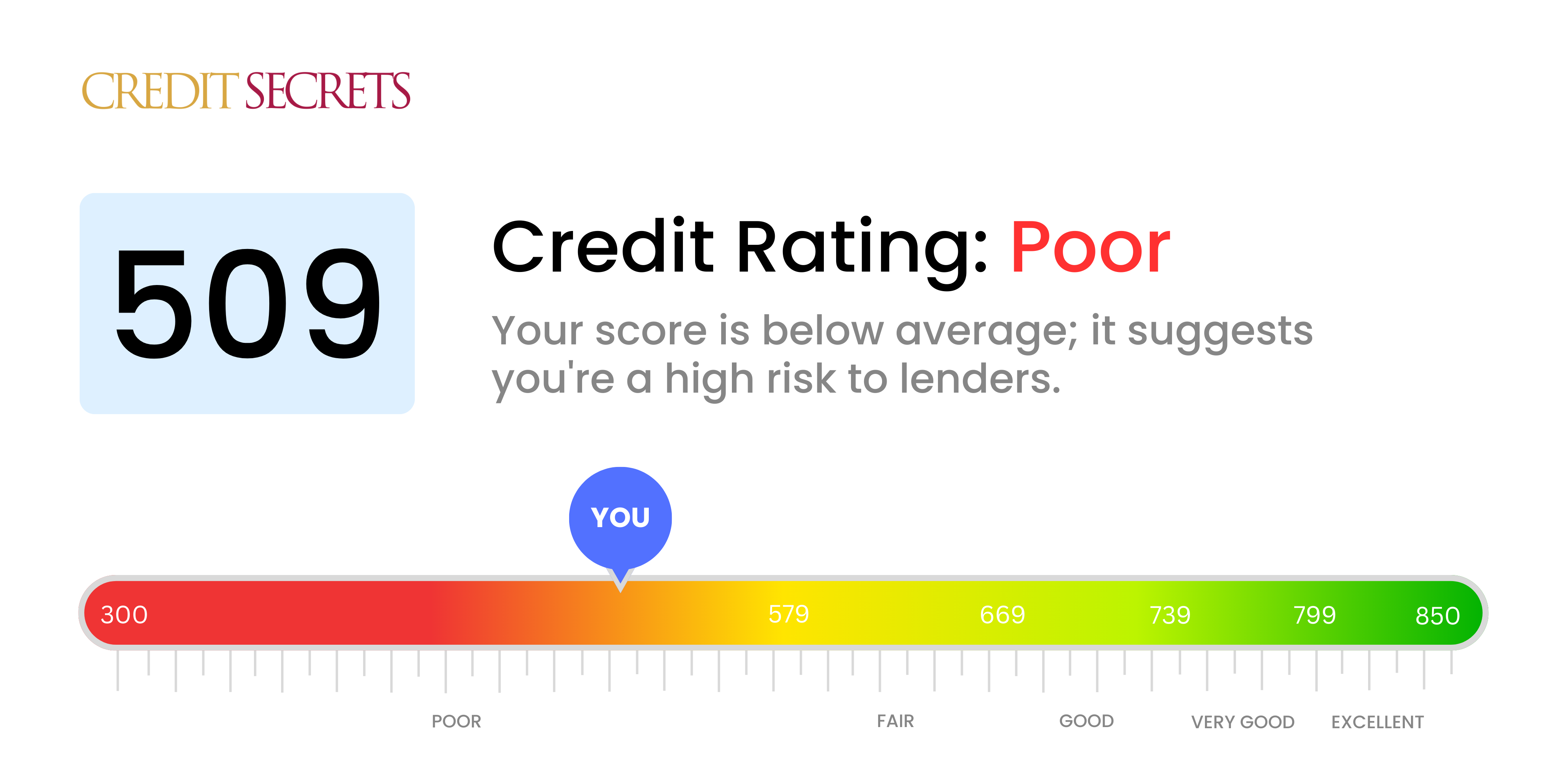

Is 509 a good credit score?

With a credit score of 509, unfortunately, you're currently in the "poor" credit range. This means you may encounter difficulty when applying for loans or credit cards, as lenders consider this score a higher risk. Don't lose hope, though! There are tried and true methods to boost credit scores that you can begin applying today.

Improving a credit score takes time, but remember, a few small changes could lead to big improvements. By paying bills on time, reducing your debt, and consistently checking your credit report for errors, you can start to raise that score. Stay positive, and remember that good credit habits will surely pay off.

Can I Get a Mortgage with a 509 Credit Score?

Unfortunately, with a credit score of 509, securing approval for a mortgage would be challenging. This score is significantly below the minimum threshold usually preferred by mortgage lenders, which indicates a likelihood of past financial struggles such as missed payments or financial mismanagement.

Although this might feel discouraging, it's important to remember that this moment doesn't define your financial future. Your options include looking into alternative financing like FHA loans that cater to borrowers with low credit scores, or rent-to-own agreements that allow you to build up credit over time while residing in your prospective home. Meanwhile, consider dedicating effort towards improving your credit score by addressing any outstanding debts, avoiding further delinquencies and maintaining strict financial discipline.

