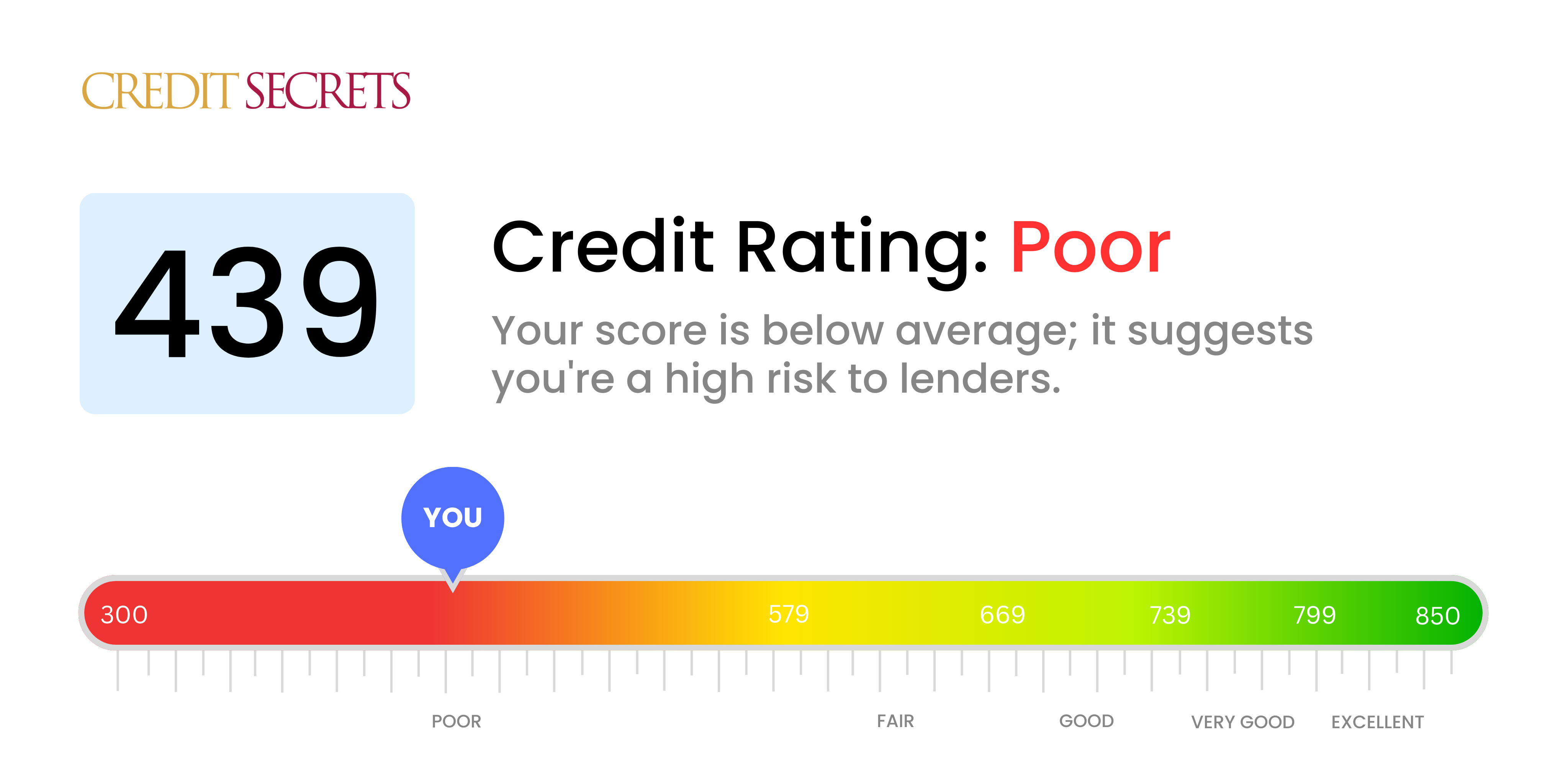

Is 439 a good credit score?

A credit score of 439 falls into the 'Poor' category. It's serious that your score is this low, but remember, it's just a temporary setback and there is room for improvement. Begin by paying your bills on time and reducing your debt; these actions could have positive impact on your credit score. Your current score might make it a bit challenging to obtain new credit, however, lending institutions understand everyone has different circumstances. Keep working towards better financial habits and gradually you will see your score improve.

Can I Get a Mortgage with a 439 Credit Score?

Regrettably, with a credit score of 439, the chances of being approved for a mortgage are relatively slim. This score falls well below the threshold that most lending institutions deem acceptable. A score in this range typically indicates a track record of fiscal challenges such as defaults or late payments.

While this may be a difficult reality to face, there are alternative avenues worth considering. Private lenders or government-insured loans may be options, albeit with higher interest rates due to the risk involved. Another approach is to begin the process of improving your credit score. This involves making a concerted effort to clear any existing defaults and consistently making on-time payments. Remember, improving your credit score won't happen overnight, but with dedication and diligence, you can work towards a more secure financial future.

