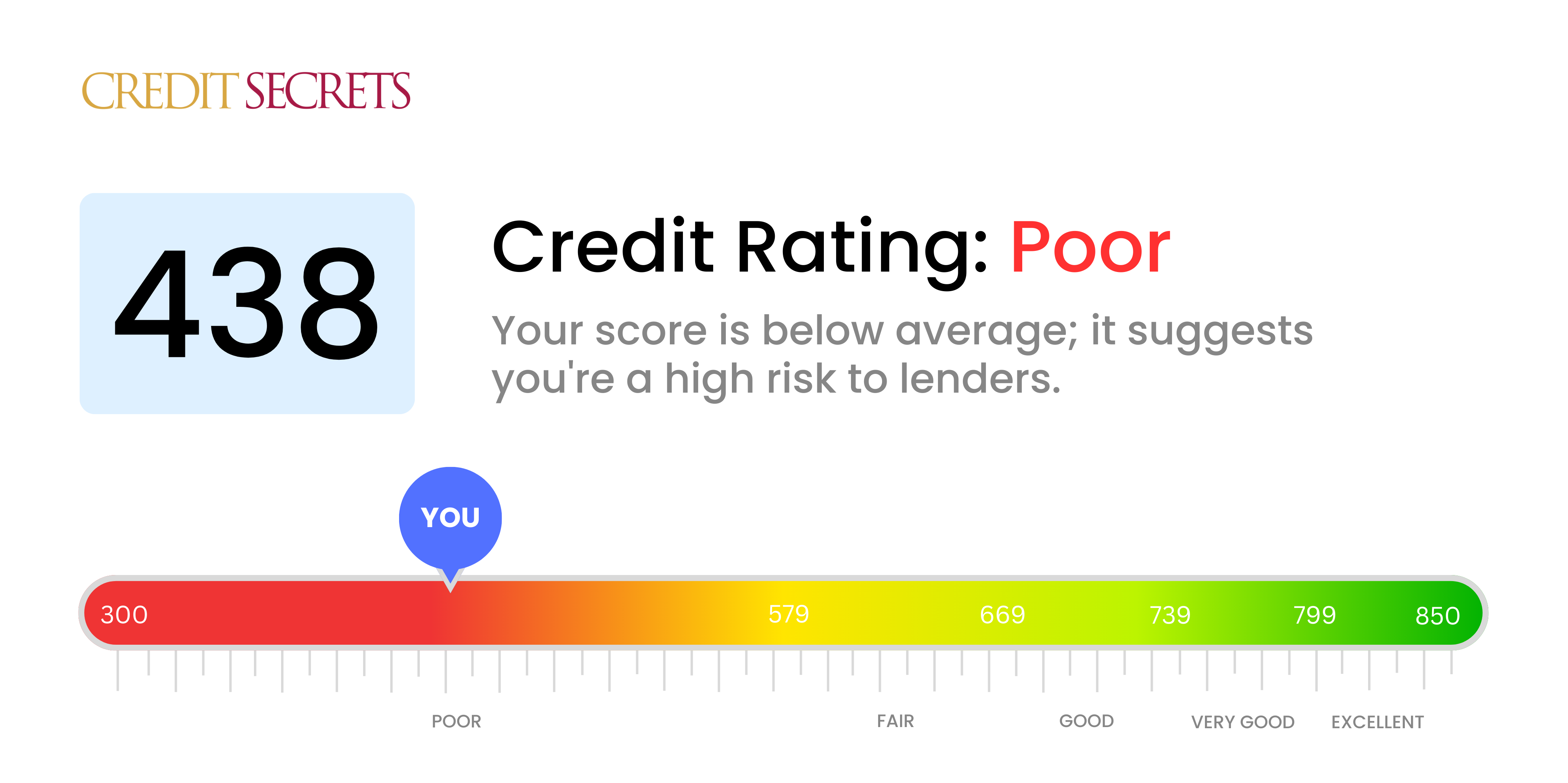

Is 438 a good credit score?

A credit score of 438 falls into the 'Poor' category, which indicates a significant level of credit risk. Having this score means you may have difficulties obtaining new credit, receive higher interest rates when granted credit, and possibly face restrictions on things like renting an apartment or getting utilities without a significant deposit.

However, do not lose hope. Even with a poor score, you can still take steps to improve it. It will involve managing your finances responsibly and diligently over time. Remember, progress may be slow, but with consistency and discipline, you can work your way towards a better credit score.

Can I Get a Mortgage with a 438 Credit Score?

Unfortunately, with a credit score of 438, the possibility of being approved for a mortgage is quite low. Lenders often look for scores considerably higher as it demonstrates responsible credit practices and behaviour. A score like 438 may suggest a pattern of financial difficulties, such as late payments or defaults, making you a high-risk borrower in the eyes of lenders.

That said, do not feel disheartened. There are alternative options for individuals in similar situations. Federal Housing Administration (FHA) loans, for example, are more lenient and may accept lower credit scores. There's also the option of getting a co-signer with a good credit score. Saving up and offering a larger down payment can also improve your qualification chances. However, it's worth noting that these alternatives often come with higher interest rates. Ultimately, remember that improving your credit is a long journey, but every step brings you closer to achieving your financial goals.

Can I Get a Credit Card with a 438 Credit Score?