Keep in mind that with a low credit score, even if you get approved for a mortgage, expect to be offered higher interest rates. This is because lenders see you as a higher risk borrower. Over time, as your credit score improves, you might be eligible to refinance to a lower interest rate.

Can I Get a Credit Card with a 509 Credit Score?

With a credit score of 509, it might seem daunting to apply for a credit card. This is because some credit companies may perceive this score as relatively risky, indicating prior financial struggles or less-than-ideal money management practices. Though this can be an unwanted realization, remember that knowing your credit score is a pivotal part of bettering your financial health.

Due to this lower score, alternatives to traditional credit cards may be more suitable. Secured credit cards for instance, could be a viable option; they require a deposit which then serves as your potential credit limit. Not only are these cards easier to gain approval for, but they can also assist in methodically improving your credit score over time. Other alternatives to consider could be seeking a co-signer or utilizing prepaid debit cards. No matter the route you decide to take, it's important to remember that interest rates for credit options available at this score likely will be higher, which mirrors the lenders' higher perceived risk. It's not easy, but rest assured, it's certainly possible to make strides towards financial stability from this point.

Having a credit score of 509 significantly decreases your chances of receiving approval for a personal loan via traditional means. Lenders view a score of this magnitude as a high-risk proposition, which, unfortunately, makes it difficult for you to secure a loan under standard conditions. It's definitely a tough spot to be in, but it's essential to grasp what such a credit score entails for your possibilities as a borrower.

Even though the standard personal loan might not be within reach, you could explore alternatives like secured loans, which need collateral, or co-signed loans, where another person with a better credit score essentially supports your application. Peer-to-peer lenders could also be worth considering, as they may have more lenient credit prerequisites. Please note, however, that these substitute options often carry higher interest rates and tougher terms in exchange for the increased lender risk. Approaching these options, make sure you are prepared and fully understand the obligations and potential drawbacks.

Can I Get a Car Loan with a 509 Credit Score?

It's important to understand that a credit score of 509 presents a significant hurdle when seeking approval for a car loan. Most lenders prefer scores above 660, and anything below 600 is generally viewed as subprime territory. This is where your score of 509 falls. High-interest rates or even outright denial are possible outcomes with such a score. This essentially comes down to risk: the lower your credit score, the higher your perceived risk of default in the eyes of the lender.

That said, it's not necessarily the end of the road. There are lenders who are willing to work with those who have lower credit scores. This does come with a caveat - these types of loans tend to carry higher interest rates. This is the trade-off for the increased risk that lenders take on. Though it may be a bumpy ride, with careful planning and an understanding of the terms involved, obtaining a car loan is not entirely out of reach. It is vital, however, to tread cautiously due to the potentially high interest rates involved.

What Factors Most Impact a 509 Credit Score?

A score of 509 signifies your credit health requires some attention. Studying the factors influencing this score will equip you with the necessary insights to improve your financial standing. Bear in mind that your financial path is personal and full of learning experiences.

Payment History

Your credit score is highly influenced by your payment history. Defaulting on payments or paying late are probable reasons for your current score.

How to Check: Examine your credit report for any payment defaults or delays. Think about any instances where you have made late payments, as these could be bringing down your score.

Credit Utilization

High credit utilization might be negatively influencing your score. If you're close to maxing out your credit cards, this could be a significant reason for your score of 509.

How to Check: Scrutinize your credit card statements to find out if you are nearing your limits. Try and maintain a low balance relative to your credit limit to improve your score.

Credit Inquiries

Too many recent credit inquiries can hurt your score. If you've been applying for a lot of new credit, this might be a major factor.

How to Check: Check your credit report for the number of recent credit inquiries. It's advisable to apply for new credit sparingly.

Public Records

Public records such as foreclosures or tax liens can severely hurt your credit score.

How to Check: Look into your credit report for any public records. Resolving any listed items may help to improve your score.

How Do I Improve my 509 Credit Score?

With a credit score of 509, you fall into the range of having a poor credit score, but fear not, there are practical steps that can be taken to improve it.

1. Prioritize Past-Due Accounts

A crucial first step is to address any existing past-due accounts. Reacting to these will help contain any damage as your most delinquent accounts weigh heavily on your score. Reach out to the lenders to discuss a viable repayment arrangement, if necessary.

2. Manage Your Credit Card Utilization

Aim to keep your credit card balances low compared to your credit limit. Ideally, strive to keep the utilization ratios under 30%, but eventually, you’ll want to aim for less than 10%. Look at the cards with the highest usage first and begin to lower those balances.

3. Consider a Secured Credit Card

At your current score, a regular credit card may not be an option. Look into obtaining a secured credit card, which is backed by a deposit. Use this card wisely, keeping charges low, and paying the balance off monthly to promote a favorable payment history.

4. Request to Be an Authorized User

If permissible, have someone with a solid credit background add you as an authorized user to their credit card. This can assist in improving your score as their positive payment behavior can be mirrored on your report. Ensure the card issuer reports all user activity to credit agencies.

5. Explore Diverse Credit Options

Mixing up the types of credit you use can impact your score positively. Once you’ve established responsible usage with a secured card, delve into other forms of credit like credit builder loans, or maybe a retail card. Manage them all responsibly to enhance your credit reputation.