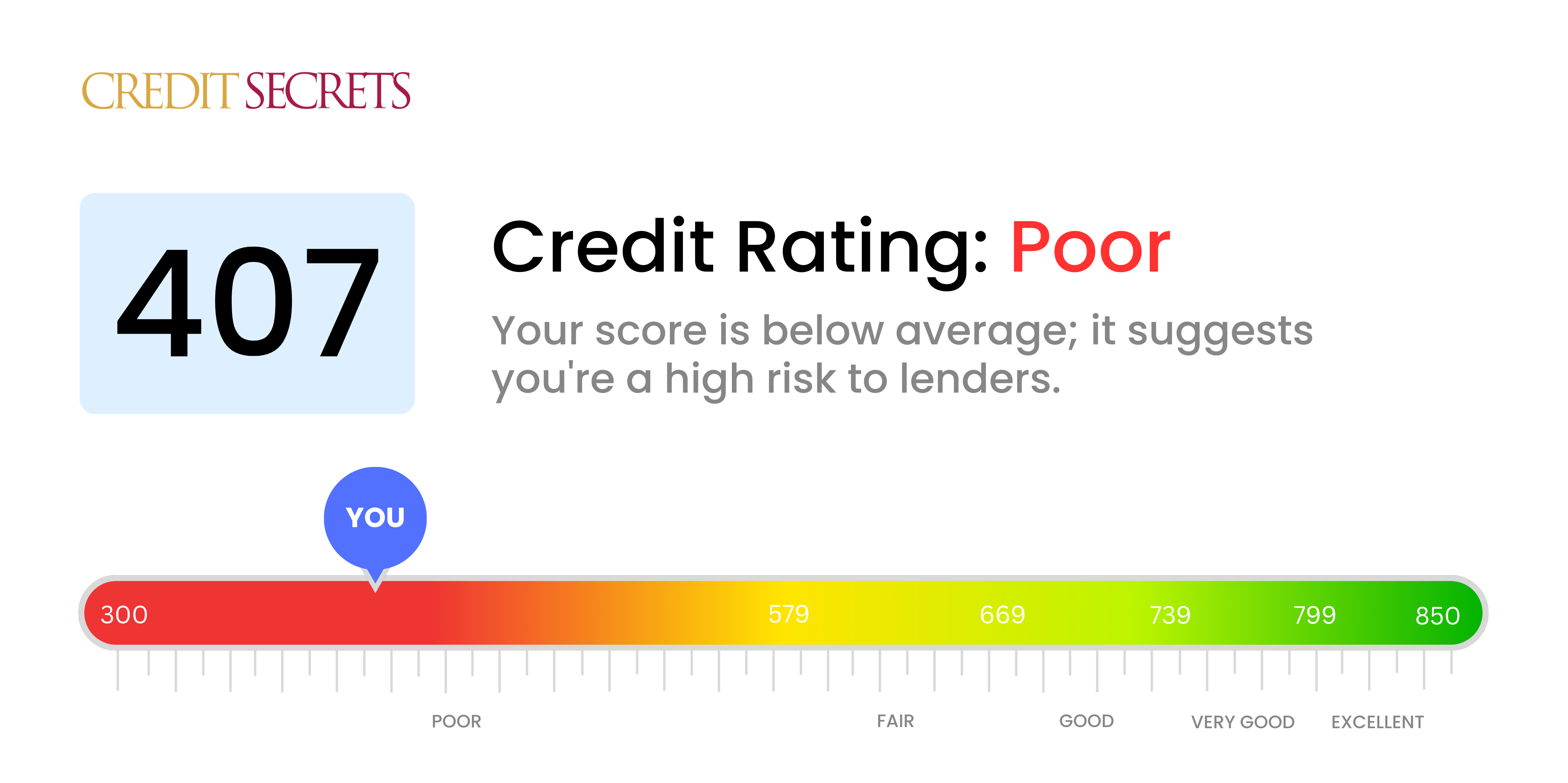

Is 407 a good credit score?

A credit score of 407 leaves room for improvement, as it falls within the 'Poor' category. It can result in difficulty when trying to borrow money, obtain a loan or get approved for credit. It may also result in higher interest rates since lending institutions consider this score a high risk.

However, don't despair; at Credit Secrets, we're here to help you navigate credit improvement, and a score of 407 is not a life sentence. With the right steps and strategies, bad credit can be repaired, and you can achieve a credit score that better reflects your financial goals and aspirations.

Can I Get a Mortgage with a 407 Credit Score?

Unfortunately, with a credit score of 407, it's unlikely that you'll be approved for a mortgage. This score is significantly lower than what most lenders typically require. A credit score in this low range often indicates a past record of missed payments, defaults, or other financial complications which is why lenders might hesitate to offer a loan.

This is definitely a tough situation, but not one without solutions. One possible alternative could be seeking a loan from less traditional lenders who might be willing to work with lower credit scores, such as private lenders or credit unions. Keep in mind though, these alternatives often come with higher interest rates and additional conditions. Rent-to-own agreements might also be a feasible option to consider, providing a path to homeownership without traditional financing. Lastly, consider focusing on improving your credit score. Paying down outstanding debts, creating a history of timely payments, and prudent credit use can raise your score over time. It's a gradual process, but with consistent efforts, you can work towards a more secure financial future.

