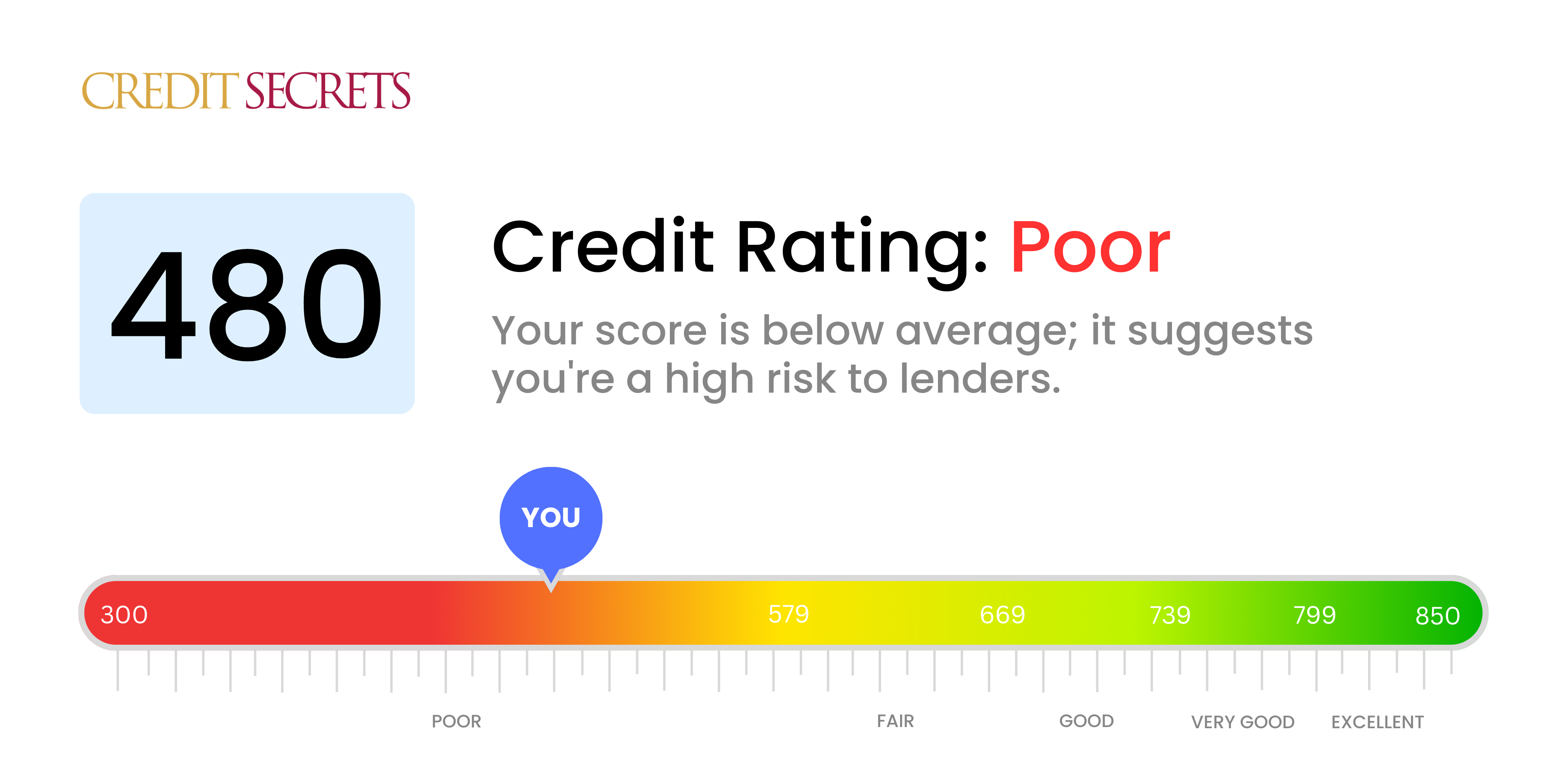

Is 480 a good credit score?

Unfortunately, a credit score of 480 falls into the 'poor' category, but it's essential to remember there's room for improvement. With this score, you may face challenges securing loans, receive higher interest rates, or be asked for security deposits on utilities but there are actionable steps you can take to start boosting this score right away.

Can I Get a Mortgage with a 480 Credit Score?

If you're working with a credit score of 480, it's important to know that you may face difficulties securing a mortgage. This score is significantly lower than the minimum requirement set by most lenders, which could be reflective of past financial challenges such as late payments or serious defaults. This presents a risk for financial institutions who may see you as less likely to meet your loan obligations.

This can feel like a crushing burden, but remember that this is not the end for your home-ownership dreams, and there's always a way forward for you. The first step is to clear up any current debt and actively work towards punctual repayment to avoid future detrimental hits to your score. If you're able to make rental payments, try to get credit for those — rent reporting services can be a great resource. Where possible, apply for secured credit cards that require a deposit and use them responsibly. You should also consider more mortgage alternatives, like Federal Housing Administration (FHA) loans that require lower credit scores. But in all these, be sure to read and understand all the terms and conditions. With time and patience, you can take back control of your credit narrative.

