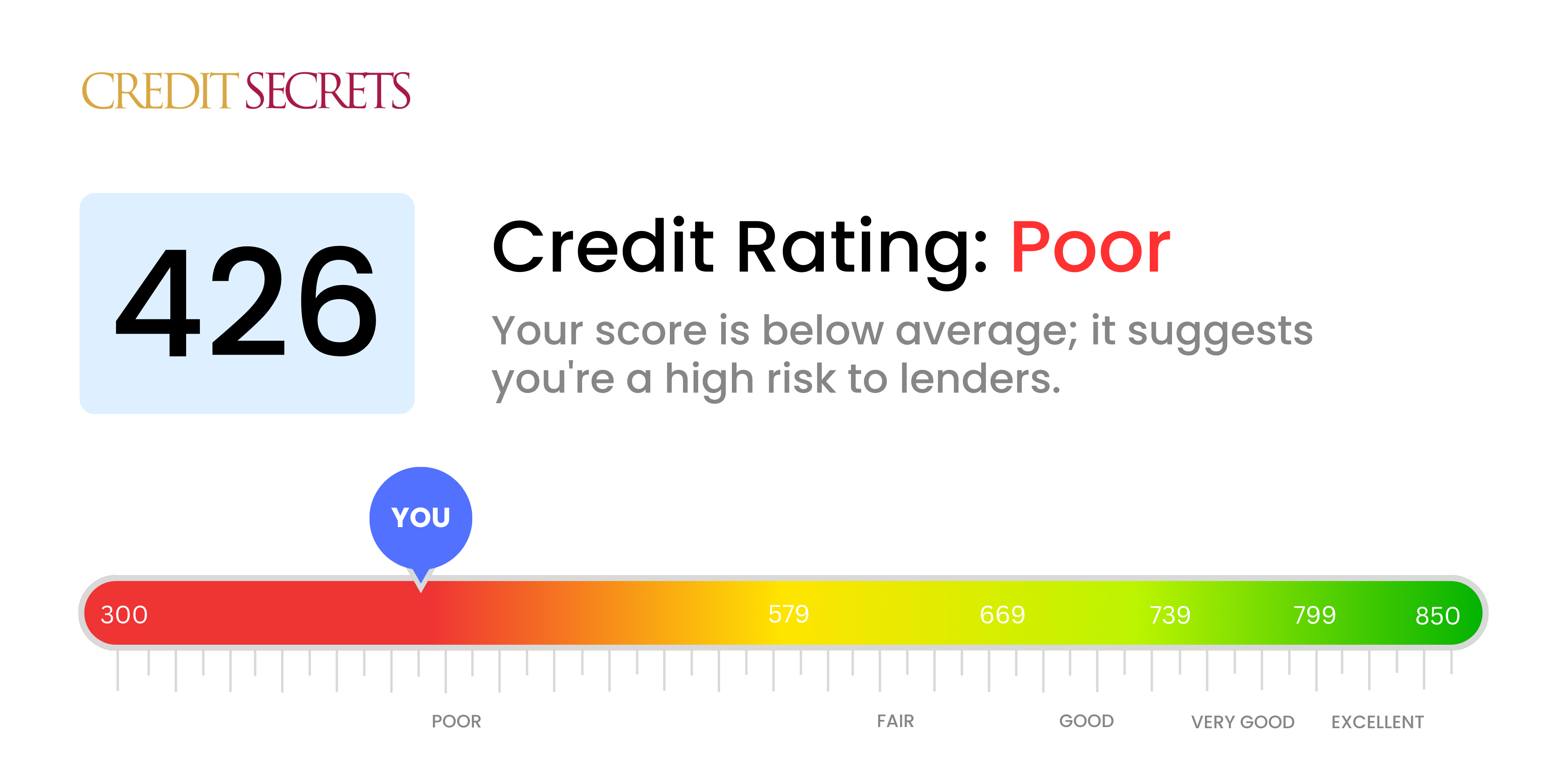

Is 426 a good credit score?

A credit score of 426 is classified as poor according to standard credit score ranges. This score may lead to difficulties when applying for loans or credit, often resulting in higher interest rates or denied applications. However, don't lose heart; there are practical steps that can help improve your credit score over time. With persistent effort, knowledge, and patience, you can build a healthier financial future.

Can I Get a Mortgage with a 426 Credit Score?

A credit score of 426 typically makes obtaining a mortgage challenging, as it falls significantly below the baseline accepted by most lenders. A score within this range often signals to lenders a track record involving financial struggles, possibly including defaulted loans or delayed bill payments.

Despite this daunting reality, it's important to remember that everyone's financial journey is unique and solutions exist. For example, the Federal Housing Administration (FHA) provides loans designed for those with lower credit scores. While interest rates may be higher with a lower credit score, FHA loans could be a feasible alternative. Confronting your credit score and understanding it is the first step toward reclaiming your financial freedom.

Statuses are not set in stone, credit scores can be improved. Aggressively tackling any existing debts and forging a punctual bill payment history can lift your score over time. Remain diligent and optimistic on your journey to enhancing your financial standing.

