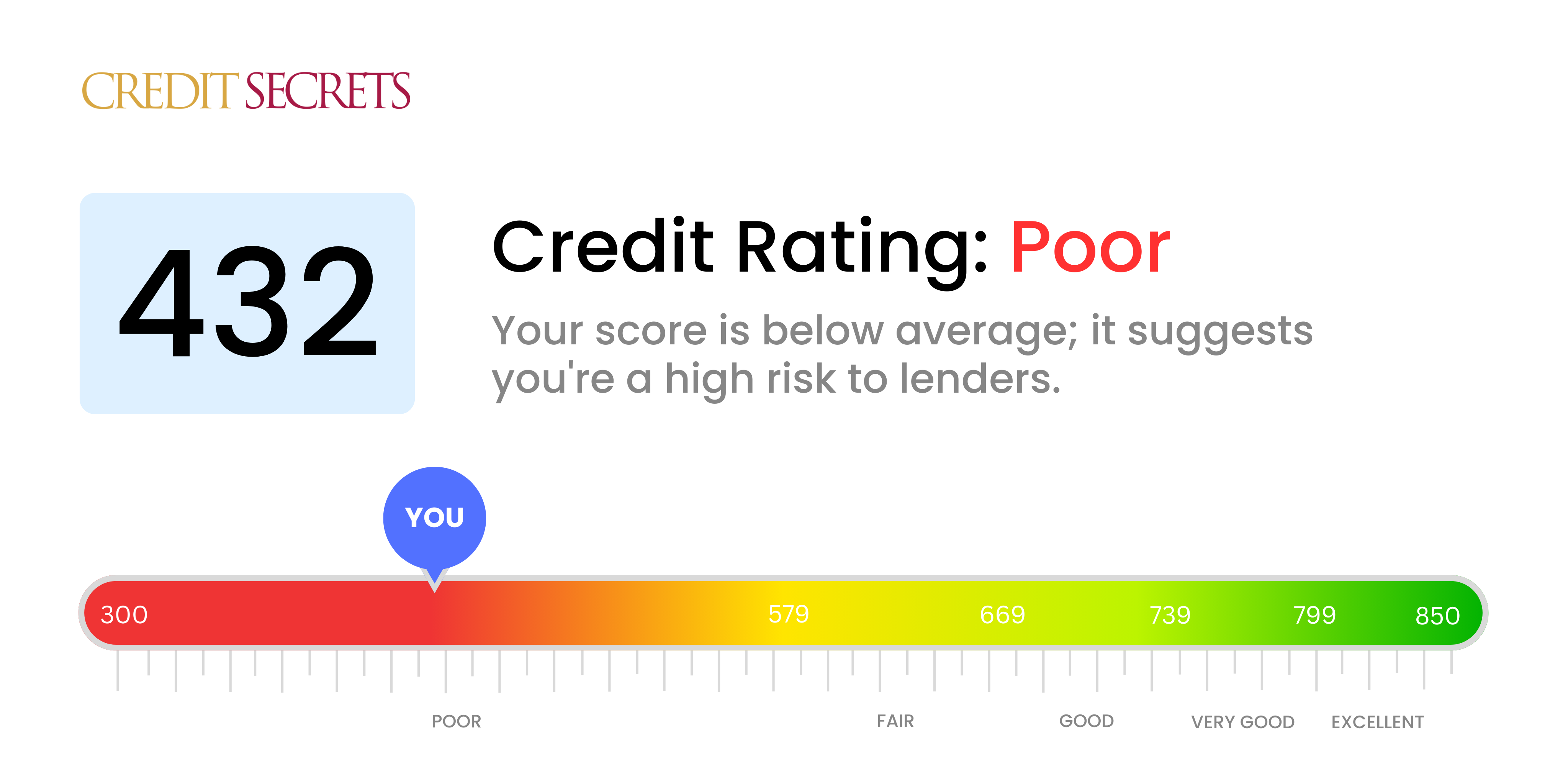

Is 432 a good credit score?

With a credit score of 432, unfortunately, you fall into the 'Poor' category. This typically means that due to past financial mistakes, lenders and creditors may view you as an increased risk, and it may be hard to get approved for loans, credit cards, or lower interest rates.

However, don't lose hope – improving your credit score isn’t an impossible task. By applying better financial habits like paying your bills on time, keeping your credit card balances low, and not taking on more debt than you can handle, you can gradually improve your scores over time. Stay positive and remember, you are capable of turning your financial situation around.

Can I Get a Mortgage with a 432 Credit Score?

Unfortunately, with a credit score of 432, the probability of being approved for a mortgage is extremely low. This score is significantly below the minimum score preferred by most lenders. A credit score in this vicinity suggests past financial hardships, which could include unpaid debts or delayed payments.

Though this may be a tough position to find oneself in, better days are certainly ahead. By setting in motion actionable plans to improve your credit score, you can turn around this situation. Initially, address any outstanding debts or arrears negatively impacting your score. Proceed to establish a pattern of timely payments and judicious use of credit. While interest rates may be elevated due to the low credit score, they can be lowered over time as your score improves. Ascending out of a lower credit score is an incremental journey, hence, by persisting with diligent efforts, you can better your financial standing for the future.

