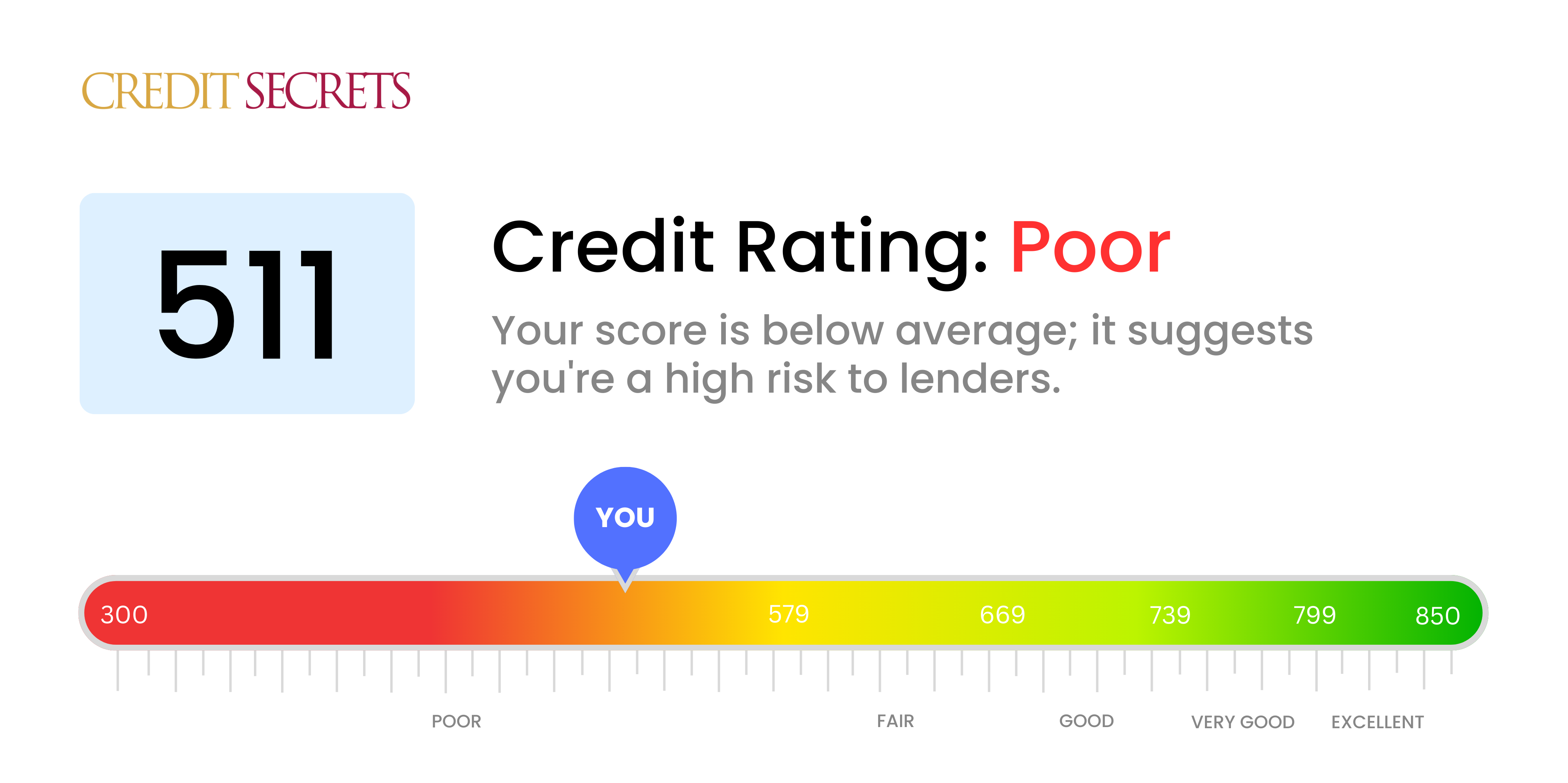

Is 511 a good credit score?

A credit score of 511 is considered to be in the 'Poor' range. This means that you may potentially face issues when trying to secure credit, loans, or other financial services, as lenders may see you as a higher risk due to your credit score. However, there are steps you can take to improve your score, and it's important to remember that a credit score is not a reflection of your worth, but a tool lenders use to determine creditworthiness.

Expect that interest rates offered to you may be higher than those with 'Good' or 'Excellent' credit scores. You may also find it more challenging to get approved for credit cards or loans, and if you are approved, you might have lower spending limits. However, there are still financial opportunities available, and remember, you do have the power to improve that credit score over time.

Can I Get a Mortgage with a 511 Credit Score?

With a credit score of 511, it is unlikely you'll be approved for a mortgage. Lenders typically seek scores much higher than this, as your score is a reflection of your financial responsibility. A score of 511 suggests there may have been some financial setbacks in your past, like late payments or defaults.

Although this situation may feel discouraging, you are not out of options. It's possible to turn your credit score around, unlocking new financial opportunities. An important initial step is to clear any existing unpaid debts. Secondly, establishing a consistent history of on-time payments can have a positive impact on your score. Additionally, some non-traditional mortgage lenders may consider factors beyond your credit score, such as your income and employment history, when determining your eligibility for a mortgage loan. This is a challenging journey, but rest assured, with diligent efforts, you can improve your financial standing. And remember, the road to a higher credit score and better financial health is a marathon, not a sprint.

