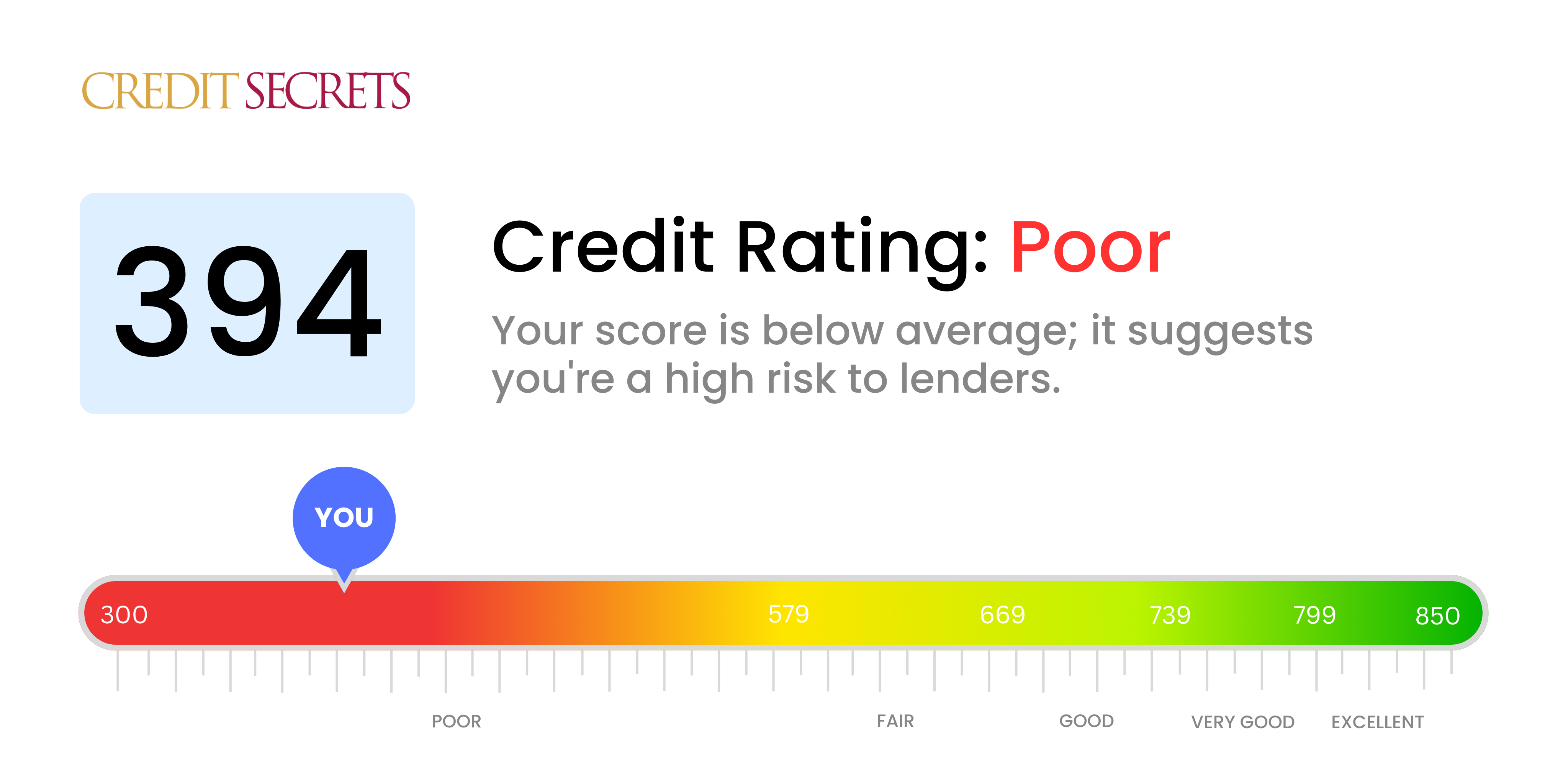

Is 394 a good credit score?

With a score of 394, it's clear you're dealing with a poor credit score. It's likely you'll face challenges when it comes to securing loans or receiving attractive interest rates.

Remember that this score isn't a final verdict, and it's possible to improve it. Our Credit Secrets program is here to guide you on the path to better credit health so you can achieve your financial goals.

Can I Get a Mortgage with a 394 Credit Score?

With a credit score of 394, the odds of being approved for a mortgage are unfortunately quite low. This score, significantly below most lenders' minimum requirements, indicates that you've encountered serious financial issues in the past, such as missed or defaulted payments.

It's clearly a difficult situation to be in, but keep in mind that your current circumstances are not your final destination. Start taking control by addressing any existing debts impacting your score. Consistently making payments on time and using credit responsibly will gradually improve your score. While it won't instantly change your credit status, consistent efforts can set you on the path to better financial health. Please bear in mind that securing a mortgage with a lower credit score may lead to higher interest rates. However, your journey towards improving your credit score may eventually lead you to more favorable mortgage conditions in the future.

