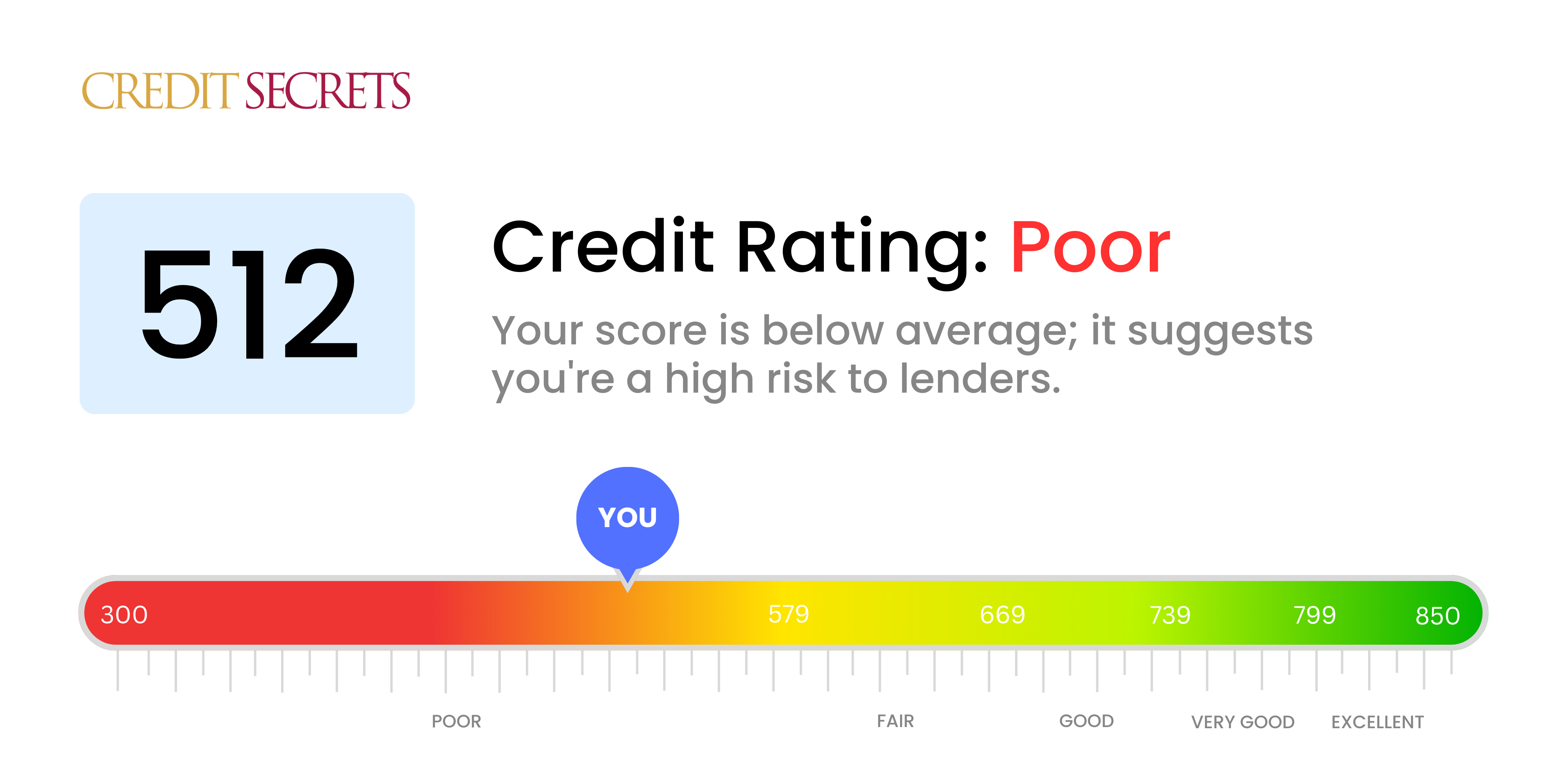

Is 512 a good credit score?

Unfortunately, a credit score of 512 falls into the poor range and it's not considered as a good credit score. With a score like this, it might be challenging to get approved for loans or credit cards, and if you do get approved, the interest rates are often higher.

Don't lose hope, though. While it may take some time, improvement is absolutely possible and taking the right steps can help rebuild your credit history and improve your score. Credit Secrets is here to guide you every step of the way towards achieving a better financial future.

Can I Get a Mortgage with a 512 Credit Score?

A credit score of 512 is below the threshold typically sought by lenders to approve a mortgage. This score highlights a series of financial challenges, including late payments or possibly even financial default. It's quite unlikely that you'll be successful in securing a mortgage with this score, but remember, it's not an insurmountable obstacle, but rather, a hurdle you need to cross.

However, there's no need to lose hope. Instead of dwelling on the low score, consider it as an opportunity to learn and improve. There are credit improvement programs like 'Credit Secrets' that could guide you on this path. You could also explore alternative housing arrangements or loan types that cater specifically to individuals in your situation. Some choose smaller, alternative home loans or opt to lease while working on their credit health. Moreover, addressing any outstanding debts on time and ensuring careful credit use can slowly improve your score. This journey may take time, but each step you take brings you closer to achieving your financial goals.

