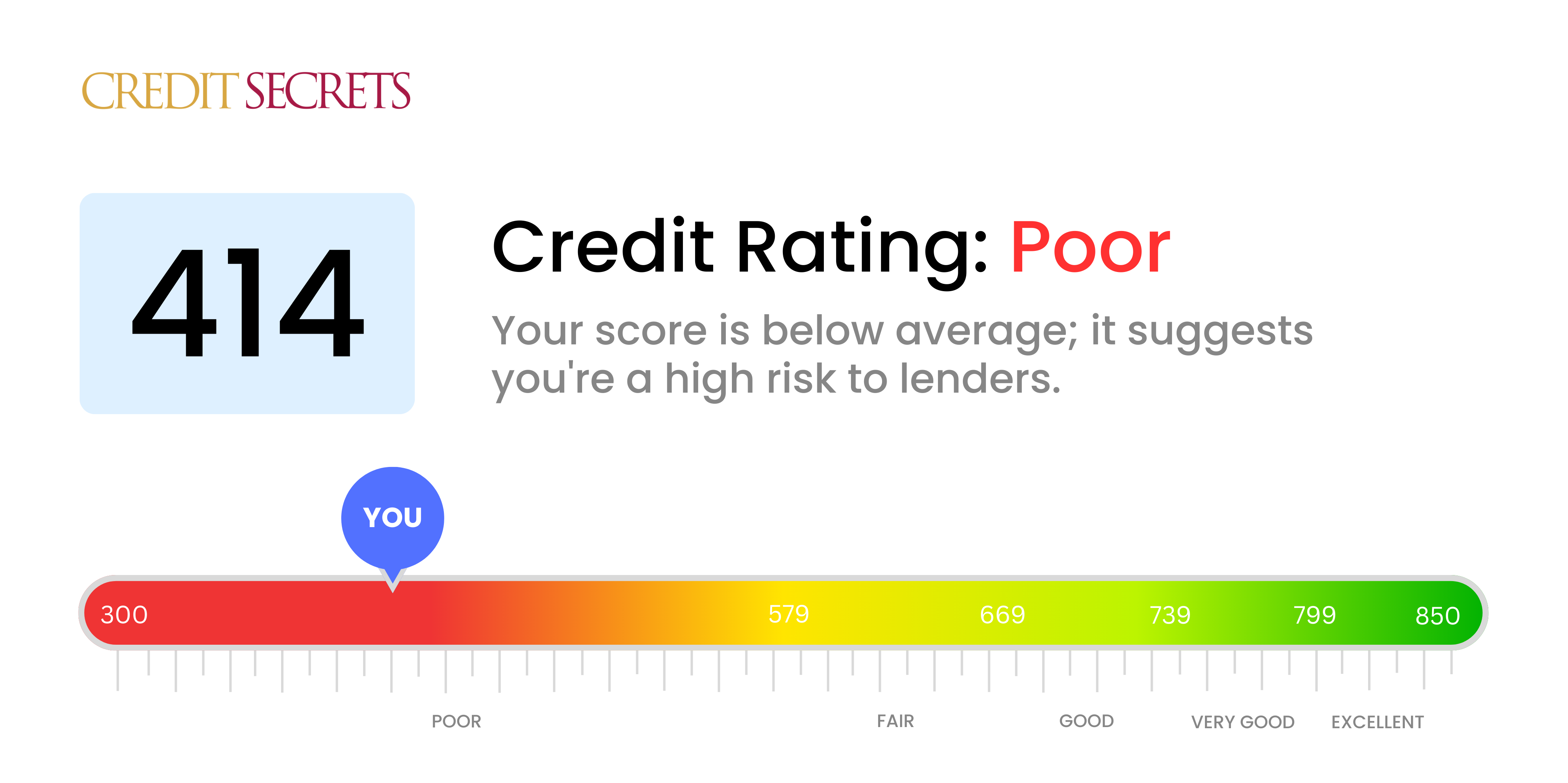

Is 414 a good credit score?

With a credit score of 414, you are in the 'poor' category. This might create some difficulties when you're trying to access various types of personal finance products, such as loans and credit cards. However, it's important to remember that every situation is unique, and there are always opportunities for improvement.

A score of 414 can indicate a history of late repayments, debt collections, bankruptcies, or other negatively impacting aspects on your credit report. While it may limit your financial opportunities now, it's never too late to start working towards better credit. Knowledge, consistent effort, and patience can help you on your journey towards a healthier financial future.

Can I Get a Mortgage with a 414 Credit Score?

Unfortunately, with a credit score of 414, it's improbable that you'll secure approval for a mortgage. This score is significantly under the required minimum for most lenders. It may suggest a record of financial trouble, such as late payments or defaulted loans.

Don't be disheartened, though. A poor credit score isn't a dead-end, but it does signal the need to embark on a credit-improvement journey. Start off by tackling any debts or delinquencies currently dragging your score down. Then, focus on building a clean financial track record featuring timely payments and careful credit usage. With perserverance, your credit score situation can slowly, but surely, improve. But kindly remember that it's a long-term commitment, so it's key to remain patient and consistent all throughout.

Alternatively, you could consider options like FHA loans. They often have more flexible credit requirements, which might be a more suitable option for you at this point.

