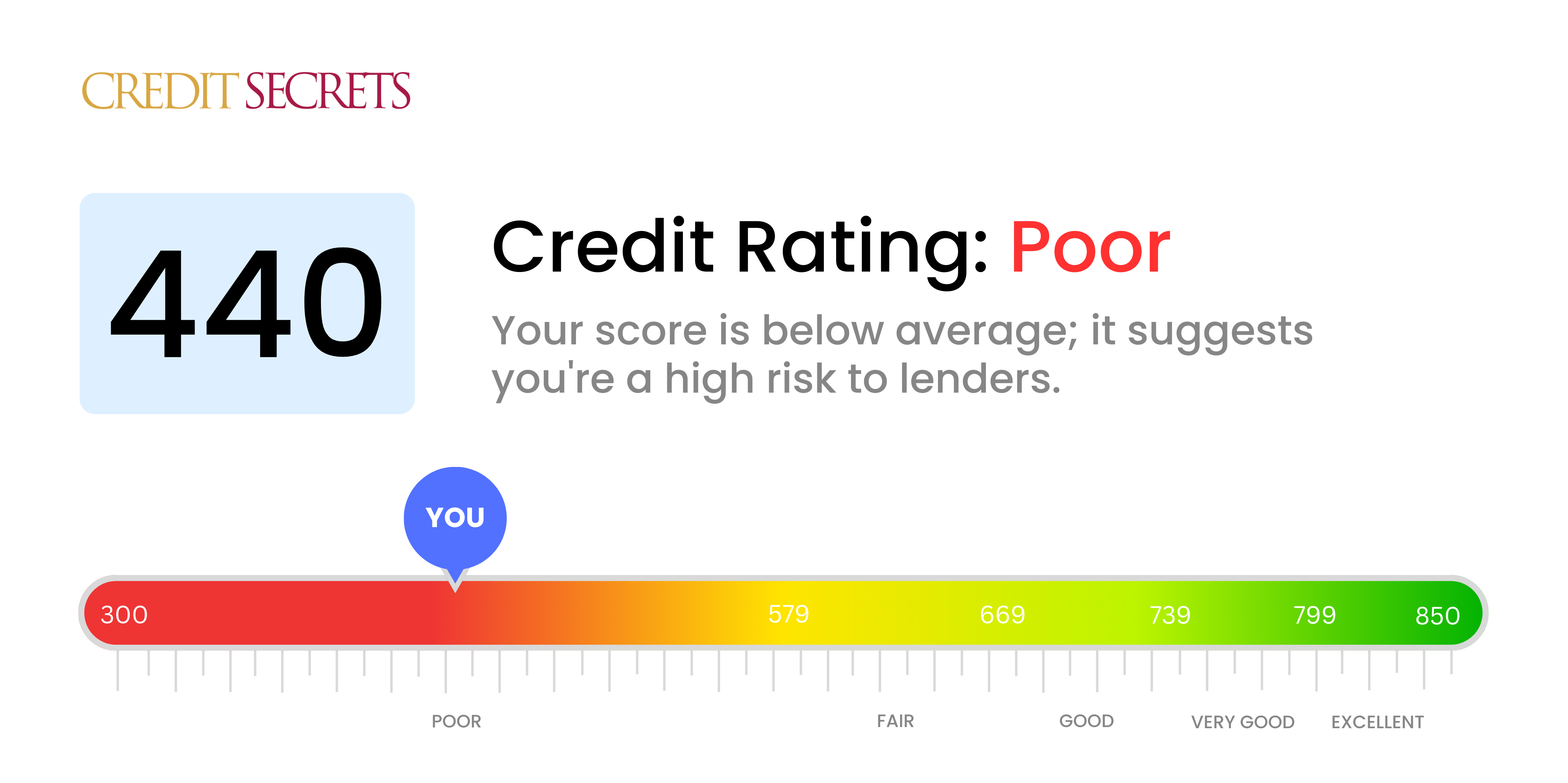

Is 440 a good credit score?

Unfortunately, a credit score of 440 is considered to be poor according to the standard credit score range. This might mean you could face difficulties when seeking approval for credit cards, loans, or mortgages, potentially leading to higher interest rates and less favorable terms.

However, don't get disheartened, as this situation isn't permanent. There are several proven methods to repair and improve your credit score. By adopting responsible credit behavior, paying bills on time, maintaining low credit card balances, and staying away from new debt, your score can gradually improve. Just remember, rebuilding a credit score takes time, but the sooner you start, the sooner you can see the results. You've got this!

Can I Get a Mortgage with a 440 Credit Score?

With a credit score of 440, securing a mortgage approval may be extremely challenging as this falls significantly below the typical lender's required minimum. This credit score range typically signals a history of financial hardships such as late payments or defaults, leading lenders to be wary about the risk involved in extending a mortgage loan.

However challenging your present situation might be, remember you are not without options. The path to improving your financial situation isn’t quick or easy, but it’s possible. Begin by addressing any outstanding debts and work diligently towards maintaining a pattern of on-time payments. Although it may be an uphill struggle at first, these actions can pave the way to a better credit score eventually. Interest rates, unfortunately, will be higher for lower credit scores. It's a hard truth to accept, but it's important to remain optimistic. Step by step, you can work towards financial health.

Can I Get a Credit Card with a 440 Credit Score?

