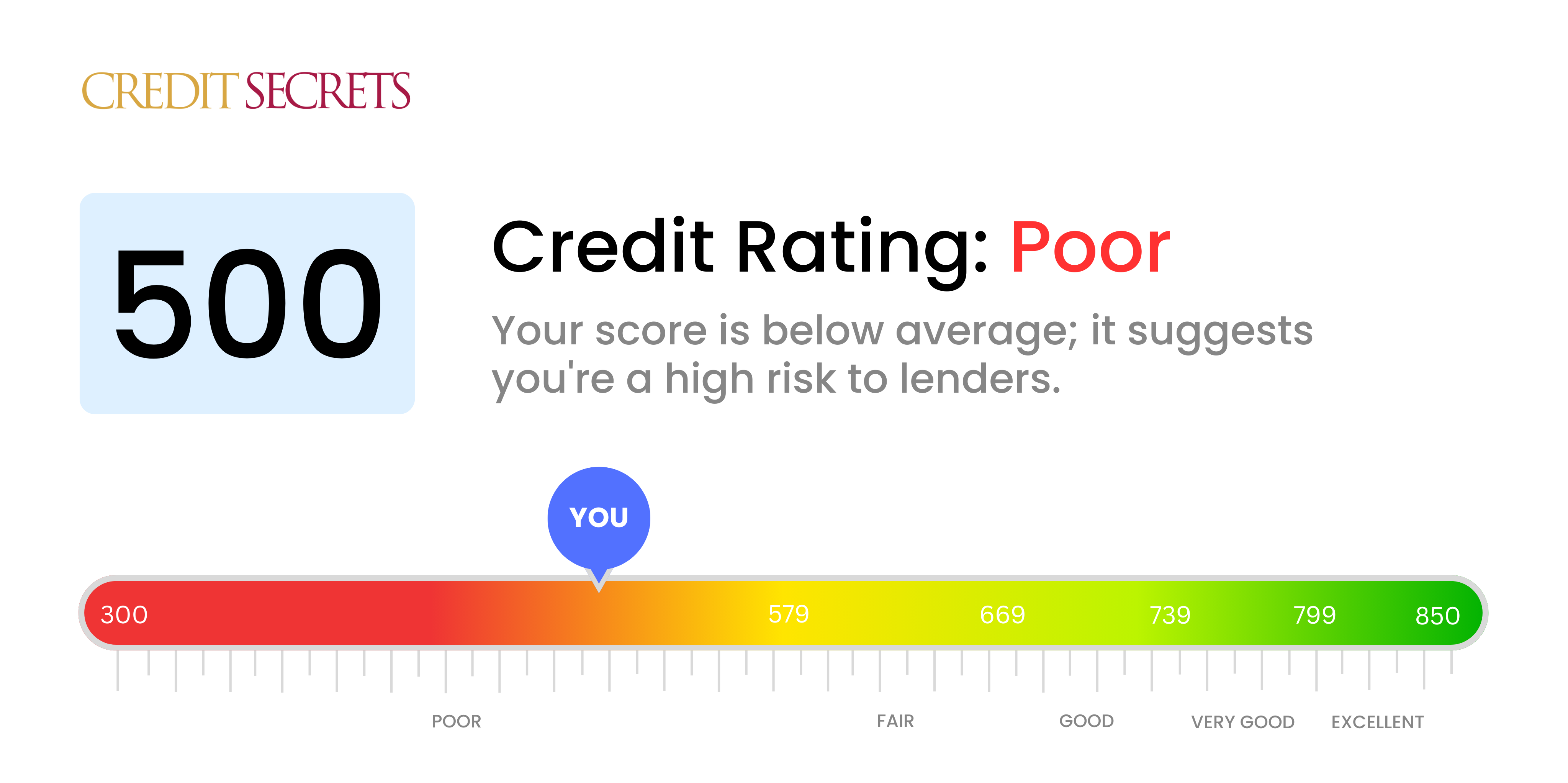

Is 500 a good credit score?

Having a credit score of 500 places you in the 'poor' category, meaning it is not regarded as a good credit score by lenders. This score may bring challenges, including higher interest rates, difficulty securing loans, and potential rejection from some creditors.

However, remember everyone starts somewhere, and you have the power to improve this situation. Think of this moment as a starting point, a place from where you can only go up. By applying good financial habits, patience and discipline, it's certainly possible for you to transform your 'poor' credit score into a 'fair', 'good', or maybe even 'excellent' score down the line.

Can I Get a Mortgage with a 500 Credit Score?

Unfortunately, with a credit score of 500, the likelihood of securing a mortgage approval is quite slim. This score is often viewed by lending institutions as an indication of past financial difficulties. This could include a history of late payments, defaults on loans, or bankruptcy. Because lenders need assurance that borrowers can repay their loans, a low credit score can significantly hinder your ability to be approved for a mortgage.

