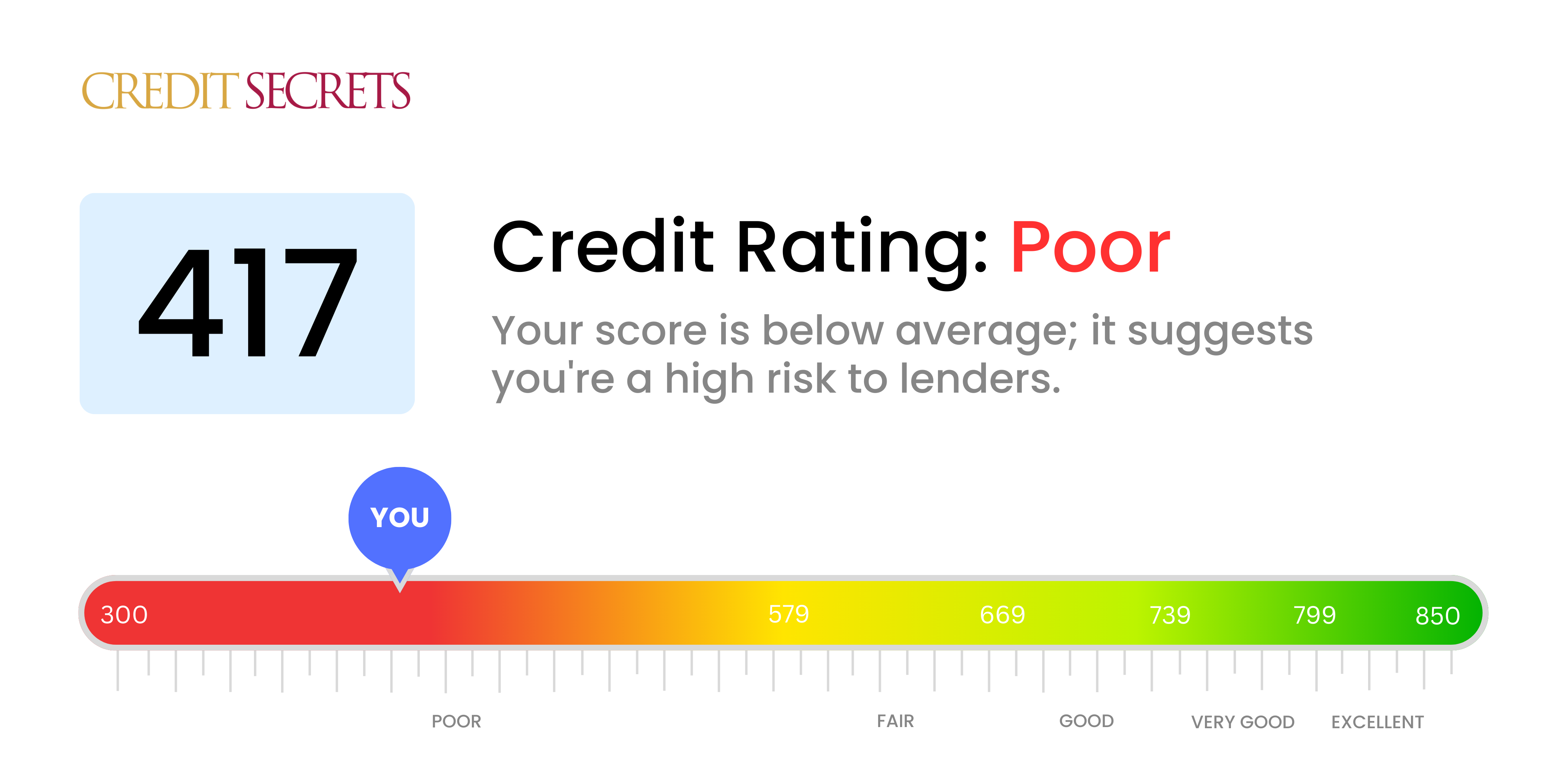

Is 417 a good credit score?

Your score of 417 falls into the category of 'Poor'. This might sound daunting, but don't be dismayed; it's just a snapshot of your financial health at this moment and can be improved with time and effort.

With a poor credit score, you may face some challenges, such as getting loan applications denied, or being approved, but with higher interest rates. But remember, this isn't a life sentence. You can take steps to improve your credit score with a disciplined approach towards financial management.

Can I Get a Mortgage with a 417 Credit Score?

Regrettably, a credit score of 417 is considerably low and is likely to lead to difficulty in securing a mortgage approval. Typically, most lenders require a minimum score significantly higher. A score at this level may signal to potential lenders that there have been significant past difficulties managing finances, such as defaults or missed payments.

Nevertheless, please don't lose hope. While approval for a traditional mortgage may not be immediate, there are other avenues you could consider. Exploring other loan types, such as Federal Housing Administration (FHA) loans, which have more lenient credit requirements, could be an option. Alternatively, you might consider adding a co-signer with a higher credit score to your application. Both of these paths, however, come with their own obstacles and should be researched thoroughly. Additionally, it's important to make strides towards improving your credit score. This won't be a quick journey, but remember, each step forward, no matter how small, can help lead you to your financial goals.

