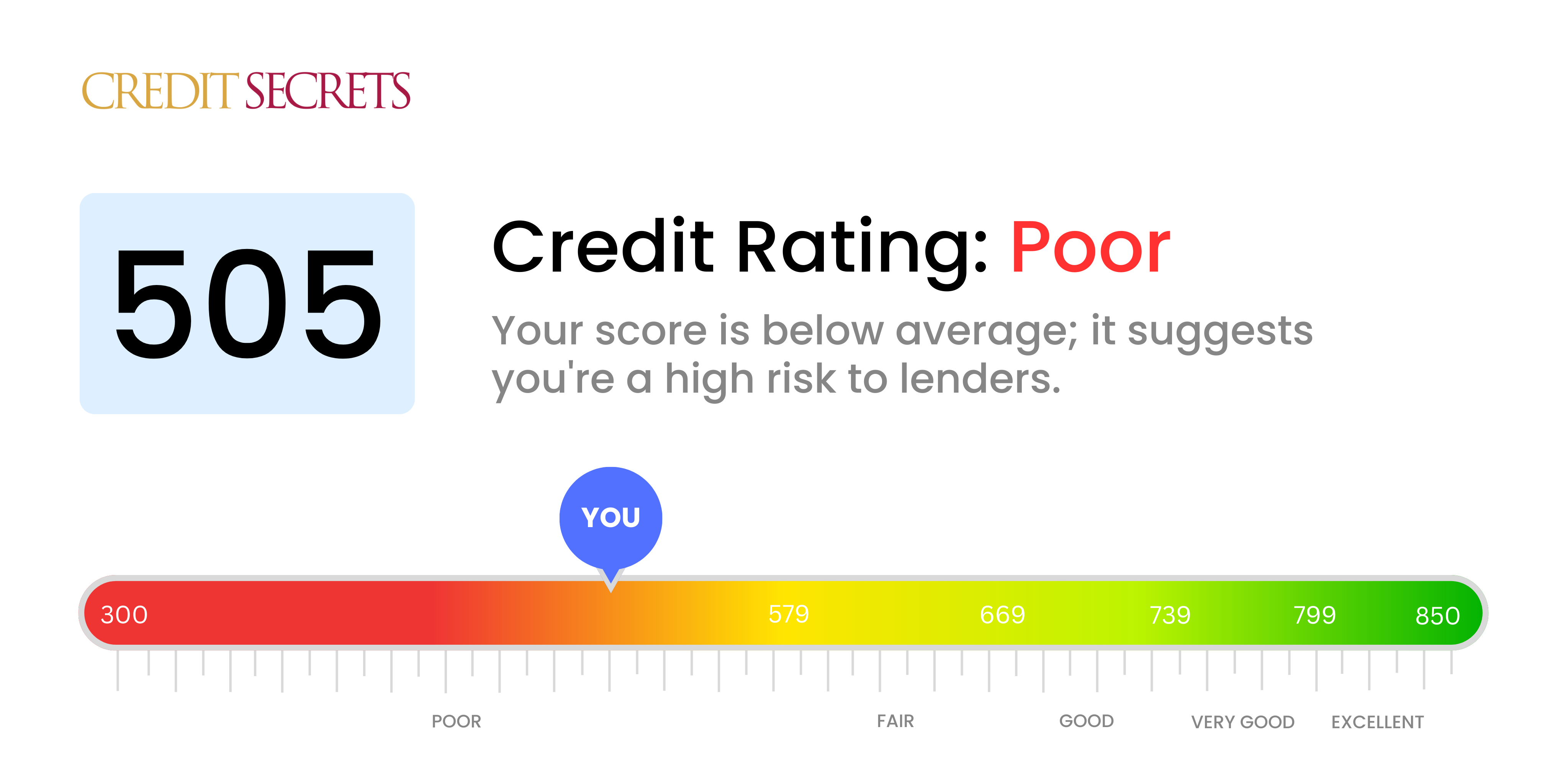

Is 505 a good credit score?

With a credit score of 505, it's clear you're in the "poor" range. This is not an ideal place to be, but it doesn't mean everything is lost, and it's essential to understand that your situation can improve.

Having a poor credit score like 505 can make it challenging to secure loans or credit at favorable rates, and you might face rejections from lenders or higher insurance premiums. Nonetheless, remember - it's just a number, and with time and dedication working towards better financial habits, you can raise this score and open more doors of financial opportunities in the future.

Can I Get a Mortgage with a 505 Credit Score?

Having a credit score of 505 may make it challenging to be approved for a mortgage. This score falls below the preferred range that most lenders seek, often associated with past financial missteps such as late payments or potential defaults.

It's an understandably tough situation, but there's room for improvement. Start by addressing any debts or delinquencies affecting your score adversely. Then seek to foster a history of on-time payments and sensible use of your credit. While this improvement is not instant, consistent effort can gradually enhance your credit health.

