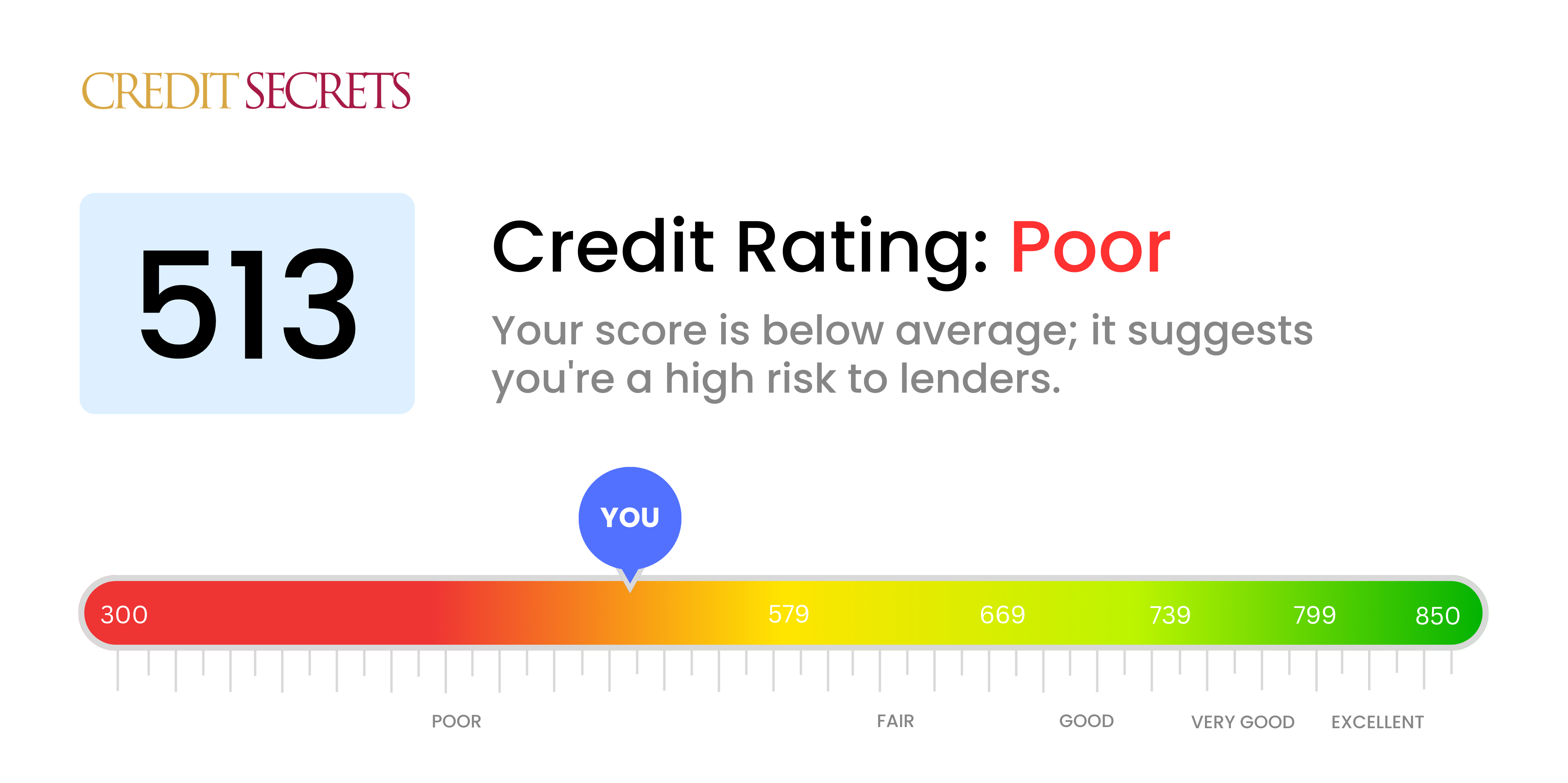

Is 513 a good credit score?

With a credit score of 513, you're currently sitting in the 'Poor' credit range. This means that lenders and financial institutions may consider you a somewhat risky borrower, and as a result, you may face difficulties securing loans or credit at favorable interest rates. However, this isn't the end of the road. It's absolutely possible to improve this score and move towards better financial opportunities in the future. A consistent pattern of responsible financial behavior, like timely payment of bills and reducing your debt, can positively contribute to your credit health.

Can I Get a Mortgage with a 513 Credit Score?

Holding a credit score of 513 may present significant challenges when attempting to secure a mortgage. This score clearly falls below the threshold that most lenders require for such significant lending, reflecting issues such as late payments or other financial difficulties in your history. Unfortunately, this makes it less likely that your mortgage application will be successful.

However, it is important to remember that this isn't a permanent situation. You have the power to influence your credit score. Simple actions like focusing on making all of your payments on time, addressing any outstanding balances, and exercising careful management of your financial commitments can, over time, help to elevate your credit score. There are also alternative lending options like credit unions or federally backed loans that may have more flexible credit requirements. Ultimately, while a score of 513 is a challenging place to be, with diligent effort, it's possible to improve your financial position. Interest rates are typically higher with lower credit scores, but each improvement in your score brings you one step closer to more favorable terms.

