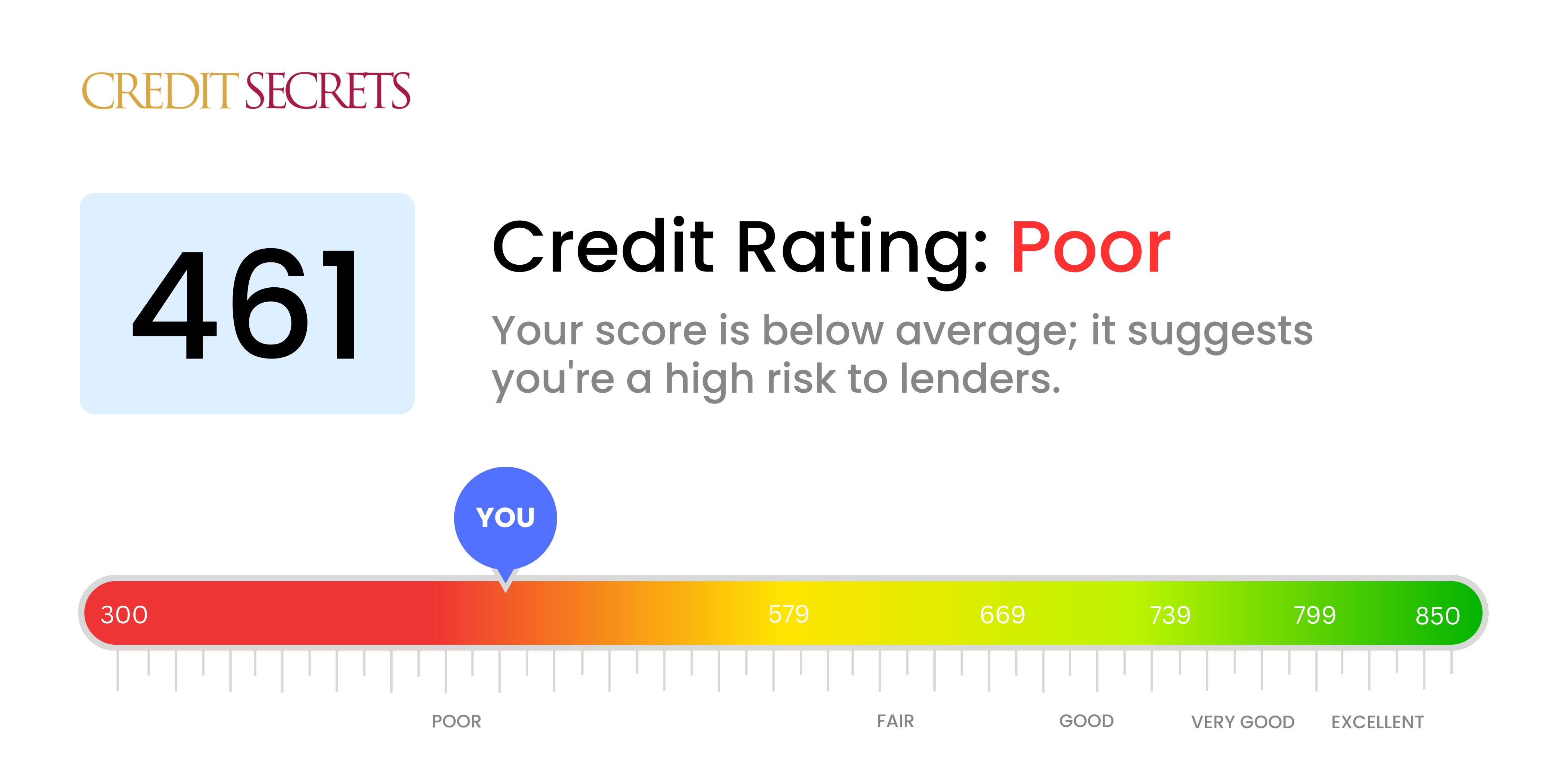

Is 461 a good credit score?

Having a credit score of 461 means your credit health is currently ranked as poor. It's not what you'd hope for, but remember it's not a life sentence - credit scores can be improved. With this score, you might face challenges such as higher interest rates or difficulties in securing loans or credit cards due to lenders perceiving you as a high-risk borrower.

But don't lose hope. While your present score is struggling, remember there are steps you can take for improvement. With the right strategies, focus, and discipline, you have the potential to turn this around and make progress towards your financial goals.

Can I Get a Mortgage with a 461 Credit Score?

With a credit score of 461, it's improbable that you'll be approved for a mortgage. This score is significantly below most lenders' minimal requirements, suggesting a pattern of financial issues like missed payments or unresolved debts. It's essential to acknowledge this isn't an easy situation, but it's also not permanent.

Alternatives to traditional mortgage loans might be necessary at this point. One possibility is a FHA loan, which caters to applicants with lower credit scores. However, it's important to note that while it might be easier to get approved, the interest rates may be higher which could result in a bigger overall cost. Another potential alternative is seeking a co-signer. This could be a friend or a relative who is willing to assume the risk if you default on your payments. However, this is a serious commitment for them and should not be taken lightly. In the meantime, strive to settle any outstanding debts and build a dependable payment record to gradually enhance your credit performance.