If traditional mortgage approval is out of reach now, there are some alternatives to consider. For example, government-insured loans such as Federal Housing Administration (FHA) loans often have more flexible credit score requirements. You may also look into options like rent-to-own programs or seeking a co-signer. Remember, your present credit score is not permanent, and the journey to financial health is within reach.

Can I Get a Credit Card with a 505 Credit Score?

Having a credit score of 505 may seem discouraging when considering credit card applications. It's often viewed as a risky number by lenders, pointing to past financial struggles or management mishaps. While this might seem like a challenging situation, it's essential for getting a grasp on your financial well-being. Understanding your current credit status, even if it's a hard pill to swallow, is a critical step towards a healthier financial future.

Due to the obstacles that a lower score like 505 presents, you might want to consider alternatives such as secured credit cards. A secured credit card requires a deposit that serves as your limit, and these cards can often be obtained more easily and can help improve credit gradually. Other potential options to consider could involve a trusted co-signer, or exploring the use of prepaid debit cards. Keep in mind, these solutions won't provide an instant fix, but they're valuable stepping stones on the path to improving your finances. It's important to remember that interest rates can be higher for individuals with lower scores, reflecting lenders' perceived risks.

Having a credit score of 505 signifies a considerable challenge when it comes to obtaining a personal loan from conventional lenders. Most lenders see this score as a great risk, making loan approval quite difficult. It's not the news you want to hear, but it's vital you recognize what this credit score indicates for your borrowing potential.

While traditional loans might not be feasible, don't lose hope. There are alternatives available. You might consider options such as secured loans, where you provide a safety net in the form of collateral, or co-signed loans, where someone with a higher credit score backs you up. Peer-to-peer lending platforms could also be a path to explore, as they can sometimes be more relaxed about credit scores. However, you should be aware that these loan options generally come with higher interest rates and terms that may not be as friendly, due to the higher risk perceived by the lenders.

Can I Get a Car Loan with a 505 Credit Score?

Having a credit score of 505 might make getting a car loan a little tricky. Lenders usually look for a score of 660 or above, and anything less than 600 is considered subprime. Your 505 score is in this subprime range which could lead to less favorable terms or a loan denial. This is because lenders see a lower score as a higher risk, signifying you might have had past issues paying back borrowed funds.

But don't lose hope, this doesn't mean your journey to car ownership has reached a dead end. Some lenders work specifically with individuals who have lower credit scores. Bear in mind, these loans often come with higher interest rates to counterbalance the lender’s risk. So, while it might be a path filled with challenges and obstacles, with careful planning and understanding of the terms, securing a car loan is not impossible.

What Factors Most Impact a 505 Credit Score?

Payment History

Your payment history can play a major role in a credit score of 505. Late or missed payments might have contributed to your current score. How to Check: Evaluate your credit report for any missed or overdue payments, as they could have contributed to lower score.

Credit Utilization Ratio

Your credit utilization ratio, which shows how much of your available credit you're using, might be high, negatively impacting your score. How to Check: Assess your credit cards' statements. Keeping the balances low compared to the limit can aid in managing your credit score.

Credit History Duration

Lack of an extended credit history may be affecting your score negatively. How to Check: Review your credit report to determine how long you've had each of your accounts. Opening new accounts potentially could have reduced your score.

Type of Credit

It might be your lack of diverse credit types i.e. credit cards, car loans, mortgages or student loans. This mixture builds a robust credit profile. How to Check: Review your credit report to see the types of credits you have. Diversity in credit types can often positively influence scores.

Negative Entries

Items such as collections, foreclosures, or bankruptcies can greatly affect your score. How to Check: Review your credit report for any such entries. Handling negative entries promptly brings you closer to boosting your credit score.

This unique journey might seem challenging, but it's a path paved with opportunities to learn and grow.How Do I Improve my 505 Credit Score?

A 505 credit score is poor, but don’t worry! With the right approach, you can enhance this score. Here are some crucial and feasible steps to achieve this while considering your current situation:

1. Rectify Outstanding Debts

Pending debts always pull your scores down. Begin with settling the oldest debts first, as they gravely affect your credit score. Engage with your lenders to establish a payment plan if necessary.

2. Minimize Credit Card Debts

Strive to decrease your credit card debts to under 30% of your credit limit, with a long-term objective of remaining under 10%. Start paying the cards with the most significant utilization rates at first.

3. Opt for a Secured Credit Card

A secured credit card might be more feasible to obtain with your current score. To get one, you need to deposit cash collateral which defines the credit limit of that account. Use this card responsibly and pay off the balance each month to establish a good payment track record.

4. Seek to Become an Authorized User

Find a trusted individual with a high credit score and request to be an authorized user on their credit card. This helps improve your score as their positive payment history reflects on your credit report. Make certain that the card issuer reports authorized users’ activity to credit bureaus.

5. Explore Different Types of Credit

Keeping a variety of credit accounts can positively affect your score. Once you’ve built a strong payment history with a secured card, explore other types like retail credit cards or credit builder loans and manage them conscientiously.