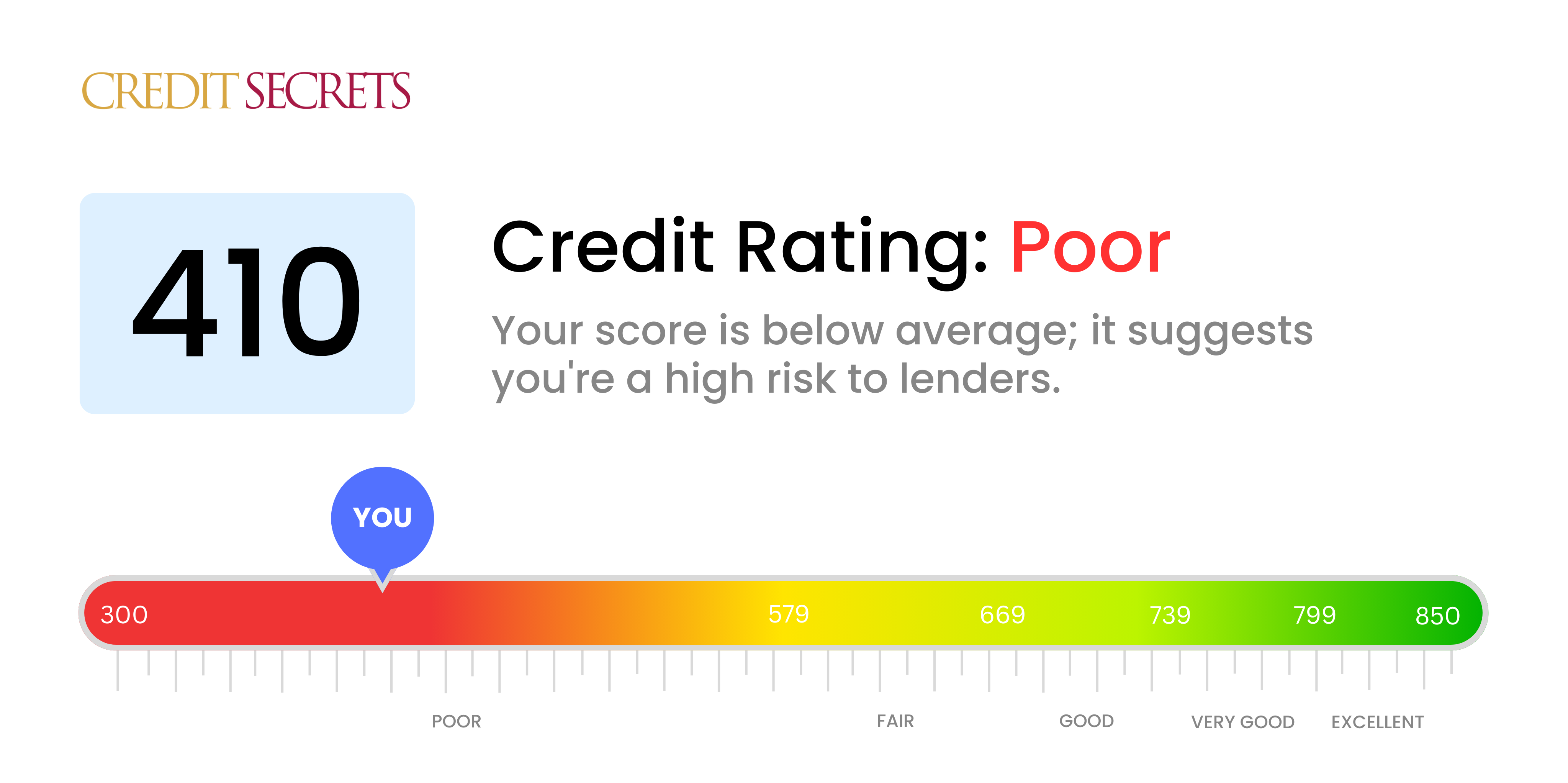

Is 410 a good credit score?

Having a credit score of 410 does place you in the 'poor' category, but it's crucial to remember that credit scores aren't static—they can, indeed, be improved. With your current score, you can expect to face challenges when trying to obtain credit, and lenders may impose higher interest rates or request additional deposit funds to mitigate risk.

However, it's key to understand that financial missteps of the past don't dictate the future. You have the power to turn your situation around. Thoughtful financial habits, repaying debts on time, and handling credit responsibly moving forward can help gradually increase your credit score. There is always room for improvement, and taking the right steps today can make a big difference for your financial tomorrow.

Can I Get a Mortgage with a 410 Credit Score?

Regretfully, with a credit score of 410, obtaining approval for a mortgage can be highly challenging. This score falls significantly below the minimum benchmarks set by most lenders, acting as an indicator of severe financial concerns such as late payments, defaults, or serious debt.

It's important to keep in mind that this doesn't mean you are permanently ineligible for a mortgage. There are others paths to homeownership, though they might require more effort and patience. Such alternative options could be securing a loan through a credit union, or exploring government-backed loan programs that have more lenient credit requirements. Additionally, having a substantial down payment or a strong income can sometimes influence a lender to overlook a lower credit score. High-interest rates could be a trade-off in these scenarios, due to the perceived risk to lenders.

