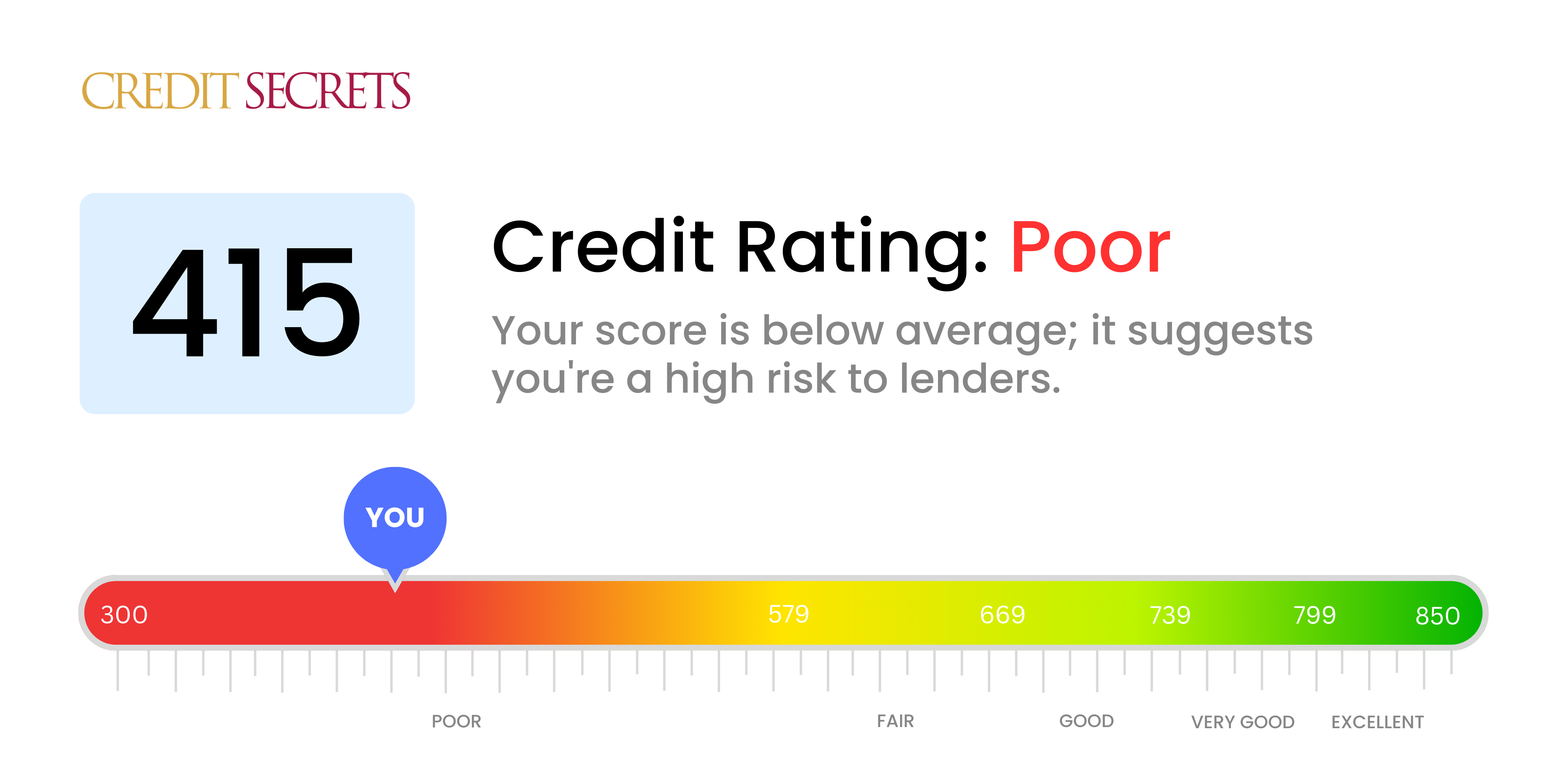

Is 415 a good credit score?

With a score of 415, your credit ranking falls into the 'Poor' category. This might make borrowing challenging, as lenders typically view poor credit scores as a risk.

However, don't lose hope - this score isn’t a life sentence. Lots of people have improved their credit scores from this range. It's possible to make changes and begin your journey to a stronger financial future. Understanding the factors that contribute to your score is a great start. You can then focus on improving these areas, such as consistently paying bills on time, and reducing your debt. And remember, patience is key. Building a better credit score won't happen overnight, but each step you take is a step closer to your financial goals.

Can I Get a Mortgage with a 415 Credit Score?

Unfortunately, a credit score of 415 is significantly low and will most likely impede your ability to secure a mortgage. Lenders typically require a minimum score to consider you a viable applicant, and this score falls considerably below that threshold. A score in this region suggests a history of financial strain, including defaults or missed payments.

There is, however, a silver lining. It might be challenging, but it's not impossible to raise your credit score. Start by dealing with any existing debt or overdue payments that may be affecting your credit. Develop a habit of making all your payments on time and responsibly managing your credit. Remember, improving your credit score is a marathon, not a sprint - it takes consistent effort and time. Eventhough the journey might seem long, it should be remembered that this is an attainable goal with patience and diligence. Moving forward, consider alternatives such as 'rent-to-own' options or investigate government-backed loans that cater to individuals with lower credit scores.