Having a credit score of 438 can make it difficult to get approved for a traditional credit card. An original score of this level can signify financial struggles in the past. That's tough to hear, yet it's crucial to deal with the situation head on. Knowing where your credit stands is the stepping stone to financial health, even though this means accepting some hard truths.

When faced with a credit score like 438, consider exploring options like secured credit cards. These cards require a deposit which serves as your credit limit and are often easier to get approved for. They can also help in gradually building up your credit score. You might also want to think about the option of a co-signer or using prepaid debit cards. Keep in mind that these alternatives won't magically fix everything, but they are crucial tools to assist you on your path to financial steadiness. Lastly, it's important to note that any credit form accessible to individuals with such scores usually come with significantly higher interest rates, as lenders see these as higher risk applications.

With a credit score of 438, your chances of acquiring a standard personal loan can be somewhat slim. Most traditional lenders might find this score a bit too risky, making it hard for your loan application to get the green light. It's essential to understand this scenario and what it entails for your borrowing prospects. Nevertheless, don't lose heart, as there are still several options you can explore.

You might want to consider other alternatives, such as secured loans, where you have to provide some form of collateral. There’s also an option for co-signed loans, where you get someone with a better credit score to vouch for you. Peer-to-peer lending platforms can be another avenue to consider, as these platforms can sometimes offer more lenient credit requirements. However, you need to be aware that these alternatives can often come with higher interest rates and terms that may not be as favorable because of the aforementioned risk involved for the lender.

Can I Get a Car Loan with a 438 Credit Score?

Your credit score of 438 is unfortunately considered by lenders as a very low score. The typical threshold for favorable car loan terms is a score of 660 and above. A score below this level is typically viewed as subprime and your current score does fall into this subprime category. With this score, you may face higher interest rates or even outright denial by some lenders. The reasoning behind this notion is that a lower credit score signifies a higher risk for the lender due to the possible difficulties you may face in repaying the loan.

Nonetheless, it's not all disheartening. There are alternative options available, such as lenders who specialize in giving loans to individuals with lower credit scores. However, it's essential to approach these alternatives cautiously as the interest rates are typically higher due to the perceived risk to the lender. It may take a bit of navigating through some unsteady terrain, but by thorough examination of loan terms and making a well-informed decision, the possibility of obtaining a car loan still exists for you.

What Factors Most Impact a 438 Credit Score?

Analyzing a credit score of 438 is pivotal in creating a roadmap towards a better financial future. By acknowledging and taking actionable steps to correct specific factors, you can uplift your financial stability. Remember, there's no such thing as a one-size-fits-all money journey, every experience is individual and ripe with chances to grow and learn.

Payment Track Record

Keeping track of payment history is crucial as it plays a prominent role in shaping your credit score. Late payments or not being able to pay can be a prime reason behind your current score.

How to Check: Study your credit report meticulously for any instances of late or missed payments. It helps to introspect about any situations in which you might have been unable to pay on time.

Credit Card Usage

Maxing out on your credit cards frequently can have a negative impact on your score. If you see that your card balances are almost reaching their entire limit, this might be a part of the challenge.

How to Check: Look over your credit card statements carefully. Are you pushing towards the maximum usage limit each time? Maintaining a lower balance compared to your credit card usage could work in your favor.

Duration of Credit

A short credit history can be harmful for your score.

How to Check: Dive into your credit report to examine the age of your various accounts and the average age they make up. Consider if you have opened any new accounts recently.

Variety of Credits and Newly Acquired Credit

Maintaining a diverse pool of credit sources and demonstrating responsible handling of new credit is fundamental for a sound score.

How to Check: Look at your array of credit accounts including credit cards, retail accounts, installment loans, and mortgage loans. Reflect on how responsibly you have been in acquiring new credit.

Public Records

Public records like bankruptcies or tax liens can have a highly significant impact on your score.

How to Check: Go through your credit report to identify any public records. Tackle any items that may need to be resolved to help boost your score.

How Do I Improve my 438 Credit Score?

Considering an optimistic outlook in relation to your credit score of 438, which is identified as a poor score, the following actionable steps can lead to a significant improvement:

1. Settle Unresolved Debts

One of the most impactful steps you could take is settling any existing unpaid, overdue accounts. Prioritize those with high balances and overdue time as they contribute negatively to your credit score. Engage with your creditors for a feasible payment plan if necessary.

2. Optimize Credit Utilization Ratio

A high credit utilization ratio could adversely affect your credit score. Strive to keep your card balances below 30% of your credit limit, and in the long term aim to reduce it below 10%. Begin with cards that have the highest utilization.

3. Consider a Secured Credit Card

With your current score, getting a regular credit card can be difficult. A secured card can be the way forward. It requires a deposit that also serves as your credit limit. Demonstrating responsible use can create a positive credit history.

4. Avail Authorized User Status

If you have a trusted person with a good credit history, you can ask them to add you as an authorized user on their card. This will reflect their positive credit behavior on your credit report, uplifting your score. Make sure the issuer reports the authorized user’s status to credit bureaus.

5. Explore Different Credit Types

Introducing diversity in your credit portfolio can positively affect your score. Once you’ve shown good handling of your secured card, consider a credit builder loan or retail credit card and manage them wisely to establish a strong credit foundation.