Can I Get a Credit Card with a 512 Credit Score?

With a credit score of 512, getting approved for a regular credit card could be difficult. This score is considered below average and may indicate some past financial troubles. It's important to face this reality head on and know that it's a step towards bettering your financial health. Although it's tough news to digest, it's essential to recognize where you stand and how you can move forward.

One possible alternative when dealing with a lower score like this could be a secured credit card. These require a deposit which then becomes your credit limit. Another option is to consider finding a co-signer. Or, check out prepaid debit cards as a way to manage finances. While these aren't immediate solutions, they're constructive steps towards improving credit health. Bear in mind, however, that the interest rates for any credit available to those with lower scores may be higher due to the increased risk for lenders. Yet, don’t lose hope. With time, diligence, and the right tools, it's entirely possible to work on boosting that score.

Having a credit score of 512 places you under the range most lenders find suitable when approving personal loans. Your score, in the eyes of the lender, indicates a level of financial risk associated with lending to you. It's tough news to hear but understanding what your credit score means for your loan prospects is important.

Traditional personal loans may not be accessible with a score of 512, but other alternatives might be possible. Secured loans, which involve providing collateral, or co-signed loans, where a person with better credit supports your application, can be options to consider. Additionally, peer-to-peer lending platforms can be more flexible regarding credit scores. It's important to note though, these alternatives typically carry higher interest rates and generally less favorable terms due to the increased risk assumed by the lender.

Can I Get a Car Loan with a 512 Credit Score?

With a credit score of 512, qualifying for a car loan could pose a difficult task. Because lenders usually seek scores above 660 for favorable terms, your score, which is less than 600, falls into what is typically referred to as a subprime category. This simply means that loan providers may see your credit score as a representation of higher risk, indicating past difficulties in repaying borrowed funds, which could lead to inflated interest rates or even denial of the loan.

Despite this, there's still hope. Even with a low credit score, there might still be opportunities for car loan approval. Some lenders focus on assisting those with low credit scores; however, it's important to note that these loans tend to carry higher interest rates to balance the assumed risk. Choosing this path may be challenging, but with careful observation of the terms, the goal of securing a car loan is not entirely remote. So while the journey may be more challenging, it is not impossible. Stay optimistic and carefully consider all options.

What Factors Most Impact a 512 Credit Score?

Recognizing the reasons behind a credit score of 512 is foundational to your financial progression. By pinpointing and addressing the specific factors that affect your score, you can move towards better financial health. Each credit journey is distinctive and offers valuable learning experiences.

Payment Practices

Your payment history can significantly influence your credit score. Late payments or defaulted loans could be significant drivers of your current score.

Strategy for Improvement: Scrutinize your credit report for late payments or defaults. Reflect on cases where you may have postponed payments which could have affected your score.

Credit Use

High utilization of available credit can adversely impact your score. If your utilized credit is close to or exceeding your limit, this could be a primary cause.

Strategy for Improvement: Look at your credit card statements. Are you reaching your credit limits? Strive to keep balances low compared to the limits.

Credit History Duration

A short credit history may negatively impact your score. Younger credit records are generally not as beneficial as older, well-managed ones.

Strategy for Improvement: Analyze your credit report to check the age of your accounts. Contemplate if you have opened new accounts recently which could have negatively affected your score.

Type of Credit and Recent Applications

Having an assortment of credit types and demonstrating responsible management of new credit applications contribute to a healthier score.

Strategy for Improvement: Gauge your variety of credit accounts, such as credit cards, retail accounts, installment loans, and home loans. Reflect whether your applications for new credit have been prudent.

Public Records

Public records like bankruptcies or tax liens can have a significant bearing on your score.

Strategy for Improvement: Review your credit report for any public records. Address any listed items that may require resolution.

How Do I Improve my 512 Credit Score?

With a credit score of 512, you are not alone. It’s considered a low score, but change is possible. We’ll guide you towards accessible, impactful steps to upgrade your credit status.

1. Clear any Collections or Liens

Records of collections or liens hold considerable weight when it comes to your credit score. Make it a priority to deal with these debts. Communicate with the concerned parties to settle these accounts, either with payment or a reconfigured payment strategy.

2. Keep Credit Utilization Low

Credit utilization refers to the amount of your available credit you’re using. Reducing this percentage can significantly boost your credit score. Pivot your attention towards paying off debt on lines of credit with the highest utilization ratios.

3. Contemplating a Secured Credit Card

Though it might be harder to get approved for a conventional credit card with your score, a secured credit card could be a feasible alternative. Secured cards need a refundable deposit, which sets your credit limit. Handle this responsibly and you’ll see credit score increases.

4. Leverage an Authorized User Strategy

If someone with an established credit history allows you to be an authorized user on their card, their credit habits can positively impact your score. Make sure the card issuer reports authorized user activity to credit bureaus.

5. Cultivate a Diversified Credit Palette

Another beneficial tactic includes diversifying your credit types. Once you’ve held a secured card responsibly for some time, consider extending to a retail card or credit builder loan. Managing them wisely can lift your credit standing.