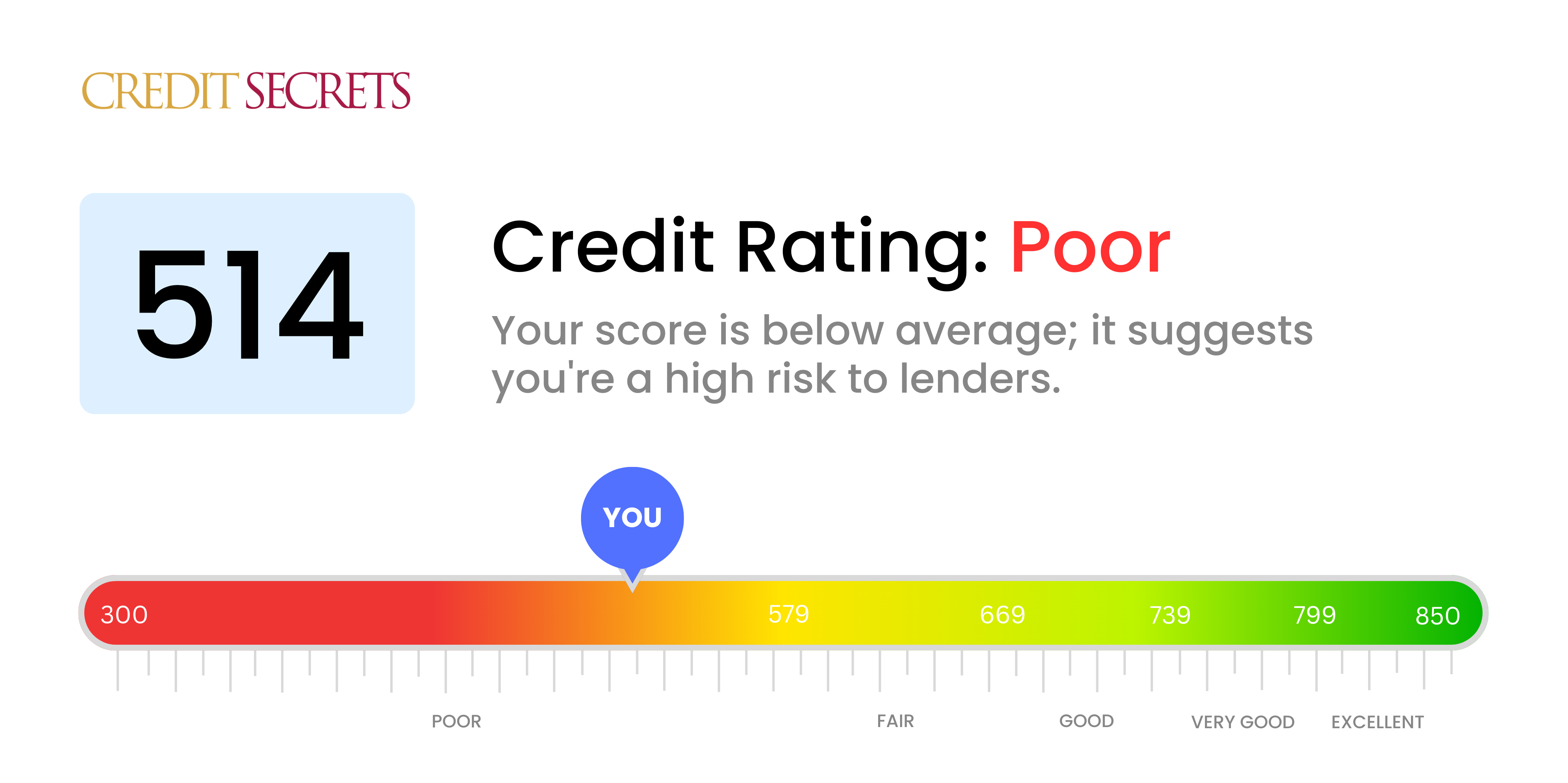

Is 514 a good credit score?

Your credit score of 514 falls into the 'poor' category. This means you may experience challenges in getting approved for credit products like personal loans or credit cards, and if you do get approved, you may likely have to pay high interest rates and fees.

But remember, this is not a life sentence. With discipline, responsible financial behaviour, and time, you can improve your score and march towards financial stability. Our Credit Secrets program can be your guide on this journey, empowering you with strategies and actionable insights that can help elevating your credit standing.

Can I Get a Mortgage with a 514 Credit Score?

With a credit score of 514, it's unlikely that you'll qualify for a mortgage. This score falls below the threshold many lenders typically require, indicating a history of financial difficulty such as missed payments or defaults. It's a tough situation to be in, but it's not without hope.

It's crucial to understand why your score is low. Perhaps there are delinquent debts or unpaid bills subsequently hurting your score. Identifying and addressing these issues is key. Additionally, adopting responsible credit habits, like making all payments on time and not maxing out your credit cards, can start to improve your score over time. Unlike a quick fix, rebuilding your credit is a process that requires patience and consistency. However, tackling your credit challenges head-on now can lead to better opportunities, such as mortgage approval, in the future.