While this situation might seem tough, it's important to remember that everyone has the ability to work towards a healthier credit score. Start by ensuring that all current bills and financial obligations are paid on time, as good payment history can help lift your credit score over time. You could also explore alternatives such as Federal Housing Administration (FHA) loans, which have more lenient requirements, or saving for a larger down payment. Interest rates may be higher due to your low score, but these are steps that could eventually enable you to achieve homeownership. Remember, the journey to improving credit is a marathon, not a sprint. With time and consistent effort, you can improve your financial standing.

Can I Get a Credit Card with a 500 Credit Score?

With a credit score of 500, getting a traditional credit card might be tough. This is typically seen as a risky score by lenders, suggesting past financial struggles. It might feel disheartening, but embracing the reality of your credit status is crucial. Recognizing where you stand is an essential starting point in your financial recovery, even if it includes acknowledging a few uncomfortable truths.

You may want to consider other routes such as obtaining a secured credit card, which necessitates a deposit that can become your credit line. This option may be more easily attainable and can assist in progressively enhancing your credit. You could also consider having a co-signer or researching pre-paid debit cards as potential alternatives. While these solutions won't deliver immediate results, they can be instrumental in progressing towards a better financial future. Remember, for those with lower scores, the interest rates on any accessible credit options will likely be higher, as lenders perceive you as a higher risk.

With a credit score of 500, securing a personal loan from traditional lenders might be a challenge. This score is significantly lower than what most lenders accept as a good risk. They may view it as a signal that you carry a higher chance of defaulting on loan terms. It doesn't mean the end of the road for your financial goals, but it does signify a need for alternative approaches or solutions.

When traditional loans aren't an option, you can look into secured loans, which require collateral, or co-signed loans, where someone else with a better credit score can guarantee the loan for you. Another route could be peer-to-peer lending platforms, which may have softer credit score requirements. Remember though, these alternatives often present higher interest rates and tougher terms, given the higher risk to the lenders involved. It's essential to carefully consider these aspects before moving forward.

Can I Get a Car Loan with a 500 Credit Score?

Having a credit score of 500 can make it difficult to get approval for a car loan. Traditional lenders typically prefer to see credit scores over 660, and anything below 600 is often labelled as subprime. Unfortunately, your score of 500 falls into this challenging range. This represents higher risk to lenders due to the likelihood of having a hard time repaying the loan based on credit history.

But don't lose hope. There's a chance to find lenders who are ready to work with those who have lower credit scores. Be aware, though, these loans likely come with higher interest rates to counterbalance the perceived risk lenders are taking. It's important to understand and think through these terms. Despite the hurdles, a car loan remains a possibility with some careful planning and thoughtful decision-making.

What Factors Most Impact a 500 Credit Score?

Grasping the factors influencing your credit score of 500 is a crucial first step to boosting your credit. Understanding these aspects will guide you towards better financial habits and higher credit scores.

Past Due Accounts

Overdue balances can severely impact your credit score. This might be one of the dominant issues contributing to your score of 500.

How to Check: Go through your credit report and look for any unpaid or overdue accounts. Reflect on whether you've struggled to keep up with payments recently.

Credit Utilization

A high credit utilization ratio can negatively affect your score. This becomes a problem when your credit card balances are near or at their limits.

How to Check: Review your credit card statements. If balances are nearing or exceeding limits, this might be detrimental to your score.

Short Credit History

Limited or short credit history can pull down your score. If you're relatively new to the world of credit, this could be impacting your score.

How to Check: Go through your credit report to gauge the average age of your credit accounts, alongside the age of your oldest and newest account. Evaluate if you've been opening new accounts frequently.

Collection Accounts

Having an account in collections can significantly lower your score. If you have unresolved debt that's been sold to a collection agency, this could be hurting your score.

How to Check: Analyze your credit report for any accounts listed under collections. Attempt to resolve these issues at the earliest.

Public Records

Public records such as personal bankruptcy or tax liens can dramatically lower your credit score.

How to Check: Review your credit report for any public records. Address these promptly as they can linger on your report for years.

How Do I Improve my 500 Credit Score?

With a credit score of 500, your credit health is in need of some attention. But don’t worry, there are several viable strategies suited to your situation that can help you bounce back:

1. Clarify Credit Report Errors

A critical first step is to thoroughly inspect your credit report and correct inaccuracies, if any. Errors can negatively impact your credit score. It’s good practice to review your credit reports from all three bureaus regularly and to dispute any inaccuracies promptly.

2. Handle Past-Due Accounts

Paying off past-due accounts should be a priority. Overdue accounts can weigh heavily on your credit score. Talk to your lenders about constructing a manageable payment schedule or even debt settlement if necessary.

3. Credit Utilization Ratios

Strive to lower your credit utilization ratio (the percentage of your available credit being used). Aim for below 30% and make an effort to keep it that low. Start by paying off the credit cards with the highest balances first.

4. Consider a Secured Credit Card

Raise the odds of improving your score by utilizing a secured credit card. These cards are designed for individuals with lower scores. A cash deposit is required that acts as your credit line. Charge small amounts and pay off the full balance each month to establish a positive payment history.

5. Explore a Credit Builder Loan

Once you’ve shown a trend of responsible payment behavior with a secured card, look into a credit builder loan. Paid off over time, these loans can help to boost your credit profile in a controlled and responsible way.