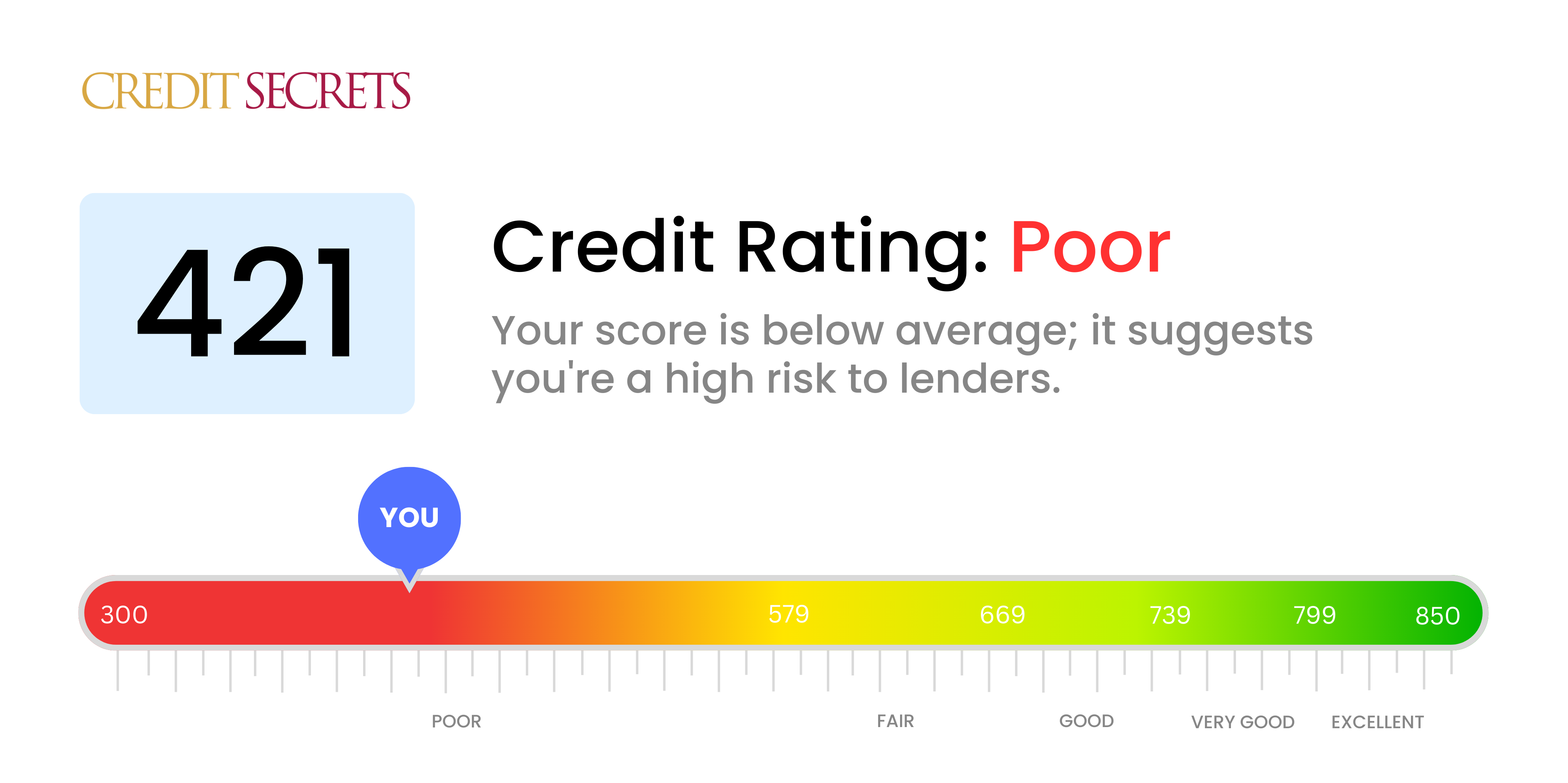

Is 421 a good credit score?

Having a credit score of 421 is considered poor, but remember, with the right steps, it's possible to change. A score in this range might make it more challenging to secure credit or loans at favorable interest rates. Don't be disheartened though--every journey to better credit begins somewhere.

Understandably, you may encounter some obstacles while applying for credit cards or loans with this credit score. These could include higher interest rates or more stringent requirements. Unfortunately, some lenders may not approve your application at all. But remember, this isn't a permanent situation. With consistent, responsible financial habits, your credit score can improve over time.

Can I Get a Mortgage with a 421 Credit Score?

Should you possess a credit score of 421, obtaining approval for a mortgage may be a challenge. This score falls significantly below most lenders' minimum criteria, reflecting a history of financial setbacks, which may include late payments or credit defaults. This is a difficult circumstances, no doubt, but not without potential resolutions.

While conventional mortgage options may be inaccessible, alternatives such as non-traditional or subprime mortgages might be a viable route. However, these often come with higher interest rates and less favorable terms due to the perceived risk. It's also useful to note that some lending programs are crafted specifically to assist individuals with lower credit scores. Importantly though, there are no immediate solutions to swiftly elevate your credit score; it demands time and diligent management of your financial commitments. While this may present a challenging short-term scenario, if navigated right, it can lead to remarkable long-term financial transformations.

