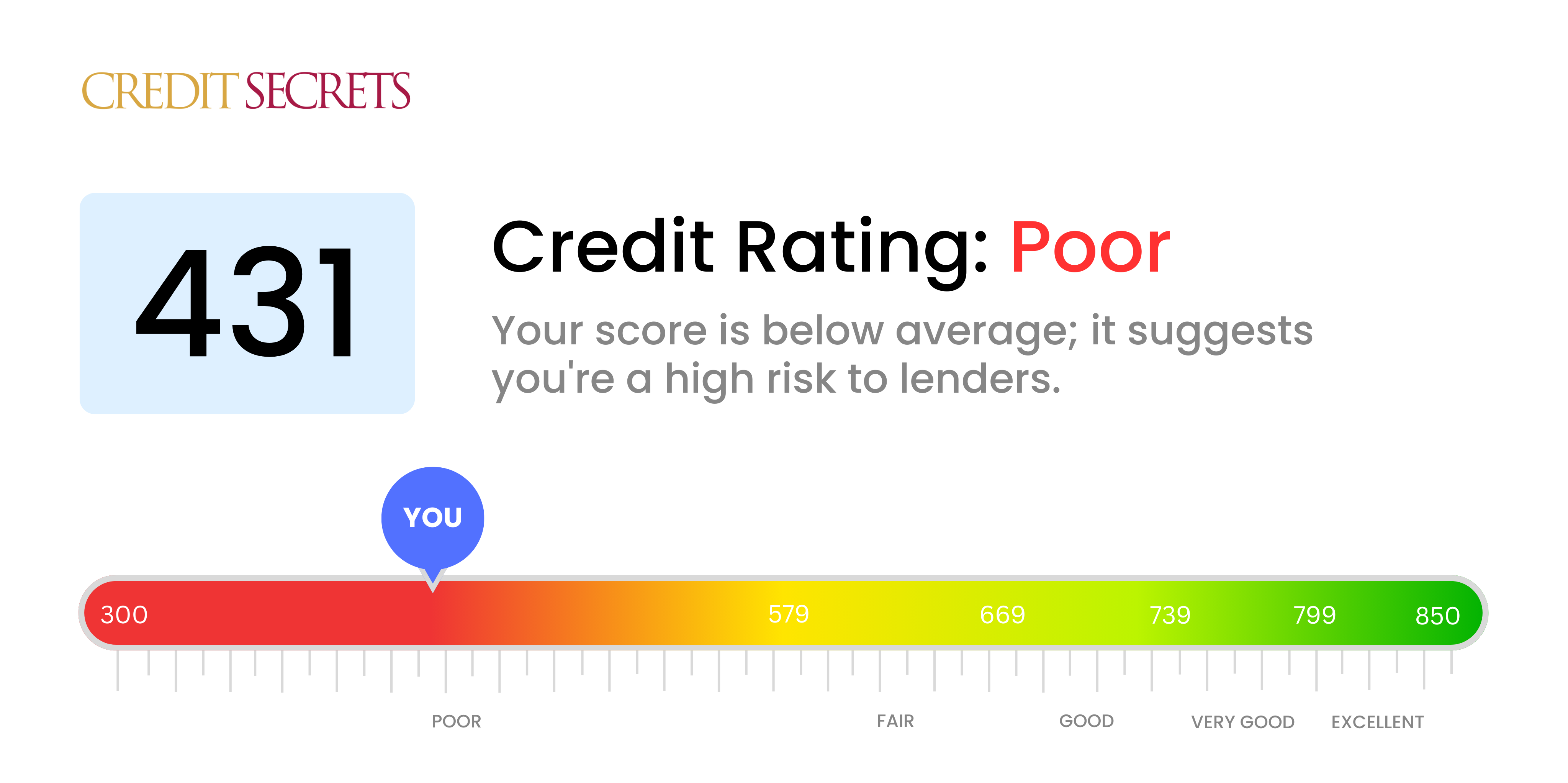

Is 431 a good credit score?

A credit score of 431 isn't good; it falls into the 'Poor' category. However, it's important to recognize that financial situations can change and you have the power to improve this score over time.

With a score of 431, you're going to face some challenges. It could likely be difficult to get approved for new credit lines, and interest rates may be high if you are approved. Potential landlords and employers might be wary too, as they often check credit scores as part of their decision-making process. Don't despair, however, as there are always ways to start rebuilding your credit and turn your financial situation around.

Can I Get a Mortgage with a 431 Credit Score?

Having a credit score of 431 often signifies that getting approval for a mortgage is quite challenging. This score is significantly lower than most lending institutions would consider sufficient for granting a loan. It's usually an indication of previous financial mishaps such as frequent late payments or defaults on past loans.

While this appears daunting, understand that it's not the end of the road. There are alternative paths to homeownership that can work for those with a low credit score. One potential route could be exploring government-assisted programs like FHA loans which accommodate low credit scores. In addition, you can also look into making a larger down payment or finding a co-signer to offset the risk. It's crucial to note that although these options might allow you to secure a mortgage, they often come with higher interest rates due to the perceived risk involved. Nevertheless, remember that even with such score, your journey to achieving financial stability and homeownership is not impossible, it just requires patience and perseverance.

