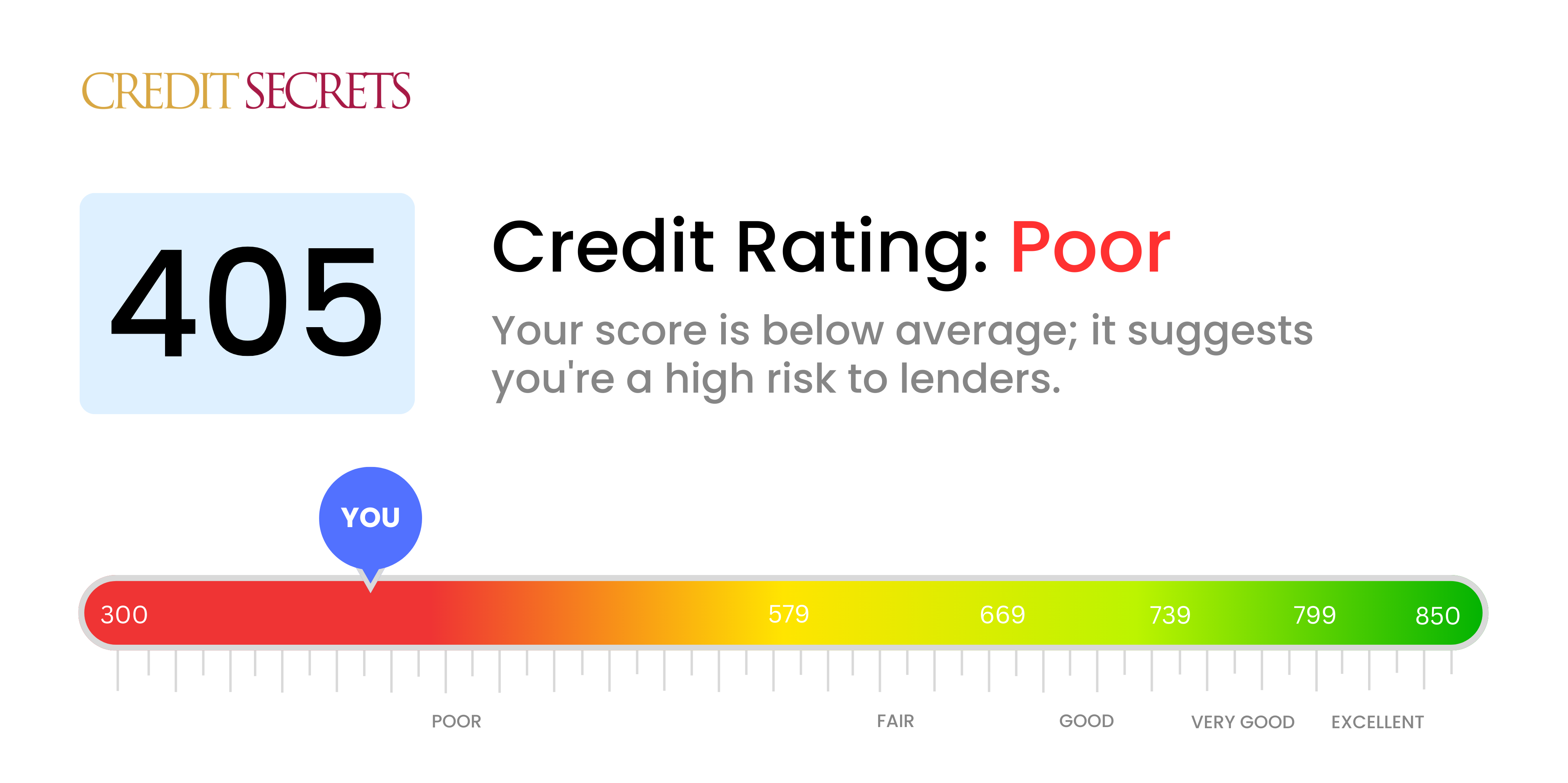

Is 405 a good credit score?

With a credit score of 405, it's clear that your financial situation isn't where you'd like it to be - this score falls into the "poor" category. But don't lose heart, because it's not the end of the road and there's always potential for progress.

Being in this bracket might make it challenging to secure loans or credit cards, and if you do get approved, you're likely to face higher interest rates. However, remember that each step you take towards improving your credit score can open doors to better financial opportunities in the future.

Can I Get a Mortgage with a 405 Credit Score?

With a credit score of 405, securing a mortgage can be quite challenging. This score falls significantly below the threshold that most lenders deem acceptable for approving a mortgage. It suggests an extensive history of credit issues, such as late payments, defaults, or a high debt balance.

This situation may feel daunting but it's important to remember that it's also an opportunity for improvement. Start by addressing the causes of your low credit score, such as unresolved debts, late payments, and high credit utilization. From there, focus on building a positive credit history with timely payments and good credit practices. Interest rates offered to you may be higher due to your lower credit score, but with diligence and responsible financial habits, you have the potential to change your credit outlook and move towards your goal of homeownership. Remember, it's a journey that requires patience and consistency, but the end result will be worth the effort.

