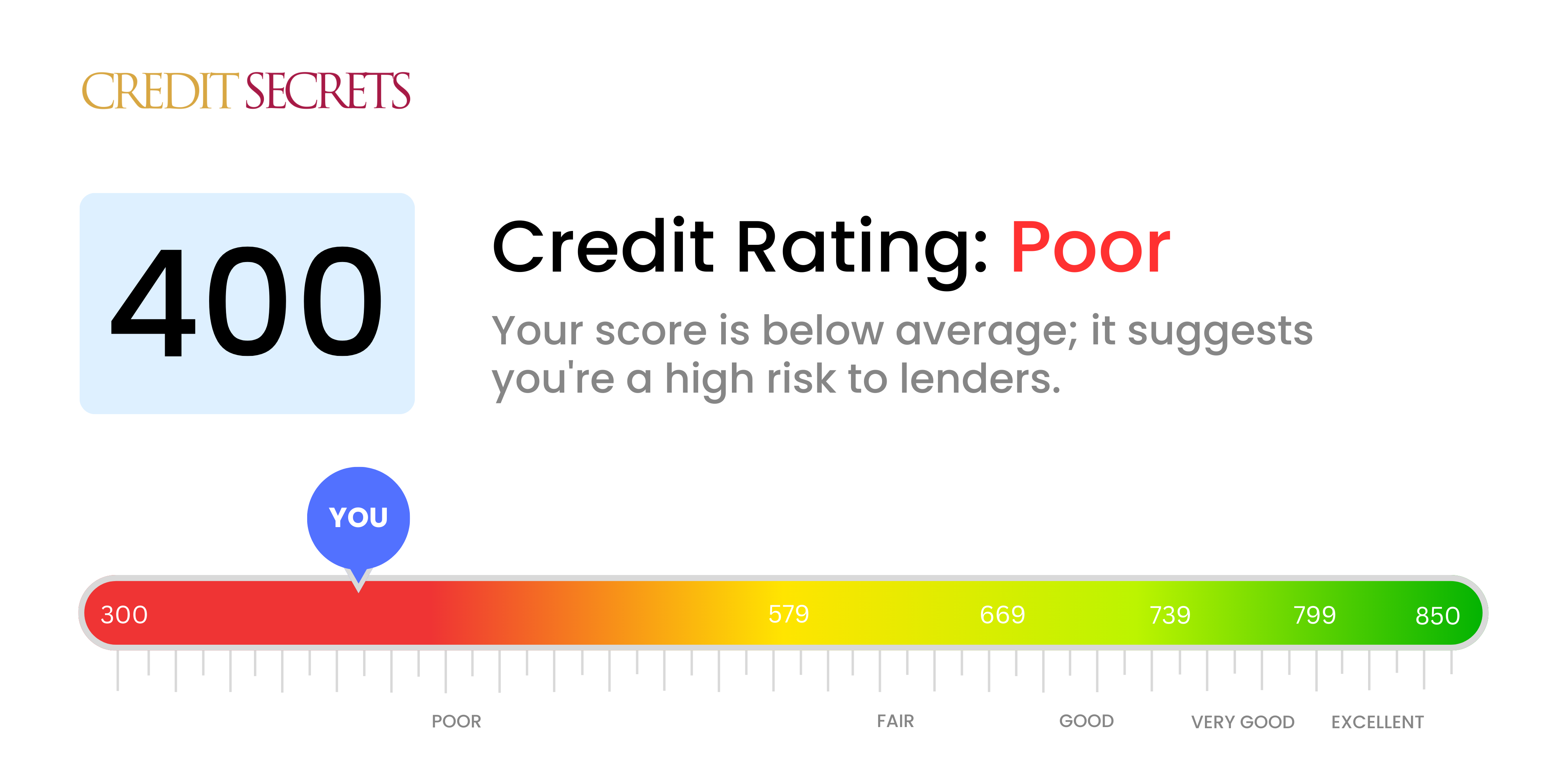

Is 400 a good credit score?

Unfortunately, a credit score of 400 isn't in the best range and is considered poor. With this score, you may face difficulties receiving approval for loans or credit cards and if approved, expect to have higher interest rates and unfavorable terms. But remember, it's never too late to work towards improving your credit score.

Through a combination of demonstrated financial responsibility and time, you can raise your score. Increased on-time payments, lowering your debt-to-credit ratio, and avoiding new debt can all contribute to a better score. At Credit Secrets, we believe in your potential to turn your financial life around.

Can I Get a Mortgage with a 400 Credit Score?

With a credit score of 400, your chances of securing a mortgage are quite slim. This score, unfortunately, is significantly lower than the requisite score most mortgage lenders typically seek. Having a score in this area is generally indicative of past financial struggles such as neglected payments or loan defaults.

This may seem daunting, but it's not an insurmountable obstacle. The first priority is to pay attention to your outstanding financial obligations that are still due. Tend to these debts promptly, aiming to establish a consistent pattern of responsible financial behavior and timely bill payments. Also, bear in mind that a lower credit score often results in higher interest rates on any loans you may secure, which means you'll be paying more in the long run. Embrace this as an opportunity for growth, not a failure. Better financial days lie ahead with consistent effort.

