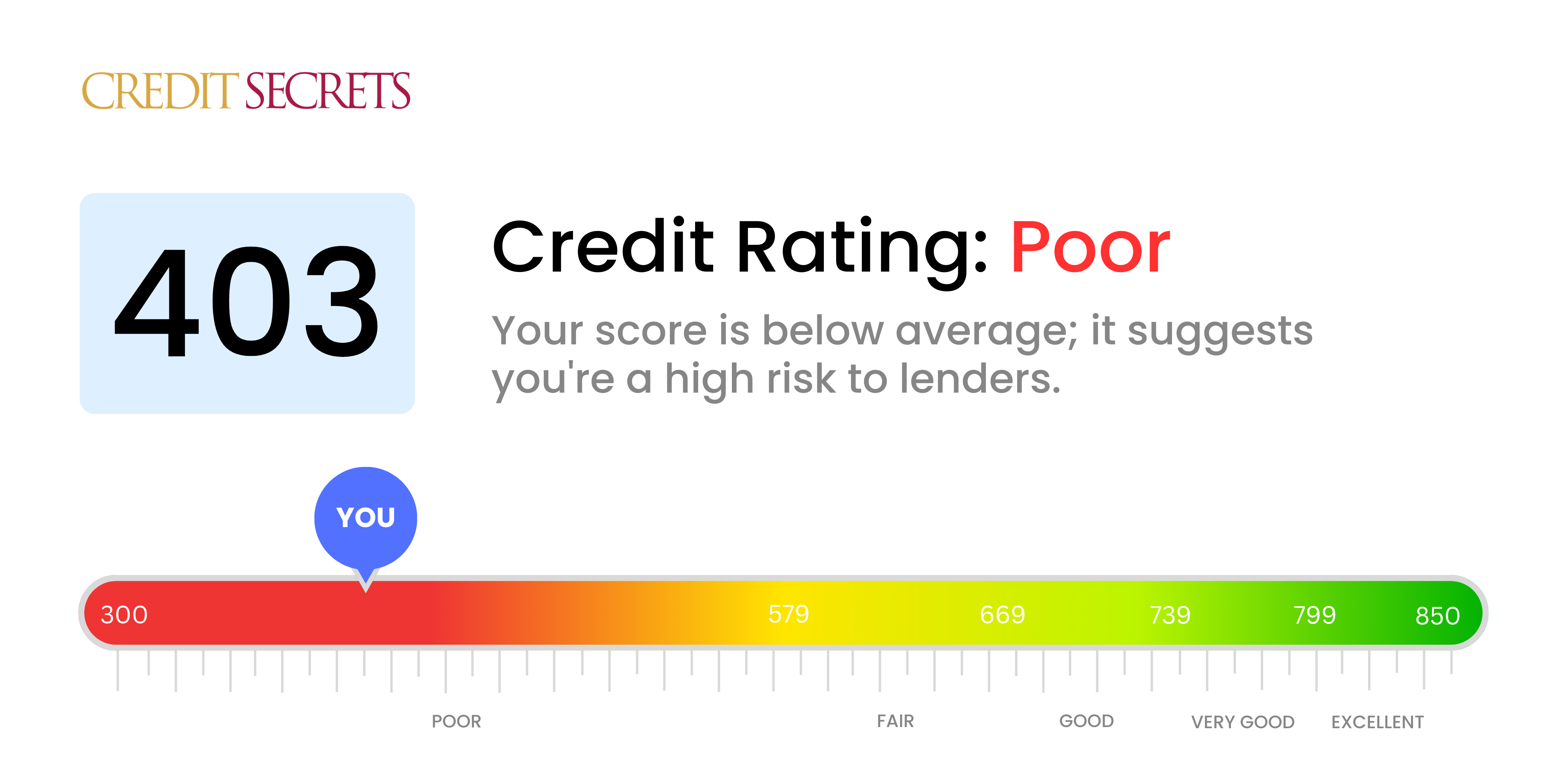

Is 403 a good credit score?

Having a 403 credit score is not ideal, as it falls within the 'Poor' range. You're dealing with a tough situation, but remain hopeful. Things may feel financially unstable right now, with this score you might face some challenges, such as higher interest rates, stricter terms on loans, and difficulties getting approved for credit or rental applications.

However, remember, credit circumstances can always be improved. You have the power to bolster your financial future by taking proactive steps to improve your score. Becoming a member of Credit Secrets can equip you with valuable tools and guidance to help you elevate your score and work toward your financial goals.

Can I Get a Mortgage with a 403 Credit Score?

If your credit score is 403, approval for a mortgage could be incredibly challenging. Generally, lenders require minimum scores well above this range. A score like 403 tends to suggest a history of financial issues, such as missed payments or defaults on loans.

Realizing that you're in a tough financial condition can be difficult, but it's a key step towards financial improvement. Begin by rectifying any outstanding debts that may be pulling down your score. Afterward, establish a consistent pattern of on-time payments and sensible credit utilization. Remember, it's a gradual journey to improve your credit score. However, with regular dedication and effort, better financial standing can be reached over time.

Additionally, securing a mortgage with such a low score may come with exorbitant interest rates, effectively increasing the cost of the home over the mortgage period. You may want to explore alternative housing options, like renting, while working on improving your credit score.

