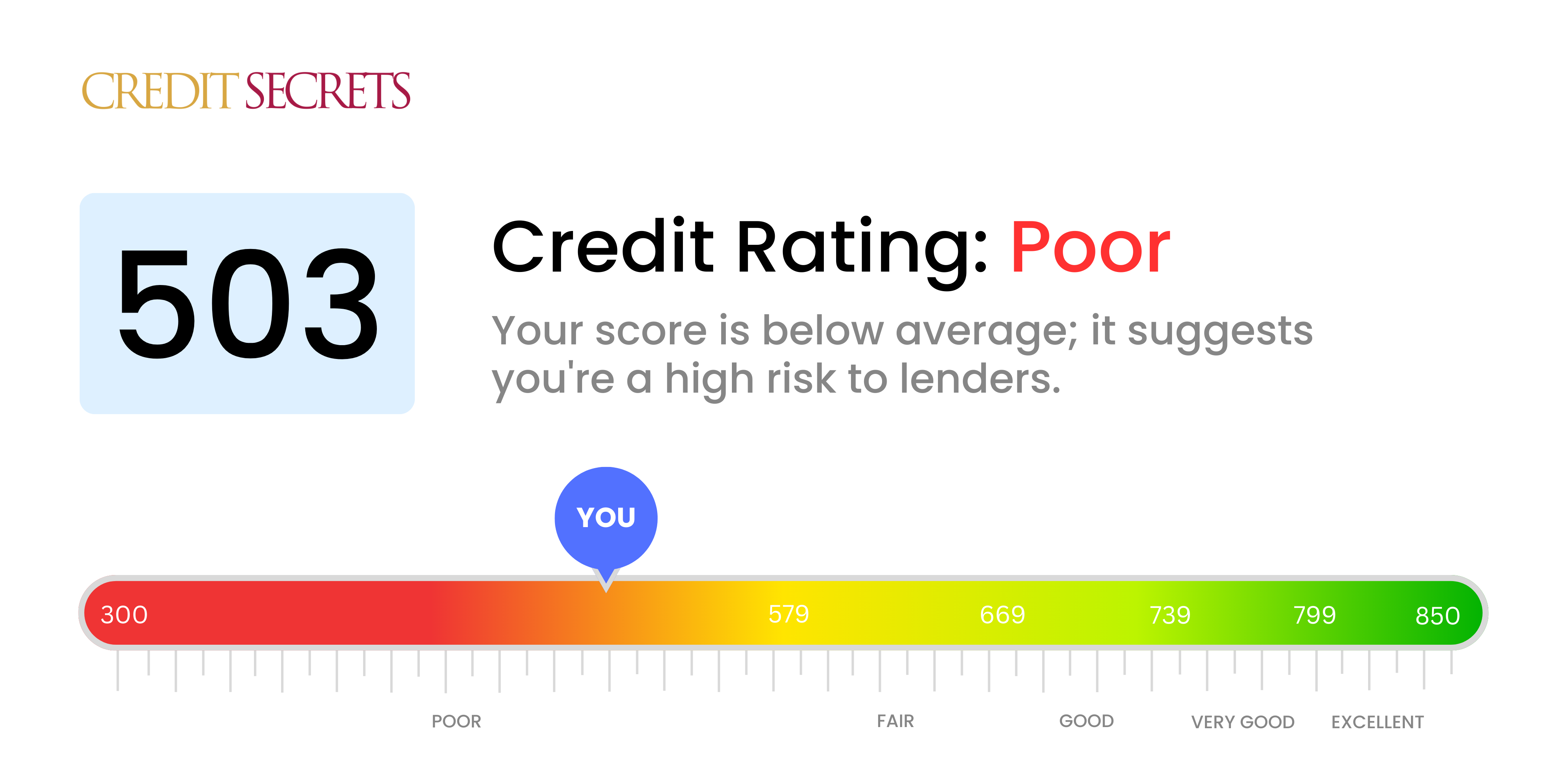

Is 503 a good credit score?

Your credit score of 503 is considered to be in the 'poor' range. Unfortunately, this can often mean facing obstacles when trying to obtain new credit, numerous financial challenges, higher interest rates, and less favorable credit terms. However, there's always potential for improvement and better control of your financial future.

By adopting credit-positive behaviors such as making payments on time, keeping low credit utilization, and regularly checking your credit reports for discrepancies, you can start working towards upgrading your credit score. Remember, improving a credit score takes time but every step you take in the right direction brings you closer towards obtaining a stronger financial standing.

Can I Get a Mortgage with a 503 Credit Score?

Regrettably, securing a mortgage with a credit score of 503 will be challenging. Most mortgage lenders consider a credit score 580 or higher to be acceptable, so a score of 503 is likely to be seen as a risk. This score indicates there might have been past financial difficulties such as missed payments or defaults on debts, leading lenders to be cautious.

Don't lose hope, though. There's still a possibility of securing a home loan but do bear in mind that the terms may be less than favorable. Typically, such loans come strapped with higher interest rates as lenders factor in the risk they're taking. An alternative option would be to explore government-backed loans like FHA loans that are designed to assist people, usually first-time home buyers, with low credit scores. Even so, it's crucial to keep in mind that boosting your credit score is an essential step toward achieving better loan terms and a brighter financial future.