Can I Get a Credit Card with a 394 Credit Score?

Dealing with a credit score of 394 might seem like a tough task at the moment, particularly when trying to secure a credit card. Many lenders see this as a risky score that reflects past problems managing finances. This may come as difficult news, but acknowledging your current financial circumstances is a crucial step towards progress.

With a score in this range, traditional credit cards are typically out of reach. However, some feasible options might fit better into your situation. Secured credit cards, for instance, require a deposit which is then used as your credit limit. This type of card is typically easier to get and plays an important role in gradually rebuilding your credit. Other alternatives include getting someone with a better credit score to co-sign a card for you, or opting for a pre-paid debit card. While these solutions won't magically boost your credit overnight, they set the foundation for improved financial stability. Remember, interest rates for any type of credit can be rather high with such a score, as it implies greater risk for the lenders.

Can I Get a Personal Loan with a 394 Credit Score?

Having a credit score of 394, you're in a tough spot when it comes to applying for a personal loan. Most standard lenders see a score within this range as a red flag, signaling high risk. Unquestionably, it's a daunting situation to be in. However, it's essential to come to terms with what this credit score means for your borrowing possibilities.

Conventional loans might be difficult to obtain with a score like yours, but that doesn't mean there aren't alternatives. Some of these include secured loans, which require you to provide collateral, or cosigned loans, where someone with a better credit score can back your application. Peer-to-peer lending platforms can sometimes exhibit more lenient credit requirements. Please bear in mind though, the alternatives often come with higher interest rates and less favorable terms to balance out the higher risk to the lender.

Can I Get a Car Loan with a 394 Credit Score?

With a credit score of 394, securing approval for a car loan may be quite challenging. Banks and lenders usually look for scores above 660 for loans with favorable terms. Unfortunately, a score of 394 is considerably lower, placing it in the subprime category often associated with higher interest rates or loan refusal. It is simply because this score indicates a higher risk to lenders, who may see it as a sign of possible repayment difficulties.

However, having a score of 394 doesn't mean the possibility of purchasing a car is out of reach. Yes, it might be a steeper hill to climb, but some lenders do work with individuals whose credit scores are lower. Always be vigilant though, these loans can attract much higher interest rates to counterbalance the higher perceived risk the lenders are taking. Even though it might be a bit demanding, with careful consideration and better understanding of the terms, obtaining a car loan is not entirely impossible.

What Factors Most Impact a 394 Credit Score?

Understanding a Score of 394

Your score of 394 might seem intimidating, but remember, renewing your financial health is a journey that starts one step at a time. The following factors could likely have an impact on your score.

Payment History

Consistent, on-time payments are the backbone of a solid credit score. Late or missed payments might be largely contributing to your score.

How to Check: Look at your credit report and pay special attention to any inconsistencies in your payment history.

Credit Utilization

Maxing out your credit limits may negatively affect your credit score. Therefore it could be a major factor for your current score.

How to Check: Check your credit card limits and their respective balances. Try to keep your usage well below your limits.

Credit History Duration

A shorter credit history might be working against your score. The longer your accounts are open, the better.

How to Check: Check the ages of your oldest and newest accounts and the average lifespan of all your accounts on your credit report.

Credit Type Mix and New Credit

The variety of credit types and new credit might factor into your credit health. Having a mix of credit can show lenders that you can handle various kinds of debt.

How to Check: Examine the various types of credit accounts you have and whether you've had any recent applications for more credit.

Public Records

Public records like defaults, liens, or bankruptcies can significantly detract from your credit score.

How to Check: Look at your credit report for any public records. Rectify any issues listed to the best of your ability.

How Do I Improve my 394 Credit Score?

Navigating your financial journey with a credit score of 394 may feel uphill, but positive change is within reach. Let’s focus on the most impactful and achievable steps you can take right away:

1. Rectify Overdue Bills

Overdue accounts can drastically pull down your credit score. Your most pressing task should be to catch up with these bills. Start with the oldest unpaid bill and work your way forward. Seek a payment schedule from your creditors if required.

2. Curb Credit Utilization

Your credit card balances play a big role in your credit score. Strive to maintain them below 30% of your credit limit and eventually aim for less than 10%. Start with the most overutilized card.

3. Consider A Secured Credit Card

Your current score may prevent you from getting a regular credit card. A secured credit card, backed by a cash deposit, can be a good alternative. Ensure you use it wisely, by making minor purchases and fully clearing the balance monthly to build a positive credit history.

4. Secure Authorized User Status

Becoming an authorized user on a credit card belonging to a close and responsible family member or friend can help boost your credit score. Make sure their card issuer reports the account activity to credit bureaus.

5. Broaden Your Credit Spectrum

Having a variety of credit types can improve your credit score. Once you’ve established good credit habits with a secured card, explore other credit options, like a credit builder loan or store card.