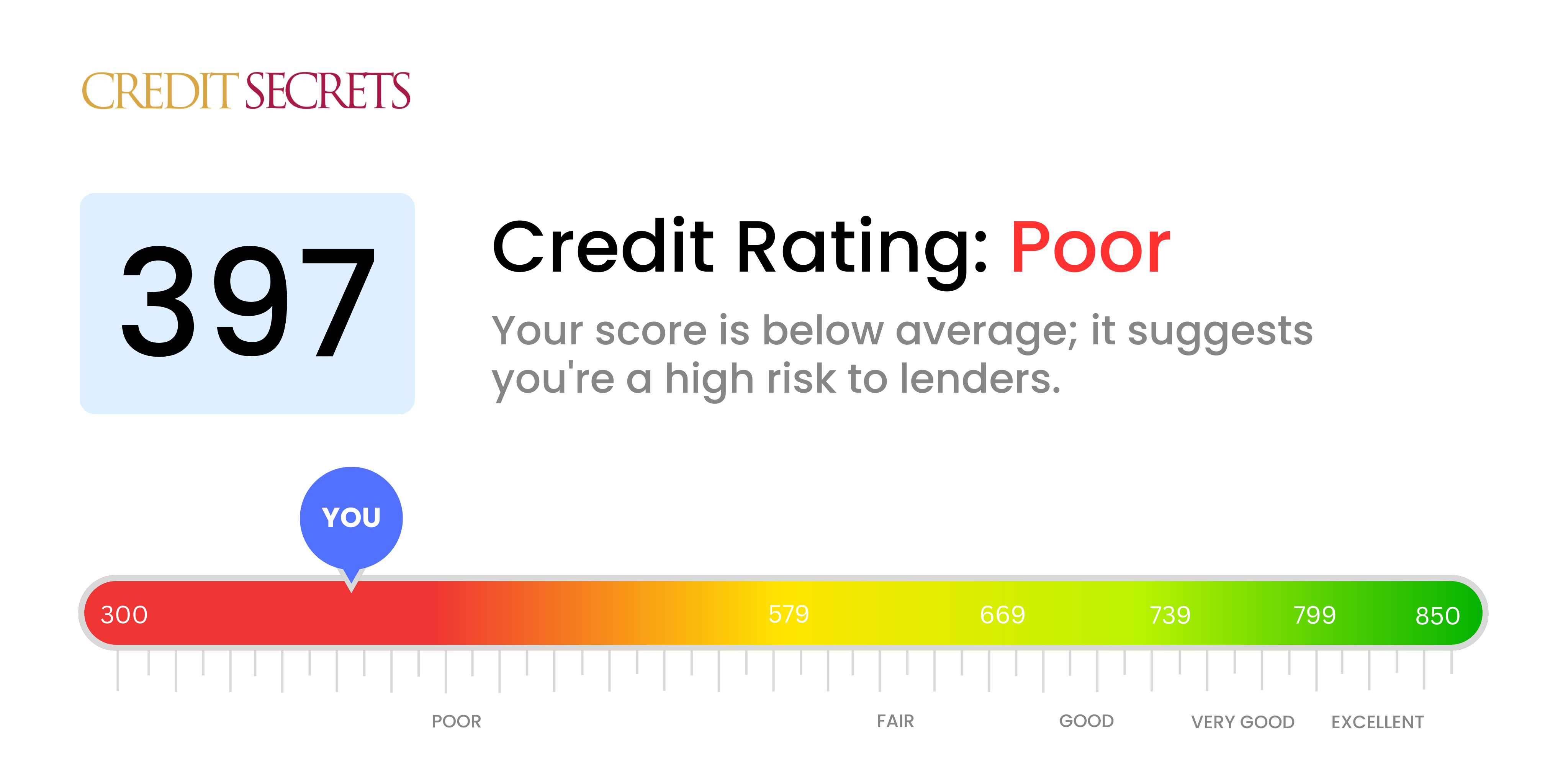

Is 397 a good credit score?

A credit score of 397 definitely leaves room for improvement, as it falls into the 'Poor' category. Having this score could make it more difficult for you to get approved for credit cards or loans, and you might face higher interest rates. But don't worry, your financial situation isn't unchangeable, and there are proactive steps you can take to start raising your credit score.

Understanding how credit scores work, and the factors affecting them is key. By paying your bills on time, reducing the amount of debt you owe, not making new credit inquiries, and maintaining a long credit history, you can significantly transform your financial profile. Remember, improvement takes time, but with deliberate and consistent efforts, you can reinvent your credit health and regain financial freedom.

Can I Get a Mortgage with a 397 Credit Score?

Having a credit score of 397 unfortunately places you in a challenging situation if you're seeking mortgage approval. This is significantly below the typical minimum required by most lenders, which generally suggests a past riddled with financial hardships like delinquent accounts or insolvencies.

Your credit score reflects your financial trustworthiness. A low score can be a red flag to lenders, often leading to loan applications being declined or offered with sharply high interest rates - which is the case with a score like 397.

