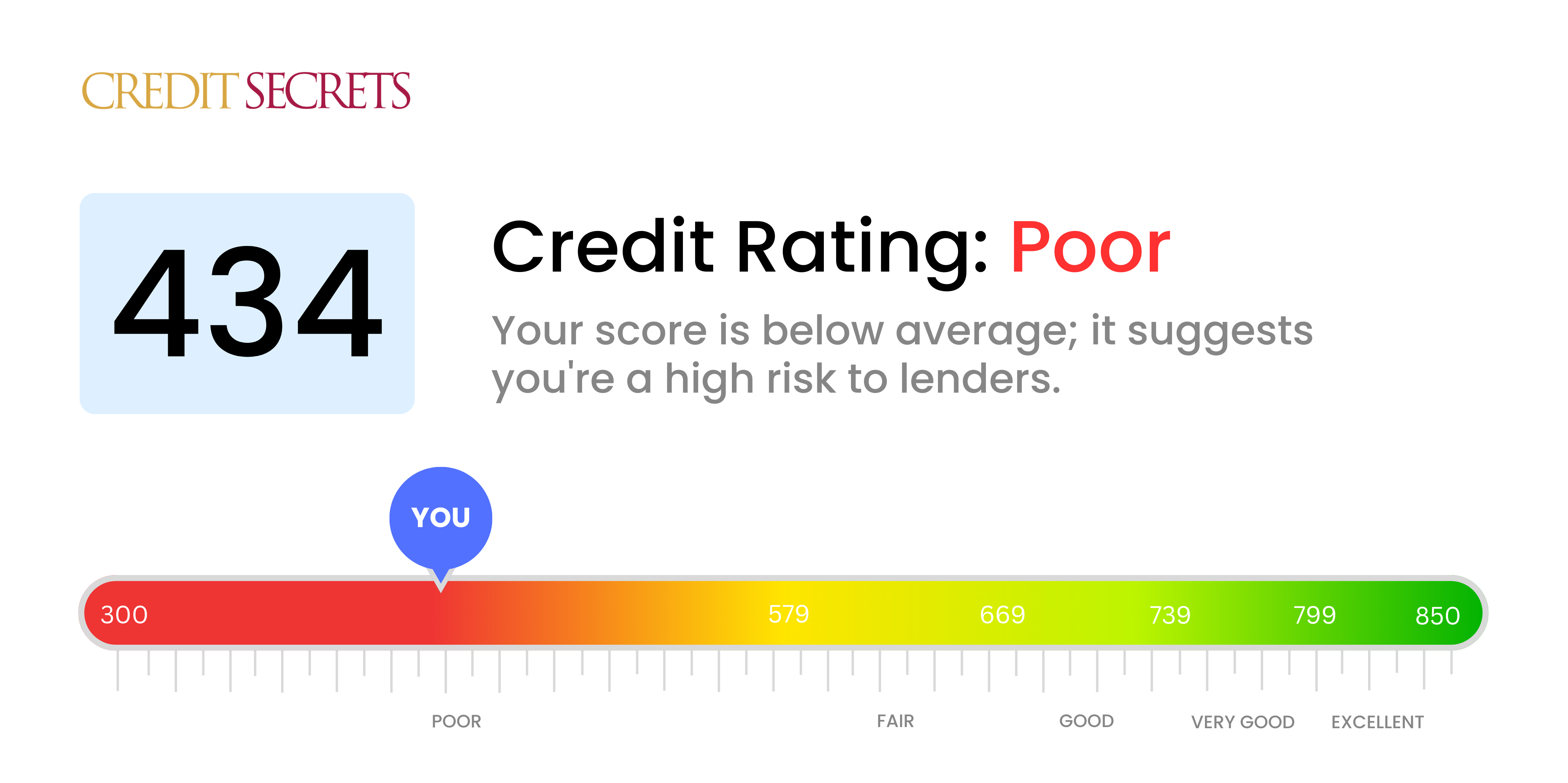

Is 434 a good credit score?

Having a credit score of 434 categorizes your credit standing into the 'Poor' range. It's not the score you might have hoped to see, and true, it can set up some challenges in financial situations. But remember, there's no need to feel despaired. There's always room for improvement, and steps can be taken to positively influence your score.

With a score like this, the likelihood of securing new credit may be reduced, and an existing lender could raise interest rates or limit your access to additional credit. However, there are a plethora of tactics to employ to increase your credit score. Consistently paying your bills on time, keeping credit balances low, and not applying for new credit often are just a few ways to get started. Always know that you're not alone in this journey and take one step at a time towards your financial goals.

Can I Get a Mortgage with a 434 Credit Score?

If you have a credit score of 434, it is not usually possible to get approved for a mortgage, as this score is significantly lower than the minimum required by most lenders. This credit score could signify a history of financial hardships such as late payments or defaults.

This situation may be difficult, but it's essential not to lose hope. Begin by addressing any outstanding debts that might be dragging down your score. Equally important is the establishment of a reputable credit history through reliable payments and responsible use of credit. Bettering your credit score is a process that takes time and consistent effort, but with dedication, it is possible to enhance your chances for future financial opportunities. Please remember, higher credit scores could lead to more favorable interest rates and terms on a mortgage. Improvement is always possible, so stay hopeful for a brighter financial future.