Can I Get a Credit Card with a 426 Credit Score?

With a credit score of 426, securing approval for a typical credit card may prove challenging. Because this score is relatively low, creditors may view it as indicative of high financial risk. They might suppose it suggests past financial struggle or poor money management. It's not an easy reality to face, but with knowledge and understanding, progress can be made towards improving your financial standing.

Considering your score, it may be beneficial to explore alternate options such as secured credit cards. This type of card requires a deposit which serves as your credit limit, and they're often more accessible for individuals with lower credit scores. They can also help rebuild your credit over time. Alternatively, seeking a co-signer or investigating pre-paid debit cards could be advantageous choices. Though these options won't provide an instant fix, they are part of the stepping stones to a better financial future. Please note, interest rates on any credit instrument available to you, given this credit score, may be substantially higher - a portrayal of the greater risk lenders are taking.

At the outset, a credit score of 426 is extremely low and does pose some serious challenges. Traditional lenders generally deem this score as unsatisfactory, as it points to a substantial risk. This score is more than likely to hamper your chances at a personal loan approval in a conventional setup. Although this may be hard to accept, it's key to acknowledge the limitations that this credit score places on your borrowing potential.

With mainstream loans seeming less feasible, you might want to explore other alternatives. Consider options like secured loans, wherein you pledge collateral, or co-signed loans, where another individual with a better credit score guarantees your loan. Participating peer-to-peer lending platforms could be another beneficial option due to their potentially relaxed credit requirements. Remember, these options have their pros and cons, and often carry higher interest rates and less favorable terms, reflecting the increased imminent risk for the lender. It's necessary to be fully aware of these nuances before making a decision.

Can I Get a Car Loan with a 426 Credit Score?

With a score of 426, getting a car loan might be a tough journey. Scores higher than 660 tend to get the best rates from lenders, while scores under 600 are seen as subprime. Unfortunately, your score of 426 fits into this latter group, which can lead to higher interest rates or even outright rejection of your loan application. This is because lenders often view lower credit scores as a sign of higher risk; they suggest a history of trouble paying back borrowed funds.

However, don't lose hope just yet. While the path might appear rocky, there are other possibilities. Some lenders work specifically with individuals with lower credit scores like yours. However, please exercise caution - their car loans might come with notably higher interest rates. This is the lender's way of balancing the percieved risk of lending to someone with a lower credit score. So, while getting a car loan might not be a walk in the park, it isn't entirely out of reach. Meticulous planning and an understanding of loan terms can put you in a better position to secure a car loan. Always remember, every bump in the road is an opportunity to learn, adapt and grow.

What Factors Most Impact a 426 Credit Score?

Gaining insight into your credit score of 426 is a key step towards enhancing your financial health. By pinpointing what factors have contributed to this score, you will be paving the way for a financially resilient future. Let's explore the elements that might have affected your credit score.

Payment History

Your payment history has a profound effect on your credit score. The presence of late payments, missed payments, or defaults could be a major reason for your score.

How to Check: Assess your credit report for any late or missed payments. Reflect on any periods when payments were not made on time or in full.

Credit Utilization Ratio

A high credit utilization ratio could be detrimental to your score. If you have been consistently reaching or exceeding your credit limit, this could be a primary cause.

How to Check: Analyze your credit card statements. If the balances are consistently high relative to the limits, this could be affecting your score.

Debt-to-income ratio

A high debt-to-income ratio, which shows how much of your income is going towards paying off debts, might be affecting your score negatively.

How to Check: Calculate how much of your monthly income is spent on debt payments. If the fraction is high, it could be a contributing factor.

Insufficient Credit History

Lack of a diversified and long credit history might be negatively influencing your score.

How to Check: Review your credit report to examine your oldest and newest accounts and the average age of all your credit accounts.

Collections and Public Records

Having accounts in collections or public records such as bankruptcies, lawsuits, or tax liens could be significantly impacting your score.

How to Check: Inspect your credit report for any collections or public records and take steps towards resolving them.

How Do I Improve my 426 Credit Score?

With a credit score of 426, your financial health requires thoughtful attention. Don’t worry, a leap forward is within your reach. Here’s your tailored roadmap to credit score recovery:

1. Check Your Credit Report for Errors

First and foremost, obtain a free copy of your credit report. Look out for errors and dispute them if found. Even a small mistake can greatly lower your score.

2. Prioritize Defaulted Accounts

In your situation, defaulted accounts have likely played a role in your score. Make an effort to pay these off or negotiate a settlement. A settled account is far better for your credit than an unpaid one.

3. Fix Late Payment Triggers

Identify the reasons behind late payments and work to eliminate these hurdles. Contact your lenders and set up automatic payments or align payment dates with your payday.

4. Consider a Credit Builder Loan

Acquiring a credit builder loan can help improve your score over time. Your payments are reported to credit bureaus, helping you establish a record of on-time payments.

5. Limit Credit Applications

Each new application for credit could bring a hard inquiry into your report, lowering your score. So be cautious and only apply when necessary.

Remember, improving your score is a marathon, not a sprint. Patience, persistence and informed decisions will get you there.