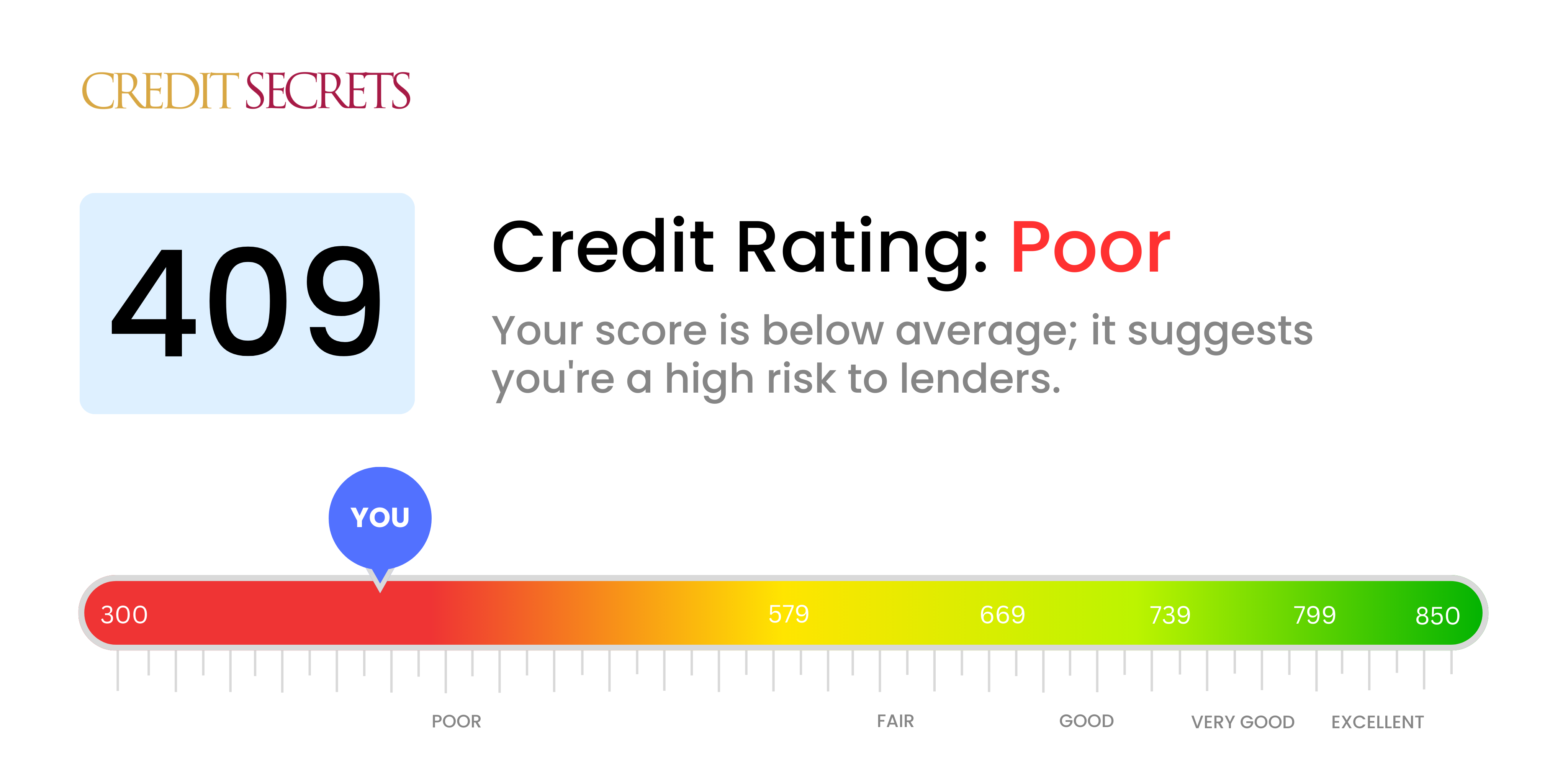

Is 409 a good credit score?

With a credit score of 409, you unfortunately fall into the category of 'Poor'. This is not an easy spot to be in, but it's not a life sentence - there's always room for improvement.

As it stands, getting approval for credit cards, loans, or mortgages might be extremely challenging with a score of 409. However, by following some practical steps, such as timely payment of bills and minimizing your debt, you can start to increase your score over time. Rest assured, an upward journey to a better financial future is within your reach despite this rough beginning.

Can I Get a Mortgage with a 409 Credit Score?

Having a credit score of 409 means that your chances of securing a mortgage approval are unfortunately quite slim. This low score suggests that you may have encountered substantial financial challenges in the past, such as defaults or missed payments. Lenders typically require a higher score to provide a mortgage, as it offers them more confidence in a borrower's ability to repay.

Your current financial position may be difficult, but it doesn't have to define your future. While improving your credit score will take time, it's definitely possible. You could start by addressing any existing debts or delinquencies that are contributing to your low score. Prioritize repayment plans and practice responsible credit behaviors. Also, explore alternatives such as Federal Housing Administration (FHA) loans, that may offer some flexibility for those meeting certain criteria, even with lower credit scores. At this stage, patience and discipline helps. Remember, your financial path is not immutable and every journey towards financial health begins with a single step.

Can I Get a Credit Card with a 409 Credit Score?

