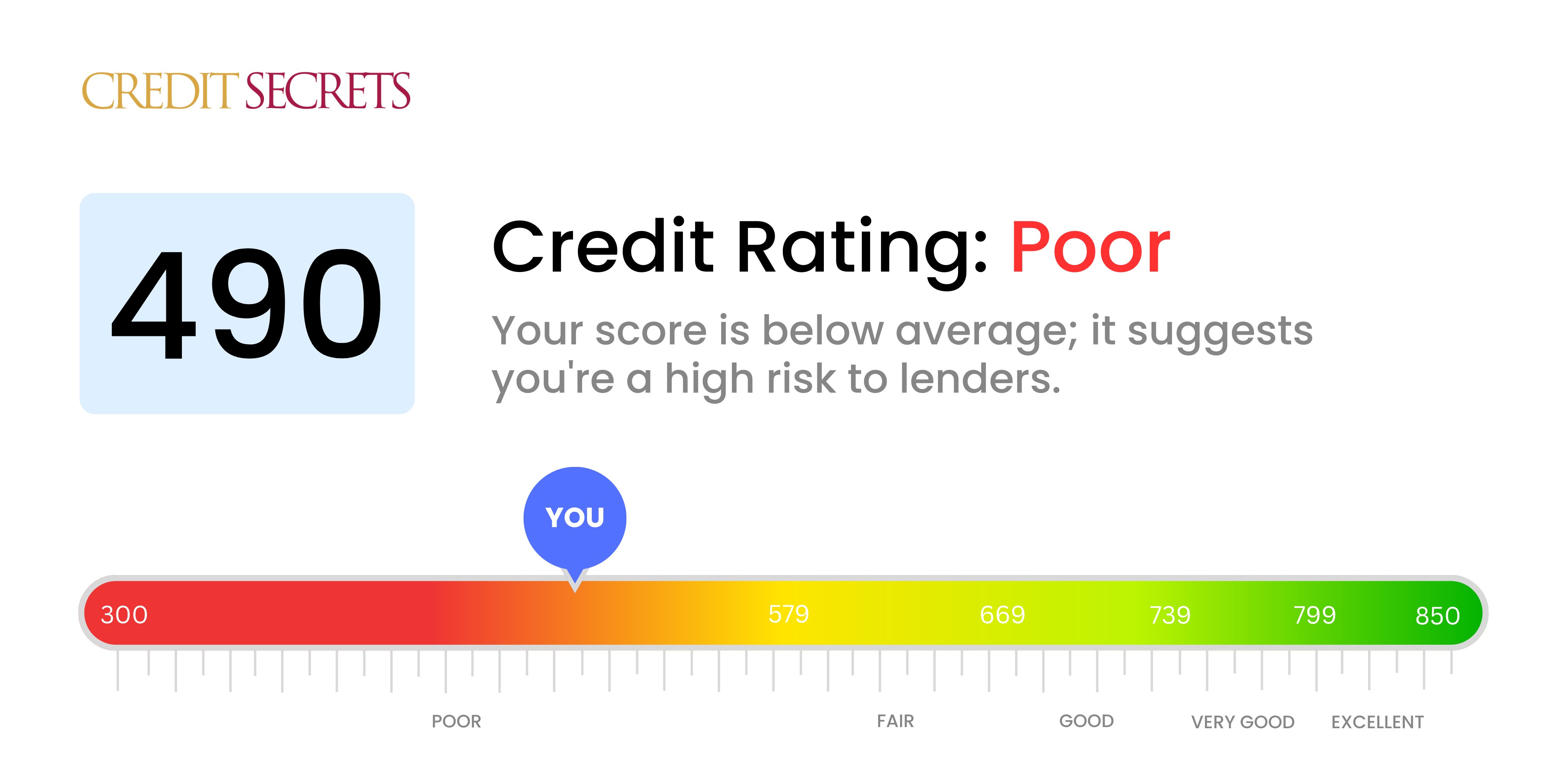

Is 490 a good credit score?

With a credit score of 490, unfortunately, you're in the poor range. There's no sugarcoating it – obtaining credit or loans may be challenging for you and interest rates might be quite high. But don't lose hope, by using resources like Credit Secrets, you can steadily improve your score over time.

Individuals with a credit score like yours often find themselves in difficult situations when negotiating financial terms, such as loan repayments or credit card interest rates. However, remember that even seemingly small positive changes to your financial habits can instigate a gradual increase in your credit score. With consistency and discipline, you can work towards achieving a better credit score and a healthier financial future.

Can I Get a Mortgage with a 490 Credit Score?

If your credit score is sitting at 490, it’s important to acknowledge upfront that securing a mortgage is likely to be extremely challenging. Most conventional lenders seek borrowers with considerably higher scores, as a score of 490 speaks to financial struggles that might have included late payments or even defaults.

A credit score in this range can make it increasingly difficult to secure favorable interest rates, often resulting in higher overall loan costs. As a potential alternative to conventional loans, consider government-backed alternatives like an FHA loan which generally have more flexible credit requirements. This might put home ownership within your reach even with a lower credit score. Of course, your goal should always be to improve your credit score over time, as this will set you up for a stronger financial future. Declining credit scores are not a life sentence and with intentional effort, you'll see an improvement.

