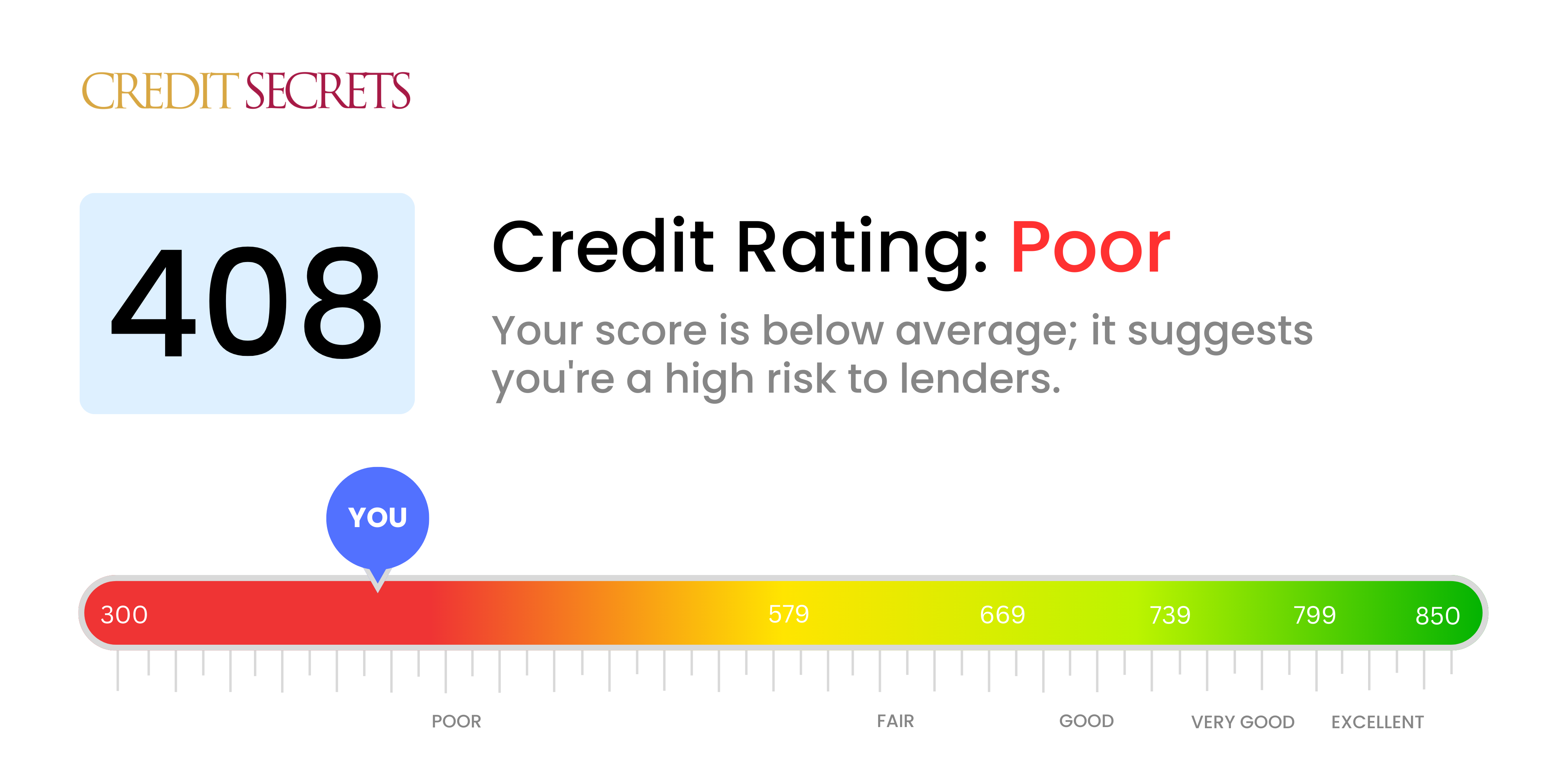

Is 408 a good credit score?

A credit score of 408 falls within the 'poor' category as per standard credit rating scale. This isn't the best situation, but remember, there's room for improvement and it's completely feasible to elevate this score with the right measures.

With a score of 408, one's likelihood of being approved for loans or credit cards may be significantly hindered and any approvals might come with higher interest rates. However, consistent, responsible credit behavior can gradually foster a more favorable outcome and help to get you on the path to improved financial stability.

Can I Get a Mortgage with a 408 Credit Score?

Having a credit score of 408 is unfortunately quite low, and being approved for a mortgage with this score can be extremely difficult. Typically, mortgage lenders are looking for credit scores that are at least in the 'fair' range, usually no lower than 580. A score of 408 usually signals past financial difficulties, such as late repayments or defaulting on loans, making lenders wary.

If seeking a mortgage is a pressing need, there may be some lenders who're willing to approve, albeit at higher interest rates and stricter terms. However, it's recommended that you aim to improve your credit score first to ensure you receive a fair deal. A more robust score will make you a less risky prospect to lenders and secure you more favorable terms. This is achievable through diligent, timely payments and by managing your credit usage carefully and responsibly. Thankfully, even though this situation may seem hard, credit scores are not static and with focused effort, they can be improved.

Can I Get a Credit Card with a 408 Credit Score?

