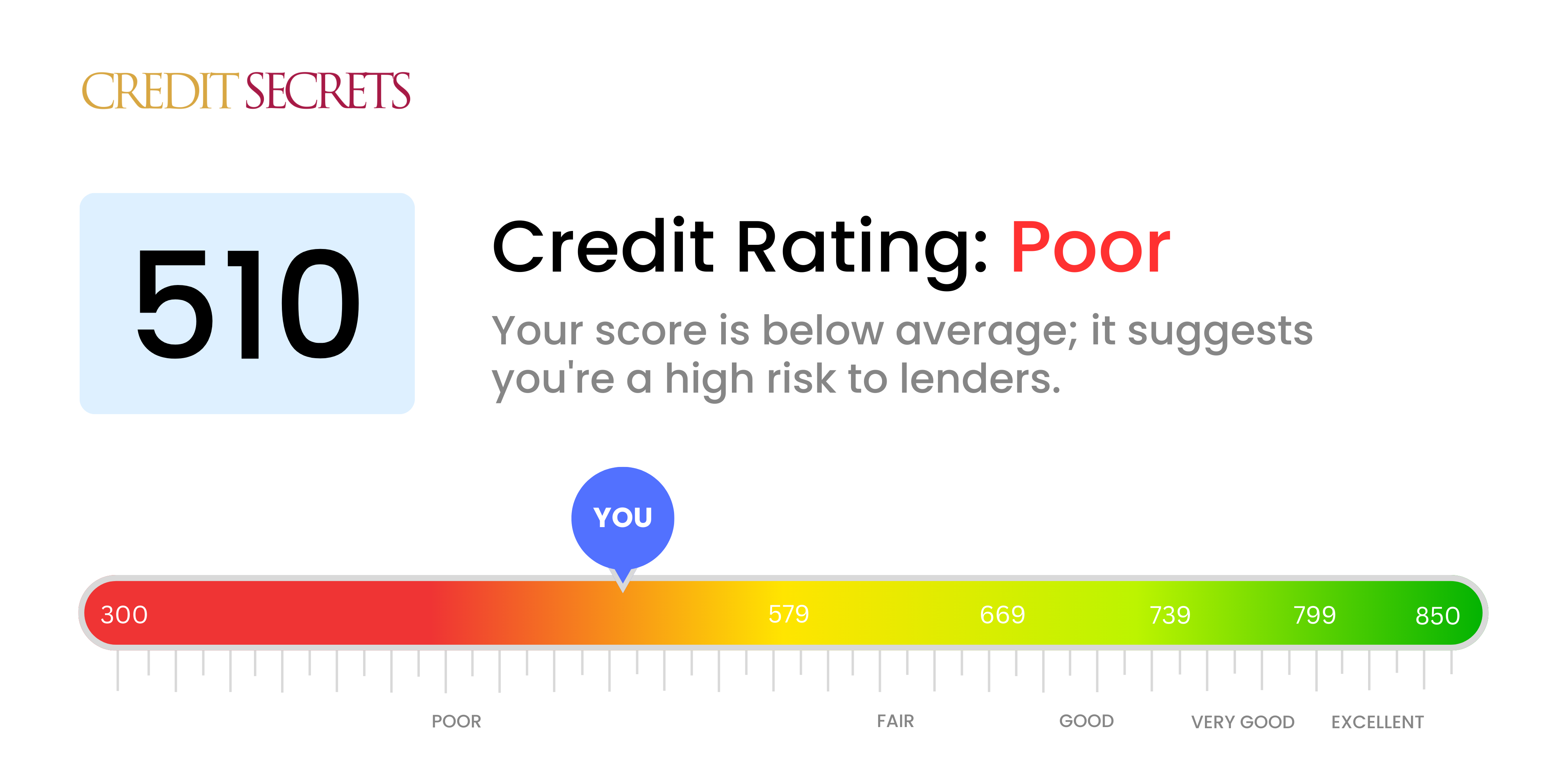

Is 510 a good credit score?

A credit score of 510 falls within the 'Poor' category, indicating it's not considered a good credit score. Understandably, this may lead to difficulties when applying for loans or credit, as lenders may see a higher risk of not getting paid back - but it's not the end of the world.

There is much room for improvement, and many who have found themselves in this situation have successfully improved their scores. It's crucial to start taking steps towards rectifying the situation, such as reviewing your credit reports for errors, paying bills on time, and reducing high balances. Your journey towards a healthier financial future can begin today, and every little step brings you closer to achieving it.

Can I Get a Mortgage with a 510 Credit Score?

With a credit score of 510, it's unlikely that a mortgage approval will be forthcoming. This score is considerably lower than what lenders usually look for, indicating potential past struggles with financial commitments such as late payments or defaults. Having a low credit score can make securing any form of credit more challenging and typically leads to higher interest rates if approved.

Though this might feel like a setback, it presents an opportunity for positive change. There are alternatives available for individuals in your situation. Consider researching government-backed loans, such as FHA loans, which are designed for those with lower credit scores. Alternatively, you may want to explore private lenders who may be more flexible with their lending criteria. However, keep in mind these options could carry higher interest rates. The road towards improving your credit might seem long, but every step you take brings you closer to your financial goals. Remember, it's a marathon, not a sprint, and every small victory counts.