Can I Get a Credit Card with a 511 Credit Score?

It's essential to treat your credit score of 511 seriously, as lenders see this score and associate it with a high level of risk. With a score like this, approval for conventional credit cards could prove difficult or even unattainable. This might be a tough pill to swallow, but it's necessary to understand your financial reality to move forward. Accepting this can help you to develop your plans for financial recovery.

However, don't despair, there are other options you may consider. One of which is a secured credit card; secured cards require an upfront deposit that serves as your credit limit. This could be a manageable way to gradually rebuild credit. You might also want to think about getting a co-signer or a pre-paid debit card. However, be aware that the interest rates associated with credit access for those with a low credit score may potentially be higher due to increased risk. While these alternatives don’t solve credit issues instantly, they do pave the way for future financial improvement.

With a credit score of 511, it may be difficult to qualify for a personal loan through conventional lenders. This score is seen as risky in the banking world, and it can lead to loan applications being rejected. It's a tough situation, but it's crucial to understand what this score means for your potential to secure financing.

Although traditional personal loans may be out of reach, there are still other options you might want to explore. Secured loans or co-signed loans could be possibilities. With secured loans, you use collateral (like a car or home) to back the loan. For co-signed loans, a person with a better credit rating signs on to your loan, and agrees to repay it if you can't. Additionally, lending platforms that connect individual borrowers and investors might be more lenient regarding your credit score. Keep in mind, however, that these options usually have higher interest rates and less favorable conditions, due to the riskiness for the lender.

Can I Get a Car Loan with a 511 Credit Score?

With a credit score of 511, it's going be a bit tough getting approval for a car loan. Many lenders prefer a score of at least 660, as it's more assuring and demonstrates less risk. Anything below 600, like your 511 score, is usually viewed as subprime, making lenders more hesitant. This score indicates to them that there might be potential hurdles in managing and reimbursing any borrowed money.

Yet, this doesn't mean it's the end of the road for your car buying journey. Specialized lenders do exist who are willing to work with lower credit scores. But remember, this does come with its own set of challenges often including steeper interest rates. This is because lenders see it as a form of safeguarding their investment given the perceived risk. With caution, an understanding of the loan terms, and a bit of determination, securing a car loan, though difficult, is still a possibility.

What Factors Most Impact a 511 Credit Score?

Interpreting a credit score of 511 is an important component of your financial growth. Exploring the variables that culminated in this score assists you in crafting a robust financial plan. Each financial story is personal, representing room for development and enlightenment.

Track Record of Payments

Your payment history is a fundamental pillar of your credit score. Late payments or defaults may be factors lowering your score.

Method of Checking: Meticulously inspect your credit report for any indicators of late or missed payments. Any past missteps could still be affecting your score.

Credit Utilization

Maintaining high credit utilization can negatively impact your credit score. Maxed-out credit cards could be a primary contributor here.

Method of Checking: Assess your credit card statements. Are you operating close to your credit limit? Striving to keep balances low relative to your limit can help improve your score.

Credit History Duration

A less established credit history can negatively affect your score.

Method of Checking: Analyze your credit report for the longevity of your credit, your newest and oldest accounts, and the average age of all your accounts. Reflect on any recent accounts you've opened.

Mix and Management of Credit

Operating a diverse range of credit types and taking care of new credit responsibly are integral for maintaining a strong credit score.

Method of Checking: Consider your distribution of credit types - credit cards, retail accounts, installment loans, mortgages. Contemplate your approach to new credit application.

Public Records

Public records including bankruptcies or tax liens can substantially hinder your credit score.

Method of Checking: Explore your credit report for any public records. Ensure to settle any outstanding matters that might negatively influence your score.

How Do I Improve my 511 Credit Score?

A credit score of 511 is seen as below average, but with specific steps, turning it around is not out of reach. Here are some efficient and feasible strategies you can adopt at this credit score range:

1. Settle Debt Collections

If any of your accounts are in debt collections, settling them swiftly should be your upfront prioritized action. Neglecting them can massively impede your credit score. Liaise with debt collection agencies, if possible, find amicable terms to settle the debts and have them remove the collection account from your credit reports.

2. Pay Your Bills on Time

Your payment history is a large factor in your credit score. Be sure to pay all your monthly bills promptly, not just credit cards, but utilities, rent, and car payments as well. Consistently on-time payments will steadily boost your credit score.

3. Apply for a Credit-Builder Loan

Obtaining a traditional credit card might be challenging with your current score. Think about a credit-builder loan. These are small loans that are held in a secured savings account while you make payments. This builds credit history and allows you to save money at the same time.

4. Limit Credit Inquiries

Continually applying for new credit can bring down your score by adding hard inquiries to your credit report. In your current situation, limit credit inquiries to essential applications.

5. Check Your Credit Reports Regularly

Regularly monitoring your credit reports helps you track your progress, and spot and dispute any inaccuracies processed in them which might be lowering your score. You are entitled to a free annual report from each of the three major credit bureaus.