With a credit score of 440, obtaining a standard credit card might seem like an uphill task. This score is considered to be on the lower end of the scale, and lenders may see it as a sign of previous financial struggles or mishandling. However disheartening this may feel, it's crucial to approach the situation with a practical mindset. Being informed about your credit score is an essential stepping stone towards financial recovery, even if it means acknowledging some uncomfortable realities.

On account of the challenges associated with such a low score, you could explore other options, like a secured credit card. This form of credit card requires a security deposit that serves as your credit limit. They can be a potent tool for rebuilding credit over time, even if they are not a quick fix. Additionally, you could consider seeking out a co-signer or exploring prepaid debit cards as potential alternatives. Also, any form of credit that might be available to people with low scores will likely have higher interest rates, demonstrating the increased level of risk for lenders. Remember that these alternatives may not solve your credit score issues instantly, but they are a necessary step on your path towards financial health.

A credit score of 440 is considerably lower than what most traditional lenders typically accept when deciding on personal loan approvals. Essentially, a low score like this suggests a high risk to lenders, making it unlikely for a personal loan approval under standard conditions. It might be tough to swallow, but it's crucial to understand the implications of your current credit score on your borrowing potential.

Although traditional personal loans may seem unreachable, you still have alternatives. Secured loans, where you offer collateral, or co-signed loans, where a person with a higher credit score stands for you, could be viable options. You might also explore peer-to-peer lending platforms which can often be slightly more accommodating regarding credit score limitations. However, it's important to bear in mind that these alternatives usually come attached with higher interest rates and stricter loan terms, as the lender is at a higher risk.

Can I Get a Car Loan with a 440 Credit Score?

If your credit score is 440, it might be tough to get the green light for a car loan. This number falls into a category that lenders often see as high-risk. Much of the time, lenders feel more comfortable with scores above 660, and anything under 600 can make the road a bit bumpier. Unfortunately, your 440 score falls into this rougher territory. This can lead to more costly interest rates or it might even mean you are denied a loan altogether. This comes down to how lenders see credit scores. A low one can suggest you've had some obstacles paying back debt in the past.

But don't lose hope yet. It's not impossible to secure a car loan with your current score. Some lenders are equipped to work specifically with folks who have lower credit. Yet, caution is key here as these loans might have steeper interest rates. Higher costs are the lenders’ way of protecting themselves against the potential risk. It might be a little challenging, but remember, it is possible to navigate through this process and find a car loan that fits your needs.

What Factors Most Impact a 440 Credit Score?

Understanding a credit score of 440 is pivotal to your financial restoration journey. It is important to analyze and address the crucial factors influencing your score so you can move towards a better financial standing. Each journey is personal and unique, offering various learning and growth experiences.

Payment History

The most significant impact on your credit score is your payment history. Late or missed payments may likely be contributing to your score of 440.

How to Check: Scrutinize your credit report for any missed or late payments. Take note of occasions when you may have overlooked or delayed payments; these could be damaging your score.

Credit Utilization

High credit utilization can be a critical negative influence on your score. If you're nearly maxing out your credit cards, this might be playing a role in your current score.

How to Check: Analyze your credit card statements. Are your balances nearing their limits? Strive to maintain lower balances as compared to your credit limit for a healthier score.

Length of Credit History

A shorter credit history can harm your credit score.

How to Check: Analyze your credit report to determine the age of your oldest and most recent accounts, plus the average age of all your accounts. Think about whether you've been opening new accounts lately.

Credit Mix and New Credit

Maintaining a balanced mix of different types of credit and handling new credit responsibly can significantly impact your score.

How to Check: Review your collection of credit accounts, which may include credit cards, retail accounts, installment loans, and mortgage loans. Consider if you have applied responsibly for new credit.

Public Records

Public records such as bankruptcies or tax liens can majorly affect your credit score.

How to Check: Look at your credit report for any public records. Attend to any listed items that need resolution.

How Do I Improve my 440 Credit Score?

Having a credit score of 440 may seem daunting, but manageable measures to significantly improve your credit score can be taken. Please find below the most practical yet powerful strategies considering your current score:

1. Rectify Defaulted Accounts

If you have any defaulted accounts, addressing them is crucial. Start by paying off your oldest debts as they tend to negatively impact your score the most. Speak with your lenders to discuss a feasible repayment plan if needed.

2. Tackle High Credit Card Debts

High credit card balances compared to their limits can severely harm your credit score. Try to cap your credit card debt to less than 30% of your limit and even more preferably, under 10%. Focus on eliminating the debt of the card with the highest credit usage first.

3. Consider a Secured Credit Card

Acquiring a regular credit card may prove difficult with your current score. A secured credit card, which necessitates a security deposit, serves as a viable option. Use this card thoughtfully, purchasing minimal items and clearing the full balance every month, contributing positively to your score.

4. Request to be an Authorized User

Enquire if a trusted acquaintance or family member with a sound credit score would let you become an authorized user on their card. This measure can enhance your credit profile by incorporating their favorable credit history. Make sure the card provider informs credit bureaus about this.

5. Broaden Your Credit Types

Improving your credit score could entail diversifying your credit sources. Once you’ve proven reliable with a secured card, ponder over acquiring other types of credit like credit builder loans or department store cards, which when handled responsibly can contribute positively to your credit score.