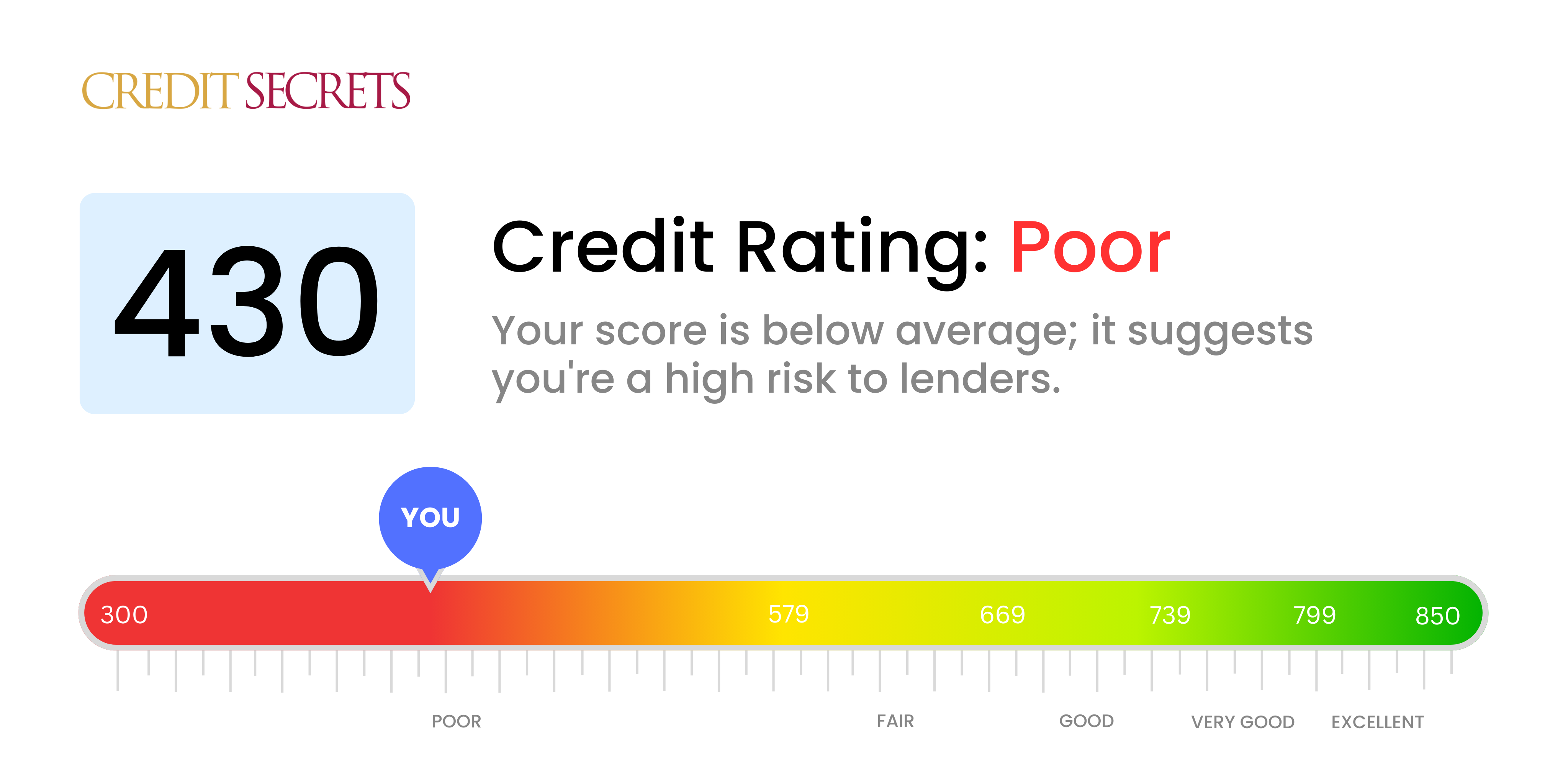

Is 430 a good credit score?

With a credit score of 430, you're unfortunately in the 'poor' category. It's not the best place to be, but it's not the end of the road either, and there's always room for improvement.

This score might make it challenging to get approved for loans or credit cards, and if you do get approved, your interest rates might be higher than average. However, it's crucial to know that credit scores are not static – they can change and you have the power to boost yours. By managing your finances responsibly and regularly checking your credit report for any inaccuracies, you can start to see an improvement in your score over time.

Can I Get a Mortgage with a 430 Credit Score?

With a credit score of 430, you will face challenges in securing a mortgage approval. This score is significantly below the minimum requirements of most lenders, suggesting a history of financial struggles such as late payments or defaults.

This situation is undoubtedly tough, but there are potential alternatives to consider. One option might be to explore government-backed loans, such as FHA loans; these often have less strict credit requirements. Another option could be to save for a larger down payment to make your application more appealing to lenders. Whilst there is no quick-fix solution, taking steps like these may improve your chances of home ownership. As you met these challenges, remember that improving your credit score is a slow, consistent process that can help you in the long-run.

Can I Get a Credit Card with a 430 Credit Score?

