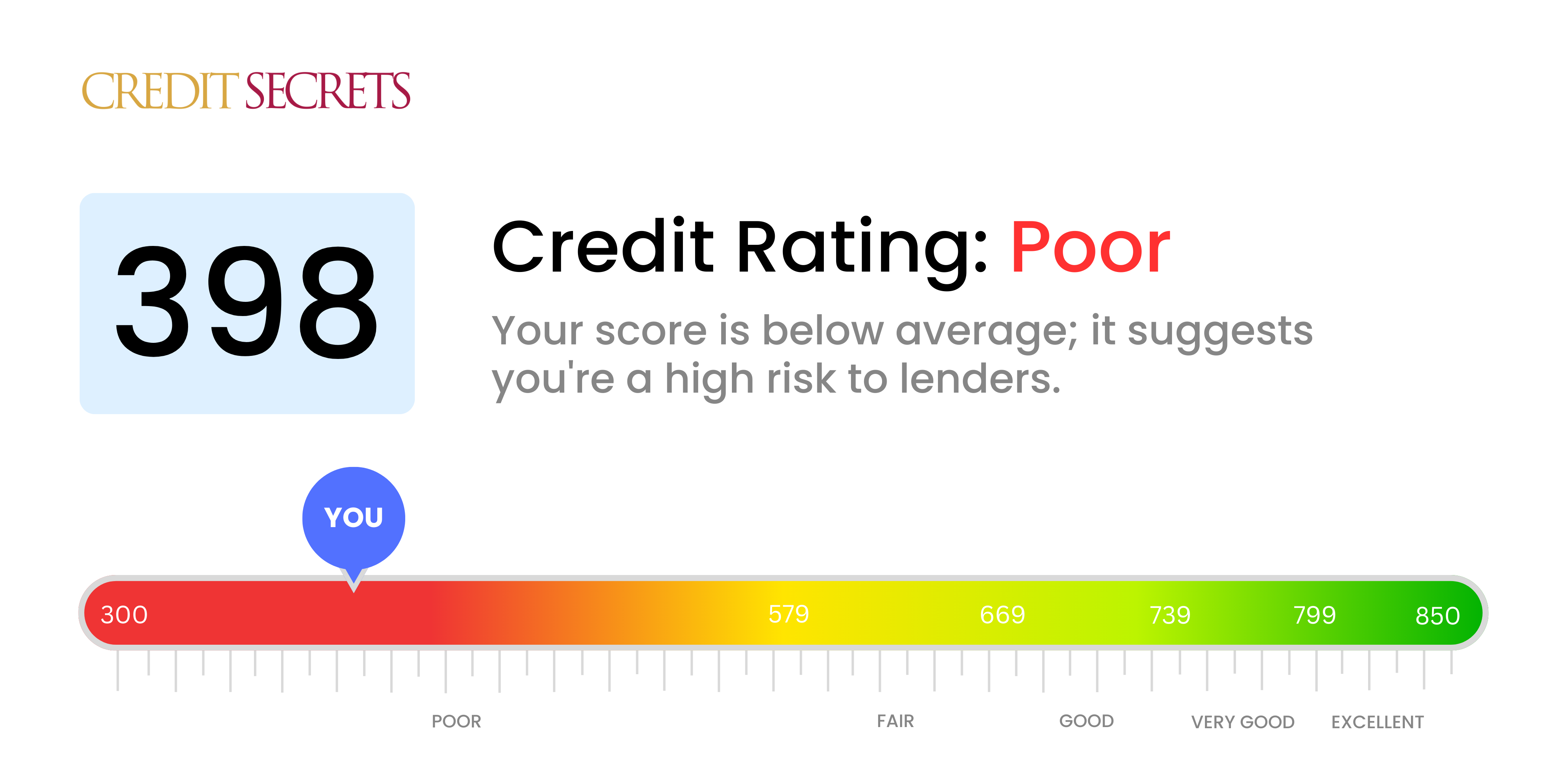

Is 398 a good credit score?

A credit score of 398 falls into the category of "poor". This indicates that your current credit management needs improvement. It might prove challenging to secure credit from prime lenders, you may face higher interest rates, or require a sizeable down payment. However, it's important to remember that bad credit doesn't have to be permanent – there are steps you can take to begin improving your score.

Having a poor score isn’t the end of the road, but an opportunity to start the journey towards credit health with the right tools and habits. Learning and implementing credit-friendly habits like timely bill payments, minimizing your debt and limiting hard credit inquiries can lead to a positive change. Start today and you can look forward to a healthier credit score in the future.

Can I Get a Mortgage with a 398 Credit Score?

Having a credit score of 398 indicates that you're currently facing some tough financial times. Unfortunately, this score is considerably below what most mortgage lenders deem acceptable, making it unlikely to secure mortgage approval. A score in this range often points to patterns of delayed payments or financial missteps.