Can I Get a Credit Card with a 461 Credit Score?

Having a credit score of 461 makes it tough to secure approval for a regular credit card. Creditors might perceive this score as high-risk, which suggests past financial hardships or mismanagement. The reality might be hard to accept, but recognizing your credit status is the initial step towards financial recovery. Acceptance of this situation, while harsh, lays the foundation for improvement.

Regarding alternatives due to such low scores, there are still options that could work in your favor. Secured credit cards, for example, that require a deposit matching your credit limit, can be a good start. It has lower approval thresholds and can help improve your credit score gradually. Exploring prepaid debit cards or finding a suitable co-signer might also be beneficial. Remember that these choices do not offer immediate solutions, but they provide stepping stones towards achieving financial solidity. Furthermore, be aware that the interest rates associated with any credit options open for low-score holders are typically higher due to the heightened risk from the lenders' perspective.

With a credit score of 461, securing a personal loan from traditional lenders could prove to be quite difficult. This score is somewhat lower than what most lenders deem acceptable, and thus, indicates an increased risk. We completely understand that this isn't the most ideal news to hear, but it's crucial to understand the reality surrounding your credit situation.

While traditional loans may not be an option, there are still alternatives worth exploring. Considering a secured loan, which requires collateral, or a co-signed loan, where someone with a higher credit score vouches for you, could be viable options. Another pathway could be through peer-to-peer lending platforms, who may have more flexible credit criteria. Keep in mind, these alternate solutions often carry higher interest rates and tougher terms, reflecting the higher risk to the lender. It's important to approach these options with care, understanding their potential impact on your financial future.

Can I Get a Car Loan with a 461 Credit Score?

With a credit score of 461, you may find the road to securing a car loan somewhat rocky. Most lenders view a credit score above 660 as a sign of a reliable borrower; unfortunately, your score of 461 is significantly lower. This falls into the category often referred to as "subprime," which could potentially result in higher interest rates or even denial of the loan. The reason being, lenders associate a lower credit score with a higher risk of loan repayment difficulties.

That being said, it's important to remember that a low credit score like 461 does not completely close the door on your hopes of getting a car loan. There are some lenders who cater to individuals with lower credit scores. However, you need to proceed with caution as such loans usually come with much higher interest rates. These rates are their way of offsetting the risk associated with lending to borrowers with low credit scores. So while this journey may be challenging, with thorough analysis and understanding of the terms, getting a car loan isn't entirely impossible.

What Factors Most Impact a 461 Credit Score?

Navigating the world of credit scores can be a daunting task. Diving deep into the reasons behind your 461 score is a significant first step in your financial growth journey. Each financial path is distinctive, with both obstacles and stepping-stones for learning.

Payment History

Your payment history is a primary aspect of your credit score. Any late or missed payments can play a significant role in your credit score standing.

Steps to Take: Check your credit report for any signs of late or missed payments. Any past oversight on payments may have caused a dip in your credit score.

Credit Use

Maxing out your credit cards can also have a negative impact on your credit score. If your credit card balances are consistently high, then it can be a factor worth considering.

Steps to Take: Go through your credit card statements. High card balances may be one of the reasons the score is less than optimal.

Credit History Duration

The length of your credit history can also influence your score. A fresh credit history may potentially lower your score.

Steps to Take: Analyze your credit report to gauge the duration of your oldest and newest credit lines, along with the average credit age.

Credit Account Variety and New Accounts

Holding a diverse set of credit types and prudently managing new credit lines are key components of a positive credit score.

Steps to Take: Look out for your variety of credit accounts and how responsibly you've been handling recent credit applications.

Legal Records

Legal documentation such as bankruptcy filings or tax liens can significantly impact your credit score.

Steps to Take: Go through your credit report for any public records and work towards addressing the ones that need resolving.

How Do I Improve my 461 Credit Score?

A credit score of 461 is categorised as poor, but fear not, by implementing a few strategic steps, the desired improvement can be made. At this stage, the following strategies might be the most effective:

1. Address Defaulted Accounts

Any defaulted accounts need immediate attention. The impact of these accounts on your credit score can be transformational. Start by settling your most overdue payments and where required, negotiate a reasonable payment plan with your creditors.

2. Lower Credit Card Debts

Your credit score can also take a severe hit if your credit card debts are high compared to your limit. Try to reduce your balances to less than 30% of the limit. Ultimately, aim to keep them below 10%. Prioritize paying off the cards with the highest usage rates first.

3. Consider a Secured Credit Card

Given your current score, getting a regular credit card might be difficult. A secured credit card, however, could be a worthwhile consideration. To secure the card, you’ll need a cash deposit, then by using it responsibly, you can start to build a favourable payment history.

4. Request to be an Authorized Card User

A relative or a trustworthy friend with an impressive credit score can help you out by adding you as an authorized user on their card. Remember to verify with the card issuer that they report authorized users’ activity to the credit bureaus.

5. Diversify Your Credit Profile

Having a variety of credit accounts contributes to a more robust credit score. After establishing a solid payment history with a secured card, consider different types of credit like a credit builder loan and manage them carefully.