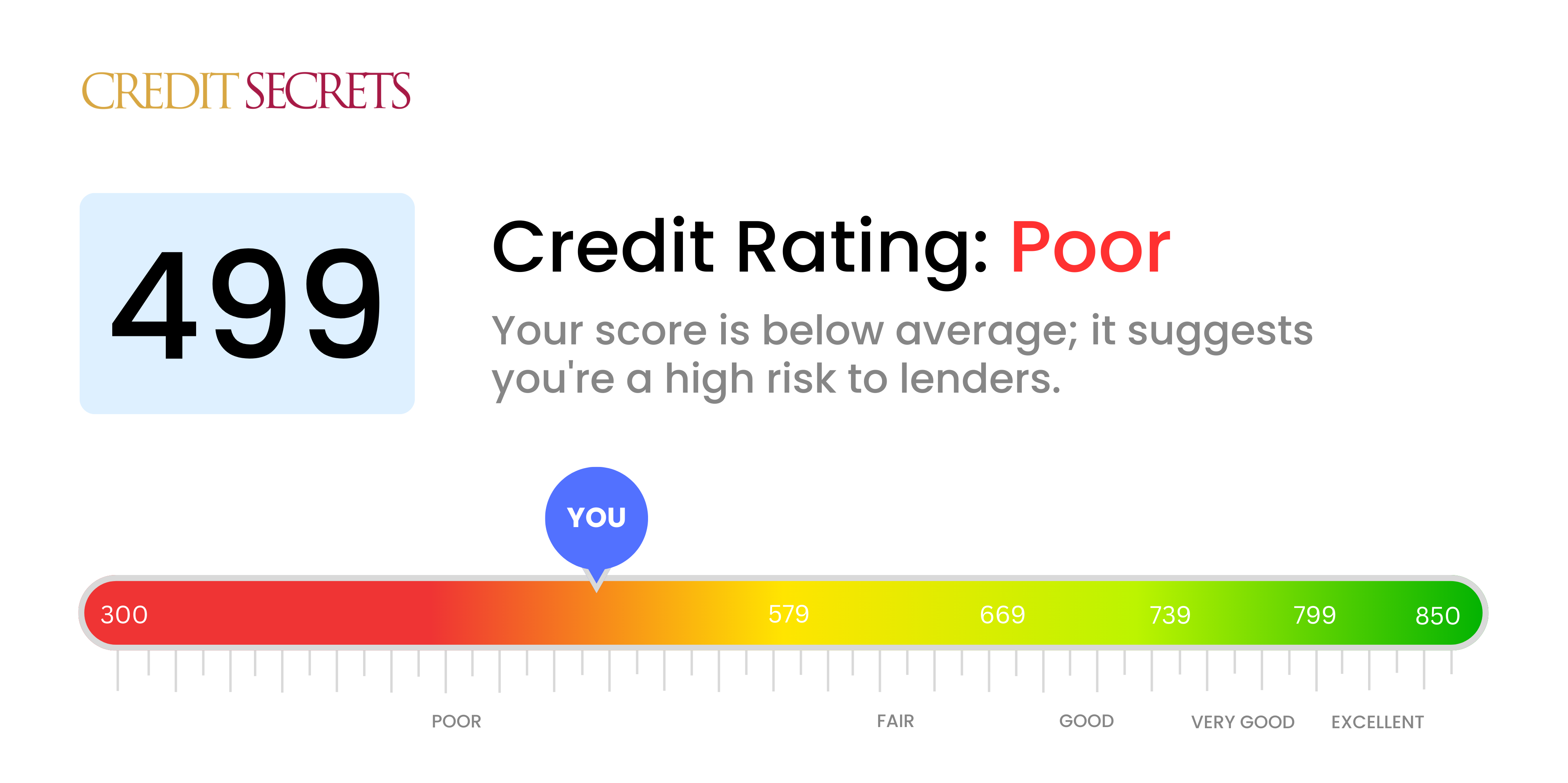

Is 499 a good credit score?

Your credit score of 499 falls within the 'Poor' category. This score is not considered a good credit score, which means you may face difficulties when seeking credit, including high interest rates, low credit limits, or rejections of credit applications.

However, remember that this isn't the end of the road and there are actions you can take to improve your score. Improving your credit score won't happen overnight, but by taking responsible steps like paying bills on time, lowering your debt, and carefully managing your credit, you could see improvements in your credit score over time.

Can I Get a Mortgage with a 499 Credit Score?

A credit score of 499 is a challenging position to be in, especially when you're striving for a mortgage approval. With this score, most lenders will likely hesitate to approve your mortgage application. This is because a credit score within this range suggests you might have had some financial struggles, including late payments, defaults, or maxed-out credit cards.

With a low credit score, a conventional mortgage may not be an option. However, alternatives exist such as government-insured loans like FHA loans, which have more lenient credit requirements. Interest rates will be higher than average due to the perceived risk, but these kinds of loans can still be a feasible stepping stone towards homeownership. Meanwhile, continue making timely payments and reducing outstanding balances to gradually improve your credit score. Credit restoration doesn't happen overnight, but with persistence, you can increase your score and mortgage approval odds.