Can I Get a Credit Card with a 514 Credit Score?

Having a credit score of 514 can make it tough to get approved for a standard credit card. This score often signifies to lenders that there's been financial difficulty in the past, making lending more of a risk. While this might be a hard pill to swallow, acknowledging and understanding the situation is a significant stride towards financial recovery.

The road might be rocky, but there are alternative routes to consider. Secured credit cards are an option – these require a deposit matching your credit limit, making approval much more likely. Co-signing a card with someone you trust, or opting for pre-paid cards could also work in this situation. While these methods don't offer an immediate fix, they're a stepping stone towards building credit gradually. One important thing to remember is that any credit extended during this period will likely come with higher interest rates, indicating the greater risk lenders are taking.

Your credit score of 514 signals a higher level of risk to lenders, so obtaining a traditional personal loan may prove challenging. This score, although substantial, falls below the usual acceptable range most lenders look for. It's an undesirable situation, but recognizing what this score implies about your borrowing power is vital.

With standard loans likely inaccessible, you might explore other options. Secured loans, where collateral is offered, are one alternative. Another option is a co-signed loan, where an individual with a good credit record backs your application. Peer-to-peer lending represents another possible solution, as these platforms sometimes have more flexible credit criteria. However, these alternatives oftentimes come with a higher interest rate and less generous terms due to the lender's increased risk. It's extremely important to understand these potential drawbacks.

Can I Get a Car Loan with a 514 Credit Score?

With a credit score of 514, getting approved for a car loan may not be as seamless as you might hope. A score in this range might cause some challenges in the car loan process. Most lenders usually look for scores that are 660 and above which are on par with better terms, while anything below 600 is generally viewed as subprime. Your 514 score is nestled within this subprime group which could indicate high-risk to lenders because past patterns could suggest possible difficulties in paying back loans.

Nevertheless, this score doesn't completely rule out the possibility of receiving a car loan. There are certain lenders who have specialized programs designed specifically for those going through similar situations. But it's crucial to be aware that these types of loans will likely come with much higher interest rates due to the increased risk perceived by the lender. So although it may be a bit more challenging, don't lose heart. With thoughtfulness, understanding of the terms, and diligent research, securing a car loan can still be a realistic goal.

What Factors Most Impact a 514 Credit Score?

Having a clear understanding of a 514 credit score is integral to formulating an effective plan for financial growth. Recognizing and dealing with the elements causing this present score can set you on the right path toward a more robust financial future. Remember, each financial journey is distinguished; it offers unique opportunities for growth and learning.

On-Time Payments

Consistent, on-time payments profoundly affect your credit score. If there are cases of missed or defaulted payments, this may be a significant reason for your score.

How to Check: Closely inspect your credit report for any missed or defaulted payments. Recall any cases where payments were not made on time, these instances might have reduced your score.

Amount of Available Credit Used

Using a large amount of your available credit can harm your score. If your credit card balances are close to your credit limits, this could be one reason for your score.

How to Check: Look through your credit card statements. Are you using most of your available credit? Keeping balances low compared to available credit can help enhance your score.

Duration of Credit History

A short credit history can have a negative impact on your score.

How to Check: Survey your credit report to check the age of your oldest and newest credit accounts along with the average age of all your accounts. Contemplate if you have been establishing new accounts lately.

Range and Freshness of Credit

Having different types of credit and properly managing new credit is crucial for a strong credit score.

How to Check: Assess your variety of credit accounts, which can refer to credit cards, retail accounts, loan installments, and home loans. Reflect if you've been sparingly applying for more credit.

Public Records

Public records such as bankruptcies or tax liens can greatly harm your score.

How to Check: Review your credit report for any public records. Consider any listed items that may require resolution.

How Do I Improve my 514 Credit Score?

With a credit score of 514, there’s room for growth, but it’s entirely manageable. The following strategies are specially tailored for your current credit score range:

1. Make Timely Payments

Your top priority should be to ensure that all your bills are paid on time. Late or missed payments can seriously diminish your credit score. If you struggle with maintaining a schedule, consider setting up auto-pay or reminders to prevent any forgotten payments.

2. Tackle High Interest Debts

Commit to paying off debts with the highest interest rates. These bleeds your resources over time, making it more challenging to pay off other debts. Allocating more of your budget to these debts would significantly reduce your credit usage and improve your credit score over time.

3. Obtaining a Secured Credit Card

In consideration of your current score, a secured credit card might be more attainable. It requires a cash deposit that then acts as your credit limit. Regularly using and paying off your secured card helps build a reliable payment history, which can boost your credit score.

4. Request Credit Limit Increase

Requesting a credit limit increase on your existing cards can improve your credit-utilization ratio, as long as you don’t increase your spending. It’s beneficial if you maintain low card balances and make timely payments.

5. Check Your Credit Reports Regularly

Aim to regularly check your credit reports for any errors or inaccuracies. Disputing any misunderstandings or incorrect information can give your score an immediate lift. Contact the credit reporting bureau and the reporting company in question to rectify any doubtful entries.