Regrettably, with a credit score of 430, it is unlikely that a traditional credit card application would be successful. This kind of score is typically seen as risky by credit card companies. It may seem harsh, but it's crucial to face the financial reality directly, as doing so is the first step towards building a better future. It's essential to bear in mind that this is just a snapshot of where you are now and not a lifelong sentence.

Despite the slim chances of being approved for standard credit cards, alternative options are available that can help rebuild credit over time. One such option is a secured credit card, which requires a deposit that becomes your credit limit. Additionally, having a suitable co-signer or using pre-paid debit cards can also be feasible options. While these alternatives won't paint an immediate rosy picture, they provide a stepping stone towards financial health. Finally, please note that interest rates for credit offered to people with this score will probably be significantly higher, which mirrors the increased risk for lenders. Stay firm in your journey to improve your credit score, this period is temporary.

With a score of 430, your credit is flagging behind most traditional lending parameters for awarding personal loans. Regrettably, this denotes that your chances of securing a personal loan with such a score are lean. A credit score of 430 demonstrates high fiscal risk to lenders, hence their apprehension to extend financing. Your situation might seem dire, but it's integral to acknowledge and understand what such a score means for your borrowing prospects.

While mainstream lending may currently be out of reach, other pathways do exist. Secured loans, where you offer an asset as collateral, or loans co-signed by an individual with superior credit, might be worth considering. Peer-to-peer lending platforms are also viable, as their credit prerequisites can often be more forgiving. However, please bear in mind that these alternatives usually entail higher interest rates and more stringent terms due to the amplified risk the lender is assuming. It's important to keep your optimism, but also to stay aware of the realities and challenges that come with your current credit score.

Can I Get a Car Loan with a 430 Credit Score?

Having a credit score of 430 is indeed a significant challenge when it comes to securing a car loan. Ideally, lenders prefer credit scores around the 660 mark for the best terms. A score of less than 600 is often viewed as subprime, and your score of 430 places you in this lower bracket. This could result in higher interest rates or possibly denial of a loan. A lower credit score indicates a higher lending risk, with some past issues in repaying funding may likely be present.

But a low credit score isn't a complete blockade to achieving your automotive dreams. There are lenders out there who are willing to work with individuals who have lower credit scores. However, it's important to tread carefully, because these loans often come with much higher interest rates. Higher rates are a measure lenders take due to the perceived risk, and a way for them to protect their investment. While the path could potentially be a little difficult, with cautious decision-making and a full understanding of the terms, securing a car loan remains a possibility.

What Factors Most Impact a 430 Credit Score?

Delving into the elements affecting a 430 credit score is crucial to help you improve your finances. By recognizing these contributing factors, you can start embracing better credit practices.

Detailed Payment History

Payment history can considerably lower your credit score. Late payments or missed debts might be playing a role here.

How to Check: Verify your credit report for any late or missed payments. Contemplate if any forgotten payments have recently occurred.

Elevated Credit Utilization Ratio

A high credit utilization rate - the proportion of your available credit that is being used - can pull your score down. If you're frequently maxing out credit cards, it could be part of the problem.

How to Check: Take a look at your credit card statements. Observe if the used credit is too close to your credit limit. Aim to maintain a lower ratio.

Short Credit History

If your credit history doesn't span a long time, it can be harmful to your score.

How to Check: Inspect your credit report to find out the age of your oldest and newest accounts and your overall credit history’s average length.

Lack of Credit Diversity and New Credit

Maintaining a variety of credit types and managing new credit responsibly can determine your score quality.

How to Check: Look over your credit types, like credit cards, installment loans and mortgage loans. Remember to be cautious when applying for new credit.

Public Records

Highly visible public records like bankruptcy or tax liens can be detrimental to your credit score.

How to Check: Look at your credit report for these public records. Resolve any potentially unresolved issues as soon as possible.

How Do I Improve my 430 Credit Score?

A credit score of 430 is indeed low; but it’s never too late to start improving it. Here’s how to gear the recovery process towards your specific situation:

1. Rectify Outstanding Debts

Clearing outstanding debts will be crucial at this point. If there are accounts in arrears, plan a budget that prioritizes their settlement. Contact your creditors, explain your situation, and attempt to forge an agreement that allows you the leeway to catch up on payments.

2. Manage Card Balances Keenly

As far as possible, try to keep your credit card balances under control. A good practice is maintaining them at less than 30% of your credit limit, and ideally aim to get them to below 10% over time. Pay off cards with the highest utilization first.

3. Contemplate a Secured Credit Card

In your current situation, getting a regular credit card might be a challenge. But don’t fret just yet; consider a secured credit card, which requires a deposit that doubles up as your credit line. This gives you a chance to build a positive payment record over time.

4. Leverage Authorized User Status

If you know someone with good credit willing to add you as an authorized user on their card, this could greatly assist your credit recovery process. This way, their positive payment behavior reflects on your credit report as well. Just confirm that the card company reports authorized user activities to credit bureaus.

5. Diversify Your Credit Portfolio

Your credit mix plays a role in your score calculations. When your payment history begins to improve with your secured card, consider adding other forms of credit like retail accounts or credit builder loans, to provide a healthy diversity of credit in your file.