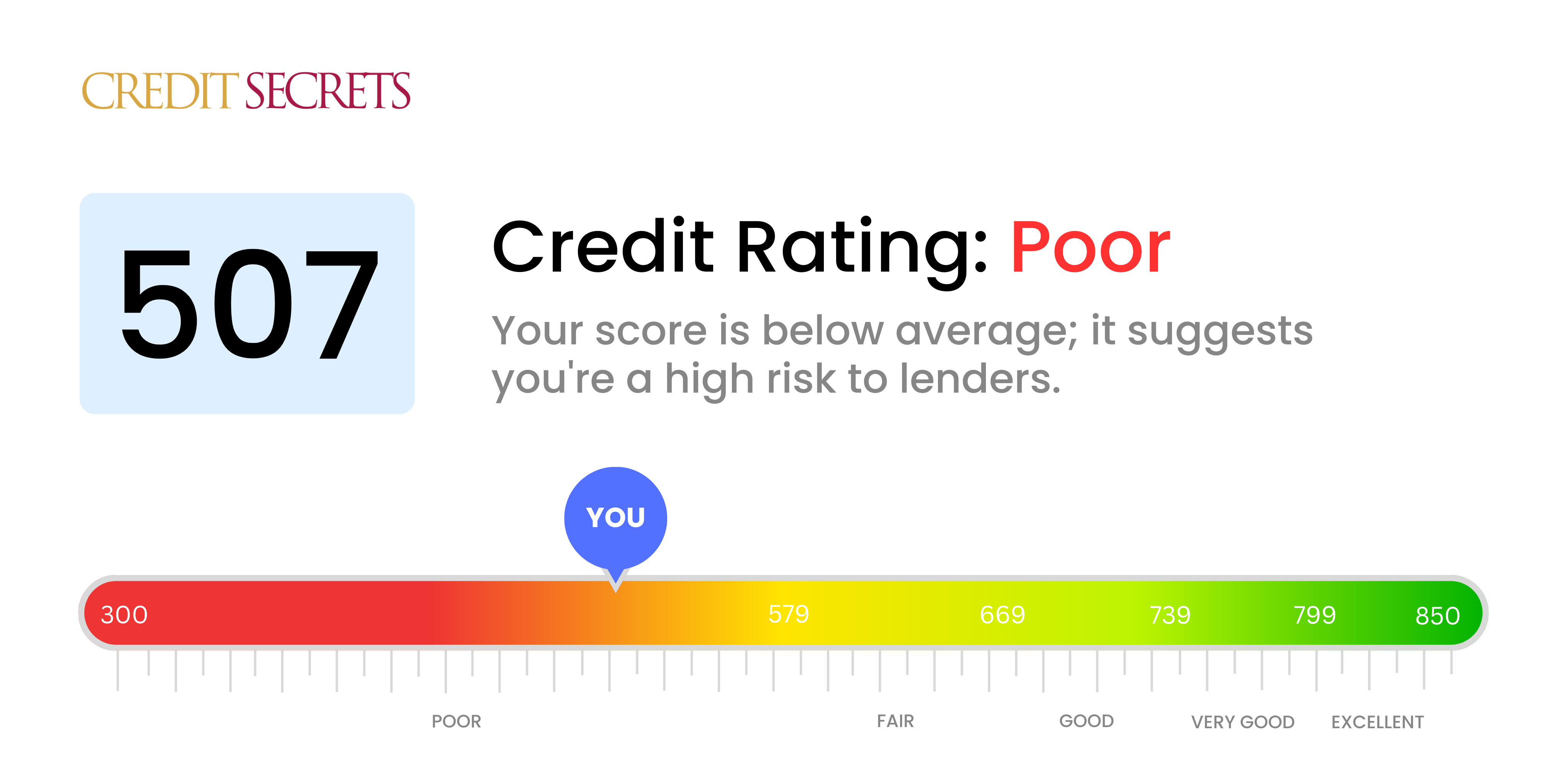

Is 507 a good credit score?

It's important to acknowledge that a credit score of 507 is considered poor. This means you may face difficulties when trying to secure credit such as loans or credit cards due to the potential risk lenders perceive.

However, this doesn't mean hope is lost. On the road to financial stability, a score of 507 is simply a starting point. There are strategic ways this can be improved and Credit Secrets can help to guide you. With patience, dedication and the right mindset, it's entirely possible to increase this score and open up more opportunities for financial freedom.

Can I Get a Mortgage with a 507 Credit Score?

With a credit score of 507, obtaining approval for a mortgage may be especially challenging. A score in this range suggests previous financial difficulty such as missed payments or defaults, and is generally viewed as risky by lenders. Most lenders require a higher score for mortgage approval, as this gives them more assurance you will be able to repay your loan on time.