The pathway to obtaining a mortgage isn't entirely closed. Evaluating your credit report for errors and addressing outstanding debts could help. Additionally, maintaining a record of timely bill payments, minimizing credit utilization, and possibly considering alternatives such as lender programs designed for lower credit scores might provide you with the necessary leverage. Though improving your credit score may take time, every step you take brings you closer to realizing your goal of homeownership.

Can I Get a Credit Card with a 397 Credit Score?

With a credit score of 397, unfortunately, it's unlikely that a traditional credit card application will be approved. This score is considered quite low and signifies to lenders a potential risk. It's tough to hear, but it's crucial to face the facts with honesty and a drive to improve. Acknowledging your current credit standing is a vital step in the journey towards financial health.

Given the challenges a low score presents, there are other financial tools that might be worth exploring. Secured credit cards, for instance, require a deposit that becomes your credit limit. These cards can often be obtained more readily and can help to rebuild credit incrementally over time. A co-signer with a stronger credit score or a pre-paid debit card may also be beneficial options to consider. It's important to remember, though, that the interest rates for these alternatives are generally much higher, reflecting the increased risk to lenders. While these solutions don't offer an instant panacea, they are effective steps on the path to financial improvement.

Can I Get a Personal Loan with a 397 Credit Score?

With a credit score of 397, obtaining approval for a personal loan from traditional lenders can be a real challenge. Most lenders view a score of this level as a significant risk, reducing the likelihood of a positive decision on a loan application. This situation may be tough, but understanding your current position is the first step to unlocking alternatives.

While a traditional loan may not be feasible, you might consider other options such as secured loans, where you pledge an asset as collateral, or co-signed loans, where another individual with better credit signs alongside you. In some cases, you could also explore peer-to-peer lending platforms, which might have more relaxed credit requirements. However, be aware that these alternative solutions often have higher interest rates and less-favorable terms, reflecting the greater risk posed to the lender.

Can I Get a Car Loan with a 397 Credit Score?

Having a credit score of 397, unfortunately, it might not be easy to get approved for a car loan. Most lenders are looking for credit scores around 660 and higher. Your score is considered as subprime, which could likely result in higher interest rates or refusal of the loan. This is because lenders see your lower credit score as a higher risk, judging by the past, it could indicate potential problems with loan repayment.

But don't lose heart. Just because your credit score is low, it doesn't mean buying a car is impossible. There are lenders out there willing to work with people who have low credit scores. But make sure to proceed with caution, these loans can come with much higher interest rates. This is to offset the risk the lender is taking. It may be a steep road to climb, but with care and an understanding of the terms, getting that car loan is still possible.

What Factors Most Impact a 397 Credit Score?

Understanding your 397 credit score is the first critical step towards financial improvement. By knowing what factors have led to a low score, you can begin to make strategic moves towards better financial health. Remember, you are not alone on this journey, and it's an opportunity to learn and grow.

Payment History

Poor payment history could be one of the central factors bringing your credit score down. Missed or late payments could significantly impact your score.

How to Check: Look at your credit report for late or missed payments. Reflecting on any episodes of delayed payments could give you insight into why your score is low.

Credit Utilization

Maintaining high living on your credit cards can also have a negative impact on your score. If you're constantly nearing the limits of your credit cards, this could be a problem.

How to Check: Examine your credit card statements. Are you consistently reaching or exceeding your limits? Working to keep your balances lower can help increase your score over time.

Length of Credit History

Having a brief credit history can negatively affect your score. Your score might be low because you don't have a long history of credit use.

How to Check: Assess your credit report to see the age of your oldest and newest accounts, as well as the average age of all your accounts.

Credit Mix and New Inquiries

Lacking a diverse mix of credit types and having too many new credit inquiries can also lower your score.

How to Check: Look at your mix of credit accounts and consider whether you're applying for new credit too frequently.

Public Records

Public records like bankruptcies or unpaid taxes can significantly lower your score.

How to Check: Check your credit report for any public records. It's important to handle any items listed promptly and responsibly.

How Do I Improve my 397 Credit Score?

With a credit score of 397, you are in what’s considered a bad credit range. This is a significant hurdle, but don’t be disheartened. Some focused steps can help raise your score:

1. Review Your Credit Report

The first step is to request a free copy of your credit report from all three credit bureaus and ensure there are no mistakes. Correct any errors you might find as swiftly as possible.

2. Clear Up Any Outstanding Debts

It is essential that you settle any remaining bills, loans or unpaid debts that have damaged your score. Contact the creditors to agree on a repayment plan if you can’t pay right away.

3. Commit to On-Time Payments

Timeous payment of bills is vital to improve your score. Ensure that your rent, loans, bills, and credit accounts are paid promptly every month to demonstrate financial responsibility.

4. Apply for a Secured Credit Card

A conventional credit card may be out of reach with a 397 score, so consider a secured credit card. Use it wisely, pay regularly, and your score could see a meaningful boost.

5. Limit Your Credit Inquiries

Inquiries on your credit can negatively affect your score. Therefore, only apply for new credit when necessary and work on improving your present financial situation first.

6. Consider a Credit-Builder Loan

Once you’ve managed your secured card responsibly, try diversifying your credit mix with a credit-builder loan. This can further improve your financial credibility.