Can I Get a Credit Card with a 400 Credit Score?

Regretfully, a 400 credit score is viewed as a high-risk score by credit card companies. This score is an indication of past financial challenges, which might mean that being approved for a standard credit card could be a struggle. It can feel disheartening to face such a truth, but possessing an awareness of your credit status is a first stepping stone towards improving your financial wellness.

Given the improbable odds of securing a traditional credit card with a score of 400, alternative solutions such as secured credit cards may be beneficial. Secured cards demand a security deposit which acts as your credit limit, making them more accessible. You might also consider having a co-signer or using pre-paid debit cards. While such options don't immediately remedy the situation, they can be instrumental in credit rebuilding efforts. Beware, though, that interest rates for these types of alternative credit can be quite high, as lenders factor in the high risk associated with such a score.

Can I Get a Personal Loan with a 400 Credit Score?

With a credit score of 400, it's probably going to be tough for you to secure a personal loan from traditional lenders. This score is highly risk-associated in the lender's perspective, indicating that there could be potential penalties for missed payments or defaults in the past. That said, it's crucial to confront your current situation honestly and understand what it implies for your borrowing chances.

Although conventional loans might be difficult to obtain, some alternative routes may still be open to you. Consider secured loans, which require assets as collateral, or loans with a co-signer who possesses a strong credit background. There's also peer-to-peer lending, which may have softer creditworthiness standards. However, please remember that these alternatives often carry higher interest rates to account for the increased investment risk, and they may offer less favorable conditions. It's crucial, nonetheless, to stay hopeful and explore all available options.

Can I Get a Car Loan with a 400 Credit Score?

If you have a credit score of 400, the truth is that approval for a car loan is going to be a significant hurdle. It's common for lenders to prefer credit scores above 660 as this is considered to be a safer bet for them. With a score of 400, it's seen as quite risky, as historically it suggests more difficulties in paying back the loan. This often results in lenders either denying the loan outright or offering loans with much higher interest rates.

It may feel discouraging, but it's important to remember that a low credit score doesn't necessarily mean that purchasing a car is completely off the table. You can find lenders who specialize in providing loans to individuals with lower credit scores. However, exercising caution with these type of loans is crucial as they can come with considerably higher interest rates. This is the lender's way of managing the higher risk associated with lending to someone with a lower score. So while the journey to getting a car loan might be a bit rough, with understanding and planning, it's definitely still something that can be achieved.

What Factors Most Impact a 400 Credit Score?

Understanding your 400 credit score is the first step towards financial wellness. Let's focus on the factors most likely impacting your current score, and how you can work to improve these areas.

Payment History

Your payment history greatly affects your credit score. Late or missed payments could be a significant factor causing your present score.

How to Check: Go through your credit report to determine if there are any missed or late payments. If you recall any instances where you were unable to make a payment on time, this likely had a negative impact on your score.

Credit Utilization

Managing your credit limit well adds to a good credit score. If your credit card balance is too close to your credit limit, it could contribute to a lower score.

How to Check: Carefully look at your credit card statements and check if your balances are near their limit. Striving to maintain a lower balance, relative to your credit limit, is advisable.

Length of Credit History

The duration of your credit history can either contribute to or reduce your credit score. Newer credit histories may not reflect financial stability, leading to lower scores.

How to Check: Review your credit report to determine the age of your oldest account, your newest one, and the average age of all your accounts. Newly created accounts could be contributing to your low score.

Public Records

Public records such as bankruptcies or tax liens can significantly lower your credit score.

How to Check: Scan your credit report for any public records. Addressing these can provide a starting point for improving your credit score.

Type of Credit

Having a mix of credit types, and managing them responsibly, can help boost your credit score.

How to Check: Assess your current mix of credit accounts like credit cards, retail accounts, installment loans, and more. Limiting new credit applications could help improve your score over time.

How Do I Improve my 400 Credit Score?

With a credit score of 400, you’re likely facing some significant credit challenges. It’s a tough spot to be in, but improvements can be made. Here’s your specially tailored game plan:

1. Prioritize Managing Unpaid Debts

Unpaid debts could be the biggest culprit impacting your score. Aim to handle these first. For overdue accounts, see if payment plans are feasible. It’s essential to communicate with your creditors about your situation and willingness to pay.

2. Handle High Credit Card Utilization

If your credit card balances are high compared to your limits, work on decreasing them. High utilization rates can be harmful to your score. Target balances below 30% of your credit limit; far lower than that is even better. Tackle the cards with the highest utilization rates first.

3. Consider a Secured Credit Card

Standard credit cards might be out of reach with your current score. A secured credit card, backed by a cash deposit, could be a solid alternative. Use it responsibly to gradually build a positive payment history.

4. Seek To Be an Authorized User

Becoming an authorized user on the credit card of someone with a good credit score can give your rating a boost. Make sure their positive payment history gets reported on your credit report by the card issuer.

5. Broaden Your Credit Types

Once you’ve established better habits with a secured card, explore other forms of credit, like retail credit cards or credit builder loans. Responsible handling of a variety of credit types can be beneficial to your score.