Can I Get a Credit Card with a 434 Credit Score?

A credit score of 434 is below average, which may present difficulties when trying to get approved for a standard credit card. This score might indicate past financial struggles, but remember, it's not a reflection of your self-worth - just a tool that lenders use to assess risk. Realizing this truth might sting, but understanding it is the key to starting your climb up the credit ladder.

With a low score like 434, you may need to consider other options such as secured credit cards. These are unique in that they require a deposit upfront, which then becomes your credit limit. They can often be obtained more easily and can assist in gradually restoring your credit. Considering having a co-signer or switching to prepaid debit cards could also be an alternative solution. While these steps won't magically transform your credit overnight, they can provide a solid foundation for financial revival. Please note, it's likely any credit means you qualify for will have significantly higher interest rates, as these match the increased risk seen by lenders.

A credit score of 434 is considered quite low by traditional lenders. Unfortunately, with such a score, your chances of securing a personal loan are slim, as the risk to lenders is deemed significantly high. With this score, lenders feel the odds are more likely that the loan may not get repaid. This situation might feel tough, but it falls within the harsh reality of having this credit score.

However, don't lose hope. There's still opportunities to secure some kind of loan, although it might be a little different from your average personal loan. Secured loans are an option where your loan is backed by an asset like your home or car. Co-signed loans, where another person with better credit agrees to sign with you, could also be a possibility. Another promising avenue to explore could be peer-to-peer lending platforms which sometimes offer loans with relaxed credit requirements. Please be aware that these alternative lending options tend to include higher interest rates and less agreeable terms. This is due to your lower credit score representing a higher risk for the lender. Regardless, these are valid placeholders until you can improve your standing and have more conventional options open to you.

Can I Get a Car Loan with a 434 Credit Score?

Holding a credit score of 434 can make obtaining a car loan quite difficult. Lenders usually prefer to work with individuals who have scores above 660, as this range is typically seen as more trustworthy. Your score of 434, unfortunately, falls into what lenders would consider a high-risk category. This likely means facing higher interest rates, or possibly being declined for a loan altogether. This is largely due to the implied risk that lenders see in lower scores, as it can indicate potential concerns with the repayment of the loan.

But don't lose hope. Your journey towards car ownership isn't entirely out of reach. There are certain lenders that extend loans to individuals grappling with lower credit scores. It's important, though, to proceed with caution. These loans often carry considerably higher interest rates as a way for the lender to offset their risk. If you commit to carefully understanding the terms and conditions and weigh them against your financial situation, a car loan can still be a possibility for you, despite your current credit score.

What Factors Most Impact a 434 Credit Score?

Decoding your credit score of 434 is the first step toward financial enhancement. The factors contributing to this score need to be addressed to elevate you to a stronger financial standing. Keep in mind, every person’s financial path is different, presenting opportunities for growth and knowledge.

Past Due Balances

Outstanding balances are a considerable factor your credit score. Any unattended balances could be reducing your score.

How to Verify: Go through your credit report. Check for any overdue balances. Think about any unpaid accounts, these could be affecting your score.

Credit Use

Heavy credit use can reflect negatively on your score. If your credit cards are exhausted, this might be contributing to your current score.

How to Verify: Look at your credit card statements. Are your balances near or at their limits? Maintaining a low balance in relation to your limit is advantageous.

Length of Credit

A brief credit history can negatively affect your score.

How to Verify: Inspect your credit report for the age of your oldest and newest accounts and the overall age of your accounts. Contemplate whether you've recently opened new accounts.

Type and Frequency of Credit

Managing different credit types responsibly and not frequently applying for new credit are crucial for a healthier score.

How to Verify: Examine your variety of credit accounts, like credit cards, store accounts, and loans. Reflect on whether you've been applying for new credit sparingly.

Public Files

Public records such as bankruptcies or outstanding taxes can heavily influence your score.

How to Verify: Scrutinize your credit report for any public records. Address any items noted that require resolution.

How Do I Improve my 434 Credit Score?

With a credit score of 434, you’re in a challenging segment, but don’t worry, you can draw a path towards credit growth. Here’s your personalized plan:

1. Rectification of Delinquent Accounts

If any of your accounts are in arrears, work immediately to make them up-to-date. Accounts with extensive delinquency harm your credit score the most. It may be necessary to consult your lenders and establish a feasible payment schedule.

2. Maximize Credit Utilization Ratio

Credit utilization, or how much of your available credit you’re actually using, is a crucial factor in your credit score. Strive to keep it under 30%—the lower, the better. Begin by paying off the cards with the highest utilization first.

3. Opt for a Secured Credit Card

Your present score might make obtaining a conventional credit card difficult. A secured credit card could be a sensible alternative, as it uses a cash deposit as your credit line. Utilize it wisely to cultivate a consistent payment history.

4. Explore Authorized User Status

Consider becoming an authorized user on a good-credit individual’s credit card account – a relative or a close friend perhaps. This can boost your credit score as their positive credit behaviour would reflect in your credit history. Ensure the issuer reports to the credit bureaus.

5. Broaden Your Credit Portfolio

A mix of diverse credit accounts can assist in enhancing your credit score. After you’ve managed a secured card responsibly, look into other types of credit like a credit builder loan or department store cards to exhibit creditworthiness.