A credit score of 408 unquestionably presents challenges when it comes to securing a traditional credit card. This score is seen as a high-risk by lenders, indicative of past financial hardships or missteps. Although this can feel discouraging, understanding and accepting the reality of your credit situation is an essential step in the path toward fiscal betterment.

Your journey along this path could involve exploring other options like secured credit cards. These cards, which use a deposit as your credit limit, are often more attainable for someone with a low score. Alternatively, you could consider finding a co-signer or using prepaid debit cards. While these courses of action don't offer an immediate solution, they can be instrumental in gradually rebuilding your credit over time. Be aware, however, that interest rates with any form of credit available to someone in your situation are likely to be significantly elevated, due to the high-risk perception by lenders.

Can I Get a Personal Loan with a 408 Credit Score?

With a credit score of 408, the likelihood of getting a traditional personal loan is unfortunately quite low. This score is significantly lower than what most traditional lenders would consider a manageable risk. From a lender's perspective, a score in this range suggests you have had serious payment issues in the past or an extremely high level of current debt. It's tough to hear, but these are the facts and it's essential to be upfront about what this means for your borrowing possibilities.

However, there are alternative borrowing options available. One could be a secured loan, where you offer an asset such as your car or house as collateral. Another option might be finding a co-signer with a higher credit score who agrees to pay your loan if you can't. You could also explore opportunities in the peer-to-peer lending sector where the credit requirements may not be as stringent. Keep in mind, though, that these alternatives often come with higher interest rates as they offer loans to higher-risk borrowers. It's not the ideal situation, but these could be routes worth considering.

Can I Get a Car Loan with a 408 Credit Score?

A credit score of 408 is certainly low, making it difficult for you to get approved for a car loan. Most lenders prefer credit scores above 660 as they are considered more trustworthy. Unfortunately, your score of 408 falls into a riskier category. This might lead to unfavorable loan terms, such as higher interest rates or even being turned down for a loan altogether. The reason is that a lower credit score is seen as a sign of financial instability and risk to lenders. It is indicative of potential difficulties in payment history.

Despite this, remember that having a lower credit score does not entirely prevent you from achieving your dream of owning a car. There are lenders who specialize in working with people who have lower credit scores. However, caution is key. These loans usually come with much higher interest rates due to the higher risk the lender is taking on. Yet, with careful thought and a comprehensive understanding of the loan terms, it's possible for you to secure a car loan. It's all about patience, planning, and understanding your financial capabilities. Keep the hope alive!

What Factors Most Impact a 408 Credit Score?

Grasping the reasons behind a 408 credit score is the first step to skyrocketing your financial growth. Your score is influenced by a variety of elements, and understanding them is vital to enhancing your financial health. Remember: every financial journey, no matter the starting point, provides opportunities for significant improvement.

Payment Record

One of the primary pillars of your credit score is your payment history. Late payments or missed installments could be greatly impacting your score.

How to Check: Analyze your credit report for any unanticipated late or missed payments. These could be the key influences in reducing your score.

Credit Utilization

High rate of credit utilization might be pulling your score down. If your credit balances are nearing their limits, it's likely affecting your score.

How to Check: Peruse your credit card statements. High balances near the credit limit? Strive to keep balances under control to maintain a healthy score.

Length of Credit History

A relatively shorter credit history could be resulting your score to be on the lower side.

How to Check: Have a look at your credit report to evaluate the age of your oldest and most recent accounts, and the average age of all your accounts. Do consider if you've opened any new accounts recently.

Type of Credit and New Credit

Maintaining a diverse mix of credit types and responsibly handling new credit is key to a decent credit score.

How to Check: Scrutinize your mix of credit accounts. This includes credit cards, retail accounts, installment loans, and mortgage loans. Also, check if you have applied for new credit frequently without proper management.

Public Records

Public records encompassing information about bankruptcies or tax liens can considerably lower your score.

How to Check: Scour your credit report for any public records. Addressing these records can aid in improving your score.

How Do I Improve my 408 Credit Score?

A credit score of 408 is undoubtedly low, but remember, it’s never too late to start rebuilding. Strategic actions based on your current situation can help you see noteworthy improvements. Here’s how:

1. Prioritize Overdue Accounts

Your first step should be to focus on any delinquent accounts. If you owe any unpaid debts, make arrangements to pay them off. These debts influence your credit score the most, so handling them promptly will pave the way for improvements. Be proactive in discussing payment arrangements with your creditors, they may be willing to help.

2. Manage Your Credit Card Usage

Credit card balances can greatly influence your credit score. Try to maintain the balances below 30% of the card’s credit limit. It’s even better if you can keep them below 10%. Target the cards having the highest utilization rates first.

3. Consider a Secured Credit Card

With a score of 408, qualifying for a regular credit card could be a challenge. A secured credit card, backed by a cash deposit, could be a solution. This functions as your credit limit. Make small purchases and settle the full balance every month to establish a healthy credit record.

4. Seek to Become an Authorized User

You could request a close friend or family member with good credit to add you as an authorized user on their credit card. This strategy can enhance your credit score as their good credit habits positively reflect on your credit file.

5. Diversify Your Credit Portrayal

Having a variety of credit products can also help. After proving responsible use of a secured card, consider a credit builder loan or retail credit card. Responsible management of these credit accounts can provide a boost to your credit score.