Can I Get a Credit Card with a 417 Credit Score?

Having a credit score of 417 might make it tough for you to be approved for a conventional credit card. This score is usually seen as high-risk by lenders, implying a past of financial issues or mishandling of funds. This can certainly feel disheartening, but it's crucial to face the situation with honesty and determination. Recognizing the state of your credit is the initial move toward financial recuperation, even if it introduces some uncomfortable realities.

With a score as low as this, you might want to consider alternatives like secured credit cards. These cards necessitate a deposit which will become your credit limit. It's generally simpler to be approved for this type of card, and they can assist in rebuilding credit over time. Another alternative could be having a co-signer or using pre-paid debit cards. Bear in mind, these choices won't magically solve your credit issues, but they're stepping stones on your path to financial stability. Lastly, remember any credit available for credit scores like yours may feature considerably higher interest rates, indicating the elevated risk perceived by lenders.

Can I Get a Personal Loan with a 417 Credit Score?

Having a credit score of 417 can make it quite challenging to secure a traditional personal loan. Lenders often view this score as indicative of a high-risk borrower, which can significantly reduce your eligibility for a loan. This is undeniably a tough situation, but confronting the implications of this credit score on your financial decisions is exceedingly important.

As traditional loans might not be accessible, you could consider other routes. Secured loans are an option if you can offer an asset, like your car or house, as a guarantee against the loan. Co-signed loans are also a possibility, particularly if you have someone with a strong credit score willing to support your application. Another alternative is peer-to-peer lending platforms which might have less strict credit requirements. It's essential, however, to remember that these options often carry higher interest rates and less accommodating terms, which are reflective of the increased risk to the lender.

Can I Get a Car Loan with a 417 Credit Score?

If your credit score is 417, getting approved for a car loan can be very difficult. Most lenders ideally want a credit score above 660. A score below 600 is firmly in the subprime category and yours is much lower at 417. This low score indicates to lenders that you might have struggled with paying back borrowed money in the past, and they see this as a risk.

However, don't lose hope. Even with your credit score, you still have options. There are some lenders who specialize in car loans for people with lower credit scores. Be aware though, these loans typically come with higher interest rates because of the increased risk the lender is taking on. It's not an easy path, but with careful planning and a clear understanding of the loan terms, you could still secure a car loan.

What Factors Most Impact a 417 Credit Score?

Unraveling the factors resulting in a 417 credit score is vital to set the pace towards a bright financial future. We understand that financial circumstances differ from person to person, hence it's important to acknowledge the learning curve and growth in this process.

Negative Information

One key contributor that might have led to this score is the presence of negative information, such as collections, bankruptcies, or judgments, on your credit report.

How to Check: Peruse your credit report for any negative items. Pay particular attention to the 'public record' and 'collections' sections.

High Amounts of Debt

Your levels of debt might also be influencing your score. This might include outstanding balances on credit cards or loans.

How to Check: Evaluate your credit report for large balances or high credit utilization rates. If you’re near your credit limits, this could be harmful to your score.

Poor Payment History

Having a history of late or missed payments can significantly decrease your score.

How to Check: Inspect your credit history for any missed or late payments. Any listed defaults or delinquencies could be impacting your score.

Lack of Positive Credit Information

Lack of enough positive information, such as a sparse credit history or few accounts in good standing, can limit your score.

How to Check: See if you have enough accounts in good standing on your credit report.

New Credit Inquiries

Excessive new credit inquiries might be lowering your overall score.

How to Check: Review your credit report for multiple recent hard inquiries. Remember, applying for credit should be mitigated to avoid decrease in score.

How Do I Improve my 417 Credit Score?

A credit score of 417 is indeed a challenge, but rest assured that with the right strategies, it is definitely surmountable. Let’s focus on these crucial and workable steps for your current score level:

1. Prioritize Delinquent Accounts

Start by addressing any outstanding accounts. By initially focusing on accounts that are significantly overdue, you’ll have a better chance of improving your credit score. If it seems overwhelming, consider reaching out to your creditors about possible payment plans.

2. Manage Credit Card Usage

It’s crucial that credit card balances are managed effectively. If your balance is more than 30% of your credit limit, aim to reduce it. A lower balance ratio has a beneficial effect on your credit score, especially if you can maintain it below 10%.

3. Contemplate Secured Credit Card

Given your credit score, getting a traditional credit card may be tough. Look for a secured credit card where a cash collateral deposit becomes your available credit. Regularly making purchases and promptly paying off the monthly balance helps build a healthier credit history.

4. Investigate Authorized User Status

A useful step might be to become an authorized user on a trusted person’s credit card. Doing so can greatly aid your credit score since their good credit habits will reflect in your credit report. However, this only works if the card issuer reports the authorized user’s activity to the credit bureaus.

5. Explore Different Types of Credit

A broader range of credit types can assist in boosting your credit score. Once a good payment record is established with the secured credit card, consider applying for a retail credit card or a credit builder loan, handling them prudently to enhance your credit history.