Can I Get a Credit Card with a 499 Credit Score?

With a credit score of 499, acquiring a traditional credit card approval can be particularly tough. This score is commonly perceived by lenders as risky, indicating past financial hardships or mismanagement. Although this reality might be hard to accept, it is essential to face it with a clear understanding. Accepting your credit situation is the initial step towards financial recovery, even if the truth seems harsh at times.

Secured credit cards, requiring a deposit equivalent to your credit limit, could be an outstanding alternative given your credit score. Acquiring these cards are typically easier and they could help enhance your credit over time. Another worthwhile option may involve having a reliable individual to co-sign on a card with you or using pre-paid debit cards. Although these alternatives might not rectify your financial situation instantly, they can serve as practical building blocks towards credit improvement. One thing to remember is that interest rates will likely be higher for any credit form, due to the increased lending risk your score signifies.

If you have a credit score of 499, it's going to be a challenge to get approved for a personal loan from a traditional lender. Lenders see this score as a high risk, and it's hard for them to trust that the loan will be repaid in full and on time. We understand that this may be a tough pill to swallow, yet acknowledging the impact of your credit score on loan prospects is a necessary step.

The good news is, there are still alternatives that might help you secure a loan. Secured loans requiring collateral, co-signed loans backed by someone with a higher credit or peer-to-peer lending platforms might be possible paths to explore. Please be aware, though, these lenders may set higher interest rates or less flexible terms to offset any potential loss. Each option carries its own risks and benefits, so it's crucial to carefully evaluate the details before making a decision.

Can I Get a Car Loan with a 499 Credit Score?

A credit score of 499, unfortunately, places you in a challenging position when it comes to securing a car loan. Credit lenders usually prefer credit scores above 660. Anything below 600 is deemed subprime, meaning high-risk. Naturally, your score of 499 is well within this subprime zone. This reflects a heightened risk to lenders, suggesting potential difficulties in repaying the loan. This might result in higher interest rates or even outright rejection of your loan application.

Despite this, don't feel discouraged. Some lenders have designed their services around people with less-than-perfect credit scores. But tread carefully as loans from these companies come with hefty interest rates. This is a protective measure for them due to the perceived high risk. It won't be an easy ride, but with prudent decision making and a thoughtful review of the terms, obtaining a car loan isn't entirely impossible either. Strive to stay positive and proactive in your journey to secure a loan.

What Factors Most Impact a 499 Credit Score?

Understanding your credit score of 499 is key to starting your journey toward financial health. Regardless of the large or small influences, all of them carry weight and require attention.

Pending Collections or Judgements

Having collection accounts or civil judgments can lead to a low credit score. A score of 499 suggests these negative records could be likely on your credit report.

How to Check: Thoroughly review your credit reports for collection activities and any civil lawsuit judgments.

Account Delinquencies

Late or missed payments can significantly impact your credit score. Regular delinquencies might explain why your score is currently at 499.

How to Check: Look into your credit report for any marks of late or missed payments on past or present debts.

High Credit Balances

A high balance on your credit cards relative to your credit limit, also known as credit utilization, can harm your credit score.

How to Check: Examine your credit card statements. Are your balances near or at their maximum limits?

Length of Credit History and New Credit

A short credit history or opening multiple new credit lines in a short period of time can negatively impact your score.

How to Check: Consult your credit report to assess the age of your accounts and the number of newly opened credit lines.

Bankruptcies or Tax Liens

Public records such as bankruptcy or tax liens can be severely detrimental to your credit score.

How to Check: Check your credit report for any public records. Aim to resolve any listed items promptly.

How Do I Improve my 499 Credit Score?

With a credit score of 499, you’re facing a real challenge, but it’s not an insurmountable one. With the right efforts and determination, your score can increase dramatically. Let’s examine immediate actions you can take:

1. Rectify Delinquent Accounts

Accounts that are significantly past due can greatly damage your credit score. Your initial focus should be on updating these accounts. Aim to clear the most overdue ones first and consider contacting your lenders to customize a repayment plan, if needed.

2. Lower Credit Card Debt

High balances on your credit cards, compared to your credit limit, can drastically affect your score. Strive to bring your balances down to less than 30% of your limit, ultimately aiming for under 10%. Pay utmost attention to the cards with the highest usage first.

3. Consider a Secured Credit Card

With your current score, getting a traditional credit card might be difficult. A secured credit card, which requires a deposit that also serves as your credit limit, could be a great alternative. Use it wisely, make small purchases and pay the balance in full every month to start building a good payment history.

4. Obtain an Authorized User Status

If possible, request a friend or relative with a healthy credit score to add you as an authorized user on their credit card. This allows your score to benefit from their positive credit activity, but make sure the card company reports authorized user activity to the credit bureaus.

5. Broaden Your Credit Portfolio

A varied combination of credit types can assist in improving your credit score. Once you’ve established a positive payment record with a secured card, consider other forms of credit like store cards and credit builder loans; remember to handle them responsibly.