Can I Get a Credit Card with a 510 Credit Score?

With a credit score of 510, it's not likely that traditional credit card approval will be on the cards. This score can be seen as risky by lenders, possibly a sign of past financial struggles or mishandling. Knowing this may be tough, but it's necessary to recognize and confront the realities of your financial situation. Understanding your credit status is an important part of starting your journey towards financial improvement.

Considering alternatives like a secured credit card, which requires a refundable deposit, could be beneficial. These cards can be easier to obtain and can help rebuild your credit over time. Finding someone to act as a co-signer or opting for a prepaid debit card could also be options worth exploring. While they won't fix everything instantly, these can be good steps towards rebuilding your credit. Remember, any form of credit likely to be available will carry higher interest rates due to your lower score, but with responsible use, it's possible to improve your financial outlook in the future.

With a credit score of 510, it may be challenging to secure a personal loan from traditional lenders. This score is lower than what's typically considered by most financial institutions, who see it as a high-risk scenario. It's a tough situation, but it's crucial to recognize the realities of navigating the world of borrowing with this level of credit.

While traditional loans may be difficult to procure, there are alternatives that you could explore. Secured loans, wherein you provide an asset as collateral, or co-signed loans, where a person with a stronger credit stands as your guarantor, may be options to consider. Moreover, Peer-to-peer lending platforms are known to have somewhat relaxed credit requirements compared to standard banks. However, keep in mind that these alternatives may carry higher interest rates and less-advantageous terms due to the increased risk perceived by the lender.

Can I Get a Car Loan with a 510 Credit Score?

Carving the road to your financial dreams can indeed be tough, especially with a credit score of 510. Most lenders prefer a credit score above 660. Anything below 600 is typically categorized as subprime, putting your score of 510 in this tier. The consequence of this could be steep interest rates, or in some cases, outright denial. All of this is rooted in the perception that a low credit score reveals greater risk to the lenders. From their perspective, your history may imply potential challenges with paying back the borrowed money.

No need to park your dreams just yet. Even with a lower credit score like yours, some loan options may still exist. Certain lenders offer solutions tailored specifically to people with lower credit scores. But, it's crucial to tread carefully, as these loans often come with considerably high interest rates. They reflect the risk lenders incur, acting as a buffer to protect their investment. Despite the hurdles, with meticulous review and full understanding of the loan terms, the possibility of securing a car loan can be realized.

What Factors Most Impact a 510 Credit Score?

To propel your credit score of 510 toward improvement, acknowledge the elements that brought you here. This understanding can help set the course towards an upgraded financial future. Remember, progress takes time, but every small step counts in this personalized journey.

Payment Habits

Diligent payments are crucial. Late payments and defaults could be the major players behind your score.

Your Action: Look into your credit report for any delayed payments or defaults. Consider any circumstances that might have led to late payments as these can heavily impact your score.

Credit Spending

Excess credit utilization can pull down your score. High balances on your credit cards could be an integral factor here.

Your Action: Scrutinise your credit card bills. Are you brushing against the spending limits? Maintaining a balance well below the limit can be beneficial.

Credit History Span

A shorter credit history can potentially leave a dent in your score.

Your Action: Study your credit report to gauge the lifespan of your oldest and most recent accounts and the average age of all your accounts. Think about if you have inaugurated any new accounts of late.

Varied Credit and Recent Credit

Having a mixed bag of credit types and handling new credit prudently play key roles in a good score.

Your Action: Consider the diversity of your credit accounts, including credit cards, installment loans, and mortgage loans. Be mindful of applying for new credits only when required.

Public Records

Public records such as bankruptcies or tax liens can significantly alter your score.

Your Action: Check your credit report for any public records. Make sure to resolve any pending issues listed.

How Do I Improve my 510 Credit Score?

With a credit score of 510, you’re residing in “poor” credit territory. However, by honing in on some specific efforts, you can start to elevate that number. Here are some practical steps tailored for you:

1. Prioritize Outstanding Balances

Investigate your credit report carefully and identify any past due accounts. These must be tackled immediately because their impact is the most pernicious on your score. If you’re unable to fully pay off the balances, negotiate a manageable payment scheme with your creditors.

2. Minimize Credit Card Debt

High credit card balances suppress your credit score; aim to get them below 30% of your limit, ideally even below 10%. Concentrate your efforts on cards with the highest debt ratios.

3. Consider a Secured Credit Card

Your current score could make obtaining a typical credit card tough. However, a secured credit card, which uses a cash deposit as its limit, is within reach. By making small purchases and fully paying them off monthly, you can start building a positive credit history.

4. Leverage Trusted Relationships

If there’s a trusted friend or relative with great credit, ask them to add you as an authorized user on one of their credit cards. This strategy can aid your credit score by blending their positive history into your report. Just confirm the card issuer will report to the credit bureaus.

5. Broaden Your Credit Types

Once a good historical track record exists with your secured card, try branching out into different forms of credit like credit builder loans or retail cards. Assure they are responsibly managed.