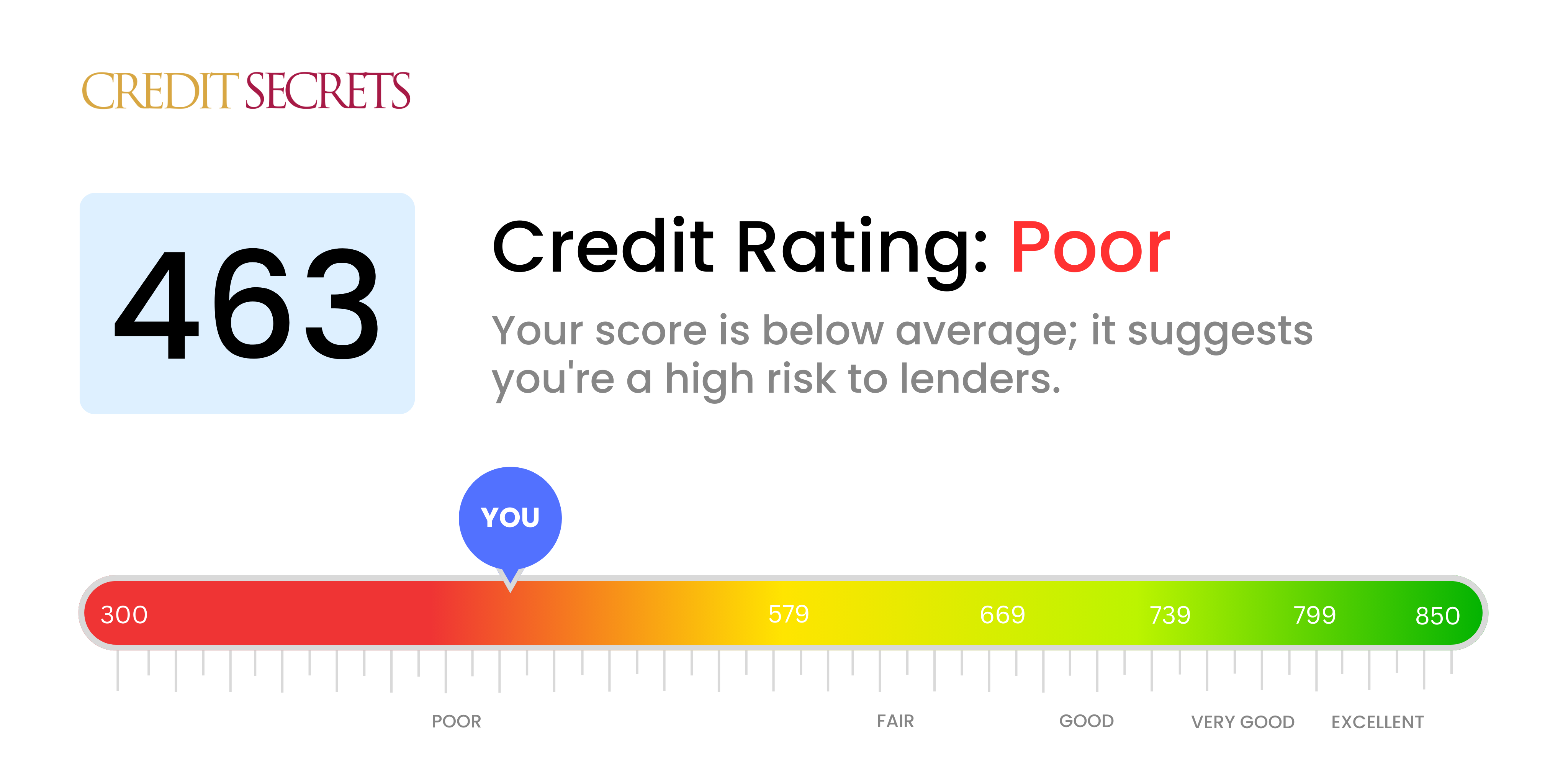

Is 463 a good credit score?

With a credit score of 463, you're currently in the 'Poor' range. This is far from ideal, but remember, it's just a temporary snapshot of your current financial status - not a life sentence.

While it's true that this score may limit your options for credit cards and loans, and you may face higher interest rates, it's also completely possible to turn it around. With the right actions and careful management of your finances, your credit score can and will improve over time. Keep in mind that better days aren't far off as long as you take the necessary steps to improve your financial habits.

Can I Get a Mortgage with a 463 Credit Score?

Unfortunately, with a credit score of 463, it’s quite unlikely that you'll be approved for a mortgage. Most lenders require a significantly higher credit score for approval. A score in the 400s often signifies problematic financial history, like continuous late payments, which is a risk for lenders.

Despite this challenge, there are alternatives to consider. You could look into loans backed by the Federal Housing Administration (FHA), which tends to be more lenient with credit scores. Another option is a subprime mortgage, designed for individuals with low credit scores. However, these often come with higher interest rates. While a traditional mortgage might be out of reach currently, these alternatives could provide a stepping stone towards homeownership. As you start this journey, remember that improving your credit standing is not an overnight process, but each step you take brings you closer to your financial goals.

Can I Get a Credit Card with a 463 Credit Score?

