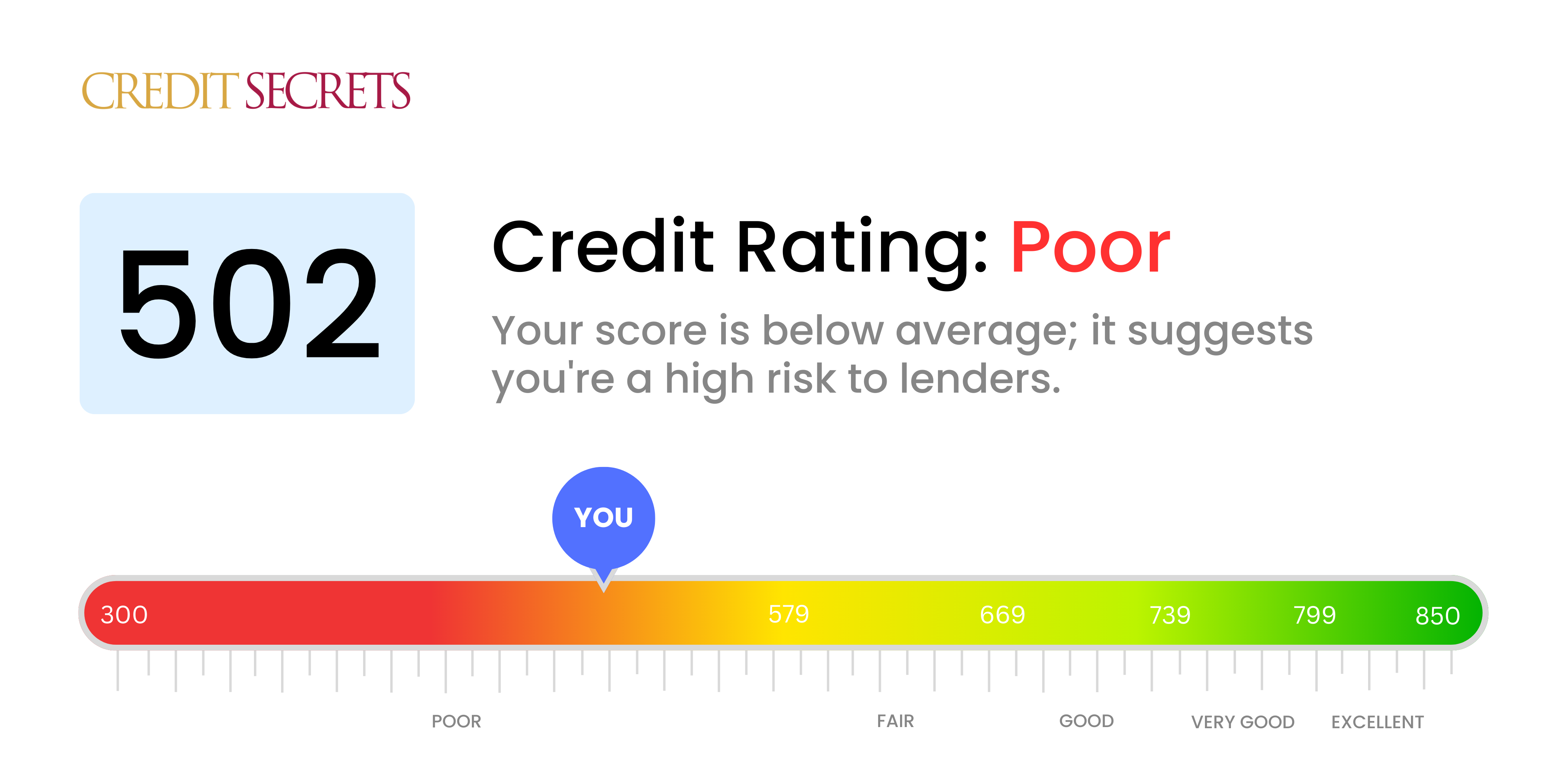

Is 502 a good credit score?

A credit score of 502 isn't exactly what would be considered a good credit score, as it falls in the 'Poor' range. This could lead to more challenging financial circumstances like potentially higher interest rates or difficulties in securing loans or credit.

However, remember that where you stand today isn't where you have to stay. With the right approach and tools from Credit Secrets, you could start on a path to improving your credit score and achieving your financial objectives.

Can I Get a Mortgage with a 502 Credit Score?

Having a credit score of 502, it's crucial to acknowledge upfront that approval for a mortgage is highly unlikely. This score is significantly lower than what most mortgage lenders require, indicating a history of financial hiccups, such as late payments or defaulting on loans.

While this situation can feel daunting, it's important to remember that financial health can be rebuilt over time. Addressing any current debts promptly is a key starting point as this directly impacts your credit score. In addition, consistently making payments on time and practicing responsible credit use can slowly result in an improved score. Avoid taking out new credit unless entirely necessary and always keep your credit utilization below 30%. Although the journey towards financial stability can sometimes appear overwhelming, with steady commitment, you can in time achieve a better credit standing and increase your chances of securing a mortgage.

