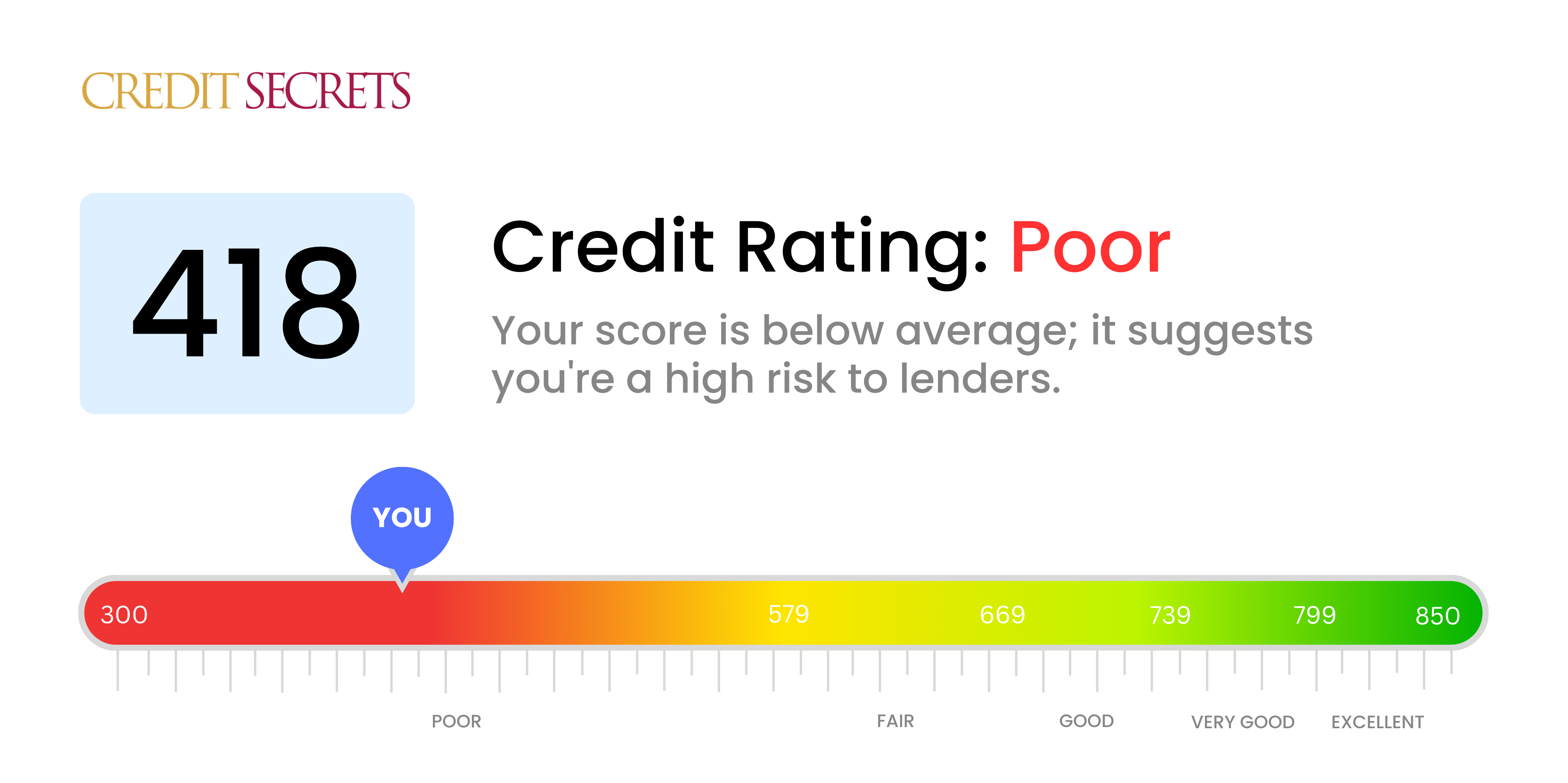

Is 418 a good credit score?

A credit score of 418 is considered to be in the poor range. This typically indicates that there have been significant credit problems in your past, likely making it difficult to qualify for most loans or credit cards. However, remember, it's just a number, and it's never too late to start working towards improving it.

While it may be challenging, a score of 418 is not a life sentence. There are proven strategies and practices you can apply, like paying bills on time, reducing debt and potentially opening a secured credit card, to rebuild credit over time. It's a journey, but every step you take towards raising your credit score is a step towards your financial freedom.

Can I Get a Mortgage with a 418 Credit Score?

If you have a credit score of 418, it's important to know that it could be challenging to secure a mortgage loan. This score is significantly below what most lenders consider the minimum standard for loan approval. Typically, a score in this range suggests a history of financial struggles that may include late payments, defaults, or other troubles.

While the current situation might seem daunting, there are other options available. One possible course of action may be to explore options like FHA loans, which are federally insured mortgages that generally have more lenient credit score requirements. Additionally, it could be beneficial to start implementing strategies to elevate your credit score. Paying off any lingering debts, maintaining a consistent record of making payments on time, and using credit responsibly can gradually improve your score over time. Ultimately, a commitment to elevating your financial stability could make a future mortgage approval more likely. Remember, while your credit score today may not grant you the mortgage you desire, it doesn't have to determine your financial future.