Can I Get a Credit Card with a 490 Credit Score?

Having a credit score of 490 could make it tough for you to be approved for a traditional credit card. Your score is seen as a high-risk indicator by lenders, suggesting past financial troubles or missteps. It can be hard to face, but recognizing the reality of your credit health is a critical step in your financial recovery.

This doesn't mean there are no alternatives. Secured credit cards might be an option. These are cards that require a deposit that serves as your credit limit. They can sometimes be easier to get and can also help in rebuilding your credit gradually. Another alternative could be finding a co-signer or possibly using pre-paid debit cards. It's important to remember these options won’t immediately change your financial conditions, but they're part of the process in your journey towards financial health. It is also noteworthy that interest rates on any form of credit that you might be able to get with such scores can come with significantly higher interest rates. This is due to the increased risk lenders perceive when offering credit to those with this credit score.

With a credit score of 490, obtaining approval for a traditional personal loan might be difficult. Lenders see this score as a high indication of risk. It suggests that there's a history of not meeting financial obligations, which may deter them from approving your application. We understand this may not be the outcome you were hoping for, but it's necessary to be aware of what your credit situation implies for your borrowing capacity.

While conventional loans may not be within reach, there might be other alternatives to consider. Secured loans, which require you to put forward an asset as security, or co-signed loans, where another individual with a better credit rating vouches for you, could be explored. You might also look into peer-to-peer lending platforms. They might offer more flexible credit requirements. However, these alternatives typically come with higher interest rates and less favorable terms due to the increased risk faced by the lender. It's essential to understand all the conditions involved before going ahead.

Can I Get a Car Loan with a 490 Credit Score?

Having a credit score of 490 does make securing a car loan more difficult. Most lenders prefer a score over 660 for ideal terms, and under 600 is frequently seen as subprime. Your score of 490 falls into the subprime bracket, which can result in higher interest charges or possible loan refusal. The reasoning behind this is that a lower credit score shows lenders a higher risk due to a history of likely challenges in repaying borrowed funds.

On a brighter note, a lower credit score doesn't completely eliminate the possibility of getting a car loan. There exists a set of lenders who concentrate on providing loans to those with lower credits. However, be wary, as these loans usually carry much higher interest rates. The extra cost is a reflection of the risk the lenders are assuming. So, while the path may have a few more hurdles, obtaining a car loan is not completely out of reach. Just remember, understanding your terms and conditions thoroughly is key.

What Factors Most Impact a 490 Credit Score?

Exploring the reasons behind a credit score of 490 is the first step on your path towards improved financial health. Breaking down the factors can give you a clearer understanding of your current situation - everyone's financial journey is unique and full of opportunities for growth.

Repayment History

A significant factor in your credit score is repayment history. Missed or delayed payments will damage your score.

How to Check: Browse your credit report for any missed or late payments. Consider times where you might have paid your bills past their due date.

Credit Usage

If you're frequently using most of your available credit, this could be discouraging your score. High credit utilization sends up red flags.

How to Check: Look through your credit card statements. How close are the balances to the maximum limits? Strive to keep your usage low, relative to your credit limit.

Credit History Duration

A short credit history may negatively affect your score. Lenders like to see proof of long-term financial responsibility.

How to Check: Scrutinize your credit report to determine the average age and range of your credit accounts, and whether any new ones were recently opened.

Types of Credit and Recent Inquiries

A diversified credit portfolio and careful management of recent credit applications are crucial for a panoramic credit profile.

How to Check: Study your range of credit products, including credit cards, loans, retail accounts, and mortgages, and consider if you've been judicious about new credit applications.

Legal Actions

Legal judgments such as bankruptcies or tax liens dramatically impact your score.

How to Check: Review your credit report for any legal actions that require attention.

How Do I Improve my 490 Credit Score?

With a credit score of 490, you have significant room for improvement, but by implementing certain targeted steps, your financial health can get back on track. Here are the most impactful strategies tailored to your financial situation:

1. Address Collections Accounts

At this credit score, it’s likely that some of your accounts have moved into collections. It’s essential to resolve these issues as soon as possible. Contact the collections agency to negotiate a payment plan. Once paid, these accounts will be marked as ‘paid collection’ which is less detrimental to your score.

2. Prioritize Outstanding Debts

If you have any outstanding debts, focus on repaying those. Debts with higher interest rates should ideally be settled first to avoid accumulating more interest and further hurting your credit score. If the debts are too large, consult with your lenders to set up a feasible repayment plan.

3. Apply for a Secured Credit Card

Qualifying for an unsecured credit card may be challenging with this score range. A secured credit card, backed by a cash deposit which acts as your credit limit, can be a helpful alternative. Ensure you use this card sensibly, making small purchases and clearing the balance each month to boost your credit score.

4. Reliable Rent Reporting

If you pay monthly rent, see if your landlord can report your on-time payments to credit bureaus. This can help demonstrate financial responsibility and positively impact your credit score.

5. Maintain a Healthy Credit Mix

Once your score begins to improve, diversify your credit portfolio. Different types of credits such as personal loans, retail accounts or installment loans, handled responsibly, can contribute towards a higher credit score.