It's understandable that this situation may leave you feeling discouraged, but the reality is there are steps you can take from here. It might be worth exploring other housing options that are within your current financial reach. Whether it's renting for a while longer or looking at rent-to-own agreements, there are alternatives available. Additionally, focusing on regular bill payments and reducing the overall debt can drastically help improve your credit score. Remember, bettering your financial situation often takes time; however, every small step taken can account for substantial progress in the long run. Maintain a positive mindset, and rest assured that your situation can change for the better.

Can I Get a Credit Card with a 398 Credit Score?

Having a credit score of 398, it would be rather difficult to be approved for a standard credit card. This low score may imply to creditors that there's a heightened risk, possibly due to past financial missteps or challenges. While this situation could feel disheartening, it's necessary to face it with honesty and a realistic outlook. Recognizing the status of your credit is an essential first step towards fiscal recovery, which sometimes requires acknowledging harsh realities.

Faced with the hurdles of a low score, it's worth considering alternatives such as secured credit cards. These require a deposit that acts as your credit limit and are usually more accessible for those having low credit scores. The benefit of these cards is they allow you to rebuild your credit gradually. Other alternatives that could be explored include having a co-signer or considering prepaid debit cards. These don't present immediate solutions, but they are beneficial in the long term goal towards financial stability. Be mindful, interest rates offered to those with such scores are typically high due to the increased risk envisaged by the lenders.

Can I Get a Personal Loan with a 398 Credit Score?

Unfortunately, a credit score of 398 suggests that your chances of being approved for a traditional personal loan are quite slim. Lenders view this score as indicative of a high risk borrower and often hesitate to extend credit under these circumstances. This may seem daunting, but it's important you understand what a score at this level truly means for your borrowing potential.

Don't lose hope. There are still routes you can take. Some people with low credit scores turn towards alternatives like secured loans, which involve pledging an asset as collateral, or co-signed loans, which require a guarantor with good credit. Peer-to-peer lending platforms might be another viable option since some platforms have less rigid credit requirements. However, with these alternatives, know that interest rates may be high and terms may not be as favorable as with traditional loans. This is due to the perceived increased risk taken on by the lender.

Can I Get a Car Loan with a 398 Credit Score?

Having a credit score of 398 presents its own set of challenges when applying for a car loan. Just for reference, lenders usually prefer credit ratings of over 660 for the most favorable conditions. A score lower than 600 is often seen as subprime, meaning it's viewed as a higher risk. Your score of 398 definitely falls into the subprime bucket. This could lead to more expensive interest rates or even a denied application due to the high risk it poses to lenders, as it implies potential issues paying back the loan.

But don't lose hope just yet. Even with a low credit score, you still have options for securing a car loan. Some financial institutions cater to the needs of those with lower credit scores. But keep in mind, the loans they offer often come at a higher price point in terms of interest rates. This is to offset the risk they're taking on. Despite the bumps that might be ahead, remember it's possible to secure a car loan with careful planning and a thorough understanding of the conditions.

What Factors Most Impact a 398 Credit Score?

If you're dealing with a credit score of 398, understanding the potential factors contributing to this rating is the first step toward positive change. Let's break down the areas you may need to focus on to start improving your score:

Late or Missed Payments

When it comes to your credit score, timely payments carry weight. A trail of late or missed payments may be hurting your score.

How to Check: Examine your credit report for a history of late or missed payments. These notations can point to a pattern that you need to address.

Credit Utilization

If you're utilizing the majority of your available credit, it could be negatively impacting your score.

How to Check: Review your credit card statements. If your balances are near their limits, reducing them should become your goal.

Length and Variety of Credit

A limited or one-type credit history could be a part of the problem. Variety and the length of your credit history can have positive impacts on your score.

How to Check: Look at your credit report. Does it reflect a mix of credit types? Are your accounts relatively new? If yes to both, promote diversity and patience.

Negative Public Records

Public records like bankruptcies or unpaid tax liens can substantially decrease your credit score.

How to Check: Check your credit report for any negative public records. Prioritize addressing these to improve your financial health.

How Do I Improve my 398 Credit Score?

With a credit score of 398, it’s important to face the fact that it’s low, but the good news is, there are actions you can take to help raise it. For an individual in this position, here are some key steps you can take:

1. Settle Accounts in Collections

Outstanding accounts likely have been sent to collections. It’s crucial to make repayment of these your foremost responsibility. Make contact with the collections agencies, and discuss a repayment deal. Once you’ve settled, this will positively affect your score.

2. Apply for a Credit-Builder Loan

Access to most credit types might be difficult at this stage. However, through a credit-builder loan, you can start to amass a positive credit history by borrowing a small amount and making consistent repayments.

3. Get a Co-signer

Ask a loved one with good credit to co-sign a loan or credit card application. This can better your chances of obtaining approval. Be cautious though, as any default in payment will affect both parties’ credit scores.

4. Employ a Secured Credit Card

A secured credit card is ideal for your circumstance, as it needs a deposit that becomes your credit limit. Use this card responsibly to show an improvement in credit behavior, which can enhance your score.

5. Regularly Check Your Credit Report

Study your report for errors or inaccuracies that could be negatively impacting your score. If any, dispute them immediately to have them corrected. Keeping tabs on your report can also help you understand the elements that most affect your credit score, assisting you in your improvement journey.