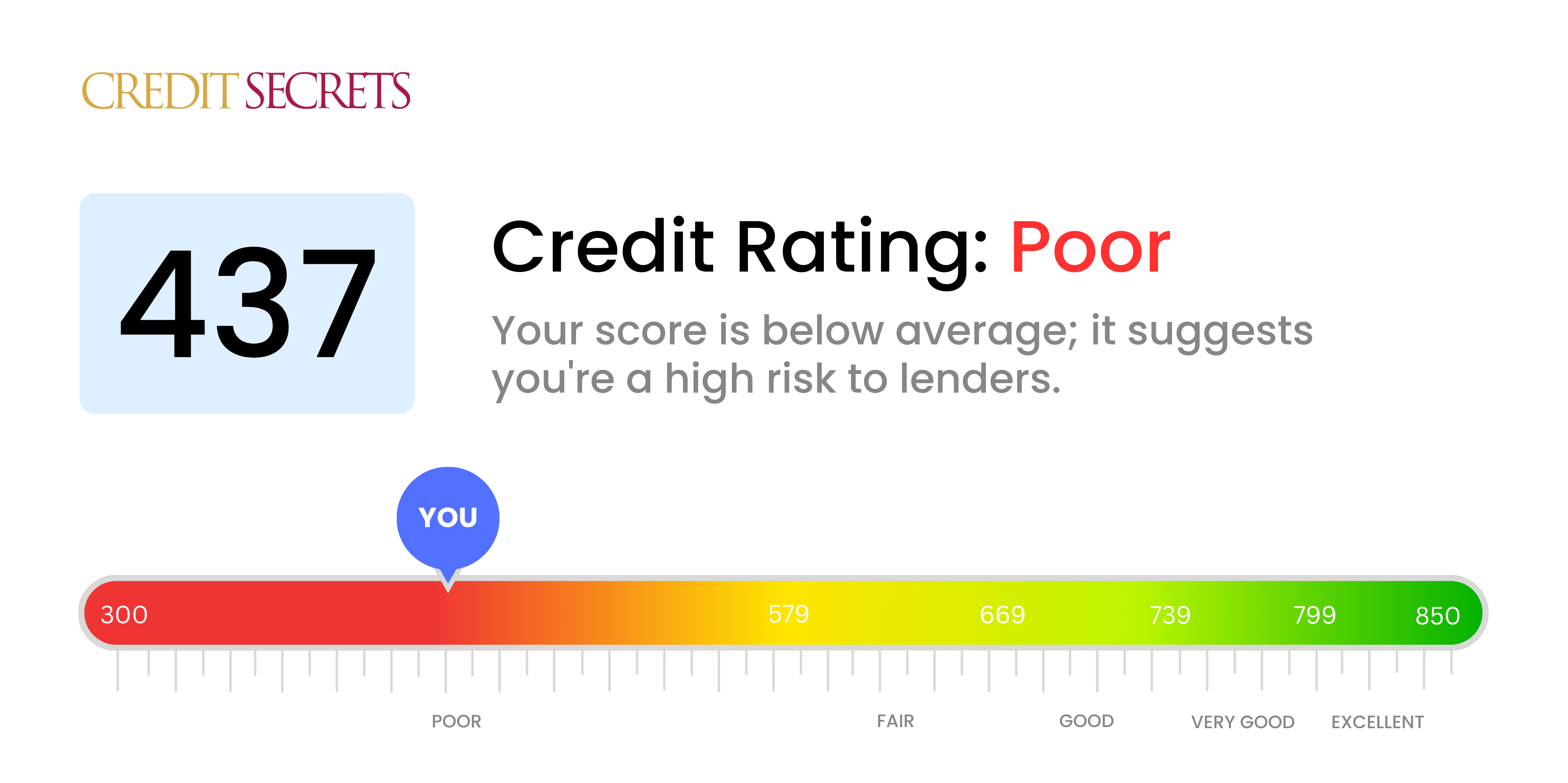

Is 437 a good credit score?

A credit score of 437 falls into the 'Poor' category. However, don't lose hope - this score isn't permanent and can certainly be improved.

With this score, obtaining new credit may be challenging and if approved, you'll likely face higher interest rates and possibly need a co-signer due to your score being seen as a higher risk to lenders. But don't worry, with some time, effort and improving your payment habits, you have the opportunity to change your financial future and work towards an improved credit score.

Can I Get a Mortgage with a 437 Credit Score?

Having a credit score of 437 can unfortunately make it extremely difficult to become approved for a mortgage. A score in this range, significantly below the typical lender requirements, reflects a previous or ongoing challenge with financial responsibilities, such as consistent late payments or even defaults. Notably, a score this low might result in prohibitively high interest rates for the mortgage loans that are actually available.

While this realization can be disheartening, it's important to remember there are numerous strategies you can implement for improving your credit score. Changing your credit behaviors, paying down debts and beginning to build a record of regular, on-time payments can all contribute over time to an uplift in your credit score. And remember, with higher credit scores come better loan terms and lower interest rates. It's a journey that requires commitment, but it can lead you towards better financial health and the ability to secure that sought-after mortgage approval.

Can I Get a Credit Card with a 437 Credit Score?