Can I Get a Credit Card with a 403 Credit Score?

With a credit score of 403, the chances of securing a traditional credit card are quite low. This score often signals to lenders a higher risk due to former financial setbacks or issues. It's a tough reality to accept, but understanding your current financial position is a valuable step on the path to improvement. Remember, you're not alone in this journey, and while the score presents challenges, there are ways forward.

When faced with a lower score like 403, you might want to consider alternatives such as secured credit cards. These cards require a deposit that equals your credit limit, and though they are often easier to acquire, they represent a sensible strategy to start rebuilding your credit gradually. Co-signing with a trusted individual or using pre-paid debit cards are other potential options. Keep in mind that these choices don't offer a quick fix, but rather a means to progressively improve. Any credit options available to you may come with higher interest rates reflecting the increased risk to lenders, but these are small hurdles in your path to greater financial stability.

Can I Get a Personal Loan with a 403 Credit Score?

With a credit score of 403, it's hard to break the news, but it's unlikely you'll be approved for a personal loan through traditional lenders. This score is significantly lower than what most lenders look for. They typically see a score in this range as a high risk, making it difficult to secure a traditional loan. Your situation may seem tough, but understanding and accepting this fact is the first step in exploring other possible solutions.

Since securing a personal loan from a traditional lender may not be an option, you might want to start considering alternatives. Secured loans—where you provide a form of collateral—and co-signed loans—where someone with a better credit vouches for you—might be good places to start. You could also explore peer-to-peer lending platforms, which sometimes have more lenient credit requirements. However, keep in mind these alternatives often come with higher interest rates and less favorable terms. They tend to reflect the lender’s increased risk, so it's very important to fully understand the terms before proceeding.

Can I Get a Car Loan with a 403 Credit Score?

With a credit score of 403, finding approval for a car loan may prove to be a tough task. That's because lenders generally prefer scores that are above 660, and any score below 600 is often viewed as subprime. 403, unfortunately, falls into this subprime category, potentially leading towards steeper interest rates or even outright loan denial. The reason for this is quite simple; a credit score on the lower end signals a higher lending risk to providers, indicating that there may have been previous issues with managing debt and repayments.

However, your current credit score doesn't necessarily eliminate your chances of getting a car loan. Certain lenders are prepared to work with those with lower credit scores. Be aware, though. Loans from these sources often come with significantly higher interest rates. This is because they view lending to you as a riskier investment. So while these high rates can seem daunting, if you approach the situation with caution and a good understanding of the terms, getting a car loan is still possible. Remember, the road to your dream car might have a few bumps, but it is definitely one that can still be crossed.

What Factors Most Impact a 403 Credit Score?

Understanding your credit score of 403 is key to improving your financial situation. Many factors can influence this score, and identifying them can help you take proactive steps toward healthier credit.

Payment History

With a score of 403, payment history could be negatively affecting your credit. Missed or late payments are likely factors.

How to Check: Review your credit report for missed or late payments. Take note of any patterns or habitual late payments.

Credit Utilization

Utilizing most of your available credit can negatively impact your score. High levels of debt on your credit cards could be harming your score.

How to Check: Look at your credit card statements. If you're reaching your credit limits, consider strategies to reduce these balances.

Length of Credit History

A short credit history can lower your score. Lack of long-standing credit could be a factor in your score.

How to Check: Check your credit report for the age of your oldest and newest accounts, and the average age of all accounts. Short, rapid histories can have a negative effect.

Type of Credit

Lacking a diverse mix of credit, such as credit cards, mortgages, or installment loans, can impact your score.

How to Check: Evaluate your credit types on your credit report. If you only have one type of credit, such as credit cards, it might be affecting your score.

Public Records

Public records like unsettled tax liens or bankruptcies can significantly lower your score.

How to Check: Examine your credit report for any public record items and take actionable steps to resolve these issues.

How Do I Improve my 403 Credit Score?

Having a credit score of 403 denotes a poor credit history, but don’t let this worry you. With dedicated efforts and smart strategies, you can enhance your credit score. Currently, your practical approach should be:

1. Rectify Defaulted Accounts

Addressing any defaulted accounts as soon as you can is essential. They are a primary reason your score is suffering. Communicate with your lenders to figure out an approval payment plan.

2. Minimize Debt-to-Credit Ratio

Your debt-to-credit ratio plays a major part in determining your credit score. Strive to reduce your credit card balance to less than 30% of your credit allowance. Long-term, you should aim to maintain this percentage below 10%.

3. Sign Up for a Secured Credit Card

At this score level, obtaining a regular credit card could be arduous. A secured credit card, which requests a cash deposit as collateral, can be a solution. Employ the card sensibly by making small purchases and settling the charges in full every month to establish a record of responsible payments.

4. Consider Becoming an Authorized User

If feasible, you could request a responsible friend or family member with an excellent credit standing to add you as an authorized user on their card. This way, their positive credit history could reflect on your credit report. This option is worthwhile only if the card company reports authorized user action to the credit bureaus.

5. Incorporate Variety into Your Credit Portfolio

A broad range of credit accounts can boost your credit score. Once your payment history begins to improve via your secured card, look at other types of credit like credit-boosting loans or department store credit cards, and manage them responsibly.