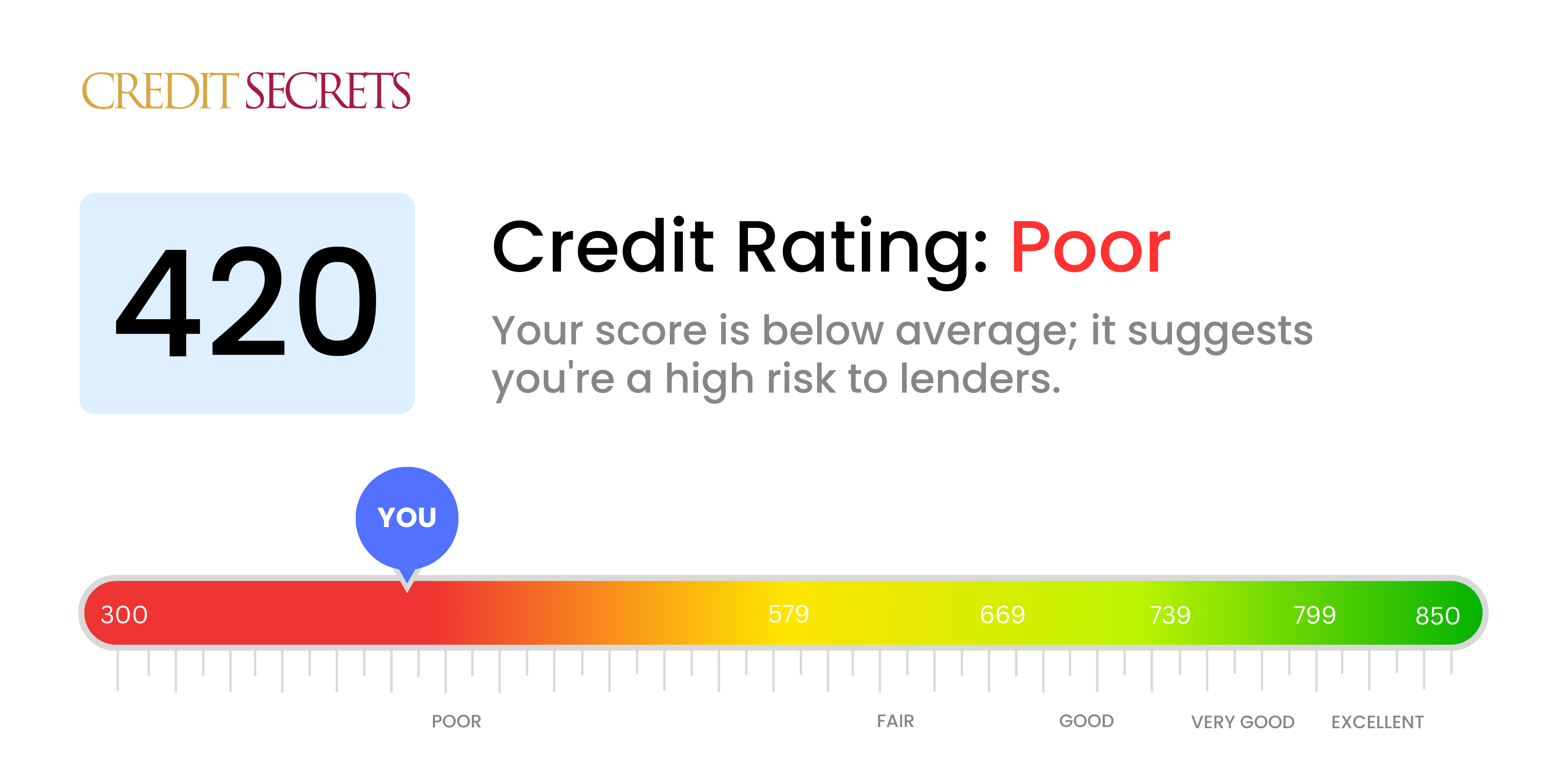

Is 420 a good credit score?

It's clear that a credit score of 420 isn't ideal. This falls into the 'poor' category, according to standard credit score ranges.

With a credit score like this, you might find it challenging when it comes to obtaining new credit, renting apartments, or securing favorable interest rates on loans. It's never too late to boost your score, and Credit Secrets is here to help you navigate this process. While your current situation might feel tough, making consistent, positive changes can lead to significant improvements over time.

Can I Get a Mortgage with a 420 Credit Score?

With a credit score of 420, it's not very likely that you'll qualify for a mortgage. This score is considerably lower than what most lenders typically require for loan approval. Unfortunately, a credit score in this range often signals serious past financial challenges such as late payments or defaults, which causes lenders to see you as a higher risk.

While this certainly may feel daunting, there are alternatives to consider. Some lenders specialize in 'bad credit' loans, which are designed for individuals with lower credit scores. While these loans may be easier to secure, they typically come with higher interest rates and stricter repayment terms. Another possibility is to delay the mortgage process and focus on improving your credit score. A steady record of on-time payments, low balances, and responsible credit use can gradually improve your score over time. This might take patience, but remember that each step forward is a step toward your financial goals.