Can I Get a Credit Card with a 415 Credit Score?

With a credit score of 415, it's not likely that you'll be approved for a conventional credit card. This score is seen as high risk to lenders, usually indicating past financial struggles or money management issues. Even though this is tough to accept, it's key to handle it honestly and confidently. Recognizing your credit status is the initial step towards financial growth, which sometimes includes acknowledging some harsh realities.

Given the challenge of a low score like this, you could consider different options such as secured credit cards. These require a deposit that becomes your credit limit and are typically easier to get. They can also assist you in repairing your credit over time. Another possible route is to find a co-signer or look into pre-paid debit cards. Remember, these alternatives are not a quick solution, but they can be stepping stones on the path to financial stability. Also, it's critical to understand that any credit available to you with such a score usually comes with considerably higher interest rates due to the increased perceived risk for lenders.

Can I Get a Personal Loan with a 415 Credit Score?

Having a credit score of 415 makes securing a personal loan through traditional lenders highly challenging. To such lenders, this score may suggest a high risk of repayment failure. It's tough, no doubt. Still, grasping the reality of your credit score is crucial in understanding your borrowing potential.

While mainstream personal loans may not be a viable option, you might need to consider alternatives. Secured loans, which require collateral, are one solution. Then there's co-signed loans where someone with a higher credit score can stand in for you. Peer-to-peer lending platforms can also be considered as they occasionally have less stringent credit score requirements. It's worth noting, however, that these alternative routes often come with higher interest rates and less favorable terms due to the increased risk perceived by the lender.

Can I Get a Car Loan with a 415 Credit Score?

Having a credit score of 415 can pose a serious challenge when seeking approval for a car loan. Commonly, lenders look for scores greater than 660 to offer agreeable terms, and any score less than 600 is often deemed as 'subprime'. Unfortunately, your score of 415 fits into this subprime bracket, and this could mean higher interest rates or even a denial of loan. The reason for this is that a lower credit score is seen as a greater risk to lenders, indicating potential difficulties in paying back the borrowed amount.

Despite a low credit score, your car ownership aspirations are not entirely off the table. Some lenders do specialize in working with people who have lower credit scores. However, be wary, as the trade-off usually is notably high interest rates. This is a safeguard lenders apply due to the perceived risk they associate with. Even though it's a bit of a daunting path, with careful decision-making and understanding of the terms, the prospect of securing a car loan is not completely out of reach.

What Factors Most Impact a 415 Credit Score?

A score of 415 may seem daunting, but understanding what elements contribute to this score can help illuminate your path to improved financial health. Below are a few key factors that can influence such a score.

Payment Consistency

Your payment history likely plays a significant role in your current score. Frequent late or missed payments can take a toll on your credit score.

How to Check: Look towards your credit report for any cases of late or missed payments. Confronting these instances is the first step towards a better score.

Usage of Available Credit

Excessive use of your available credit can also contribute to a lower score. For instance, if you are utilizing your credit cards to their reduced capacity, this is likely negatively impacting your score.

How to Check: Review your credit card statements. Aim to maintain balances that are well below your credit limits.

Account Age

A brief credit history may be bringing down your score. Longer credit histories often correlate with higher scores.

How to Check: Scrutinize your credit report to evaluate the age of your oldest and newest credit accounts.

Credit Type Variety & Recently Opened Accounts

Lack of diversity in your credit types or recently opened new accounts can also negatively influence your score.

How to Check: Read through your credit report. Look for an assortment of credit accounts and recent account activity.

Judgements or Legal Actions

If your credit report has any public records like bankruptcies or liens, this is a significant factor that could have lowered your score.

How to Check: Revisit your credit report to identify any public records. Take action on any listed items that require attention.

How Do I Improve my 415 Credit Score?

With a credit score of 415, you’re currently in the ‘poor’ category, but don’t worry, this isn’t a permanent situation. You can take specific, accessible actions to start seeing improvements in your score. Let’s walk you through the steps that are most relevant for your scenario.

1. Clear any delinquent accounts

First up, tackle any accounts with late or missed payments. These are heavily affecting your score. It’s crucial to contact your creditors and arrange a plan to bring these back to good standing. Remember, paying off the accounts with longest delinquency first will impact your score the fastest.

2. Pay down maxed-out credit cards

Your credit utilization — how much of your available credit you use — significantly impacts your score. Focus on paying back the amount you owe on your credit cards. Ideally, aim to lower this to under 30% of your credit limit and later, try maintaining it under 10%. Begin with the cards that are closest to their limit.

3. Consider a secured credit card

Secured credit cards offer a practical route to rebuilding your credit. They require a cash deposit as collateral but can help you build a positive credit history if used wisely. Make small purchases and pay them off without any delay every month.

4. Request to be an authorized user

If a trusted person with a strong credit record would allow you to be an authorized user on their credit card, this could assist in advancing your score. It will add their good credit habits into your account. Make sure their card issuer reports user activity to the credit bureaus.

5. Start diversifying your credit

Adding variety to your credit – such as retail cards or credit builder loans – can give your score a neat boost. Take this step once you manage a secured card well. But remember, only open new credit accounts as needed and handle them responsibly.