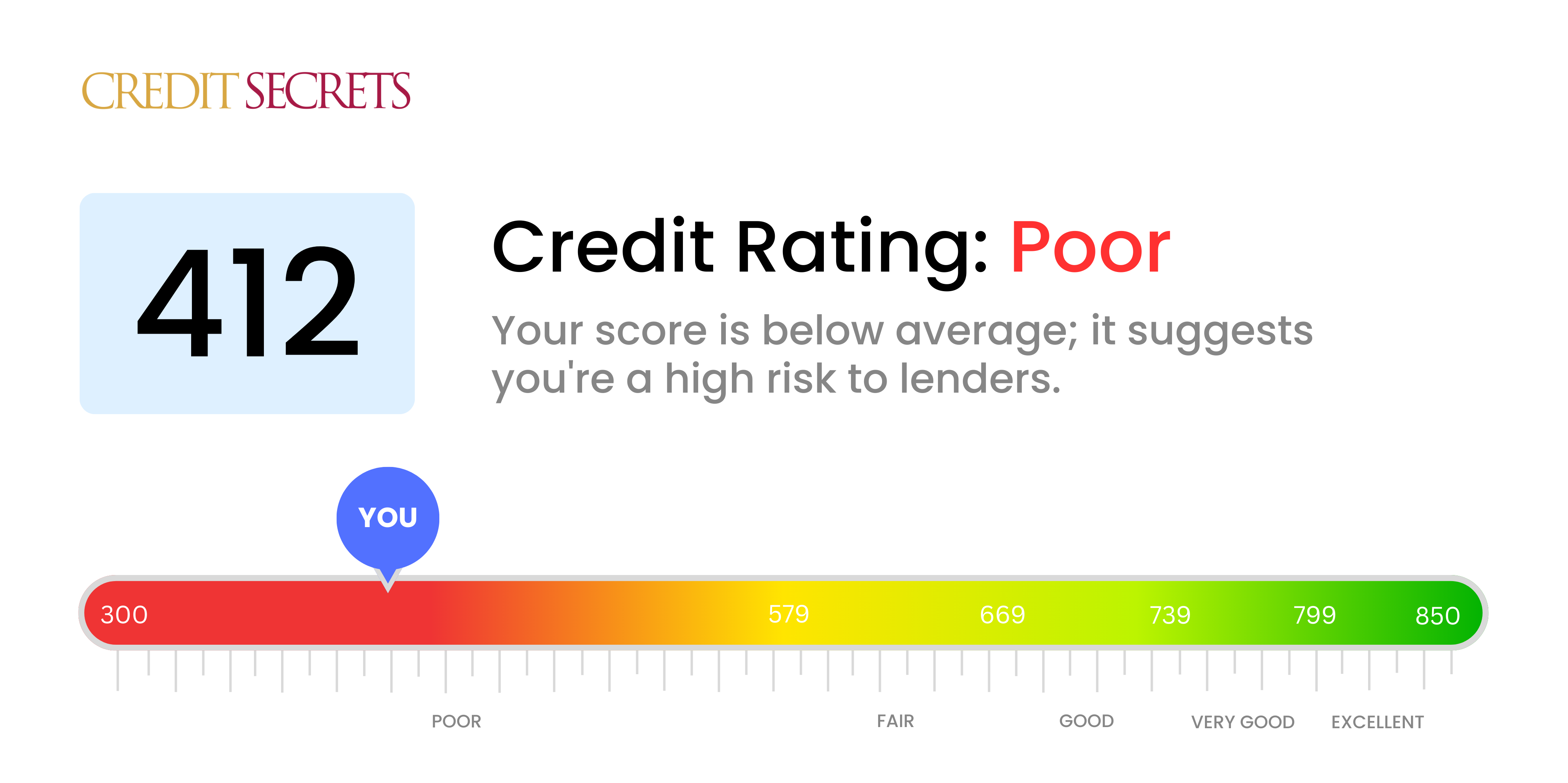

Is 412 a good credit score?

A credit score of 412 is unfortunately considered a poor credit score. Those with this score may face difficulties in getting approved for new credit, may be offered high-interest rates when credit is extended, and may even find it challenging to rent a home or get certain types of jobs.

However, don't lose hope. Improving your credit score is entirely possible and can make a major difference in your financial life. Start by consistently paying all of your bills on time, reducing your existing debt, and being cautious about applying for new credit. Over time, these actions can help boost your score and improve your financial standing.

Can I Get a Mortgage with a 412 Credit Score?

With a credit score of 412, obtaining a mortgage will be highly challenging. This low score is typically perceived by lenders as an indication of previous financial difficulties, such as missed or defaulted payments. Understandably, this situation may seem daunting. It's important, however, to remember that negative financial circumstances can be overcome, even if progress can sometimes be slow.

Acquiring a mortgage with such a score isn't typically feasible because most lenders consider a score in this range as too high-risk. Interest rates, even if a mortgage is approved, may be steep. As an alternative, consider building a stronger credit foundation before applying for a mortgage. Identify the factors contributing to your low score, like unresolved debt or inconsistencies in payment history. By addressing these issues and maintaining a pattern of responsible credit use, you can gradually enhance your score and eventually put yourself in a favorable position for a mortgage in the future.