Credit Secrets recognizes the strain of this situation and offers comprehensive strategies aiming to help you improve your financial health and credit score over time. Working steadily towards financial stability can potentially unlock more favorable mortgage options in the future.

Can I Get a Credit Card with a 410 Credit Score?

With a credit score of 410, acquiring a typical credit card may be an uphill task. This score corresponds with a high-risk profile in the view of most lenders, usually indicative of past financial challenges or mishaps. While this may seem disheartening, acknowledging your actual financial state is the initial stride towards money-related rehabilitation. It's crucial to approach these circumstances with a genuine perspective.

Given the hurdles tied with such a low credit score, you might want to consider other options such as secured credit cards. These require a deposit which then serves as your credit limit and are often more accessible. Other potential alternatives include finding a co-signer or using prepaid debit cards. Remember, these aren't instant fixes but viable tools towards your financial improvement journey. It's also worth noting that any credit type available will most likely have quite high-interest rates due to the increased risk perceived by lenders.

Can I Get a Personal Loan with a 410 Credit Score?

Having a credit score of 410 brings considerable challenges in securing a traditional personal loan. Most lenders view this low credit score as indicative of sizable risk. You could face higher interest rates or stricter loan terms due to your score. Understandably, this isn’t the ideal situation you’d hope for, but it's essential to be aware of what this credit score entails for your borrowing possibilities.

While conventional loans may not be accessible, consider alternative loan options. Secured loans, which involve collateral, or co-signed loans, where someone with a higher credit score guarantees for you, might offer a solution. Peer-to-peer lending platforms offer another alternative as they sometimes have more flexible credit requirements. However, remember these alternatives typically come with steeper interest rates and less favorable terms, as a measure for the lenders to counter the higher risk involved.

Can I Get a Car Loan with a 410 Credit Score?

Having a credit score of 410 can make the process of securing a car loan quite difficult. Typically, most lenders prefer credit scores above 660 to offer favorable loan terms. A score lower than 600 is typically viewed as subprime, and unfortunately, your score of 410 falls well within this category. This suggests to potential lenders that there might be a greater risk associated with lending to you. The higher risk is attributed to the possibility that there could be difficulties in repaying the loan based on past credit history.

Despite this, obtaining a car loan is not entirely out of the question. You'll find lenders who specialize in working with those who have lower credit scores. However, keep in mind that these loans often come with higher interest rates as a way of compensating for the perceived risk. Despite the challenging circumstances, there's still hope for accomplishing your car purchasing goal. Remember to examine all terms and conditions thoroughly and make decisions that are beneficial to your financial situation.

What Factors Most Impact a 410 Credit Score?

Grasping your credit score of 410 is a vital step to improving your financial health. Identifying and addressing the issues that contribute to this low score can set you on a path to a better financial future. Remember, every path is unique and filled with potential for growth.

Payment History

Your payment history greatly impacts your credit score. Late payments or defaults may be a major reason for your low score.

What to Do: Look at your credit report for any late or missed payments. Think about if there have been instances where you paid later, as these could harm your score.

High Credit Utilization

High utilization of your credit limit can hurt your score. If your credit cards are nearly maxed out, this could be impacting your score.

What to Do: Check your credit card statements. Are the balances nearing the limits? Keeping your balance low in relation to your limit can help.

Length of Credit History

A brief credit history could negatively affect your score.

What to Do: Review your credit report. Look at the age of your oldest and youngest accounts, and the average age of all your accounts.

Type and Amount of Credit

Having a mix of credit types and maintaining new credit responsibly are key for a good score.

What to Do: Review your types of credit accounts. Consider if you've applied for new credit in a responsible manner.

Public Records

Public records like bankruptcies or tax liens can seriously hurt your score.

What to Do: Look at your credit report for any public records. Deal with any items on the report that need resolution.

How Do I Improve my 410 Credit Score?

With a credit score of 410, there’s significant room for growth. The process may be challenging, but your financial future will reap the benefits. Here are the next steps that will make the most difference to you:

1. Get Familiar with Your Credit Reports

Order your free yearly credit reports and thoroughly check them for errors. Inaccurate or incorrect information could be weighing down your score. Dispute these errors with the credit bureaus to have them corrected and potentially raise your score.

2. Catch Up on Overdue Bills

Past-due accounts can seriously harm your score. Prioritize paying off these debts or establish a payment plan with your creditors. Maintaining a current status on all your accounts is crucial.

3. Pace Your Credit Usage

Once your accounts are in good standing, plan your credit usage wisely. Aim to utilize only a small percentage of your available credit. Pay off balances each month to keep your debt levels low.

4. Consider A Secured Credit Card

With your current score, a secured card could be a smart choice. This card uses a deposit to secure your credit limit and can help you build a strong payment history. Manage it prudently for maximum effect.

5. Keep Old Accounts Open

Older accounts contribute to the age of your credit history, a factor in your score. Even if they’re not in regular use, keeping these accounts open can support your score improvement.