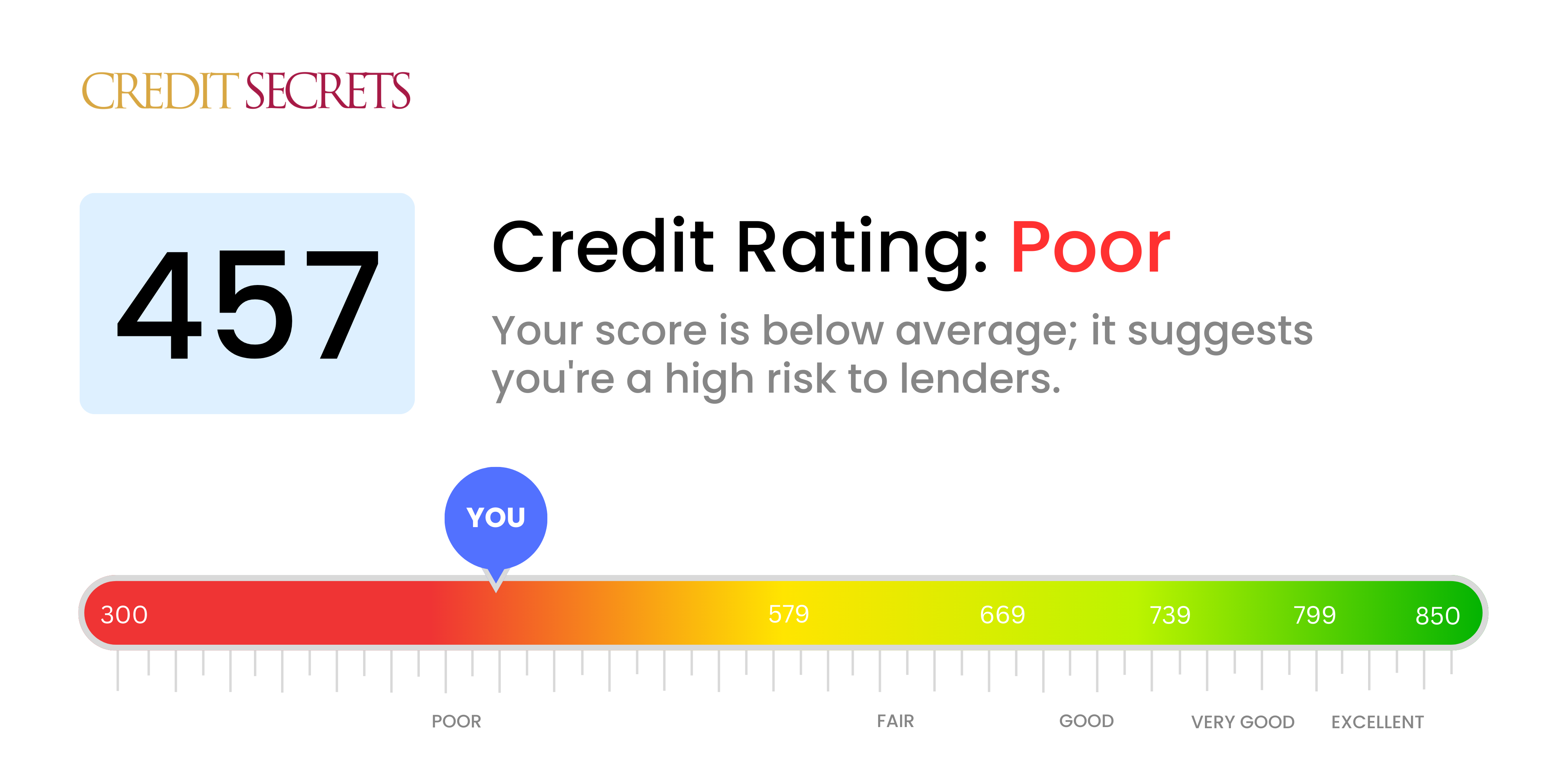

Is 457 a good credit score?

Your credit score of 457 falls into the poor credit range. This score will likely prevent you from qualifying for most types of credit, and if you are approved, you can expect to have higher interest rates. However, there are tools and strategies that can help to turn your score around. Remember, a poor credit score isn't a life sentence, it's a starting point to a better financial future.

Having a score of 457 does not mean you cannot have access to credit, but it will be much harder and more expensive. It's important now to learn ways to elevate your credit score. Start by understanding your credit report, paying your bills on time and keeping your credit utilization low. As you demonstrate responsible credit behavior over time, your score will improve. Yes, fixing your credit score isn't a quick job, but with persistence, you can do it.

Can I Get a Mortgage with a 457 Credit Score?

Holding a credit score of 457, it's unfortunate to say that securing a mortgage approval is highly doubtful. This credit score is significantly beneath the required minimum for most lenders. A score at this level typically reflects persistent financial struggles such as habitual late payments or even loan defaults.

Having said this, you ought not to lose heart. It is a tough situation, yes, but remember - it's not permanent. Significant improvement can be achieved by conscientiously addressing your financial situation. Start by resolving any existing debts that are pulling your score down. Keep a record of punctual payments and moderate credit usage. In spite of the challenges, it's crucial to remain optimistic. The climb may be steep, but encountering this challenge head-on can reward you with better financial prospects in the future.