Can I Get a Credit Card with a 412 Credit Score?

A credit score of 412 is severely low, making it rather improbable to secure approval for a standard credit card. This score indicates a troubled financial history, which lenders may regard as a significant risk. It's tough to face, but it's important to keep a clear-eyed perspective about your credit status. Appreciating your current financial situation is a vital step towards better financial health, even though it might involve some uncomfortable facts.

Because a typical credit card might not be a feasible option at this stage, consider alternatives such as a secured credit card. These cards require a deposit which serves as your credit limit, making them more attainable, and they can be instrumental in gradually rebuilding your credit. Co-signers and pre-paid debit cards should also be considered as potential options. Though they don't provide an immediate fix, these alternatives can serve as practical tools on your path to financial recovery. However, keep in mind that interest rates for any available credit to individuals with such a low score tend to be quite high, due to the increased risk perceived by lenders.

Can I Get a Personal Loan with a 412 Credit Score?

Your credit score of 412 is decidedly below the range typically seen as satisfactory by most conventional lenders. A score this low suggests considerable risk to loan providers, implying that obtaining approval for a traditional personal loan might not be possible. This situation may seem difficult, but it's crucial to understand what this score means for your borrowing potential.

While traditional personal loans may be hard to secure, there are alternative paths worth considering. Secured loans, for an example, involve providing collateral as a safety net. Co-signed loans could be another feasible option, where someone with a higher credit score co-signs your loan application. And don't forget about peer-to-peer lending platforms - they are sometimes more lenient and understanding of low credit scores. However, be aware that these alternatives often carry higher interest rates and less accommodating terms, as a reflection of the higher risk posed to the lender

Can I Get a Car Loan with a 412 Credit Score?

With a credit score of 412, it's highly unlikely that approval for a car loan will be granted. Approval for such loans usually requires a score well above 660, and scores below 600 are often viewed as deficient. A credit score of 412, being in the deficient range, could lead to steeply higher interest rates or outright refusal of the loan. This is because a low credit score means higher risk for lenders. The low score implies that there could be obstacles when it comes to repaying the debt.

That said, a low credit score doesn't entirely exclude the chance of acquiring a car loan. Some lenders focus on assisting individuals with lower credit scores. But a word of caution - these loans typically carry extremely high interest rates. These increased rates accommodate the higher risk lenders are undertaking. Despite the potentially rough journey, with careful evaluation and detailed examination of the loan’s terms, obtaining a car loan isn’t entirely off the table.

What Factors Most Impact a 412 Credit Score?

Unpacking a credit score of 412 is essential for your journey to financial recovery. Recognizing and tackling the elements impacting this low score can lay the foundation for a stronger financial future. Every financial path is distinct and full of potential for growth and learning.

Payment History

Payment history heavily impacts your credit score. Late payments or defaults are likely contributing to this low score.

How to Check: Scrutinize your credit report for any late payments or defaults. Think of any instances where you delayed payment, as this could be damaging to your score.

Credit Card Balances

Maxing out your credit cards is harmful to your score. Your credit cards may be burdened with high balances, thus lowering your score.

How to Check: Look at your credit card statements. Are you nearing your card limits? Aiming for lower balances can be helpful.

Credit Lifespan

Short credit history can negatively impact your score.

How to Check: Check your credit report to assess the ages of your accounts. Reflect on whether you have newly opened accounts.

Type of Credit and Fresh Credit

Managing a variety of credit types and new credit in a responsible manner is key for a good score.

How to Check: Inspect your types of credit accounts, such as credit cards, retail accounts, and loans. Consider whether you are not applying for new credit too frequently.

Legal Proceedings

Public records like bankruptcies or tax liens can majorly dent your score.

How to Check: Review your credit report for any legal proceedings. Attend to any that may need to be resolved.

How Do I Improve my 412 Credit Score?

With a credit score of 412, things might seem challenging. However, deliberate measures can set you on the path to substantial improvement. Let’s go over the most fitting actions given your current situation:

1. Deal with Collections

Having accounts in collections can drastically pull down your credit score. Check your credit report, address these accounts and negotiate payment plans where applicable. Clear these to prevent further damage to your score.

2. Limit Credit Card Usage

Avoid compounding your financial constraint by minimizing your credit card usage. If you must, ensure it’s well below 30% of your credit limit. Commit to spending less and paying down your outstanding balances.

3. Obtain a Secured Credit Card

Your present score may make it challenging to secure a regular credit card. A viable alternative is a secured credit card. Maintain good usage habits by making minor purchases and clearing all outstanding balances monthly. This gradually creates a solid payment history.

4. Sustain Credit Building Relationships

Having someone with excellent credit add you as an authorized user on their credit card can boost your credit score. Remember to ensure the card company reports user activities to credit bureaus.

5. Opt for Different Credit Types

Variety in credit types can positively affect your score. After building a commendable history with your secured card, try acquiring a credit builder loan or a retail credit card. Be sure to manage them responsibly for the best outcome.