Can I Get a Credit Card with a 431 Credit Score?

Regrettably, with a credit score of 431, it's quite improbable that you will be approved for a typical credit card. Credit card companies often view this score as a high-risk indicator, pointing to past financial obstacles or lack of proper financial management. Although this might come off as discouraging, acknowledging your credit position is the initial step towards financial recovery.

With a credit score of 431, finding other alternatives might be necessary. One such option is a secured credit card, where a deposit is set as your spending limit. These cards are generally more accessible and can help rebuild credit over time. Besides, using a co-signer or opting for prepaid debit cards could also serve as sound alternatives. And although these options won’t entirely resolve the issue, they are indeed constructive aids on your path towards a better financial future. Lastly, please bear in mind that credit available for such low scores come with higher interest rates, mirroring the higher risk as perceived by lenders.

A credit score of 431 suggests a significant level of risk to potential lenders. Unfortunately, with a score in this range, prospects for securing a personal loan through conventional lenders may be slim. This score is much lower than what most lenders deem acceptable, leaving you in a difficult position. That said, it's crucial to understand your situation and explore the possible solutions.

While personal loans from traditional lenders might not be an option, you could explore alternatives like secured loans, where you offer some form of collateral, or co-signed loans, where another person with a higher credit score essentially backs your loan. Another possibility could be peer-to-peer lending platforms. They sometimes have a more flexible approach to credit scores. Be aware, however, that such options typically come with higher interest rates and may not provide the most favorable conditions in return for the additional risk the lender is assuming.

Can I Get a Car Loan with a 431 Credit Score?

With a credit score of 431, it's important to understand that arranging a car loan may be complicated. Many lenders usually look for a credit score above 660 to offer better loan conditions. In fact, a score less than 600 can often be viewed as subprime, and your score of 431 falls into this range. This could result in lenders charging a higher interest rate or even denying your loan request. The reason being, a lower credit score signals a greater risk to lenders as it shows a history of potential repayment difficulties.

Despite the hurdles, your dreams of owning a car shouldn't be abandoned. Some lenders exist who cater specifically to those with lower credit scores. However, it is vital to tread carefully, as their loans often come with substantially higher interest rates as a way for them to defend their investment against the perceived risk. While the journey may require some extra commitment, meticulous review of the terms can ensure that securing a car loan is not an impossible task.

What Factors Most Impact a 431 Credit Score?

Understanding the factors behind a credit score of 431 is crucial in addressing issues and enhancing your financial standing. Every credit journey differs, and acknowledging influential elements can transform the way to a healthier financial future.

Payment History

Paying your bills late or missing payments can be a significant factor contributing to low scores like 431.

How to Check: Examine your credit report and look for any indents of late payments or defaults. Any past due payments can impact your score adversely.

Credit Utilization Ratio

Using a high percentage of your available credit can negatively impact your score. If your credit cards are constantly maxed out, your score may be lowered.

How to Check: Check your credit card balances. If they are consistently near their limits, it's vital to aim for a lower utilization ratio.

Credit History Duration

A short credit history can potentially inflict damage to your score.

How to Check: Scan your credit report to gauge the average age of your accounts. Newly opened accounts could adversely affect your score.

Diversity of Credit and New Credit

Managing a mix of credit types and handling new credit responsibly can enhance your score.

How to Check: Reflect on the types of credit you have, such as credit cards, retail accounts, installment loans, and mortgage loans. Exercise careful judgement when applying for new credit.

Public Record Items

Public record items like tax liens or bankruptcies can drastically plummet your credit score.

How to Check: Review your credit report for any public records. Understand and address any listed items that may require resolution.

How Do I Improve my 431 Credit Score?

With a credit score of 431, you’re definitely due for some course correction. But don’t panic—you’re much closer to improving your score than you might think. Here are some vital actions to take:

1. Manage Late Payments

Pending payments are one of the top reasons for low scores. Direct your immediate attention to handling these, ensuring you cover the oldest ones first. Sometimes, settling a payment plan with the creditors can be beneficial.

2. Inquire About a Secured Credit Card

Your current score may prevent you from obtaining a regular credit card. However, a secured credit card, which requires a cash deposit equal to its credit limit, may be a feasible option. By using this card for small purchases and paying them off each month, your credit history will improve gradually.

3. Controlled Credit Card Usage

Keeping your credit card balances below 30% of your credit limits is suggested. For a more significant boost in your score, aim to maintain them below 10%. Start by paying off the cards with the highest usage rates.

4. Seek Authorized User Status

Identify a friend or relative with a reliable credit history and ask if they would add you as an authorized user on their card. This may incorporate their positive payment record into your report. Be sure the card carrier reports authorized user activity to the credit bureaus.

5. Diversify Your Credit

Once you’ve proven to be a reliable payer with your secured card, consider varying your credit types by exploring other opportunities, such as retail cards or credit builder loans, and handle them responsibly. This represents a multi-layered credit mix, improving your score.