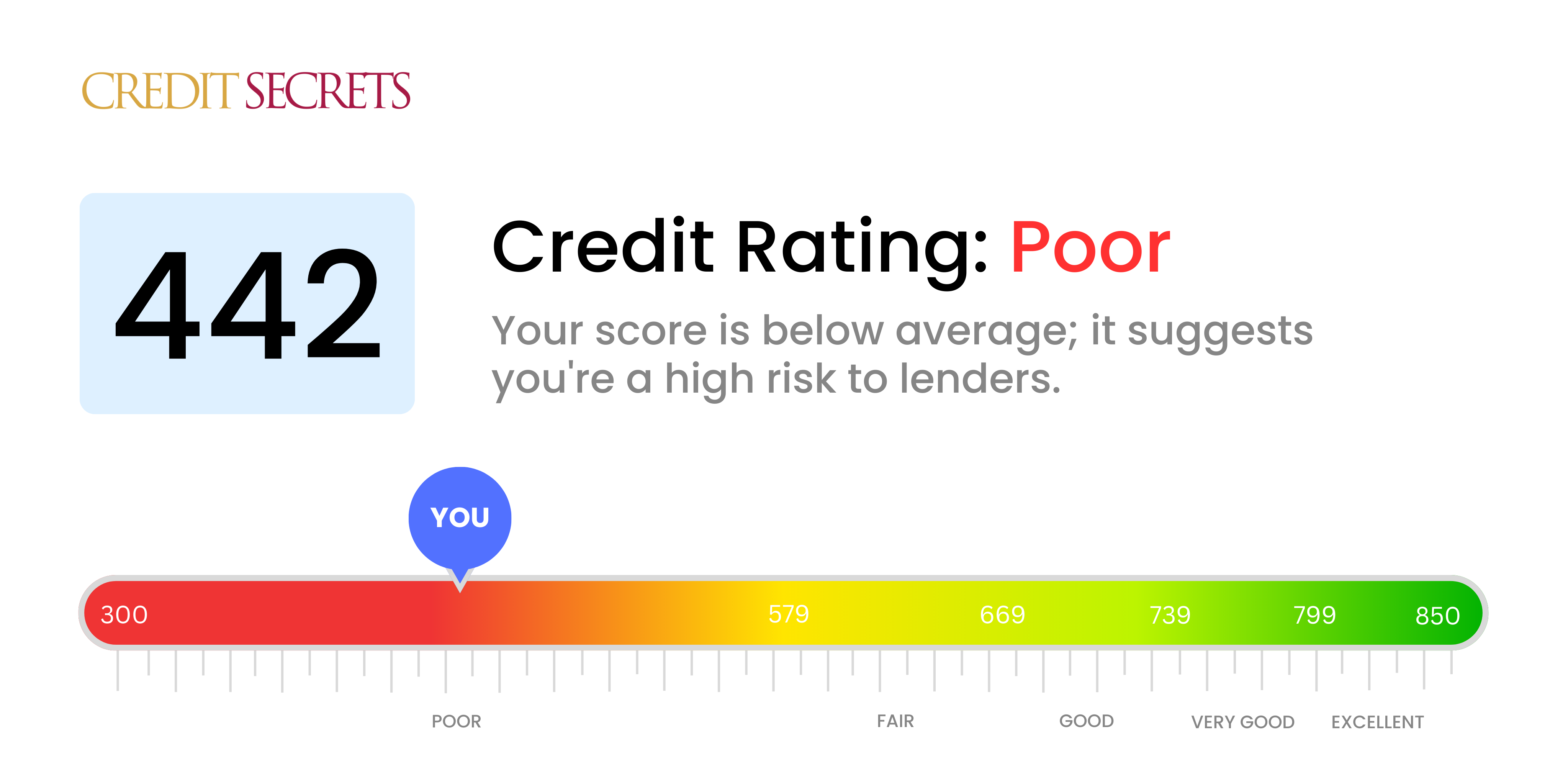

Is 442 a good credit score?

With a credit score of 442, the situation appears challenging but it is not impossible to overcome. This score falls into the 'poor' category, meaning there may be significant obstacles when trying to gain credit approvals or secure favorable loan terms. However, the opportunity for improvement is always present.

You might face higher interest rates, stricter loan terms, or difficulty getting approved for credit with this score. Keep in mind that there is room for growth and change. With patience, persistence, and wise credit practices, you can gradually improve your credit score, opening up better financial possibilities in the future.

Can I Get a Mortgage with a 442 Credit Score?

If your credit score is at 442, it might be quite challenging to get approved for a mortgage. Lenders tend to prefer credit scores that indicate a history of responsible financial behavior and safe lending. Regrettably, a credit score of 442 is typically viewed as subpar, and might signal to lenders that you've faced significant past financial difficulties such as late payments or defaults.

However, it does not mean that your situation is completely devoid of solutions. Alternative options like government-backed loans are known to have more lenient credit requirements, so that could be a viable direction to investigate. However, interest rates might be higher in these cases due to the perceived greater risk. It's crucial to remember that, while challenging, it is entirely possible for you to raise your credit score. Make sure to pay bills on time, avoid maxing out credit cards, and maintain a healthy mix of credit accounts. Remember, steady and consistent actions toward financial responsibility are key in bolstering your credit score.