Can I Get a Credit Card with a 418 Credit Score?

With a credit score of 418, you may find it quite difficult to get approval for a regular credit card. This score is often seen by lenders as high-risk, signifying past financial issues or problematic money management. It's tough to come to terms with, but understanding where you stand with your credit is a crucial first step towards mending things financially, even if that means acknowledging some harsh realities.

In order to navigate around the uphill struggle of a low credit score, you could consider alternative options like a secured credit card. The credit limit of these cards matches a deposit you have to make, making it easier for you to get and start rebuilding credit with time. Additionally, you could also ponder becoming part of a joint account or using pre-paid debit cards. Always remember, these alternatives might not be a quick-fix but they could be handy launch pads on your road to financial stability. It's also worth noting that any sort of credit you may be eligible for could come with a higher interest rate, due to the increased risk lenders perceive.

Can I Get a Personal Loan with a 418 Credit Score?

A credit score of 418 is considerably lower than what most traditional lenders deem acceptable for personal loan approval. From a lender's perspective, this score represents a high level of risk. Although it's a tough situation, it's crucial to understand what this low credit score means for your borrowing possibilities.

While typical loans may not be an option, consider alternatives such as secured loans that require collateral, or co-signed loans involving someone with better credit standing guaranteeing for you. Peer-to-peer lending platforms are additional possibilities as they often have more relaxed credit requirements. Be aware, however, that these alternatives typically come with less favorable terms and higher interest rates due to the increased risk for the lender.

Can I Get a Car Loan with a 418 Credit Score?

Unfortunately, with a credit score of 418, securing approval for a car loan will likely be a difficult task. Most lenders often prefer to see scores upward of 660 for more favorable terms, and any score below 600 is usually placed in the subprime category. Your score, at 418, sits deep within this subprime group. This could result in higher interest rates or even possibly refusal of a loan. This stems from the fact that a lower credit score can suggest to lenders a greater risk of non-payment based on past experiences.

But, bear in mind, a lower credit score does not completely close off your opportunity of getting a car loan. There are specific lenders who offer services to those with lower credit scores. However, be careful, as these loans often come with much higher interest rates. This is because, for lenders, it's a means to protect their investment against the increased risk they are potentially taking. It might be slightly tougher, but with due diligence and a detailed understanding of the terms and conditions, successfully getting a car loan is still a distinct possibility.

What Factors Most Impact a 418 Credit Score?

Navigating a credit score of 418 can feel challenging, but understanding the factors that have contributed can be the first step towards improving your financial health. Each journey is unique, but knowing where to begin is an invaluable step.

Late or Missed Payments

One major factor impacting your score could be late or missed payments. Your payment history significantly impacts your credit score.

How to Check: Obtain a copy of your credit report and look for any late payments or defaults. Reflect on any past financial difficulties that could have resulted in late or missed payments.

Credit Utilization

A credit utilization rate that is too high can negatively impact your score. If your credit cards are maxed out, this could be a major factor in your score.

How to Check: Review your credit card statements. If the balances are close to or at the limit, this could be affecting your score.

Credit History

A short credit history might be influencing your score negatively. The length of your credit history can impact the calculation.

How to Check: Examine your credit report, taking note of the age of your oldest and newest accounts and the average length of your credit history.

Type of Credit and Recent Applications

Having a diverse mix of credit and not frequently applying for new cards can positively influence your score.

How to Check: Analyze the variety of accounts in your credit report, like credit cards, installment loans, and mortgages. Review your recent applications for new credit.

Public Records

Public records such as bankruptcies or tax liens can significantly affect your score to be this low.

How to Check: Look at your credit report for any public records. Work on resolving any listed items that may need attention.

How Do I Improve my 418 Credit Score?

Securing a credit score of 418 is a clear sign that your credit needs immediate attention, but don’t lose heart. There are several attainable and effective steps you can take right now to start rebuilding your credit score:

1. Revisit Your Credit Report

At this credit level, it is crucial that you review all your credit reports to ensure accuracy. Any incorrect negative marks can be disputed and possibly removed, which would give your credit score an instant boost.

2. Settle Any Outstanding Debts

Clearing your debts should be a priority. Connect with your debtors to formulate a repayment plan. Paying off your debts not only decreases the amount you owe but also displays a commitment to paying your financial obligations, which in turn, boosts your credit score.

3. Strategically Handle Your Credit Cards

Even at this score, credit cards still represent a great opportunity to improve your credit. Use a secured credit card — a card backed by a cash deposit you make which is equivalent to your credit limit. Make sure to make regular, on-time payments to these cards.

4. Request To Be An Authorized User

Find a close friend or relative with healthy credit habits and request to become an authorized user on their card. Their good credit habits can help raise your credit score, but make sure the credit card company reports user activity to credit bureaus.

5. Expand Your Credit Variety

Once your credit improves, try diversifying your credit types. This could include installment loans or retail credit cards. However, ensure that they are manageable and within your budget limit to prevent future financial strain.