Can I Get a Credit Card with a 513 Credit Score?

Should you be carrying a credit score of 513, the odds of gaining approval for a standard credit card might be rather slim. Holding a score in this range suggests to lenders the presence of some past financial setbacks or challenges. It's critical to face these situations with a sense of realism and understanding, recognizing the state of your credit as the first stride towards financial recovery.

With such a score, alternatives like a secured credit card might be worth considering. This sort of card necessitates a deposit that serves as your credit limit, and is typically simpler to acquire, assisting you in rebuilding your credit over time. Contemplating a co-signer or pre-paid debit cards may also be suitable alternatives. Although these options won't offer an immediate fix, they're instrumental steps on your path to financial equilibrium. One important detail to keep in mind is that any form of credit that may be available to you carrying such a score will likely come with fairly high interest rates, mirroring the greater risk perceived by lenders.

Unfortunately, a credit score of 513 is considered quite low by the majority of lenders. This score suggests there's substantial risk involved for the lender and, as a result, you may find it challenging to secure a personal loan. Having a lower credit score can be a frustrating obstacle, but acknowledging it is the first step in addressing your personal financial situation.

While obtaining a conventional personal loan may not be feasible at this stage, there are alternative options available to consider. Secured loans, co-signed loans, or peer-to-peer lending platforms might be viable, albeit these typically have higher interest rates and less favorable terms due to the increased risk involved for the lender. Always remember that while these are alternatives, they should be approached with a clear understanding of the potential risks and higher costs involved.

Can I Get a Car Loan with a 513 Credit Score?

Having a credit score of 513 is likely to make securing a car loan quite challenging. Most lenders prefer a score of 660 or above to confidently offer their best terms. By falling under 600, the score of 513 is typically viewed as subprime by lenders. This lower credit range suggests to lenders a higher probability of repayment issues, potentially leading to less favorable interest rates or even an outright denial of the loan.

Not all hope is lost though. Even with a credit score of 513, there are lending options out there. There are certain lenders who focus on aiding those with lower credit scores, however, these usually come with higher interest rates. These increased rates are due to the higher risk these loan providers perceive they are assuming. So, despite a bumpier road ahead, securing a car loan is not totally impossible. With careful scrutiny of loan details and settlement terms, it's still feasible to turn your car ownership dream into reality.

What Factors Most Impact a 513 Credit Score?

Understanding Your 513 Credit Score

Having an insight into what constitutes your credit score of 513 would be a significant step on the path to improving your financial status. It's important to comprehend the factors that have influenced your current score.

Payment Track Record

On-time payments have a profound impact on your credit score. Potential late payments could likely be a primary reason behind your current score.

How to Check: Look into your credit report for any history of delayed payments, as they could be the source of your credit score.

Credit Card Utilization

A higher credit card usage may bring down your credit score. If your credit card balances are approaching the limit, this could be a contributing aspect.

How to Check: Review your credit card bills. Are you using most of your credit limit? Try to maintain usage significantly below the limit for a healthier score.

Short Credit History

A new or short credit history can pull your credit score down.

How to Check: Inspect your credit report for the age of your oldest, newest, and the average age of all your accounts. Have you been opening new accounts recently?

Credit Mix & New Credit Applications

Maintaining a good mix of credit and not over-applying for new credit is crucial for an improved score.

How to Check: Scrutinize your mix of credit accounts, like credit cards, retail accounts, and installment loans. Have you been prudent in applying for new credit?

Public Records

Public records like bankruptcies could have a severe impact on your score.

How to Check: Examine your credit report for any public records. Deal with any items listed earnestly.

How Do I Improve my 513 Credit Score?

With a credit score of 513, classified as poor, there’s ample room for improvement. There are certain strategic measures which can be taken specific to your situation:

1. Address Overdue Payments

With any noticeable overdue payments on accounts, getting them up to date should be on top of your to-do list. Remember, the most overdue ones hold the deepest impact on your credit score. Get in touch with creditors to negotiate a feasible payment structure as needed. This could help you come up with a viable plan.

2. Lower Outstanding Credit Card Debt

The ratio of credit card debt to your credit limit plays a profound role in determining your score. Aim to bring down your debt to less than 30% of your credit limit. Achieving less than 10% in the longer run should be your ultimate goal. Consider paying off the card with maximum usage rate first.

3. Explore a Secured Credit Card

A regular credit card may be challenging to get at this score. You might want to consider secured credit card which commands a cash collateral deposit equaling the credit limit. Use it cautiously, pay off on time each month, and build a healthy payment record.

4. Possibility of Becoming an Authorized User

Talk to a trusted friend or family member with a strong credit candidate for you becoming an authorized user on their card. This could enhance your credit score by direct inclusion of their payment history. Make sure the issuer reports the transactions of authorized users to the agencies.

5. Mix It Up

A diverse blend of credit accounts can enhance your credit score positively. Having a good track record with a secured card, explore other forms of credit like a retail card or a credit builder loan and handle responsibly.