Can I Get a Credit Card with a 405 Credit Score?

When your credit score stands at 405, approval for a typical credit card can indeed appear dauntingly out of reach. The reality is that such a score is often considered precarious by lenders, suggesting past financial instability or missteps. While understandably disheartening, it's crucial to remember that recognizing your credit predicament is the first stride towards a healthier financial future. By facing head-on and understanding these more challenging aspects of your financial health, you're already laying a strong foundation for progress.

With a score as low as 405, your focus should turn to potential substitutes for standard credit cards, like secured credit cards. A secured credit card involves an upfront deposit that then becomes your credit limit. They are typically more accessible to those with lower scores and can help improve your credit over time. Moreover, you may explore the possibility of having a cosigner or utilizing a pre-paid debit card. Bear in mind that these alternatives are not instant solutions, but they do provide stepping stones towards financial growth. Lastly, should any form of credit be available to you at this stage, be prepared for higher interest rates reflecting the increased risk perceived by lenders.

Can I Get a Personal Loan with a 405 Credit Score?

With a credit score of 405, you're likely to face additional challenges when seeking the approval of a personal loan. Traditional lenders often view this score as carrying a higher risk, reducing the possibility of obtaining a loan via standard routes. We understand that it's a tough situation, but acknowledging and understanding the implications of this credit score on your borrowing options is a crucial first step.

If obtaining a conventional loan proves difficult, considering alternatives could be a sensible route. Options such as secured loans, where you provide collateral, or co-signed loans, where an individual with better credit backs you, could be worth exploring. Another potential route is peer-to-peer lending platforms, which sometimes have more flexible credit requirements. Keep in mind, though, that these alternatives can come with steeper interest rates and less favorable terms, a reflection of the increased risk for the lender.

Can I Get a Car Loan with a 405 Credit Score?

Having a credit score of 405 presents a significant obstacle when hoping for approval on a car loan. Lenders often seek credit scores that exceed 660 for ideal terms. Falling below 600 is usually seen as subprime, and with your score of 405, it unfortunately falls into this lower category. This score suggests a high risk to lenders, implying potential difficulties when it comes to repaying any borrowed money.

But rest assured, scoring lower on credit doesn't definitively close off your car buying plans. Certain lenders are equipped and geared towards working with those whose credit scores are less than optimal. Be warned though, these types of loans are likely to carry higher interest rates due to the elevated risk perceived by lenders. It is their way of protecting their investment. The journey might be a little tough, but by thoroughly reviewing the terms and cautiously considering your options, securing a car loan may not be as unreachable as it seems.

What Factors Most Impact a 405 Credit Score?

A credit score of 405 is considered quite low, but never fear, with focus and determination, let's discuss the potential factors causing this and ways to enhance the score.

Neglected Payments

Delayed payments or non-payments significantly impact a credit score. This could be a contributing factor for a 405 score.

To Inspect: Go through your credit report to see if there are overdue payments or non-payments which might have resulted in a reduced score.

Excessive Debt-to-Credit Ratio

High debt-to-credit ratio can lower your score. If you're utilizing a substantial portion of your available credit, it may be a factor in your score.

To Inspect: Scroll through your credit card statements. High balances relative to your credit limits can be harmful. Strive to maintain a steadier balance.

Brief Credit History

A brief credit history might be affecting your score negatively.

To Inspect: Look at your credit report to review the age and number of your accounts. Consider if you've opened multiple new accounts recently.

Type of Credit and New Credit Usage

A diverse credit portfolio and responsible handling of new credit is essential for a sound score.

To Inspect: Review your assortment of credit accounts. Think about your recent credit applications and if those might be high.

Public Records

If you have any public records such as bankruptcies or pending tax liabilities, they could be affecting your score significantly.

To Inspect: Look at your credit report for public records. Attempt to resolve any issues which might be listed.

How Do I Improve my 405 Credit Score?

Carrying a credit score of 405, it’s evident that you’re facing financial hurdles. Nevertheless, the path to improved credit is within your reach. Below are some specially tailored strategies for those in your situation:

1. Revise Your Credit Report

Begin by requesting and reviewing your credit reports for any errors. Identify and dispute any inaccuracies found immediately, as these errors may be contributing to your low score.

2. Prioritize Payment of Delinquent Accounts

Delinquent accounts take a toll on your credit score. Your initial step should be to settle any overdue accounts as soon as feasible. Engage your creditors to arrange a reasonable payment plan is unable to pay the full amount.

3. Consider a Secured Credit Card

At your current credit score, managing a regular card could prove difficult. Opting for a secured credit card can be a sensible decision. Make sure to use it judiciously, with small purchases that you can pay off entirely each month.

4. Request to be an Authorized User

Explore the possibility of becoming an authorized user on a trusted person’s credit card. Their positive credit habits can boost your own credit score. Make sure the card issuer regularly reports to the credit bureaus.

5. Explore Different Types of Credit

Once your payment history starts to improve, contemplate opening other forms of credit accounts. This could include a credit builder loan to enhance your credit mix, but ensure that you manage them responsibly.