With a credit score of 437, it may be difficult to be approved for a traditional credit card. This isn't meant to discourage you, it's just the reality of the situation. Banks and lenders usually see this as a high-risk score. It may indicate some past financial setbacks or troubles. Remember, it's not a reflection of your worth but a snapshot of your past financial behavior. Acknowledging your credit situation is an important first step on your path to financial recovery.

In times like these, it might be worthwhile to consider options such as secured credit cards. These cards require a deposit that serves as your credit limit. They're often easier to obtain and can help with rebuilding credit over time. Alternatively, think about getting a co-signer or using pre-paid debit cards. These aren't immediate solutions, but they can certainly help you on your journey toward financial health. Please note, with a credit score of 437, any credit option you access will likely come with a higher interest rate due to the perceived risk. But remember, every step taken today is a step closer to restoring your financial health.

With a credit score of 437, it's hard to ignore the financial hurdles you may face. This score falls far below what most traditional lenders expect, making it difficult to secure a personal loan under standard conditions. Lenders view this score as a notable risk, which can significantly limit your borrowing options. It's tough to face, but it's necessary to understand the implications of this credit score.

Whilst traditional loans may appear out of reach, there are alternatives worth exploring. Secured loans, which require collateral, or co-signed loans where someone with a more favorable credit score backs your loan, are both options. Peer-to-peer lending platforms, known for more flexible credit demands, can be another route. Be aware, these alternatives often come with higher interest rates and fewer borrower-friendly terms, reflecting the lender's increased risk.

Can I Get a Car Loan with a 437 Credit Score?

With a credit score of 437, attaining approval for a car loan might be a considerable challenge. Most financial institutions prefer credit scores above 660 for preferable lending terms, and scores below 600 are often seen as subprime. Your score of 437 falls into this subprime category and may lead to high interest rates or even denial of the loan. From a lender's perspective, a lower credit score signifies a greater risk, given that your history may indicate potential struggles with repaying borrowed funds.

Nonetheless, a low credit score doesn't mean you can't achieve your aim of owning a car. There are lenders who cater to individuals with lower credit scores. Be aware, though, that these loans typically come with significantly higher interest rates due to the perceived risk associated with them. Always do your due diligence, thoroughly exploring terms before committing. Even though the path might seem tough, securing that car loan is not entirely out of reach.

What Factors Most Impact a 437 Credit Score?

Grasping a score of 437 is important to guide you on the path towards financial betterment. By recognizing and addressing the elements that shape this score, you can create a roadmap to a stronger financial position. Every financial journey is uniquely yours, full of opportunities for development and learning.

Payment Performance

Your payment performance could significantly impact your credit score. If your report shows late payments or defaults, these could be the main reasons for your score.

How to Check: Brush up on your credit report to look for any delayed or missed payments. Consider any periods when you had difficulty making payments, as these could have negatively influenced your score.

High Balance

A high balance on your credit cards can be damaging to your score. Should you often max out your credit cards, this may be affecting your score negatively.

How to Check: Go over your credit card statements. Are your card balances typically high? Striving to maintain a low balance relative to your credit limit is beneficial.

Credit Line Age

A brief credit history might negatively impact your score.

How to Check: Scan your credit report to gauge the lifespan of your oldest and most recent accounts and the median age of all your accounts. Think about whether you have just opened new accounts.

Range of Credit Types

Maintaining different types of credit and judiciously handling new credit is pivotal for a good credit score.

How to Check: Look into your assortment of credit accounts, including credit cards, retail accounts, installment loans, and house loans. Consider if you have been seeking new credit only when necessary.

Legal Judgements

Legal judgements such as bankruptcies or tax liens can severely affect your score.

How to Check: Inspect your credit report for any legal judgements. Address any issues or inaccuracies found to help support your credit score improvement.

How Do I Improve my 437 Credit Score?

With a credit score of 437, improvement is crucial, yet completely attainable. Let’s consider targeted steps pertinent to your current situation:

1. Catch Up On Delinquent Accounts

Your immediate focus should be on bringing any delinquent accounts to current status. Begin with the accounts that are most overdue, since they carry the weightiest impact on your credit score. It might be beneficial to discuss a manageable payment plan with your creditors, should the need arise.

2. Lower Credit Card Debt

High credit card debt in relation to your limit can be detrimental to your credit score, more than one might realize. Strive to bring your debt under 30% of your credit limit, eventually aiming for below 10%. Prioritize payment towards cards with the highest utilization with a focus on methodical debt reduction.

3. Contemplate a Secured Credit Card

Finding approval for a standard credit card may be challenging at your current score, prompting consideration of a secured credit card. This card necessitates a cash security deposit acting as the credit line. Make judicious purchases, ensuring the balance is paid off monthly, thus facilitating a healthy payment history.

4. Query on Becoming an Authorized User

Enquire with a trusted person who maintains good credit if they would consider adding you as an authorized user on their credit card. This can positively impact your credit score, reflecting their satisfactory payment history on your report. Confirm that the issuer reports authorized user activities to credit bureaus.

5. Diversify Your Credit Portfolio

The inclusion of a variety of credit accounts aids in credit score improvement. Upon establishing a commendable payment history through your secured card, contemplate different credit forms such as retail credit cards or credit builder loans. Remember, the key lies in responsibly managing these accounts.