Bearing a credit score of 409 can make it exceptionally tough for you to secure approval for a standard credit card. Creditors usually regard such a score as risky, indicating a past ingrained with financial hindrances or potential mismanagement of funds. It's surely a disheartening prospect, but it's equally vital to confront it with rationality and understanding. Recognizing your existing credit standing signifies the initial step towards recuperating your financial health, despite how uncomfortable the reality may be.

Faced with the challenges that come with a low credit score, you may want to explore other options such as secured credit cards. These cards necessitate a deposit that serves as your credit limit. They are more readily available and can help restore your credit gradually. Another option could be seeking a co-signer or considering prepaid debit cards. While such options may not provide an immediate fix, they can serve as constructive mechanisms in your journey towards financial steadiness. Keep in mind that any credit available to someone with a low score like 409 will most likely present with significantly higher interest rates due to the increased risk perceived by lenders.

Can I Get a Personal Loan with a 409 Credit Score?

Having a credit score of 409 can pose some challenges when it's time to apply for a personal loan. Most traditional lenders may see this as a red flag, indicating a history of financial difficulties suggesting a higher risk for repayment. It's a tough reality to face, but it's vital to understand what this score means for your borrowing ability.

Though options might be narrowed, there are still possibilities for securing a loan. You could consider a secured loan, utilizing an asset such as property as collateral. Alternatively, a co-signed loan, where someone with a higher credit score acts as a guarantor for you, could be an option. Another avenue might be peer-to-peer lenders who may have relatively lenient credit requirements. However, it's crucial to bear in mind, these options often carry higher interest rates as a reflection of the elevated risk for the lender.

Can I Get a Car Loan with a 409 Credit Score?

Receiving approval for a car loan with a credit score of 409 is likely to be a strenuous task. Usually, lenders favor scores above 660 to offer better terms, and any score lower than 600 tends to be seen as subprime. Your score of 409 falls well within this subprime category, possibly leading to steep interest rates or outright refusal of the loan. This is due to lenders perceiving a lower credit score as a higher risk, as it often signals potential repayment issues in the formal records.

Despite this, having a lower credit score doesn't entirely prevent you from fulfilling your auto purchase aspirations. There are some lending institutions that cater to people with lower credit scores. However, be vigilant as these loans usually carry considerably higher interest rates. The reason for these increased rates comes down to the lender seeing a higher level of risk, and it acts as a protecting factor for their investment. Navigating this route may be complex, but with diligent consideration and thorough examination of the loan terms, the possibility of obtaining a car loan isn't completely out of your reach.

What Factors Most Impact a 409 Credit Score?

Seeking to better understand a credit score of 409 is an important step towards a better financial life. With thorough examination of your financial behavior, you can identify the key areas contributing to your current score and create a plan for improvement.

Payment History

Your past payment patterns play a significant role in generating your credit score. Late payments, or payments you've defaulted on, could be largely responsible for your 409 score.

How to check: Undertake a detailed review of your credit report. Look out for any late or missed payments that might have resulted in devaluing your score.

Credit Utilisation

Your credit utilisation ratio can greatly impact your score. If you're consistently close to or exceeding your credit limit, this is likely affecting your score in a negative way.

How to Check: Study your credit card statements. If balances are high compared to your available limit, efforts should be made to reduce these balances.

Length of Credit History

A short credit history may be responsible for your low score.

How to Check: Inspect your credit report to determine the longevity of your oldest and youngest accounts, as well as the average age of all your credit accounts. Also, evaluate if you've started any new accounts recently.

New Credit and Credit Mix

If your credit portfolio lacks diversity (like different types of loans) or if you've been recklessly acquiring new credit, this could be hampering your score.

How to Check: Review your account types on your credit report. Consider if you have been prudent while applying for new credit.

Public Records

Public records, including bankruptcies and tax liens, can have a severe negative effect on your score.

How to Check: Go over your credit report for any public records and take necessary action to resolve any negative listings.

How Do I Improve my 409 Credit Score?

A credit score of 409 is admittedly less than ideal, but taking informed, purposeful action can help you navigate your way to an improved score. Here’s your personalized roadmap to improvement:

1. Acknowledge Collection Accounts

One big hit to credit scores like yours often comes from debt collection accounts. Take a firm hold by initiating contact with collections agencies, confirm account details, and discuss feasible payment options. Every paid debt makes your journey a little smoother.

2. Alleviate Credit Balances

A high amount of credit card debt can be a big drain on your credit health. Aim for reducing your credit balances below 30% of your credit limit, and for a more positive long-term impact, strive for a target of less than 10%. Prioritize clearing off debts on cards with the highest utilization rates.

3. Credit Builder Loans

When traditional credit cards are hard to attain due to low scores, consider a credit builder loan. Start by borrowing a small amount and making regular repayments. This strategy can demonstrate responsible credit behavior and effectively boost your score.

4. Tap into Secured Credit Card

A secured credit card, backed by cash collateral, can be another feasible step. This card lets you make purchases up to your collateral limit. Manage it wisely, keep the balance low, and pay off monthly totals to show positive credit behavior.

5. Consider a Co-Signer

Loans or credit cards with a trusted co-signer can provide additional opportunities to rebuild your credit, provided you make timely payments. Make sure your credit activity is reported to credit bureaus, as this will positively impact your credit history.

Remember, these actions, while simple, require dedication and consistent effort on your part. But take heart, a bright financial future is achievable!