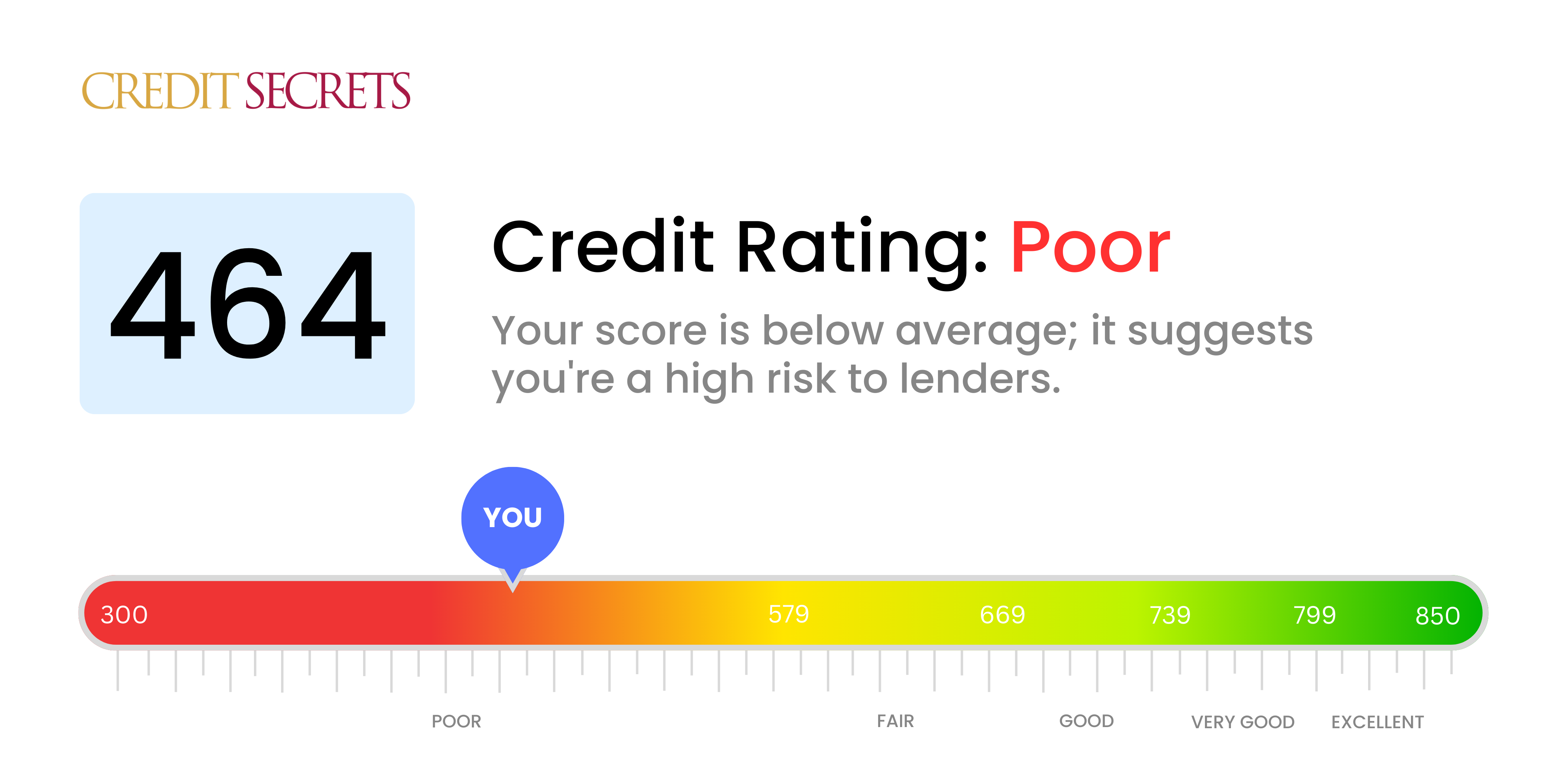

Is 464 a good credit score?

A credit score of 464 falls into the 'Poor' category. This means you may face difficulties in qualifying for credit cards or loans and might receive higher interest rates if you do qualify.

It's important to remember though, that having a score in this range does not mean you'll be unable to improve it. By taking informed steps such as paying down debts, always paying bills on time, and limiting credit inquiries, you can gradually uplift your score over time, eventually paving the way towards a more secure financial future.

Can I Get a Mortgage with a 464 Credit Score?

With a credit score of 464, unfortunately, it's unlikely that you'll be approved for a mortgage. This score is significantly below the minimum that most lenders typically require, reflecting perhaps past financial troubles including late payments or loan defaults.

Securing mortgage approval with this score might be tough, yet it's important not to be demoralized. Each credit situation can be improved over time with proper, informed steps. Address the debts and delinquencies negatively affecting your credit score and try to build a solid history of on-time payments to gradually enhance the score.

While mortgage approval may not be feasible now, considering alternatives such as rent-to-own contracts or financial assistance programs could be beneficial. Moreover, "subprime" mortgages designed for low-score borrowers might be another option. However, these come with higher interest rates due to increased lender risk. Be sure to thoroughly understand the terms before committing.