Can I Get a Credit Card with a 420 Credit Score?

Having a credit score of 420 unfortunately does not make it easy for you to be approved for a traditional credit card. Such a score is considered quite low, indicating to lenders that you might have had previous issues with managing credit or financial hardship. This may sound a bit tough, but it's crucial to face the facts as they are. Being aware of your current credit standing helps you to plan for a more secure financial future, though it might involve some difficult realities.

Considering such a low credit score, alternatives like secured credit cards could become a strategic choice. These cards need a security deposit which then becomes your credit limit. Compared to traditional credit cards, secured ones are often simpler to get and can slowly help improve your credit score. Another option to think about could be getting a co-signer or using pre-paid debit cards. Even though these solutions don't resolve your credit score issues instantly, they serve as beneficial steps toward fiscal stability. Keep in mind, however, that any credit possibility open to you might have considerably higher interest rates, as this mirrors the elevated risk that lenders perceive with such scores.

A credit score of 420 suggests that you may encounter difficulties when applying for a traditional personal loan. Many lenders regard this score as risky, limiting your accessibility to conventional loan options. It's not the news you were hoping for, but it's important to be honest about the challenges such a score presents when it comes to borrowing.

However, remember that there are alternatives. You may want to consider secured loans, where you back the loan with collateral, or co-signed loans, where a person with a higher credit score guarantees for you. There are also peer-to-peer lending platforms which sometimes have more flexible credit score requirements. Keep in mind, these typically come with higher interest rates and less accommodating terms due to the elevated risk to the lender. Continuing on your financial journey, these might be feasible options to consider.

Can I Get a Car Loan with a 420 Credit Score?

Having a credit score of 420 can make securing a car loan quite difficult. Most lenders prefer scores that are above 660 as it provides them with confidence that the borrower can repay the loan. With a score of 420, you fall into the category often known as subprime – a term used for borrowers with low credit scores. This can make it harder to acquire a car loan, as lenders might see you as a higher risk.

However, this doesn't mean the possibility of owning a car is out of reach. There are some lenders who focus on serving individuals with lower credit scores. But be thoughtful in this decision, since these types of loans can have higher interest rates. This is a way for lenders to protect their investment due to the higher risk involved. However challenging, getting a car loan may still be achievable with patience and careful review of loan terms.

What Factors Most Impact a 420 Credit Score?

Understanding a credit score of 420 is crucial for making informed decisions towards improving your financial health. Knowing the reasons this score may be low can assist you in creating an action plan for progress.

Prior Late Payments

One of the major reasons behind a low score could be a history of late payments. Your payment history significantly impacts your credit score.

How to Check: Take a close look at your credit report. Identify any instances of late payments. These could have played a role in lowering your score.

High Credit Card Utilization

Commonly, a high credit utilization can contribute to a lower score. If you're using much of your available credit, it can cause a dip in your score.

How to Check: Look at your credit card statements. If your balances are nearing the credit limit, this could be affecting your score. Aim to keep your balances far below the limit where possible.

New Credit

Frequently applying for new credit can be another factor contributing to your score. New inquiries can temporarily lower your score.

How to Check: Reflect on how often you have been applying for new credit recently. If it has been frequently, it might be impacting your score.

Credit History Length

A short credit history might be another factor affecting your score negatively. A longer history typically helps improve your score.

How to Check: Look at your credit report to determine the age of your accounts. If new accounts have been opened recently, this could be impacting your score.

Derogatory Marks

Public records such as bankruptcies, collections, or tax liens can also significantly decrease your credit score.

How to Check: Review your credit report for any derogatory marks. Address these immediately to start improving your score.

How Do I Improve my 420 Credit Score?

Having a credit score of 420 may feel disheartening, but don’t be discouraged. Success can be achieved through dedication and the right approach to manage and rebuild your credit. Below are some practical steps tailored for your current situation:

1. Settle Any Collections or Charged-Off Accounts

Address any unpaid debts or accounts that have gone to collections or been charged-off. This is crucial since these types of debts significantly impact your credit score. Contact your creditors to discuss possible payment options. Once a payment agreement is reached, ensure the status change is reported to the credit reporting agencies.

2. Limit Your Credit Utilization

Try to limit your credit use to below 30% of your allowed credit limit if you have any active cards. High credit card utilization can reduce your credit score. Aim for a longer-term goal of keeping your utilization under 10%.

3. Consider a Credit Builder Loan

With your current score, qualifying for regular credit may be challenging. A credit builder loan, usually offered by credit unions or community banks, could be a feasible option. These loans are designed to help you establish a positive credit history.

4. Authorized User Agreement

Enquire from a reliable, trustworthy person, with a good credit history, if you can become an authorized user on his or her credit card. This can help boost your credit score by sharing in their positive credit history.

5. Manage New Credit Responsibly

New credit accounts, when used responsibly, can help to improve your credit mix and demonstrate your ability to manage different types of credit. Always ensure you make payments in full and on time.