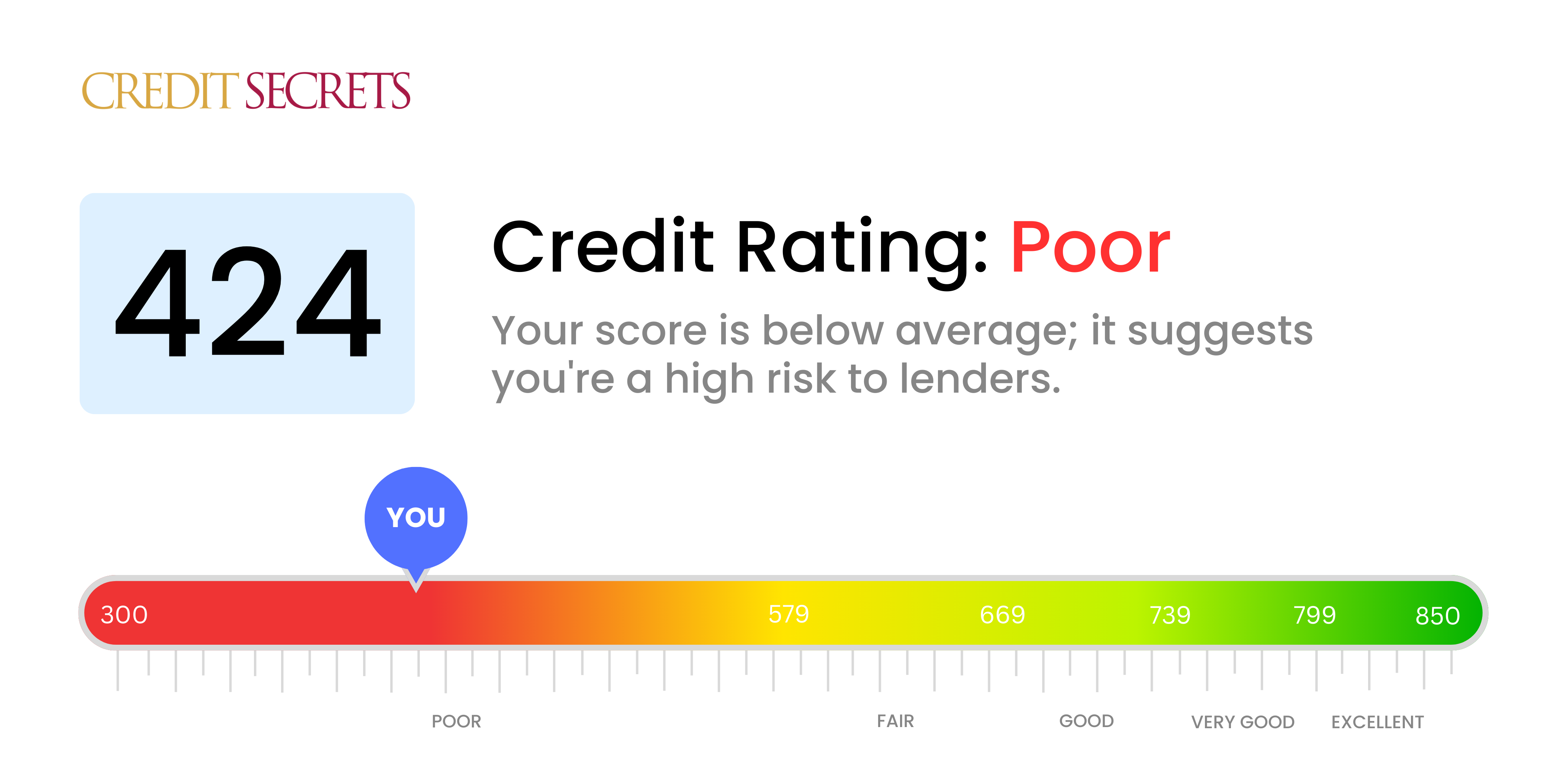

Is 424 a good credit score?

A credit score of 424 is within the 'Poor' range. It's not a favorable position to be in, but it's important not to lose hope because improving this score is most certainly achievable.

Unfortunately, with this score, you may face difficulties in getting credit or loan approval. Even if approved, the terms may not be favorable, you may be subjected to higher interest rates and deposits. But remember, this is not a permanent state. You can take the necessary steps to improve your score and thereby enhance your financial position. Keeping a close eye on your financial actions and avoiding habits that can further harm your score is key. With diligent effort and a positive approach, you can turn things around.

Can I Get a Mortgage with a 424 Credit Score?

With a credit score of 424, the chances of securing a mortgage are unfortunately rather slim. Most financial institutions require a higher score, as a number in this range might suggest a past history of financial obstacles, such as delayed payments or defaults.