Can I Get a Credit Card with a 407 Credit Score?

With a credit score of 407, it's a tough road to navigate when you're seeking approval for a traditional credit card. Financial institutions often see this score as high risk, indicating some past challenges with managing finances. It may seem disheartening, but facing the reality of one's credit situation is the first move towards financial improvement. It's crucial to confront this situation with a level-headed and practical mindset.

Given the hurdles connected with a low score, alternatives like secured credit cards might be worth considering. These cards require a deposit that matches your credit line. They can be a bit easier to get and they can help rebuild credit over time. Another route could be securing a co-signer, or looking at pre-paid debit cards as other possible options. Even though these choices don't offer an immediate solution, they could be your stepping stones on the path to better financial stability. Bear in mind that for those with a lower score, interest rates could be significantly higher as lenders see you as a greater financial risk.

Can I Get a Personal Loan with a 407 Credit Score?

With a credit score of 407, your chances of being approved for a traditional personal loan are unfortunately quite slim. A credit score of this nature is viewed as a significant risk factor to lenders, potentially suggesting a history of missed payments or financial instability. However, even though this scenario appears difficult, it's crucial to understand what this credit score means for your ability to borrow funds.

Though a personal loan via a conventional lender may be unlikely, there are other options to explore. Secured loans, which require you to offer an asset as collateral, could be a possibility, as could co-signed loans, where another individual with a stronger credit rating guarantees your repayment. Peer-to-peer lending platforms may also provide an option, as these often have a more relaxed approach to credit scores. Regardless, tread cautiously since these alternative lending options traditionally come with higher interest rates and less forgiving terms due to the increased risk to lenders.

Can I Get a Car Loan with a 407 Credit Score?

With a credit score of 407, obtaining a car loan may be quite difficult. This score is considered far below the typical threshold of good credit, which is usually around 660. Lenders take into account your credit score because it signals to them how likely you are to pay back what you borrow. A score of 407, unfortunately, causes concern for lenders, as it implies a high risk of loan default.

While this may seem discouraging, not all hope is lost. Some lending institutions are willing to work with those who have lower credit scores. Please be aware though, the terms of these loans often include higher interest rates as a result of the increased risk to the lender. Therefore, it's crucial to invest time in understanding the terms before committing to a loan. Obtaining a car loan is not unattainable, but patience, research, and a thorough understanding of loan terms will be vital in your journey to car ownership.

What Factors Most Impact a 407 Credit Score?

Recognizing your score of 407 as a starting point, we're ready to embark on a journey towards improved financial wellbeing. Let's identify those vital factors that have contributed to arriving at this score, focusing on key areas for adjustment. Every individual's financial situation is different, so use this knowledge to progress towards a stronger credit standing.

Neglected payments

Your payment conduct highly influences your credit score. A pattern of late or missed payments could be a leading reason for your low score.

To Review: Carefully inspect your credit report for any past-due payments or unpaid bills. Any lapse in payment timelines could have impacted your score.

Overused Credit Limits

Overutilization of your credit card limits can detrimentally affect your credit score. If you're consistently hitting or exceeding your credit limits, this may be part of the issue.

To Review: Go through your card statements. Are your balances often near or over the limits? Keeping balances low relative to your credit limit is advised.

Short-lived Credit History

If you're fairly new to credit or have only a few credit accounts, this can contribute to a lower score.

To Review: Check your credit report to gauge the longevity of your oldest and newest credit accounts. Reckon if you've opened new accounts recently.

Credit Type Diversity and Current Credit

Handling different kinds of credit responsibly and not dashing for new credit excessively can aid in maintaining a good score.

To Review: Reflect on the variety of credit accounts you own, like credit cards, retail accounts, installment loans, and mortgage loans. Evaluate if you've been applying for new credit too frequently.

Public Reports

Public reports like bankruptcies, tax liens, or judgments can dramatically affect your score.

To Review: Check your credit report for any public reports, and address them if needed.

How Do I Improve my 407 Credit Score?

A credit score of 407 is classed as bad, but don’t worry – it is possible to raise your score by taking precise steps suitable for your situation:

1. Prioritize Delinquent Accounts

Fulfilling unpaid debts should be your first step. Focus on resolving the oldest debts first as they negatively impact your score more. Try to negotiate with your lenders, they might be amenable to developing a payment arrangement.

2. Limit Your Credit Usage

High credit card utilization can greatly pull down your score. Make it a point to keep your balances less than 30% of your credit limit. Put emphasis on cards with the highest utilization.

3. Consider a Secured Credit Card

With your current score, acquiring a regular card might be hard. A secured credit card, which needs a refundable collateral deposit could be a beneficial option. Regular, responsible use of it can help build a positive payment history, improving your score gradually.

4. Seek to be an Authorized User

Find a trusted friend or relative with good credit and ask if they would add you as an authorized user on their card. This could enhance your score by piggybacking on their positive payment history. Check if the card issuer reports authorized user activity to the credit bureaus.

5. Broaden Your Credit Portfolio

Having diverse types of credit accounts can further bolster your score. Once you’ve shown responsible management of a secured card, venture into other credit types like a credit-builder loan or a store-based credit card. Remember to handle them responsibly.