Can I Get a Credit Card with a 503 Credit Score?

If your credit score is 503, getting approved for a standard credit card might be a hurdle. This score hints at past financial adversities or perhaps some irregular money management. It's a tough realization to make but one that's worth acknowledging if you’re serious about turning things around. Realizing the nature of your credit health is the beginning of a journey towards financial recovery, even if it brings about some tough facts.

With a credit score of 503, you might want to consider alternative strategies. Because most traditional cards may be out of reach, looking at secured credit cards could be beneficial. These use a deposit that you make which becomes your credit limit. It's worth noting that this option doesn't offer an immediate fix, but can be instrumental in rebuilding your credit standing over time. Thinking of using a co-signer or investigating pre-paid debit cards are other potential options. Also, remember, any credit you do get is likely to have significantly higher interest rates, as lenders will consider your account high risk. But don't lose hope. Your financial stability is achievable with mindful steps and patience.

With a credit score of 503, obtaining approval for a personal loan from traditional lenders may be challenging. This score is considerably lower than what's typically required to qualify for a conventional loan. Lenders often view a score in this range as high risk, which can limit your borrowing options. However, it's essential not to lose hope while navigating your financial journey. Recognizing your credit standing is the first step towards better financial decisions.

Although it may not be easy to secure a traditional loan with this credit score, there are still other avenues you can explore. One viable option might be a secured loan, which requires collateral as a guarantee. Alternatively, you could consider a co-signed loan, where someone with a stronger credit standing becomes your loan guarantor. Peer-to-peer lending platforms also could be a possibility, as they can sometimes offer loans with more forgiving credit score requirements. But remember, these additional options often come with higher interest rates and less forgiving terms due to the increased risk associated with them.

Can I Get a Car Loan with a 503 Credit Score?

Having a credit score of 503, unfortunately, may make securing a car loan more difficult. It's important to understand that many lenders are often seeking scores over 660 to offer the best terms. A score below 600 usually falls into what's considered the 'subprime' category. Your current score of 503 belongs to this subprime group, leading you to possibly face higher interest rates or even non-approval for a car loan. This is because a lesser score is viewed as a greater risk to lenders, due to the potential problems that could arise with loan repayment.

Nevertheless, don't lose hope. Even with a lower credit score, there are chances to still acquire a car loan. Some lenders specialize in dealing with lower credit scores, but keep in mind these loans could carry substantially higher interest rates. The increase in rates is the lenders' method of protecting their investment against the perceived risk. Even though it might be tougher, it's not impossible to secure a car loan. It just takes careful scrutiny of the loan's terms and some determination on your part to pull off. Never give up on your goal of purchasing a car.

What Factors Most Impact a 503 Credit Score?

Knowing what goes into your credit score of 503 is the first concrete step towards improving it. A few pertinent factors are likely influencing your present score. Understanding them can carve the path towards a better financial future. Let's examine them:

Late Payments

One significant factor that influences your credit score is your payment history. If you have paid bills past due dates or if your payments have been sent to collections, these could heavily impact your score.

How to Check: Scrutinize your credit report to spot any late payments or collection actions. Noting late payment instances will help you prevent them in the future.

Credit Usage Rate

A high credit utilization rate, meaning most of your credit limit is in use, can reflect negatively on your score. Your ideal utilization rate should be 30% or lower.

How to Check: Look over your credit card statements. If your balances are always close to your limits or exceed them, it is affecting your score adversely.

Length of Credit History

Short credit history can also lower your score, as a longer history offers more data about your credit behaviour.

How to Check: Check your credit report to see how long you've had your various credit accounts. Remember, long-standing accounts with good payment records can positively influence your score.

Unresolved Debt

Unresolved debts or issues like bankruptcies or tax liens can put a noticeable dent in your score.

How to Check: Read through your credit report to verify if there are any unresolved debts. Prioritize resolving these issues to better your score.

How Do I Improve my 503 Credit Score?

A credit score of 503 might not look promising, but there’s always room for improvement. Apply the following strategies specially designed for your score range:

1. Making Payment on Time

For your current score, making payments on time is crucial. Late payments have serious impacts on your credit health. Set reminders, or use automatic payments to ensure timely payment of all dues each month.

2. Handle Debt Collections

Your score might be affected by accounts that have gone to collections. Take immediate action by paying them off or negotiating a settlement. Remember to request for a ‘pay-for-delete’ agreement to make sure the paid-off debt is removed from your credit report.

3. Use a Secured Credit Card

A secured credit card could be a good fit for your current credit situation. They usually require a security deposit, acting as your credit limit. Use it wisely – make minor purchases and pay off the total amount every month to gradually boost your payment track record.

4. Creditors Reporting

Ensure each creditor is reporting your activity. Not all lenders report to the credit bureaus. Make sure all your positive efforts are getting counted. If some aren’t, request them to start reporting your payments.

5. Explore a Credit-builder loan

A credit-builder loan can be a good move. These are small, low-interest loans specifically designed to help you build your credit history in a manageable way.

Remember, improving your credit score is a journey. Using these strategies tailored to a credit score of 503, you are already on the right path to reaching your credit potential.