Can I Get a Credit Card with a 480 Credit Score?

Carrying a credit score of 480 greatly reduces the chances of being approved for a conventional credit card. Understandably, this piece of information may be hard to swallow. However, it's critical to face this reality head-on. Such a score is usually seen as high risk by lenders, pointing towards a history of financial hardship or poor money management.

Fortunately, there are options for people with a score like yours. One alternative might be a secured credit card, which involves providing a deposit that becomes your credit limit. Secured cards can be simpler to acquire and help rebuild credit over time. Searching for a suitable co-signer or investigating pre-paid debit cards may also be other worthwhile strategies. Interest rates with these options tend to be higher, reflecting the elevated risk lenders see, but they may be a useful stepping-stone toward healthier financial management and a better credit score.

With a credit score of 480, obtaining a personal loan through traditional lenders may be a steep challenge. Lenders view a credit score this low as a symbol of high financial risk, implying that loan approval under standard conditions may be improbable. It is essential to understand the implications of this credit score on your loan options without losing hope.

Although conventional loans may seem unreachable, alternatives like secured loans, which require collateral, or co-signed loans, backed by an individual with a better credit score, can be explored. There's also the choice of peer-to-peer lending platforms which may offer loans with easier credit score conditions compared to standard lenders. Bear in mind, these alternatives often include higher interest rates and sterner conditions due to the heightened risk for the provider.

Can I Get a Car Loan with a 480 Credit Score?

A credit score of 480 poses significant challenges in obtaining a car loan approval. Usually, lenders prefer a score upwards of 660, and anything below 600 is considered subprime. Regrettably, your score of 480 fits the subprime category. This might result in higher interest rates or even outright rejection of your loan application. Lenders view a lower credit score as a greater risk, hinting at potential problems in repayment of debt.

Yet, a lower score doesn't entirely wipe out your chances of securing a car loan. There are lenders willing to work with borrowers having lower credit scores, but beware of considerably higher interest rates. Such high rates are due to the heightened risk lenders sense, and function as a safeguard for their investment. With careful evaluation of terms and a full understanding of what you're getting into, it is still possible to land a car loan, albeit with some potential roadblocks.

What Factors Most Impact a 480 Credit Score?

Understanding a score of 480 is vital in your endeavor towards financial improvement. Being aware of and addressing the factors that contributed to this number puts you on the road towards greater fiscal stability. Remember, each financial journey is unique, creating an opportunity for crucial learning experiences.

Track Record of Payments

A significant factor in your credit score is your track record of payments. Late payments or consistent defaults could be the reason behind your score.

How to Check: Analyze your credit report for any late payments or defaults. Contemplate any times you might have made delayed payments, as these could have reduced your score.

Credit Utilization Ratio

An elevated credit utilization ratio can damage your score. If you're nearing your credit card limits consistently, this might be an issue.

How to Check: Look over your credit card statements. Are your balances almost reaching the limits continuously? Striving to maintain lower balances relative to your limit can help enhance your score.

Credit History Length

A shorter span of credit history can negatively affect your score.

How to Check: Scan your credit report to gauge the age of your oldest and newest accounts and the average age of all your accounts. Consider if you've recently opened new credit lines.

Diversity of Credit and New Credit

Maintaining a diverse range of credit types and handling new credit responsibly are key for a healthier score.

How to Check: Review your assortment of credit accounts, such as credit cards, retail accounts, installment loans, and mortgages. Reflect on whether you've been cautious when applying for new credit.

Public Records

Public records like bankruptcies or tax liens can greatly affect your credit score.

How to Check: Go through your credit report for any public records. Take care of any listed items that might require your attention.

How Do I Improve my 480 Credit Score?

A credit score of 480 is below average, but don’t give up. With perseverance and actionable plans, you can begin to rebuild your credit. One step at a time, you’ll make it where you want to be. Here’s what you can start doing immediately:

1. Keep Current on Bills

Punctuality with bill payment is crucial. The aim is to create a consistent record of on-time payments. If you have struggled with this in the past, maybe setting reminders or signing up for automatic payments could help. Your payment history plays a substantial role in your credit score.

2. Reconsider your Credit Utilization Ratio

If you’re close to maxing out the available credit on your cards, it’s important that you work on lowering this ratio. Try your best to not exceed 30% of your limit on any one card. Remember, maintaining a low balance doesn’t mean you have to stop using your cards. Use them, but keep the balance manageable.

3. Opt for a Secured Credit Card

You may find it tough to get approved for regular credit cards. In such cases, a secured credit card could be a practical choice. This card requires a upfront deposit which will act as your credit limit. By making modest, manageable purchases and making full payments each month, you can start improving your credit score.

4. Exploring Co-Signing

If you have someone willing to co-sign a loan or credit card, your chances of being approved may improve. Responsible use of this account can help increase your credit score. But remember, if the account is mishandled, both you and your co-signer will be impacted.

5. Broaden Your Credit Variety

After effectively utilizing a secured card, venture into different types of credit, like installment loans or retail cards, while ensuring they are responsibly managed. Having a variety of credit can advance your credit score in the long run.