Can I Get a Credit Card with a 421 Credit Score?

Getting credit card approval with a credit score of 421 may pose a significant challenge. In the eyes of lenders, this score signals a high level of risk, indicating past financial struggles or mismanagement. This might be a difficult pill to swallow, but recognizing the current state of your credit is a crucial part of moving towards financial health. It might not be an easy journey, but remember, it does not mean the end of the world.

With this credit score, it will be beneficial to consider other options like secured credit cards. These cards necessitate a deposit that becomes your credit limit, making it an accessible option for those having trouble with their credit. Seeking the help of a co-signer, or turning to prepaid debit cards, might serve as viable options too. It's important to note that these alternatives may not offer immediate credit relief, but they can form a critical part of a broader strategy towards financial stability. Be aware, however, interest rates for any credits available to individuals with a lower score will likely be higher due to the increased risk to the lender.

With a credit score of 421, getting approved for a traditional personal loan can be a real challenge. Lenders might view your low score as a sign of financial risk, which can limit your options. This isn't the news you hoped for, but it's important not to lose hope.

While traditional loans might not be feasible, other possibilities exist. Secured loans, for example, require collateral but don't depend as heavily on credit scores. Another option might be having a co-signer with a higher score vouch for you. Another direction to consider is peer-to-peer lending platforms. These often operate with softer credits score requirements, though it's critical to remember these alternatives usually carry higher interest rates and strict terms, due to the increased risk for the lender. Nevertheless, these paths can present an opportunity to start building a better credit future.

Can I Get a Car Loan with a 421 Credit Score?

With a credit score of 421, the path to a car loan approval may be tricky. Car loan lenders usually seek credit scores of 660 or above. Unfortunately, your score of 421 falls within the subprime range, generally considered riskier by lenders. This is based on the premise that a lower credit score might signal potential issues with paying back the borrowed funds.

While it's true that a credit score of 421 may make the loan approval process more complex, it's important to realize that it doesn't shut off vehicle ownership completely. There are lenders who specialize in working with those who have lower credit scores. Be aware, though, that this path often means accepting higher interest rates. Elevated rates represent lenders' method of protecting their investment against higher perceived risks. Securing a car loan might be tough, but with diligence and careful review of the terms, it remains a possibility.

What Factors Most Impact a 421 Credit Score?

Navigating a credit score of 421 can feel complex, but understanding the key factors that influence your score is a vital first step towards financial betterment. Every mark on your financial journey presents a chance to grow and learn.

Missed Payments

One of the major factors affecting your score could be missed or defaulted payments. These are greatly influential in shaping your credit score.

How to Check: Scrutinize your credit report for any missed or late payments. Consider any instances where you have failed to meet payment deadlines.

Credit Limit Use

If you're using a large portion of your available credit, this could be negatively impacting your score.

How to Check: Review your credit card statement to see how much of your available credit you are utilizing. Striving to maintain low balances in relation to your credit limit can be beneficial.

Credit History Duration

Shorter credit histories can harm your credit score.

How to Check: Check your credit report to ascertain the age of your oldest and most recent accounts, as well as the average age of all accounts. Bear in mind if you have opened new accounts recently.

Types of Credit and Recent Credit

A diverse range of credit types can benefit your score, and handling new credit responsibly is crucial.

How to Check: Look over your various credit accounts, such as credit cards, retail accounts, installment loans, and mortgages. Consider if you have been judicious in applying for new credit.

Public Records

Public records such as bankruptcies or tax liens can seriously harm your credit score.

How to Check: Examine your credit report for any public records. Resolve any listed items as needed.

How Do I Improve my 421 Credit Score?

A credit score of 421 is considerably low, but don’t lose heart; you can take steps to improve it. Here are some tailored strategies for you:

1. Tackle Delinquent Accounts

It’s essential to focus on any default accounts that you have. Make arrangements to catch up on these overdue payments, as they are heavily impacting your current score. It might make sense to set up payment plans with your creditors to settle these debts.

2. Mitigate Credit Card Debt

Your current credit utilization, which means how much of your accessible credit you’re using, really affects your score. Work towards bringing your credit card balances to under 30% of your limits. The ideal would be to stay under 10%. Start by focusing on the cards with the highest usage first.

3. Contemplate a Secured Credit Card

Given your existing score situation, acquiring a regular credit card could be a challenge. A secured credit card could be an excellent alternative. It requires a deposit that becomes your credit limit. Use it wisely, making tiny purchases and fully paying off the balance every month to establish a positive credit history.

4. Inquire about Authorized User status

You might want to consider asking a trusted friend or family member with an impressive credit score if they would be willing to add you as an authorized user on their credit card. This can help boost your score by integrating their good credit habits into your report. Be sure, however, that the card issuer reports authorized user accounts to the credit bureaus.

5. Broaden Your Credit Spectrum

If done responsibly, diversification of your credit accounts can aid in improving your score. Once you’ve demonstrated good practices with a secured card, think about exploring other credit options like a credit builder loan or retail credit card.