Though the regular mortgage route may be currently unattainable, there are other options to consider. FHA Loans, for instance, can be an alternative. Their credit score requirements are typically more lenient compared to traditional mortgage lenders.

Can I Get a Credit Card with a 457 Credit Score?

A credit score of 457 is quite low, unfortunately posing a tough obstacle to getting approved for a typical credit card. This low score often indicates to lenders that you might have faced serious financial issues before or struggled with proper monetary management. Nevertheless, facing this reality head-on is pivotal to your onward financial journey, even if it comes with some hard truths.

Having such a low score inevitably invites certain challenges. The most practical alternative could be secured credit cards which require a safety deposit equal to your credit limit. These cards can be less daunting to apply for and gradually help in boosting your credit. You might also look into options like a trusted co-signer, or perhaps pre-paid debit cards, which while not immediate solutions, can aid in the path to financial improvement. It's important to remember however, that any credit avenues open to you may come with pretty steep interest rates, due to the high-risk nature of a low score as perceived by lenders.

Having a credit score of 457 can present significant hurdles to obtaining a personal loan in the conventional lending climate. This score is indicative of a high-risk borrower to most lenders, which decreases your chances of approval. It's a hard place to be in and understanding the implications this credit score has on your borrowing ability is crucial.

Despite these setbacks, hope is not lost. There are alternative lending options to explore such as secured loans, which require collateral, and co-signed loans, where you can have someone with a higher credit score support your application. You may also consider peer-to-peer lending platforms, however, they might come with a higher price tag due to elevated interest rates and less-affordable terms. These reflect the elevated risk you present as a borrower with a low credit score. Remember, it's important to plan carefully and make informed decisions when exploring these options.

Can I Get a Car Loan with a 457 Credit Score?

Having a credit score of 457 means you could find it difficult to get approval for a car loan. Most lending institutions prefer a credit score above 660, and sometimes, anything below 600 is considered to be subprime. With a score of 457, you fall into this subprime zone, which unfortunately could result in potentially high interest rates or a declined loan. This is because a low credit score triggers alarms for lenders, showing a higher risk based on past financial behaviors.

But, a low score doesn't automatically eliminate you from the car-buying process. Some lenders are comfortable working with applicants who have lower credit scores. Yet, be aware that such loans often carry higher interest rates, reflecting the increased risk that the lenders perceive. While it might be a little bit of a rough road, with careful planning and close scrutiny of the terms, it's still possible to secure a car loan. Remember, a low credit score is a hurdle, not a wall, and with patience, you can overcome it.

What Factors Most Impact a 457 Credit Score?

Comprehending a credit score of 457 is critical to formulating a plan to enhance your financial future. Understanding the potential causes of this score and strategically addressing them can lead to a stronger financial outlook. Remember, every financial journey is unique, providing a multitude of lessons and opportunities for growth.

Payment History

An essential factor that affects your credit score is your payment history. Late payments or defaults could be significantly harming your score.

How to Check: Scan your credit report for any overdue payments or defaults. Reflect on past payments, recognizing any occasions where payment was delayed as it could be affecting your score negatively.

Credit Utilization Ratio

A high credit utilization ratio can be detrimental to your credit score. If your credit card balances are approaching their limits, it could be impacting your score.

How to Check: Browse your credit card statements. Is your balance near their limit? The lower the utilization, the better.

Credit History Duration

A brief credit history can negatively affect your score.

How to Check: Carefully assess the age of your oldest and newest accounts on your credit report, and the average age of all your accounts. Evaluate whether many new accounts have been recently opened.

Diversity of Credit and Recently Acquired Credit

It is essential to have a diverse credit spectrum and responsibly manage new credit to maintain a good score.

How to Check: Examine your mix of credit accounts such as credit cards, retail accounts, installment loans, mortgage loans. Ensure new credit is applied for sparingly.

Public Records

Public records like instances of bankruptcy or tax liens can have a significant impact on your credit score.

How to Check: Review your credit report for any public records. Work towards resolving any issues that may be affecting your score.

How Do I Improve my 457 Credit Score?

A credit score of 457 is decidedly low, but fear not, enhancing your score is indeed possible. Let’s focus on the most influential and feasible steps for your current situation:

1. Rectify Defaulted Accounts

If you have any defaulted accounts, your immediate task should be to rectify those. Defaulted accounts tend to severely drag down your credit score. Get in touch with your lenders and work out an achievable repayment plan.

2. Lower Your Credit Card Debt

Bearing large amounts of credit card debt, especially when compared to your credit limit, is likely to lower your credit score. Aiming to lower your credit card debt to less than 30% of your total credit limit will have a positive effect. Start with the cards bearing the highest interest rates.

3. Apply for a Secured Credit Card

With a 457 score, getting approved for a conventional credit card will be tough. However, a secured credit card could be a handy tool. This involves a cash collateral deposit, setting your credit line. Use this card sensibly, maintaining a low balance and paying full every month to demonstrate consistent and responsible credit usage.

4. Seek to become an Authorized User

Request a trusted individual with strong credit to add you as an authorized user on their credit card. This can bolster your credit score over time as their positive payments contribute to your credit history. Just ensure that the card company reports authorized user activities to the credit bureaus.

5. Venture into Different Types of Credit

Diversifying your credit types may improve your credit score. Once you’ve proved reliable with a secured card, consider starting with another form of credit, such as a store card or a credit builder loan, and handle them judiciously.