Can I Get a Credit Card with a 432 Credit Score?

With a credit score of 432, getting approved for a common credit card might prove to be a difficult task. Creditors often perceive this as a high-risk score that suggests a history of mishandling finances or past financial hardships. It may be tough to digest such news, but taking it with a grain of understanding and realism is crucial. Recognizing the state of your credit standing is an essential first move towards financial recovery, even if it means confronting some uncomfortable realities.

Given the challenges that come along with such a low score, you may need to consider alternative options like secured credit cards. These cards require a security deposit which ends up being your credit limit. They are not as difficult to acquire and might help you rebuild your credit gradually. However, interest rates on such credit options can be considerably high because you are perceived as a high-risk borrower by the lenders. A possibility might also be to consider having a co-signer or to explore the option of pre-paid debit cards. This won't rectify the situation immediately but will serve as a foundational tool on your path towards financial stability.

At 432, your credit score is significantly lower than the range commonly seen as acceptable for personal loan approval. Lenders view a score in this bracket as high risk, which admittedly lessens your chances of securing a conventional loan. It may feel tough, but understanding what this score means for your lending options is vital.

While mainstream loans may be difficult to obtain, there are still alternative methods available. Secure loans, where collateral is provided, or co-signed loans, which involve a guarantor with a good credit score, may be possible solutions. You might also look into peer-to-peer lending, as this sometimes requires less stringent credit scores. However, it's important to be aware that these alternative options often entail higher interest rates and less favorable conditions as a reflection of the escalated risk for the lender.

Can I Get a Car Loan with a 432 Credit Score?

With a credit score of 432, it's likely that you will face hurdles in securing a car loan approval. Typically, a score above 660 is what lenders consider desirable, meaning a score below 600 would be deemed subprime, which is where a 432 score sits. This positioning can spell difficulty since this type of score suggests a higher risk for lenders, based on previous credit behavior potentially signifying future payment obstacles.

Despite the challenges a low credit score presents, it doesn't necessarily mean the end of the road for your car purchase aspirations. Some lenders are willing to work with people with lower scores, but remember to tread carefully. Loans of this nature often go hand in hand with substantially higher interest rates. The reason for these inflated rates is due to the heightened risk seen by the lenders and serves as a safeguard strategy. Though the path may appear rocky, with detailed consideration and exploration of the terms, the prospect of acquiring a car loan is not out of reach.

What Factors Most Impact a 432 Credit Score?

When grappling with a credit score of 432, understanding what influences this figure is crucial for charting your financial recovery path. By pinpointing and addressing the factors at play, you can set the right course toward a stabilized financial future. Always remember that your financial journey is singular and rich with opportunities for learning and growth.

Payment Track Record

Your payment history largely determines your credit score. Late payments, defaults or debt collections are likely causing your score to dip.

Investigating: Look through your credit report for late payments or defaults. Think about any situations where you didn't pay on time, as these instances pull down your score.

Utilization Rate

A high credit utilization ratio can damage your score. If you're maxing out your credit cards, this may be pulling down your score.

Investigating: Look through your credit card bills. Are your balances high in comparison to your credit limit? Keeping your balances low relative to your limit helps your score.

Lengthy Credit History

A brief credit history could be negatively impacting your credit score.

Investigating: Study your credit history to note the ages of your oldest, newest and average accounts. Think about whether you have opened new accounts recently.

Credit Mix and Recent Credit

Maintaining a variety of credit types and handling credit responsibly counts toward a good score.

Investigating: Look at your blend of credit accounts, like credit cards, retail accounts, installment loans, finance company accounts, and mortgage loans. Reflect if you've been conservative with new credit applications.

Public Records

Public records, such as bankruptcies or tax liens, can drag your score down significantly.

Investigating: Check your credit report for any public records. Deal with any items that require resolution.

How Do I Improve my 432 Credit Score?

With a credit score of 432, you’re in a challenging credit bracket, but it’s important to know there’s room for improvement. Prioritize the following accessible and highly impactful steps tailored for your situation:

1. Review Your Credit Report

Start by getting your credit report from all three credit bureaus – Experian, Equifax, and TransUnion. Review it closely for any errors or inconsistencies and dispute them right away. Errors on your credit report can significantly lower your credit score.

2. Tackle Outstanding Debt

Your credit score is undoubtedly affected by any past-due accounts. Your primary goal should revolve around addressing these first. If possible, set up a payment plan with your creditors, focusing primarily on the most delinquent accounts.

3. Apply for a Secured Credit Card

Your credit score may make it hard to qualify for traditional credit cards. In this case, consider a secured credit card, which requires a refundable deposit. By making timely payments, a secured card can help build a healthier credit score over time.

4. Consider Becoming an Authorized User

Seek a trusted person with solid credit to add you as an authorized user to their credit card. This allows you to benefit from their good credit habits, positively impacting your credit score. Ensure their credit card issuer reports authorized user activity to credit bureaus.

5. Explore Credit Builder Loans

Once you’ve established a foundation of good credit habits with a secured card, a credit builder loan might be a viable next step. This type of loan helps establish a healthy payment history, which is profitable for improving your credit score.