Can I Get a Credit Card with a 439 Credit Score?

If you have a credit score of 439, the reality is that it will be tough to get approved for a standard credit card. This is seen as a high-risk credit score, showing that there might have been some past financial difficulties. It's certainly disheartening, but it's important to approach it with a clear understanding. Acknowledging your current credit status is the initial step towards mending your financial health.

Given the challenge that a lower score presents, other solutions like secured credit cards, which necessitate a deposit equal to your credit limit, could be considered. Achieving this card tends to be simpler and it provides a helping hand in rebuilding credit over time. Another option could be having a trustful person act as a co-signer or checking out pre-paid debit cards. It's key to remember that while these alternatives won't immediately turn your situation around, they can be instrumental in your journey towards financial steadiness. Be sure to keep in mind, however, that any credit offered to someone with such scores are likely to attract higher interest rates, as lenders see this as a high-risk score.

Having a credit score of 439 is indeed tough, and it may pose challenges when you're seeking a personal loan. Traditional lenders often view such a score as a red flag, suggesting a high-risk borrower. This perception makes it significantly less likely for you to get approved for a loan under standard terms. It's essential to acknowledge this situation in order to explore your options effectively.

With a traditional personal loan unlikely due to your lower credit score, you may need to consider alternative lending options. Secured loans, where you offer up collateral, or co-signed loans, which involve another person with a stronger credit score backing your loan, are potential routes. Peer-to-peer platforms might also be an avenue to explore, as they often accommodate individuals with credit challenges. However, bear in mind that these alternatives typically have higher interest rates and less attractive terms due to the increased risk they pose to the lender.

Can I Get a Car Loan with a 439 Credit Score?

With a credit score of 439, the path to securing a car loan might be a bit rough. Most lenders generally look for scores above 660 to offer the best terms, and anything below 600 is often viewed as subprime. Your score of 439 places you in this subprime category, which could lead to higher interest rates or even a denial of the loan. This is mainly due to lenders seeing a lower credit score as a sign of a higher risk of potential repayment issues.

However, don't lose hope yet. There are lenders out there who specialize in serving folks with lower credit scores. But keep in mind, these loans might come with higher interest rates. This is because these lenders are taking on more risk and higher interest rates help them to protect their investment. The journey could be tough, but with careful evaluation of the loan terms and a deep understanding of your financial situation, getting a car loan is still achievable.

What Factors Most Impact a 439 Credit Score?

Having a credit score of 439 is a strong signal to work on improving your financial habits and creditworthiness. Understanding the potential factors that have contributed to this score is crucial in your journey towards a better financial future.

Poor Payment History

Your credit score is likely impacted by your payment history. Late or missed payments are leading causes of a low credit score.

How to examine: Scan your credit report for instances of non-payment or late payments, as these impacts your score negatively.

High Credit Utilization Rate

Consistently maxing out your credit limit can hurt your credit score. Maintaining a lower balance can help you boost your score.

How to evaluate: Review your credit card statements to see if you’re regularly closing in on your credit limit. Aim to maintain a balance that is no more than 30% of your limit.

Inadequate Credit Mix

If you only have one type of credit (like only credit cards) this might be affecting your score.

How to determine: Look at your credit report to review the types of credit you have. Diversifying your credit types can create a positive impact.

Public Records

Public records such as bankruptcy filings and court judgments also affect your credit score.

How to inspect: Assess your credit report for any public records. Seek out resolutions for the items listed if necessary.

Newer Credit Lines

If you have many recently opened accounts this can hurt your score.

How to navigate: Check your credit report for the age of your credit accounts. If many are new, consider avoiding opening more in the short-term.

How Do I Improve my 439 Credit Score?

With a credit score of 439, it is clear there is room for improvement. In the face of this challenge, it’s crucial to note that change is possible and within reach. Here are some key steps to consider for credit improvement at this level.

1. Clear Outstanding Debts

Your first move should be to clear any outstanding debts. Check your credit report for any outstanding balances or overdue payments. Start by focusing on the most overdue debts as they greatly affect your score. Communication with your lenders can open doors to agreeable repayment plans.

2. Aim for Lower Credit Card Usage

Using a high percentage of your credit limit brings down your credit score. Aim to maintain your credit card balances below 30% of your limit. This not only helps boost your score but also aids in better credit management.

3. Consider a Secured Credit Card

While your score may not allow you to access regular credit cards, a secured credit card can come in handy. This card, backed up by a cash deposit, functions as the credit line for that account. Responsible usage and full payments improve your payment history and credit score.

4. Request Authorized User Status

If possible, ask a trusted individual with good credit to add you as an authorized user on their card. This allows their good payment habits to reflect on your credit report and enhances your score. Ensure the credit card provider reports this to the credit bureaus.

5. Introduction of Varied Credit Accounts

Once you’ve established a positive history with a secured card, consider diversifying your credit mix. Adding different accounts such as retail credit cards or credit builder loans portrays creditworthiness and improves your score if well-managed.