Unfortunately, with a credit score of 463, the likelihood of being approved for a conventional credit card is quite slim. Credit card issuers tend to view this as a high-risk score, indicating past financial hurdles or mishandling of credit. This may not be the news you hoped to hear, but recognizing your credit situation is a vital step towards regaining financial control. Acknowledging unpleasant realities can start the path towards progress.

In light of the challenges that come with a lower score like this, you might want to consider alternatives such as secured credit cards. These cards require a deposit that becomes your credit limit, and they can be relatively easier to qualify for while helping to rebuild your credit score over time. Other options could include considering a credit-worthy co-signer or using pre-paid debit cards. While such alternatives won't fix your credit status overnight, they can serve as useful stepping stones on your journey to financial confidence. Remember, any credit offered to someone with a low score often comes with higher interest rates, reflecting the increased risk perceived by lenders.

With a credit score of 463, your chances of being approved for a typical personal loan are quite slim. This score is significantly lower than the range seen as prime by most lenders. When potential lenders observe a score such as yours, they discern a heightened risk, making it unlikely for you to receive loan approval on standard terms. This situation may feel daunting, but it's critical to stay squarely aligned with the truth of what this means for loan possibilities.

Don't lose hope, though. There are still options like exploring secured loans where you offer collateral to back up the loan. Alternatively, a co-signed loan could be an option if you have someone with a stronger credit standing willing to back your loan. Peer-to-peer lending platforms can sometimes offer more flexible credit requirements. Beware, however, that these options frequently come with higher interest rates and may not offer the most favorable terms due to the increased lending risk that your credit score represents. Continuing your journey towards financial stability is still possible and achievable.

Can I Get a Car Loan with a 463 Credit Score?

A credit score of 463 is quite low, and it does present some obstacles when applying for a car loan. Most lending institutions prefer a credit score above 660 to offer agreeable terms, and anything below 600 is typically viewed as subprime. In your case, a score of 463 falls squarely into the subprime territory. This could potentially result in higher interest rates, or even an outright denial of the loan application. Your credit score is an important factor for lenders, as it gives them an insight into your past repayment behavior. A low score can suggest a higher risk of future repayment troubles.

On a positive note, having a low credit score doesn't completely dismiss the possibility of getting a car loan. There are lenders out there who cater to individuals with lower credit scores. However, it's important to tread carefully. These loans often carry significantly higher interest rates as a way for lenders to compensate for the perceived risk. So, don't lose hope. While the journey might be a bit more challenging, with due diligence and careful understanding of the loan terms, there's still a chance you can secure a car loan.

What Factors Most Impact a 463 Credit Score?

Deciphering a credit score of 463 is an essential first step to improving your financial health. This involves identifying the most significant factors that could be causing this low score.

Payment History

The most influential factor of your credit score is your payment history. Late or missed payments can dramatically lower your score.

How to Check: Scan your credit report for late or missed payments. Any overdue debts could be having a significant impact.

Credit Utilization

Another crucial factor is your credit utilization rate. If you're frequently close to maxing out your credit cards, this can be detrimental to your score.

How to Check: Look at your credit card statements. If your balances are consistently near the limit, this could be affecting your score.

Length of Credit History

A short credit history can also impact your score negatively. If you don't have a long history of credit usage, lenders may view you as a higher risk.

How to Check: Check your credit report for the age of your oldest and newest credit accounts. Newly opened accounts could potentially lower your score.

Type of Credit

The variety of credit you have in your name could also affect your score. A mix of credit cards, loans, and mortgages shows lenders that you can manage different types of debt responsibly.

How to Check: Assess your credit report for diversity in your credit accounts. Too many of one type might negatively impact your score.

Public Records

Lastly, public records such as bankruptcies or tax liens can severely affect your score.

How to Check: Search your credit report for any public records. If found, resolving these issues can help to elevate your score.

How Do I Improve my 463 Credit Score?

With a credit score of 463, you’re currently in a challenging financial position, but don’t despair—it’s not permanent. By taking precise, careful steps, you can make real strides towards improving your score:

1. Rectify Outstanding Debts

Begin your debt management journey by settling any outstanding arrears. Tackle the most delinquent accounts first, given their heavy negative effect on your score. Engage with your lenders directly to establish a feasible payment plan.

2. Trim Credit Card Debt

Excessive credit card debt compared to your limit can be detrimental for your credit score. Work towards decreasing any credit card debt to under 30% of your credit capacity, prioritizing cards with the highest utilization. Your eventual goal should be keeping it consistently under 10%.

3. Consider a Secured Credit Card

At your present score, acquiring a standard credit card might be difficult. An alternative is to apply for a secured credit card. This type of card is backed by a refundable deposit you make upfront, which sets your credit limit. Demonstrate responsible use by making moderate purchases and paying the balance in full monthly.

4. Explore the Authorized User Option

Enquire with a close acquaintance or family member with sturdy credit if they’ll add you as an authorized user on a credit card of theirs. This strategy can help enhance your credit score by integrating their favorable payment history into your credit report. Verify that the card issuer does report authorized user activity to the credit bureaus.

5. Broaden Your Credit Portfolio

Having a varied array of credit accounts can boost your credit score. Once you’ve formed a solid payment history with a secured credit card, investigate other credit options such as credit builder loans or retail credit cards. Always remember to manage these responsibly.