Don't be disheartened; there are paths you can take. Consider talking directly with lenders about your situation, as some may offer "subprime" mortgages to individuals with lower scores like yours. Be aware, however, that these will likely come with higher interest rates which could potentially increase the overall cost of your home. Government-backed loans like FHA loans can sometimes offer another option, as they often have more flexible credit requirements. Moving forward, it's essential to focus on improving your credit score with a consistent history of timely payments and smart credit usage. Remember, reshaping your credit health can be a gradual process, and every small step brings you closer to your financial goals.

Can I Get a Credit Card with a 507 Credit Score?

A credit score of 507 is considered low and might lead to some challenges when trying to get approved for a traditional credit card. Lenders often see this score as carrying significant risk, possibly due to a history of monetary mismanagement or difficulties. Although this situation may seem overwhelming, it's important to confront it with level-headedness and realism. Remember that acknowledging this current state is a crucial first step towards your financial recovery.

Don't lose hope. Other alternatives exist for people dealing with a lower credit score like yours. You might want to explore secured credit cards, which can be obtained by making a deposit that works as your credit limit. This can assist you in rebuilding your credit gradually. Similarly, applying for a credit card with a co-signer or using prepaid debit cards might also be options worth considering. Keep in mind, interest rates for these credit forms tend to be quite high because of the higher perceived risk from lenders. However, while these aren't immediate solutions, they are a part of the process towards achieving financial solidity.

With a credit score of 507, it's less likely that most traditional lenders would approve a personal loan. This score is quite below the general range accepted by lenders and is often viewed as a high-risk sign. The difficult truth is that a credit score like this may limit your borrowing choices.

While getting a personal loan via conventional means may not be probable, there are other options you may explore. Secured loans, which demand collateral, and co-signed loans, where individuals with better credit scores vouch for you, are possibilities. Peer-to-peer lending is another alternative as they sometimes have less strict credit score requirements. However, do bear in mind that these methods often carry higher interest rates and not as ideal loan terms, owing to the increased risk to the lender.

Can I Get a Car Loan with a 507 Credit Score?

If you have a credit score of 507, it could be quite challenging to get approval for a car loan. Most lenders prefer to see credit scores over 660, and anything below 600 is usually categorized as subprime. Your score of 507 means you fall into this subprime group, which could lead to encountering higher interest rates or even being declined for a loan. The reason for this is that a low credit score is seen as a greater risk to lenders, with the likelihood of having trouble repaying loans.

However, don't lose hope. Despite the potential difficulties, your car ownership dreams are not impossible. There are lenders who are willing to work with individuals who have lower credit scores. But remember, these loans may come with much higher interest rates due to the risk lenders are willing to take. Make sure to weigh your options carefully and fully understand the loan terms before making a decision. Despite a bumpy journey, securing a car loan with a low credit score is not beyond reach.

What Factors Most Impact a 507 Credit Score?

Navigating a credit score of 507 may seem daunting, but with a clear understanding of the main contributing factors, you can start your journey towards improved financial health.

Past Due Accounts

A significant impact on your credit score comes from past due accounts. The presence of unpaid or overdue debts could be influencing your score heavily.

How to Check: Refer to your credit report and identify any past due accounts. Determine if any unpaid debt is dragging down your score.

Credit Utilization

Excessive credit utilization often leads to a low score. If you're using a large amount of your available credit, this may be negatively influencing your score.

How to Check: Review your credit card balance in relation to the total limit. A high balance could be an indicator of excessive utilization.

Recent Credit Inquiries

Multiple recent applications for credit can lower your score, as each inquiry is factored in. If you've applied for multiple lines of credit in a short amount of time, this might be a factor in your current score status.

How to Check: Look at your credit report for any recent credit inquiries. If there have been many in a short time, this could be impacting your score.

Collection Accounts

Having debt in collections can significantly hurt your score. If you do, resolving these can help boost your score.

How to Check: Review your credit report for any accounts passed on to collections. Prioritize paying off these debts to improve your score.

How Do I Improve my 507 Credit Score?

With a credit score of 507, you’re on the lower end of the spectrum, but no need to fret – rejuvenating your credit score is well within your grasp. Let’s look at a plan of approach specifically related to your current score:

1. Addressing Existing Collections

At a score of 507, it’s possible you might have accounts in collections. It’s crucial that these are addressed first. Clearing dues on collections can give a significant boost to your credit score. Initiate conversation with your collectors and chalk out a feasible repayment plan.

2. Considerations for Current Debts

Keeping your account balances low relative to available credit is a surefire way of elevating your credit score. Paying down on your current debts, especially credit cards, to maintain a utilization rate under 30% is extremely beneficial.

3. Apply for a Secured Credit Card

Secured credit cards can be a great credit rebuilding tool, specifically for scores like yours. These require a refundable deposit, which limits your risk yet allows you to build a consistent payment history gradually.

4. Make Timely Payments

Your payment history takes up a significant portion of your credit score. Ensuring all your future payments on credits are made on time can increase your credit score considerably.

5. Minimize Credit Inquiries

Each time a lender checks your credit, your score likely suffers slightly. While you’re working on rebuilding your credit, avoid accruing any more “hard” inquiries by only applying for credit when urgently needed.