Can I Get a Credit Card with a 414 Credit Score?

With a credit score of 414, it's going to be tough to get approval for a standard credit card. This score usually suggests to lenders that there's been some financial missteps in the past. This isn't an easy situation to be in, and it's entirely natural to feel let down. However, acknowledging where your credit stands is a crucial step towards regaining financial footing. It may not be the most comfortable realization, but honesty can help guide the next steps forward.

Given the difficulties that come with this low credit score, alternative options like secured credit cards may be worth looking into. These cards operate on a deposit that effectively becomes your credit limit. This kind of card can be more accessible to obtain and can help with rebuilding credit over a period. Look into possibilities like having a co-signer or utilizing pre-paid debit cards as additional alternatives. Remember, these options aren't instant fixes but serve as potential resources in your progress towards financial stability. Lastly, keep in mind that any available credit to folks with these scores will often carry significantly higher interest rates due to the increased risk seen by lenders.

Can I Get a Personal Loan with a 414 Credit Score?

With a credit score of 414, securing a personal loan from a traditional lender will be quite challenging. This score, in the scope of lending, indicates a high level of financial risk and could make it less likely for you to receive a loan approval. It's certainly a tough spot to be in, but knowing and accepting the implications of this credit score on your borrowing potential is the first step in financial awareness and responsibility.

You may need to explore other alternatives outside the traditional lending sphere. Some of these alternatives include secured loans, which require collateral, or co-signing loans, where an individual with a higher credit score can vouch for you. Peer-to-peer lending platforms could also be a suitable option, as they may be more lenient with credit requirements. Just remember, these alternatives often bring about higher interest rates and less favorable terms due to the elevated risk for the lender.

Can I Get a Car Loan with a 414 Credit Score?

A credit score of 414 can make getting approved for a car loan difficult. Generally, lenders prefer to offer loans to individuals with scores above 660. Unfortunately, the credit score of 414 resides well into the range categorized as subprime, signifying a certain level of risk for lenders. This risk is often echoed through higher interest rates or even outright denial of loans. It's essentially about the lenders' confidence in your ability to repay the borrowed funds, and a low score such as 414 could imply potential repayment issues.

Regardless of the challenges, hope isn’t entirely lost. There are lenders who work specifically with individuals who have lower credit scores. Although, it's important to be mindful during this process because these kinds of loans tend to have notably steeper interest rates. This is their way of offsetting perceived risks. Understandably, securing a car loan with a 414 credit score might not be the smoothest journey, but with due diligence and a complete understanding of your loan's terms, it could still be within reach.

What Factors Most Impact a 414 Credit Score?

Let's make sense of a score of 414. By understanding the determining factors of your credit score, we can begin striving for financial enhancement. Everyone's financial journey is different, with countless opportunities for growth and learning.

Detailed Payment History

Your score can be significantly influenced by your payment history. Late payments and defaults might be a significant contributor to your current score.

To Investigate: Check for any late payments or defaults in your credit report. Think about periods when payments could have been delayed and how this may have impacted your score.

Credit Card Utilization

High levels of credit utilization can bring your score down. If your card balances are frequently close to, or at, the card limits, it can affect your score.

To Check: Look at your credit card statements. Are your card balances often near their limits?. Try to keep your balances low compared to your limits.

Short Credit History

A shorter credit history could harm your credit score.

To Verify: Analyze your credit report to see how far back your credit history goes, from your oldest accounts to the most recent ones, and the average account age.

Variety and New Credit

A mix of different types of credit, as well as handling new credit responsibly, is key to keeping your credit score healthy.

To Evaluate: Take a look at the different types of credit accounts you have, such as credit cards, retail accounts, installment loans or mortgage loans. Consider how often you apply for new credit.

Public Records

Public records such as tax liens and bankruptcies have a potent influence on your credit score.

To Evaluate: Scan your credit report for any public records. Tackle any items that need resolving.

How Do I Improve my 414 Credit Score?

A credit score of 414 signifies severe credit distress, but with the right actions, turnaround is possible. Here are the most suitable strategies at this credit level:

1. Rectify Delinquent Accounts

Begin by addressing any accounts that are overdue. Settle the most delinquent ones as they dent your credit score the most. You can reach out to your lenders to discuss a feasible payment plan.

2. Minimize Credit Card Debt

Elevated credit card balances, compared to your credit limit, play a significant role in lowering your score. To improve it, aim to reduce your balances to less than 30% of your limit and strive to keep the ratio below 10% over time. Start by settling the debts with the highest utilization rates.

3. Opt for a Secured Credit Card

Given your current score, a regular credit card may be hard to acquire. You might consider a secured credit card, guaranteed by a refundable security deposit. Make small purchases and fully pay off the balance monthly to positively influence your credit history.

4. Request Legal User Status

Seek a relative or close friend with a good credit score to add you as an authorized user on their credit card. Your credit score could benefit from their timely payments. Ensure the card issuer reports user activity to credit bureaus.

5. Variegate Your Credit Portfolio

Diversifying your credit types can also assist in improving your score. After successfully managing a secured card, explore other credit options like credit builder loans or store credit cards, handling them prudently.