Remember, while the journey to improve credit may seem daunting, with persistence, you can move towards financial stability and your dream of homeownership.

Can I Get a Credit Card with a 464 Credit Score?

With a credit score of 464, getting approved for a traditional credit card can be a steep uphill climb. That said, this is a hurdle, not a roadblock. You're not alone and understanding the seriousness of a low score is an important stride towards better financial health. This score might indicate a history of financial difficulty or maybe some stumbling blocks in credit management but knowing this can be a guide towards improving your situation.

Given the challenges of a low credit score, you might want to consider other alternatives like secured credit cards. These types of cards require a deposit that serves as your credit limit, providing a safer avenue for lenders and assisting you in rebuilding credit over time. Besides, you might want to explore having a co-signer or opt for pre-paid debit cards. Keep in mind, the alternatives don't offer a quick fix, but they are useful practical steps in the journey towards solid financial footing. Furthermore, with a low score, any credit available will likely have significantly higher interest rates, due to the increased risk perceived by lenders.

With a credit score of 464, it's unfortunately not likely that you'll be approved for a traditional personal loan. Lenders view this score as an indication of high financial risk, which means approvals for conventional loans can be challenging. This might seem like an uphill battle, but it's critical to understanding your current financial standing and what it means for your borrowing possibilities.

Despite the hurdles, alternative loan options do exist. You might want to explore secured loans, which involve providing collateral, or loans co-signed by an individual with a better credit score. Another alternative could be peer-to-peer lending platforms. These platforms sometimes have more flexible credit requirements, opening up potential avenues. However, it's important to be aware that these alternatives might entail higher interest rates and less desirable terms, reflecting the increased risk taken on by the lender.

Can I Get a Car Loan with a 464 Credit Score?

A credit score of 464 can make it difficult to secure approval for a car loan. Most lending agencies want to see credit scores over 660 to offer favorable loan terms, and scores under 600 generally fall into the subprime range. With your credit score of 464, you're within this challenging range, which could result in higher interest rates or even a declined application.

This is because a low credit score represents a heightened risk for lenders. It signals to them that there may be obstacles in repaying the borrowed money based on past credit behavior. However, a lower score doesn't completely stop your journey to owning a car. Certain lenders are willing to work with people who have a lesser credit score. Remember though, these types of car loans likely come with more costly interest rates. This is how lenders protect their investment due to the increased risk. Navigating through this scenario might be tough, but with cautious evaluation and understanding of the loan terms, purchasing a car could still be achievable.

What Factors Most Impact a 464 Credit Score?

Navigating your financial journey with a score of 464 can be a challenging yet informative endeavor. This score indicates the pressing need to identify and tackle certain factors that are most likely to affect your credit.

Missed or Late Payments

One critical aspect that could be impacting your score is missed or late payments. This shows lenders potential unreliability in paying back borrowed money.

How to Check: Look at your credit report for any instances of late payments or missed bills. These are likely to have a negative impact on your score.

High Credit Card Balances

High balances on your credit cards may be a factor. A high credit utilization ratio suggests you are using a significant portion of your available credit, which can impact your score.

How to Check: Review your credit card balances. If they're near or at their limit, consider making a plan to lower them.

Short Credit History

Having a shortened credit history could also be affecting your score. Lenders prefer to see long-standing credit accounts that are managed well.

How to Check: Look at your credit report to assess the length of your credit history. Remember, opening new accounts can lower your average account age.

Lack of Diverse Credit

If you have few or only one type of credit account, it could limit your score. Managing diverse credit types successfully demonstrates financial versatility.

How to Check: Review your credit portfolio. A mix of installment loans, credit cards, and other forms of credit is advantageous.

Derogatory Marks

Derogatory marks such as bankruptcies or collections can drastically reduce your score.

How to Check: Ensure your credit report has no instances of public records needing attention. Propose a solution for each issue listed.

How Do I Improve my 464 Credit Score?

With a credit score of 464, you’re currently in the ‘very poor’ category, but don’t worry, it’s still possible to climb from here. Below are specific and impactful steps you can take:

1. Prioritize Outstanding Debts

Start by focusing on any outstanding debts, especially those that are already in collections. Resolving these will stop them from further damaging your score. Create a realistic repayment plan and start with the most delinquent accounts.

2. Limit New Credit Applications

Avoid applying for new credit cards or loans for the time being. Each application can lower your score temporarily. Focus on improving your score first before seeking new lines of credit.

3. Consider a Secured Credit Card

A secured credit card is a great way to build credit from scratch. You’ll need a cash deposit upfront which will usually serve as your credit limit. Use it for small purchases and pay off your balance in full and on time each month.

4. Leverage Rent Payments

If you’re renting and keeping up with payments, consider services that report these payments to the credit bureaus. On-time rent payments can help build a positive payment history.

5. Review Your Credit Report

Check your credit report for errors or inaccuracies that could be hurting your score. If you find any, dispute them with the credit bureau.

Take these steps with dedication, and you’ll surely witness an improvement in your credit score over time.