If a mortgage is urgently needed, one option could be to consider finding a co-signer who has a stronger credit score. This isn't a decision to be taken lightly, as the co-signer will be equally responsible for the debt if you fail to make payments. As an alternative, you might also look into government-backed mortgage programs that don't have as stringent credit scores requirements. But remember, a sustainable long-term solution involves improving your credit standing.

Can I Get a Credit Card with a 502 Credit Score?

Having a credit score of 502 presents a tough challenge when it comes to getting approved for a traditional credit card. It’s a firm reminder that life steers us down roads we sometimes wish we could evade, but facing the reality and being aware of your credit status is the first big stride toward financial recovery.

Unfortunately, a score of 502 is often seen by lenders as high-risk and reflective of past financial problems. Don't lose hope though, because there are still workable options to consider. Secured credit cards, which require a deposit that becomes your credit limit, are often easier to get with a lower credit score. This can be a great tool for boosting your rating over time. Another option could be finding a trustworthy co-signer or using prepaid debit cards. Remember, these options are not quick fixes but they can help guide you on your path to financial restoration. Keep in mind, you'll likely face higher interest rates due to the elevated risk from the lender's perspective.

A credit score of 502, unfortunately, falls quite short of the typical requirement for personal loan approval through most traditional lenders. This lower score is seen as a signal of high risk, therefore, securing a personal loan with this score may be extremely difficult. While this may seem like serious news, remember that it is just an aspect of your current financial picture and knowing where you stand is an important first step.

Since conventional avenues might not be feasible, you may have to explore alternate loan options. Secured loans, for instance, require you to provide collateral, while co-signed loans require a guarantor with better credit standing. You could also consider peer-to-peer lending, which might have more relaxed credit criteria. However, it's crucial to keep in mind that these alternatives often carry higher interest rates and tougher terms due to the elevated risk for the lender.

Can I Get a Car Loan with a 502 Credit Score?

Unfortunately, with a credit score of 502, acquiring a car loan may prove difficult. Car loan lenders usually seek credit scores above 660 for the best terms. A score under 600 typically places you in what is referred to as the "subprime" category. Regrettably, your score of 502 lands in this area, which could result in heftier interest rates or even a lack of loan approval. This is due to lenders seeing lower credit scores, like yours, as a greater risk. It suggests a history of inconsistent repayment of borrowed money.

Nevertheless, a low credit score does not entirely close off the opportunity for a car loan. There are certain lenders equipped to assist individuals with lower credit scores. However, beware that these loans typically come with much higher interest rates. These boosts in rates are a protection for lenders against the perceived risk. It might be a rocky road ahead, but with mindful review and understanding of the terms, it's still possible to secure a car loan.

What Factors Most Impact a 502 Credit Score?

Understanding your credit score of 502 is an important step towards better financial health. Recognizing the factors affecting your score helps you pinpoint areas to focus on for improvement.

Payment History

Your credit score could be deeply influenced by your payment history. Late or missed payments might be dragging down your score.

How to Check: Cross-check your credit report for any missed or late payments. Recollect times when payments might have been delayed or forgotten, as these can negatively impact your score.

Credit Utilization

Your credit score could be affected by high credit utilization. If you're frequently reaching or exceeding your credit limit, this could be a contributing factor.

How to Check: Look through your credit card statements. If you notice the balances are consistently near the limit, it may be time to rethink your spending habits.

Length of Credit History

Having a short credit history can have an adverse impact on your score, especially if you frequently open and close accounts.

How to Check: Review your credit report to understand the length of your credit history and how often you open new accounts.

Credit Type Diversity

Holding a variety of credit types and responsibly managing them is essential, and having only one can affect your score negatively.

How to Check: Evaluate your different credit accounts. Aim to diversify your credit types to demonstrate responsible credit usage.

Public Records

Public records such as foreclosures or tax liens can significantly lower your score.

How to Check: Look through your credit report for any public records to address any unresolved issues.

How Do I Improve my 502 Credit Score?

Navigating a credit score of 502 may be challenging, but with dedicated action, it is possible to see improvements. Here are targeted steps suitable for your current score situation:

1. Prioritize Collection Accounts

Collection accounts can massively dent your credit rating. Strive to clear these debts first. Contact the collection agencies to identify any possible payment arrangements or settlement options.

2. Limit New Credit Inquiries

Multiple inquiries for new credit can negatively impact your score. Focus on your existing credit relationships and avoid applying for new credit until your score improves.

3. Credit Utilization Management

Keep the balances on your existing credit devices low. Your credit utilization ratio – the balance of your debts versus your credit limits – should ideally remain under 30% to avoid harming your score.

4. Opt for a Secured Credit Card

At this score, obtaining a regular credit card may be difficult. Consider a secured credit card which requires a refundable security deposit. Use it carefully, repaying the balance monthly to build a good payment background.

5. Seek Credit Counsel

Consider nonprofit credit counseling as a way to gain insights about ways to manage your credit effectively without having to resort to a credit repair company. They can provide guidance based on your unique circumstances.

6. Timely Bill Payments

Keeping track of your utility and other non-credit monthly bills and ensuring they’re paid promptly doesn’t directly affect your credit score. However, a good overall financial habit eventually contributes to credit score improvements.