Can I Get a Credit Card with a 442 Credit Score?

A credit score of 442 certainly poses some challenges when applying for conventional credit cards. This score usually signifies financial hurdles or mishaps in the past, and lenders tend to view it as a high-risk. It can be a tough pill to swallow, but understanding and accepting your current credit status is the first step towards financial recovery. Wrap your head around these realities and know that you can work from here.

With this particular score, looking into alternative credit options might be a beneficial next step. Secured credit cards, for example, could be an option. These require a deposit that will then serve as your credit limit, making it a more accessible choice for those with lower scores. Another path could involve finding a co-signer or investigating pre-paid debit cards. While options like these don't provide instant relief, they offer a means to gradually rebuild credit. Keep in mind though, any credit forms available to you will likely have high interest rates, due to the increased risk lenders see in lower scores. But remember, this is just a step in your journey towards more stable financial footing.

With a credit score of 442, it's rather unlikely that you'd be approved for a personal loan from traditional lenders. It's not a pleasant fact to face, but a score this low often signals a high risk to lenders, pushing them to reject loan applications. It's crucial to know exactly what this score may mean for your borrowing capabilities.

You're not entirely without options, though. Alternatives like secured loans, which require you to provide collateral, or co-signed loans, where a more creditworthy individual supports your loan, might be viable routes for you. Peer-to-peer lending platforms are another possibility. But it's essential to remember that these alternative sources generally come with higher interest rates and less beneficial terms due to the added risk for the lender.

Can I Get a Car Loan with a 442 Credit Score?

If you have a credit score of 442, it's likely you may face hurdles when applying for a car loan. Lenders usually favor scores above 660, so with a score of 442, you fall into what's known as the subprime category. This means you might experience higher interest rates or even loan refusal as this lower score suggests a heightened risk to lenders—it's an indication of potential issues in repaying borrowed money.

Yet, having a lower credit score doesn't mean you should abandon your hopes of owning a car. You might find lenders who work specifically with subprime borrowers. It's important to remember though, these loans typically come with robust interest rates. The elevated rates reflect the perceived risk, acting as a safeguard for the lenders. Being mindful and well-informed about the loan terms is essential. Even though the journey may seem challenging, acquiring a car loan isn't entirely out of reach.

What Factors Most Impact a 442 Credit Score?

Grasping the reasons behind a 442 credit score is crucial to devising an effective strategy for improving your financial standing. Let's explore some of the possible factors that could have led to this score and how you can address them.

Consistent Late Payments

Punctuality matters when it comes to credit. Habitual late payments might be a significant reason for a lower credit score.

How to Check: Inspect your credit report to identify any tardy payments or missed accounts. Reflect on your payment habits and consider timely payments moving forward.

High Usage of Available Credit

Consistently maxing out your credit cards or loans can unfavorably affect your credit score. This implies you might be over-reliant on credit, thus leading to a lower score.

How to Check: Review your credit statements. Are your credit card balances always close to your credit limits? Keeping outstanding balances under 30% of your credit limit can help improve your score.

Short Credit History

If you have not had credit for very long, this might be influencing your score negatively.

How to Check: Examine your credit report to check the overall length of your credit history. If it is short, time and responsible credit use will be the best remedies.

Lack of Credit Diversity

A variety of credit types benefits your credit score. Having only one type, like credit cards, can impact your score negatively.

How to Check: Look at your credit report to see if a mix of the types of credit you have used exists. Try to diversify your credit properly.

Unresolved Financial Liabilities

Outstanding debts or tax liens can significantly drag your score down.

How to Check: Check your credit report for any unresolved debts or liabilities, and seek resolution of these issues to improve your score.

How Do I Improve my 442 Credit Score?

A credit score of 442 isn’t ideal, but don’t lose hope. With strategic steps, you can transform your credit health. Here’s what you can do right now:

1. Confront Defaulted Accounts

If any of your accounts are in default, handling these should be your top priority. The severity of a default’s impact on your score is influenced by how overdue the account is. Communicate with your lenders to settle on a realistic repayment scheme if needed.

2. Tackle High Credit Card Debt

Excessive credit card debt compared to your credit limits can heavily suppress your score. Aim to get your credit card debts to under 30% of your credit limit, striving for less than 10% in the long run. Focus first on the credit cards with the highest utilization.

3. Consider a Secured Credit Card

Obtaining a standard credit card may be tough given your present score. You might want to think about securing a secured credit card, which demands a cash collateral deposit that serves as your credit line. Use it wisely, making minor purchases and settling the balance each month to foster a positive payment record.

4. Seek Authorization on Another’s Account

Request a relative or friend with exemplary credit to add you as an authorized user on their credit card. This step can benefit your credit score by incorporating their positive payment conduct into your report. Make sure the issuer records the authorized user activity to the credit bureaus.

5. Create a Diverse Credit Portfolio

Once your secured card shows a good payment track record, diversify your credit accounts. Consider signing up for a credit-builder loan or a department store credit card to further enhance your credit score. Remember, handle them responsibly.