This is undoubtedly a challenging situation, but remember, with dedication and focused efforts, it is possible to turn the tide. Start by addressing any outstanding financial issues that might be influencing your score adversely. Then, aim to maintain a steady record of timely payments and sensible utilization of credit. Improving your credit score is not an overnight process. It requires patience, diligent effort, and good financial habits. However, by maintaining a positive attitude and taking the right steps, you can strengthen your credit standing with time and make yourself a viable candidate for future mortgage applications.

Can I Get a Credit Card with a 424 Credit Score?

A credit score of 424 is seen as a risk by lending institutions and can make it extremely difficult to get approved for traditional credit cards. This news can be disappointing, but it's a crucial part of understanding your current financial position. Acknowledging this reality can be challenging, yet it's an essential part of your journey towards achieving better financial health.

Instead of trying for traditional credit cards, it could be beneficial to consider alternatives such as secured credit cards. To obtain these, you'd need to place a deposit which then serves as your credit limit. The advantage here is that consistent, responsible use of secured cards can help to slowly build your credit score. Other options include becoming an authorized user on a trusted family member's credit card or taking advantage of a prepaid debit card. Be aware that interest rates for these alternatives may be higher, reflecting lenders' view of your risk level. With patience and diligence, these options can become stepping stones towards improving your credit worthiness.

If you have a credit score of 424, it might be quite challenging to secure approval for a personal loan from traditional lenders. This score is notably lower than the range that is typically required, and lenders may view your loan application as high-risk. It can definitely feel disheartening, but it's crucial to understand what this score means for your borrowing possibilities.

Given these constraints, you may want to explore some alternative lending options. Secured loans, that require collateral, or co-signed loans, which involve someone else with a higher credit score supporting your loan, could be possibilities. You could also consider peer-to-peer lending platforms, which may have more flexible credit requirements. Nevertheless, bear in mind that these alternatives can often involve higher interest rates and less advantageous terms, due to the increased lending risk perceived by the lender.

Can I Get a Car Loan with a 424 Credit Score?

Having a credit score of 424 presents a challenge when seeking approval for a car loan. Most lenders give favorable terms to individuals with scores above 660, making a score under 600, much like yours, less appealing. This "subprime" category you fall in could lead to steep interest rates or even outright denial of a loan.

Why? A lower score indicates a greater risk to lenders as it shows a history of potential difficulty in paying back borrowed money. However, don't lose hope. Not all lenders shy away from lower credit scores. Some specialize in working with you, although you should remember that they often charge higher interest rates to safeguard their investment. This reality doesn't deny you the chance to secure a car loan. With perseverance and careful examination of loan terms, owning a car is not out of reach.

What Factors Most Impact a 424 Credit Score?

A credit score of 424 may present challenges but understanding the likely reasons behind this score can help you on your financial path. Let's look at factors that commonly affect a credit score like yours.

Payment History

With a score of 424, past payments may not have been timely or perhaps defaulted. Your payment history is one of the most significant factors in credit scoring.

How to Check: Identify these instances by viewing your credit report for any late or defaulted payments - these could provide insight into your current score.

Credit Card Use

Maxed-out credit cards can give you a high credit utilization ratio leading to a dip in your credit score.

How to Check: Review your credit card balances. If they're nearing their limits, consider ways to lower these balances to improve your score.

Length of Credit History

A relatively young credit history can negatively impact your score.

How to Check: Access your credit report and consider the age of your oldest and newest accounts. Recent new accounts can also decrease your score.

Credit Mix

Lacking a mix of credit types (credit cards, retail accounts, installment loans, mortgage loans), can lower your score.

How to Check: Analyze your active credit accounts. A balanced mix of credit could better serve your score.

Public Records

Public records like foreclosures and tax liens can dramatically drop your score.

How to Check: Check your credit report for any public records. Addressing these items could help improve your credit score.

How Do I Improve my 424 Credit Score?

With a credit score of 424, you may be feeling disheartened. But take heart, with focused effort, you can bolster your credit score. Here are practical steps you can take:

1. Catch Up On Missed Payments

Missed payments can greatly impact your credit score. Start by identifying any current late payments and bringing those accounts up-to-date. If necessary, establish a payment plan with your creditors.

2. Pay Down High-interest Debt

High-interest debt, like credit cards, can weigh down your credit score. Aim to bring your credit card balances to less than 30% of your credit limit. Prioritize repaying the cards that charge the highest interest first.

3. Consider a Credit Builder Loan

With your current credit score, obtaining a traditional credit card might be difficult. Look into a credit builder loan. As you pay it off, the lender will report your successful payments to the credit bureaus, helping you build a positive payment history.

4. Ask to be an Authorized User

If a trusted person in your life has a strong credit rating, see if they’ll add you as an authorized user on their credit card account. This can positively influence your credit score by factoring in their good credit management.

5. Explore Diverse Credit Options

Once you have established good payment habits, consider diversifying your credit with different account types like a retail credit card or auto loan. Timely management of these can further lift your credit score.